Earned Income Tax Credit Income Limits Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year previous years and the upcoming tax year Page Last Reviewed or Updated 11 Dec 2023

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a letter from the IRS about the EITC Find out what to do Key Takeaways If you earned less than 63 698 if Married Filing Jointly or 56 838 if filing as an individual surviving spouse or Head of Household in tax year 2023 you may qualify for the Earned Income Credit EIC These amounts increase to 66 819 and 59 899 respectively for 2024

Earned Income Tax Credit Income Limits

Earned Income Tax Credit Income Limits

https://i.ytimg.com/vi/bTVjii0XK08/maxresdefault.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/c317e21/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2F62%2F5a%2Fccfa233d46c391d75869b746dda0%2Fede7658103254185b6b3a08ad7ad5c0a

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

https://www.bankrate.com/2022/03/23160226/what-is-earned-income-tax-credit.png

The earned income tax credit EITC also called the earned income credit EIC was conceived as a work bonus plan to supplement the wages of low income workers and help offset the To qualify for the EITC you must Have worked and earned income under 63 398 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a U S citizen or a resident alien all year Not file Form 2555 Foreign Earned Income

The earned income credit is a refundable tax credit for low to middle income workers For tax returns filed in 2024 the tax credit ranges from 600 to 7 430 depending on The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year Find the dollar amounts here To Claim EITC With a Qualifying Child the Child Must Pass All of the Following Tests

Download Earned Income Tax Credit Income Limits

More picture related to Earned Income Tax Credit Income Limits

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Earned Income Tax Credit Info United Way For Southeastern Michigan

https://unitedwaysem.org/wp-content/uploads/EITC-table-2022-1024x320.png

Easiest EITC Tax Credit Table 2022 2023 Internal Revenue Code

https://www.irstaxapp.com/wp-content/uploads/2022/11/EITC-tax-credit-table-2.png

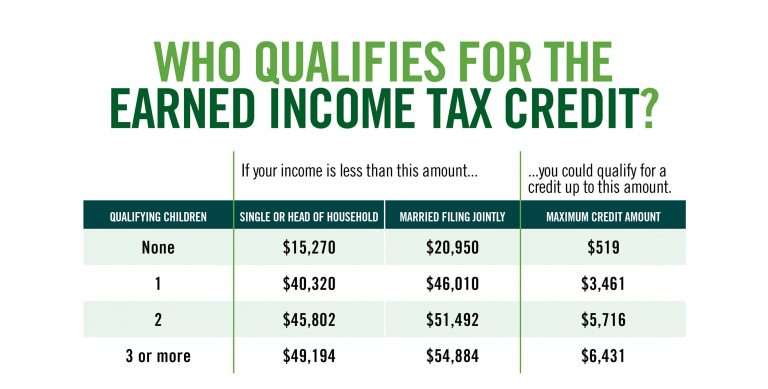

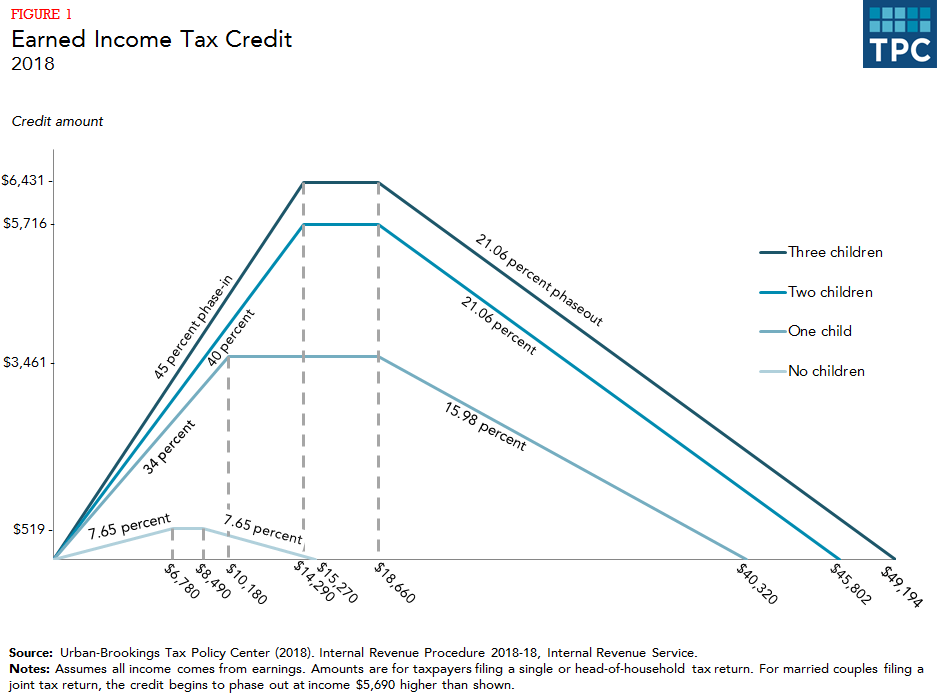

The Earned Income Credit income limits One of the most important parameters of figuring out who qualifies for the EIC is income level So if your income is higher than the limits you can t claim the credit As a starter use this table to find the maximum Adjusted Gross Income AGI credit amounts for tax year 2023 AGI Limits The Revenue Act of 1978 made the EITC permanent To qualify for the EITC for the 2022 tax year you ll need At least 1 of earned income from employment or self employment Less than 10 300 of

Nationwide during 2023 23 million eligible workers and families received about 57 billion in EITC The average amount of EITC received nationwide was about 2 541 1 EITC is for workers whose income does not exceed the following limits in 2023 56 838 63 698 married filing jointly with three or more qualifying children who have The EITC can be a significant tax credit worth as much as 7 430 for the 2023 tax year and 7 830 for the 2024 tax year However the credit amount varies significantly depending on tax filing status number of qualifying children and income earned It is phased in and then phased out at certain income thresholds

IRS Here Are The New Income Tax Brackets For 2023 Economics

https://politicalbullpen.s3.dualstack.us-east-1.amazonaws.com/original/3X/b/c/bcb63b7f3ab927219753f6ac806316c270a1979a.png

Earning Income Tax Credit Table

https://www.taxestalk.net/wp-content/uploads/earned-income-tax-credit-city-of-detroit-768x389.jpeg

https://www.eitc.irs.gov/eitc-central/income-limits-and-range-of-eitc

Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year previous years and the upcoming tax year Page Last Reviewed or Updated 11 Dec 2023

https://www.irs.gov/credits-deductions/individuals...

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a letter from the IRS about the EITC Find out what to do

The Success Of The Earned Income Tax Credit Econofact

IRS Here Are The New Income Tax Brackets For 2023 Economics

FAQ WA Tax Credit

Earned Income Tax Credit For Households With One Child 2023 Center

Earned Income Tax Credit Rural Assembly

Earned Income Credit Table 2017 Cabinets Matttroy

Earned Income Credit Table 2017 Cabinets Matttroy

Tax Return 2022 With Eic Latest News Update

Earned Income Tax Credit Tax Credits For Workers And Their Families

Earned Income Tax Credit City Of Detroit

Earned Income Tax Credit Income Limits - The Earned Income Credit EIC is a refundable tax credit available to taxpayers who have earned income IRS Publication 596 details the eligibility rules as well as earned income and AGI limits 2023 For 2023 earned income and adjusted gross income AGI must each be less than 56 838 63 398 married filing jointly with three or more