Education Loan Income Tax Rebate Web 30 mars 2023 nbsp 0183 32 The Income Tax department offers various tax deductions on education loans to ease your financial burden If you have availed of an education loan you

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as

Education Loan Income Tax Rebate

Education Loan Income Tax Rebate

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

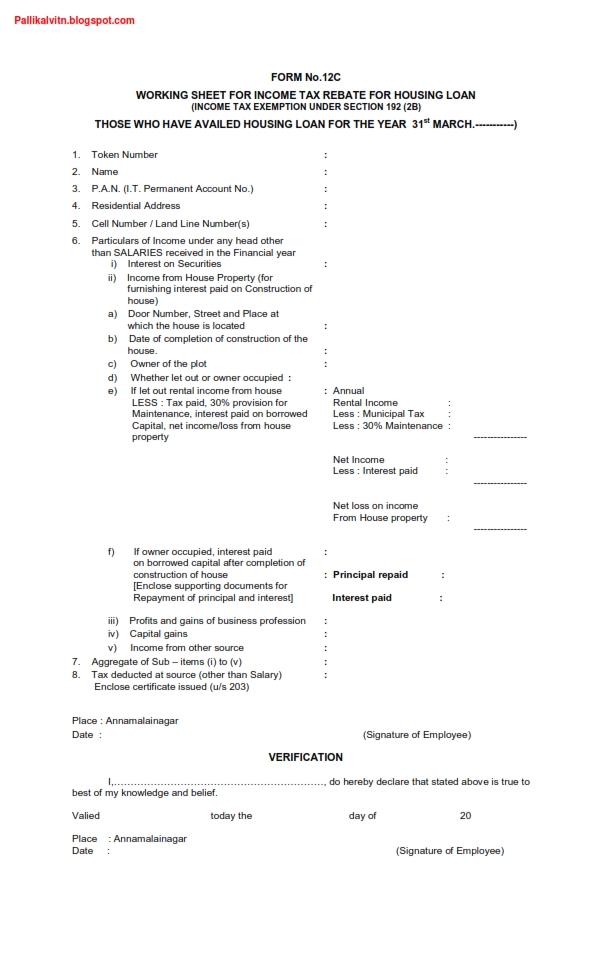

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

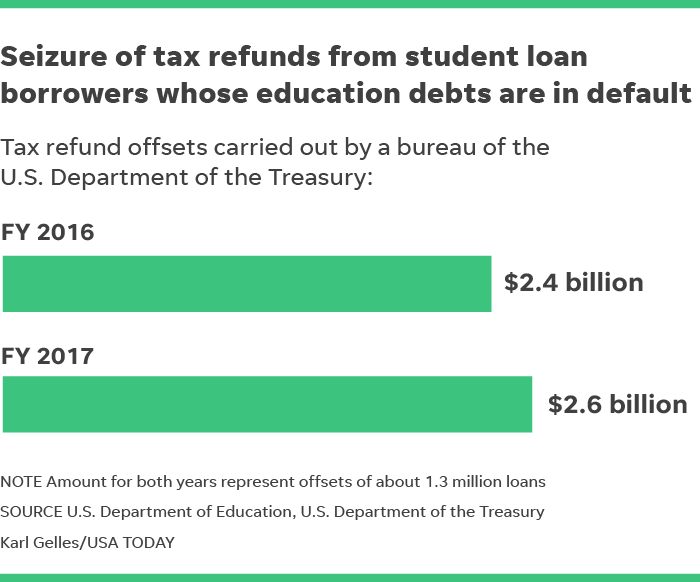

Tax Refunds Of 2 6B Were Seized During 17 To Repay Student Loans In

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

Web 16 f 233 vr 2021 nbsp 0183 32 By admin 16 February 2021 4 mins read Yes a loan for education is one of the easiest and quickest ways to finance higher studies You are eligible for tax benefits Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

Web 23 f 233 vr 2018 nbsp 0183 32 According to Section 80E of the Income Tax Act 1961 the interest paid on the education loan can be claimed as deduction This special deduction is also allowed Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file your 2022 income tax return you must

Download Education Loan Income Tax Rebate

More picture related to Education Loan Income Tax Rebate

Student Loan Calculator What You Need To Know In 2023 Pusat Kampus

https://i2.wp.com/www.studentloanplanner.com/wp-content/uploads/2017/01/student-loan-payment-calculator-image-1.jpg

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 28 oct 2021 nbsp 0183 32 Claim Education Loan Interest Portion in income tax Return of F Y 2020 21 1 Deduction allowed is the total interest part of the EMI paid during the financial year 2 Only an individual can Web 16 f 233 vr 2022 nbsp 0183 32 Student loan borrowers can deduct up to 2 500 spent on student loan interest each tax year To qualify for the student loan interest deduction you need to Be legally obligated to make the payments

Web 12 avr 2019 nbsp 0183 32 Education Loan Repayment Tax Benefit A guide on tax benefits of Student Loans Learn the benefits of paying off student loans and how you can avail rebate on Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Education Loan Tax Calculator As Per RBI Stats 2023 24 Section 80E

https://www.wemakescholars.com/images/background-design/education-loan-tax.png

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Income Tax department offers various tax deductions on education loans to ease your financial burden If you have availed of an education loan you

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

How To Calculate Tax Rebate On Home Loan Grizzbye

Education Loan Tax Calculator As Per RBI Stats 2023 24 Section 80E

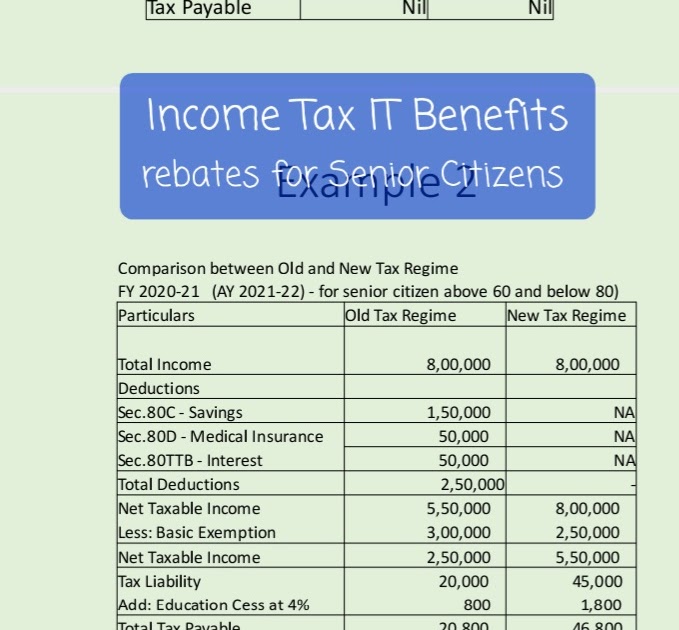

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Individual Income Tax Rebate

Individual Income Tax Rebate

Education Rebate Income Tested

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Income Tax Rebate Under Section 87A

Education Loan Income Tax Rebate - Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to