Economics Tax Rebate Graph Web Global tax revenues would slightly increase as some taxing rights shift from low tax jurisdictions to higher tax jurisdictions Most economies would experience a small tax

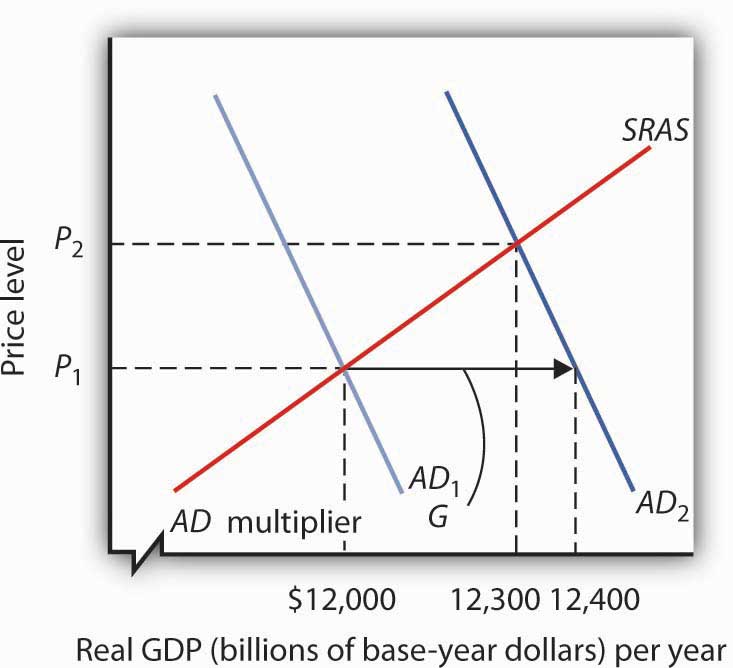

Web 19 mai 2020 nbsp 0183 32 Policy responses This note offers suggestions to governments on how tax policy can help support economies through the crisis These suggestions are structured Web I m uncertain about the MPC and tax multiplier effects Assume the government taxes 100 away and simultaneously gives a 100 refund The tax multiplier with an MPC of 0 9 is

Economics Tax Rebate Graph

Economics Tax Rebate Graph

http://www.washingtonpost.com/blogs/wonkblog/files/2013/04/Carbon-Taxes-vs.-EU-ETS-_-Dieter-Helm-_-4-Oct-2012.jpeg

FRB Finance And Economics Discussion Series Screen Reader Version

http://www.federalreserve.gov/pubs/feds/2009/200945/fig1.gif

![]()

What If America Never Exported Its Industry Doing So Was The Stupidest

https://www.ezyeducation.co.uk/images/Lexicon_Images/tax_burden.jpg

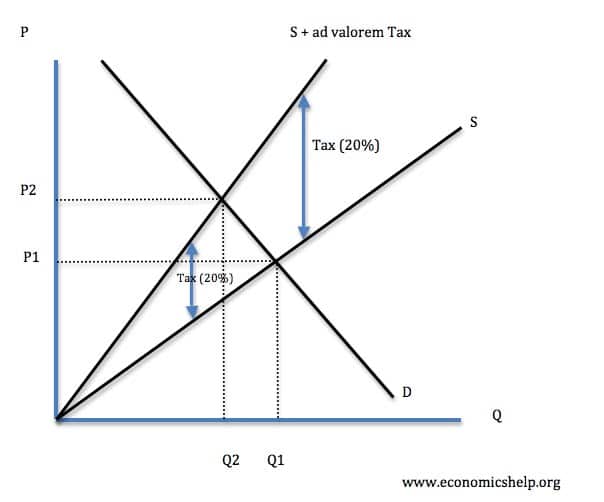

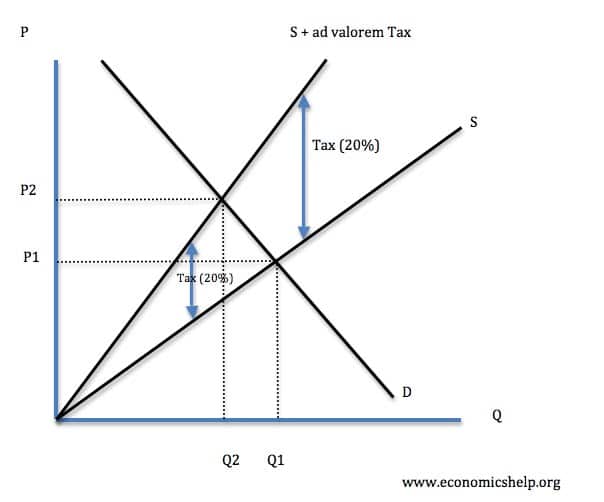

Web The government imposes a 20 per cent tax on the sellers A new supply curve emerges It is shifted upward and pivoted to the left and upwards in comparison to the original supply Web 31 juil 2021 nbsp 0183 32 The World Bank provides line graphs that reflect tax revenue as a percentage of GDP from 1972 to 2019 for selected countries and economies The values on the

