Earned Income Tax Credit Law The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low to moderate income working individuals and couples particularly those with children The amount of EITC benefit depends on a recipient s income and number of children

What is the EITC The EITC is a federal tax credit that offers American workers and families a financial boost The EITC has been benefitting low and moderate income workers for 46 years and many working families receive more money through EITC than they pay in federal income tax To claim the Earned Income Tax Credit EITC you must qualify and file a federal tax return Your refund If you claim the EITC your refund may be delayed By law the IRS cannot issue EITC and ACTC refunds before mid February

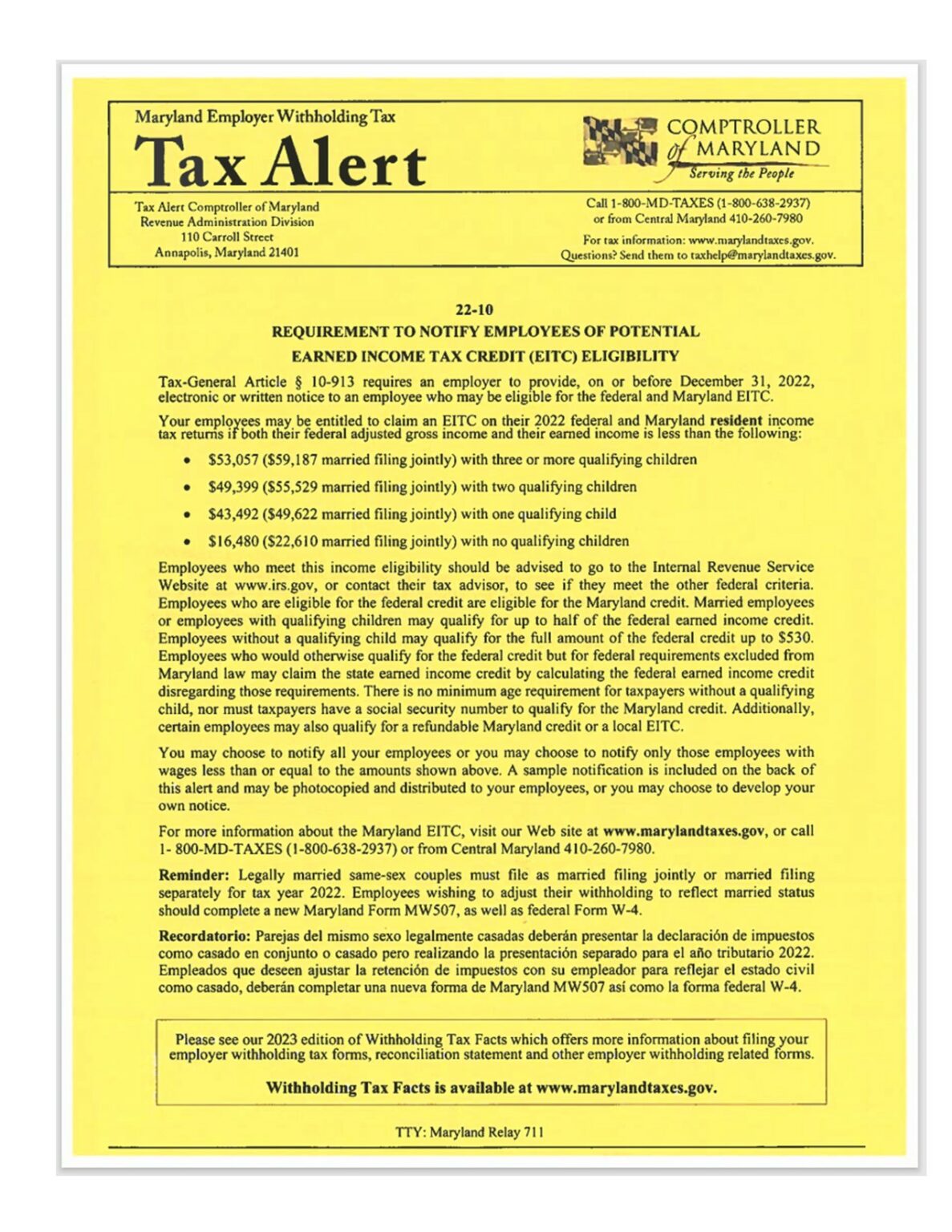

Earned Income Tax Credit Law

Earned Income Tax Credit Law

https://dfcby4322olzt.cloudfront.net/wp-content/uploads/2018/01/eitc.jpg

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

https://i.gofreedommoney.com/img/investing/earned-income-tax-credit-what-it-is-and-how-to-qualify.jpg

Mayor Coalition Urge Detroiters To Claim Earned Income Tax Credit And

https://detroitmi.gov/sites/detroitmi.localhost/files/resize/remote/ca82a627a9f80fb7ce24df2c9c079cd2-984x443.jpg

