Education Loan Rebate In Tax Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an

Web 16 juin 2021 nbsp 0183 32 You can claim tax deductions against education loans under Section 80E of the Income Tax Act However there are a few things to keep in mind about tax Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Education Loan Rebate In Tax

Education Loan Rebate In Tax

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

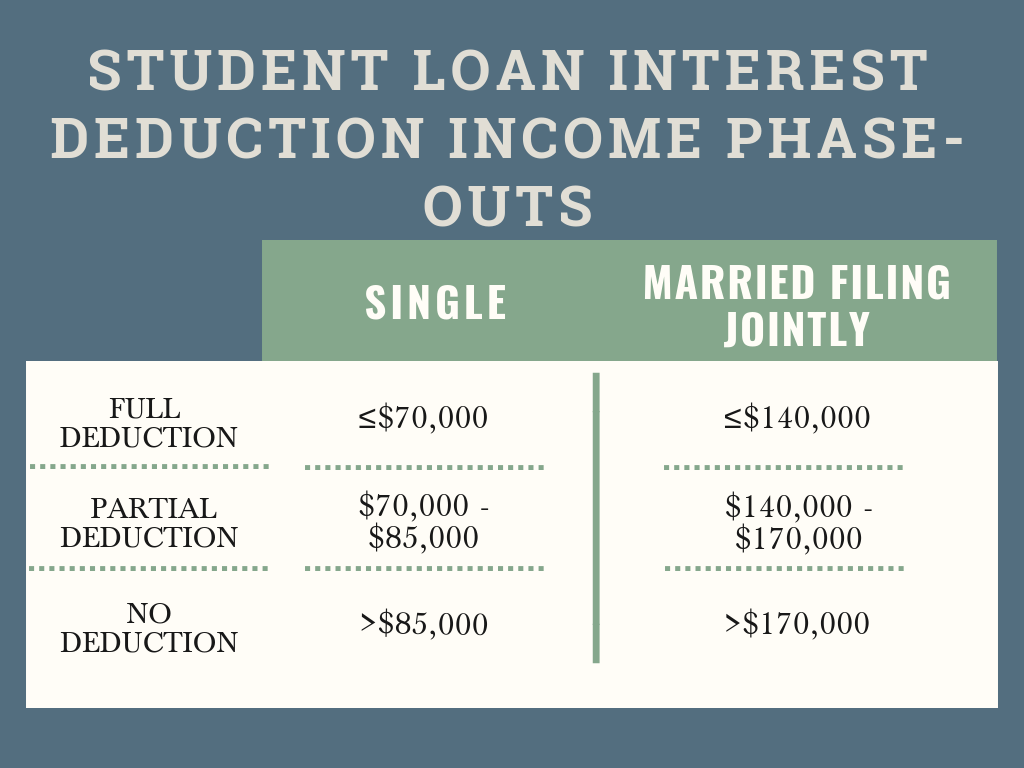

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

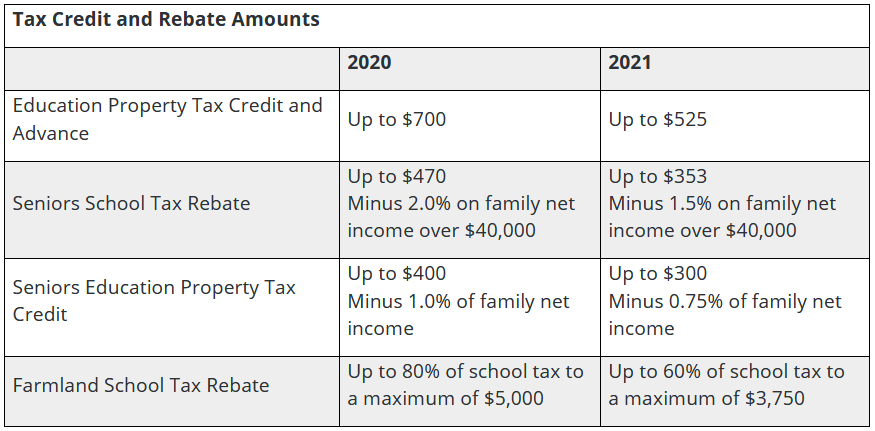

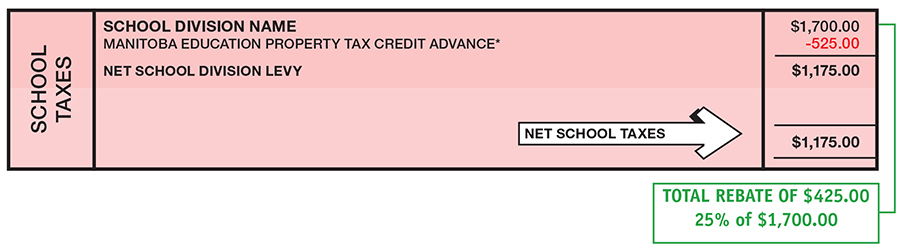

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-800x600.jpg

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is Web 31 mai 2023 nbsp 0183 32 Section 80E provides a tax deduction on the interest component paid on a loan taken for higher education by an individual assessee or on behalf of their spouse

Web 12 avr 2019 nbsp 0183 32 An education loan not only funds higher studies but also provides tax benefit on Student loan Under Section 80E of the Income Tax Act the interest part of the loan Web Tax Benefits for Education Loans Education Loans Tax Benefits Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan

Download Education Loan Rebate In Tax

More picture related to Education Loan Rebate In Tax

Interest Rates Unsubsidized Student Loans Noviaokta Blog

https://studentloanhero.com/wp-content/uploads/Federal-Student-Loan-Interest-Rates.png

Higher Education Loan Program Weekly Tax Table Australian

https://img.yumpu.com/31106089/1/500x640/higher-education-loan-program-weekly-tax-table-australian-.jpg

Can I Write Off Student Loan Interest Loan Walls

https://www.jhwfs.com/wp-content/uploads/2018/10/Student-loan-interest-deduction-2019.png

Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as Web Total tax rebate The amount of Income Tax an individual can save by availing of iSMART Education Loan from ICICI Bank The amount of rebate will vary for different tax slabs

Web 23 f 233 vr 2018 nbsp 0183 32 According to Section 80E of the Income Tax Act 1961 the interest paid on the education loan can be claimed as deduction This special deduction is also allowed Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

https://www.cakartikmjain.com/wp-content/uploads/2020/06/education-loan-tax-benefits.jpg

https://cleartax.in/s/section-80e-deduction-inte…

Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an

https://www.financialexpress.com/money/income-tax-how-to-make-the-mo…

Web 16 juin 2021 nbsp 0183 32 You can claim tax deductions against education loans under Section 80E of the Income Tax Act However there are a few things to keep in mind about tax

Provincial Education Property Tax Rebate Roll Out Rural Municipality

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Provincial Education Property Tax Rebate Roll Out Rural Municipality

What Does Rebate Lost Mean On Student Loans

Student Loan Interest Deduction Worksheet Fill Online Printable

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Q A Yellow Flower Centerpiece For Dummies

Maximizing Tax Benefits Guide To Education Loan Deductions

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Education Loan Rebate In Tax - Web 9 mars 2023 nbsp 0183 32 Section 80E of income tax act is a tax saving provision that provides tax deductions to individuals who have taken education loans to pursue their higher