Web 24 oct 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 is the third piece of legislation passed since late 2021 that seeks to improve US economic competitiveness innovation and industrial productivity Significant Web The most recent data show that the tax level in major industrialized countries members of the Organization for Economic Cooperation and Development or OECD is about double

Download Economics Tax Rebate Graph

More picture related to Economics Tax Rebate Graph

A Tale Of 2 Taxes How Carbon Pricing And Revenue Rolls Out In Alberta

https://i.cbc.ca/1.4971762.1547067964!/fileImage/httpImage/image.jpg_gen/derivatives/original_620/climate-action.jpg

Why Is There A Deadweight Loss From Taxation Socratic

https://useruploads.socratic.org/OscOMUczQnKlmKY6dnpx_slide_4.jpg

Advertisement

http://www.macleans.ca/wp-content/uploads/2012/10/harberger_tax.png

Web 21 ao 251 t 2023 nbsp 0183 32 In 2022 the Internal Revenue Service IRS collected a net 2 9 trillion in individual estate and trust income taxes or 59 2 of the total Personal income taxes Web These incentives may come in different forms to deliver assistance for businesses including credits rebates and exemptions for certain tax liabilities direct grants in the form of

Web Economic Studies Center Urban Brookings Tax Policy Center Abstract This paper examines how changes to the individual income tax affect long term economic growth Web Asian Development Bank

Government Micro Intervention Taxes Revision Notes In A Level And IB

https://www.economicshelp.org/wp-content/uploads/2014/12/Tax-ad-valorem.jpg

Tax Incidence Economics 2 0 Demo

https://s3-us-west-2.amazonaws.com/courses-images/wp-content/uploads/sites/2043/2015/07/14031817/CNX_Econ_C05_025.jpg

https://www.oecd.org/tax/beps/presentation-economic-anal…

Web Global tax revenues would slightly increase as some taxing rights shift from low tax jurisdictions to higher tax jurisdictions Most economies would experience a small tax

https://www.oecd.org/coronavirus/policy-responses/tax-and-fiscal...

Web 19 mai 2020 nbsp 0183 32 Policy responses This note offers suggestions to governments on how tax policy can help support economies through the crisis These suggestions are structured

Econ 101 What You Need To Know About Carbon Taxes And Cap and trade

Government Micro Intervention Taxes Revision Notes In A Level And IB

Reading Tax Changes Macroeconomics Deprecated

An Economic Analysis Of Protectionism Clearly Shows That Trump s

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics Of Tariffs And Trade Barriers

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics Of Tariffs And Trade Barriers

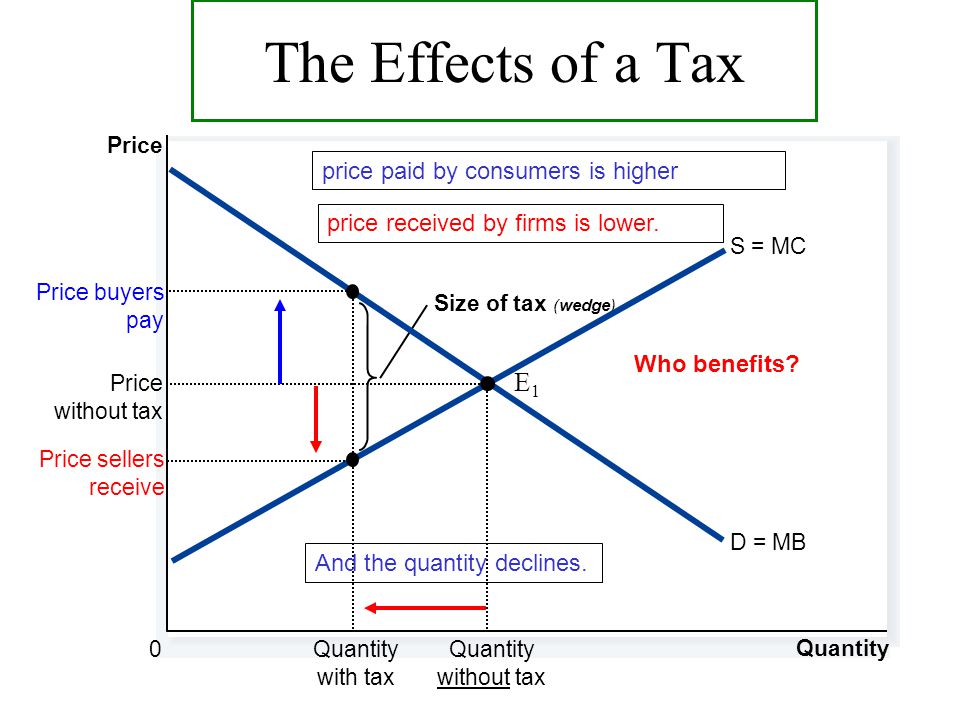

Reading Tax Incidence Macroeconomics

Market Failure

House Ways And Means Coronavirus Relief Legislation Tax Foundation

Economics Tax Rebate Graph - Web 12 janv 2023 nbsp 0183 32 Zhang et al 2022 examined the relationship between export tax rebates and productivity using firm level data for China from 2000 to 2007 They found that a one