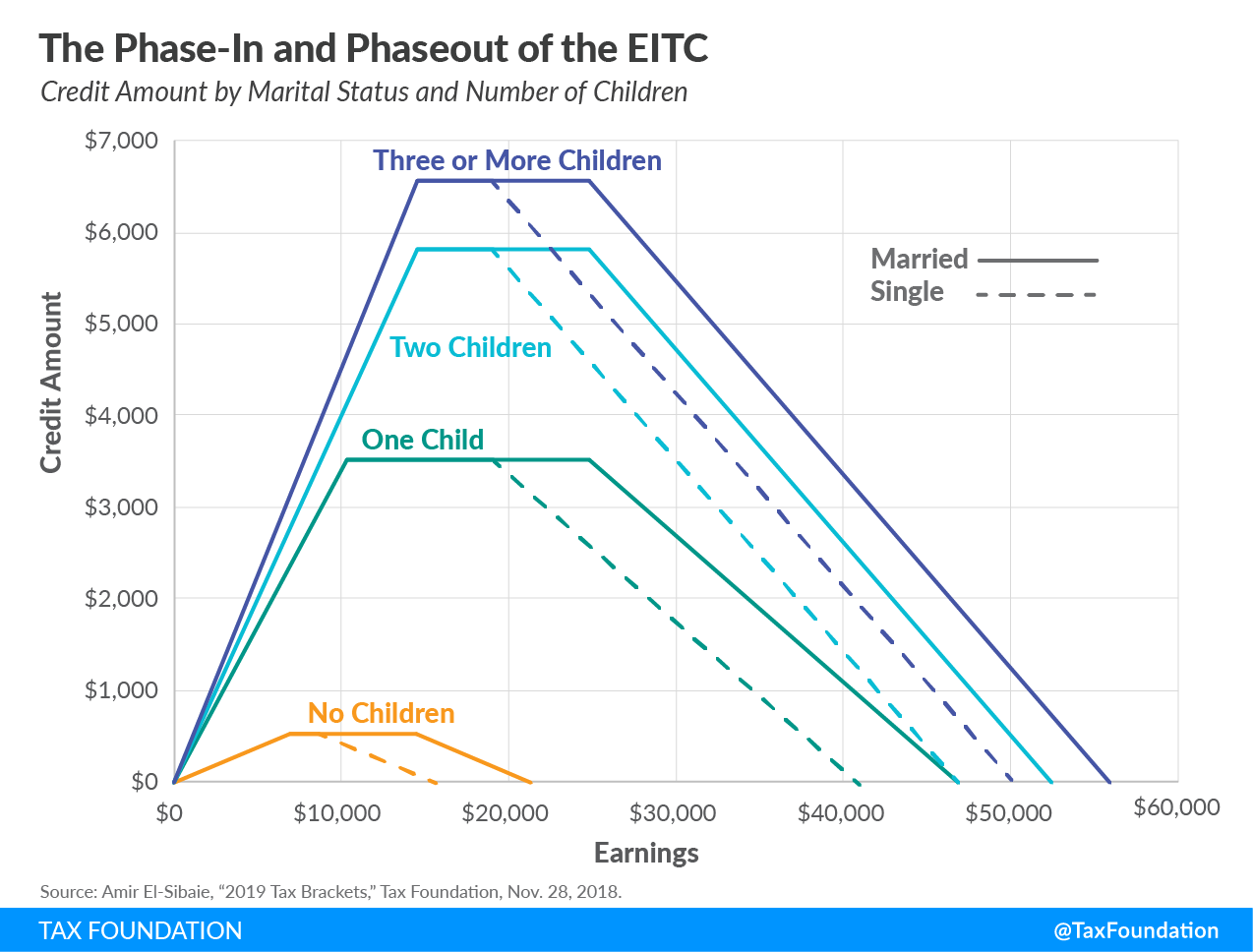

R44825 Summary The earned income tax credit EITC when first enacted on a temporary basis in 1975 was a modest tax credit that provided financial assistance to low income working families with children After various legislative changes over the past 40 years the credit is now one of the federal government s largest antipoverty programs How the EITC Works The earned income tax credit EITC provides substantial support to low and moderate income working parents who claim a qualifying child based on relationship age residency and tax filing status requirements It provides a much smaller amount of support to workers without qualifying children often called childless workers

Benefits of the EITC We estimate that four out of five workers claim the EITC which means millions of eligible taxpayers are putting EITC dollars to work for them As of December 2023 more than 23 million workers and families received about 57 billion in EITC The average amount of EITC received nationwide in tax year 2022 was about 2 541 Introduction The earned income tax credit EITC when first enacted in 1975 was a modest tax credit of up to 400 for low income working families with children It was also initially a temporary tax provision

Download Earned Income Tax Credit Law

More picture related to Earned Income Tax Credit Law

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Who Is Eligible For The Earned Income Tax Credit Medium

https://miro.medium.com/v2/da:true/resize:fit:1200/0*192vbxywjokVeji1

The Earned Income Tax Credit EITC is a refundable tax credit that boosts the income of eligible low income workers especially those with children Because the credit is refundable an EITC recipient need not owe income taxes to receive the benefit The earned income tax credit EITC is a refundable tax credit that helps certain U S taxpayers with low earnings by reducing the amount of tax owed on a

The Earned Income Tax Credit EITC How It Works and Who Receives It The Earned Income Tax Credit EITC is a refundable tax credit available to eligible workers earning relatively low wages Because the credit is refundable an EITC recipient need not owe taxes to receive the benefit Earned income is any income received from a job or self employment Earned income may include wages salary tips bonuses and commissions Income derived from investments and

Earned Income Tax Credit EITC Eligibility

https://www.taxuni.com/wp-content/uploads/2022/11/Earned-Income-Tax-Credit-EITC-Eligibility-TaxUni-Cover-1.jpg

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts

https://www.researchgate.net/publication/254426242/figure/tbl1/AS:393290550661129@1470779182610/Earned-Income-Tax-Credit-Parameters-1975-2000-Dollar-amounts-unadjusted-for-inflation.png

https://en.wikipedia.org/wiki/Earned_income_tax_credit

The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low to moderate income working individuals and couples particularly those with children The amount of EITC benefit depends on a recipient s income and number of children

https://www.irs.gov/about-irs/a-closer-look-at-the...

What is the EITC The EITC is a federal tax credit that offers American workers and families a financial boost The EITC has been benefitting low and moderate income workers for 46 years and many working families receive more money through EITC than they pay in federal income tax

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

Earned Income Tax Credit EITC Eligibility

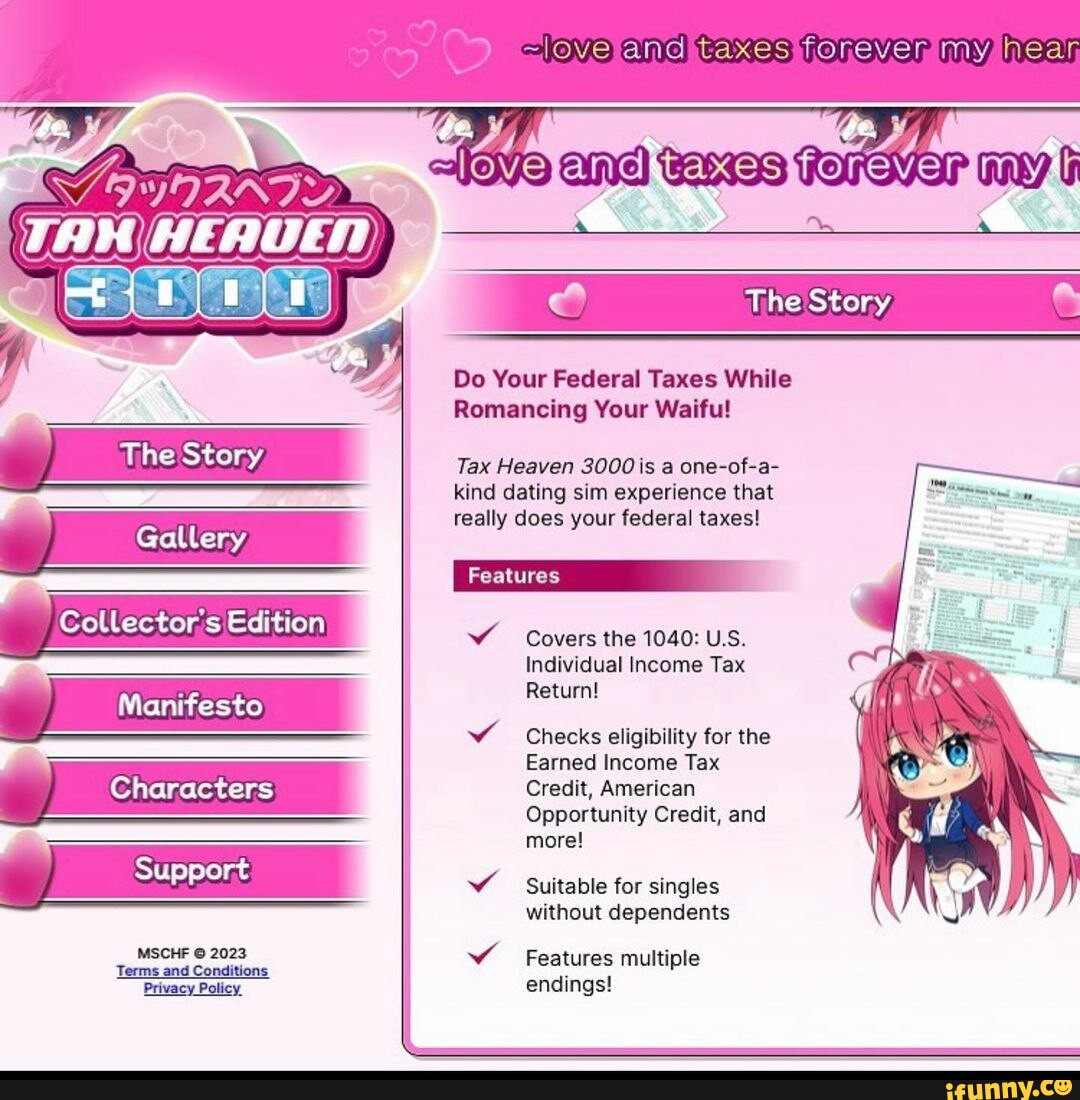

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

California Earned Income Tax Credit Worksheet

State Tax Credits Tax Credits For Workers And Families

State Tax Credits Tax Credits For Workers And Families

All About The Earned Income Tax Credit Account Abilities LLC

Earned Income Tax Credit EITC A Primer Tax Foundation

Income Tax Ordinance 2022 Pdf Latest News Update

Earned Income Tax Credit Law - R44825 Summary The earned income tax credit EITC when first enacted on a temporary basis in 1975 was a modest tax credit that provided financial assistance to low income working families with children After various legislative changes over the past 40 years the credit is now one of the federal government s largest antipoverty programs