Education Loan Repayment Tax Rebate Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web 27 mars 2021 nbsp 0183 32 So if you take an education loan for your daughter and repay it you can claim the tax deduction But if your daughter repays

Education Loan Repayment Tax Rebate

Education Loan Repayment Tax Rebate

https://i.pinimg.com/originals/95/41/ff/9541ff6232c24f5f0b2c42160968df28.jpg

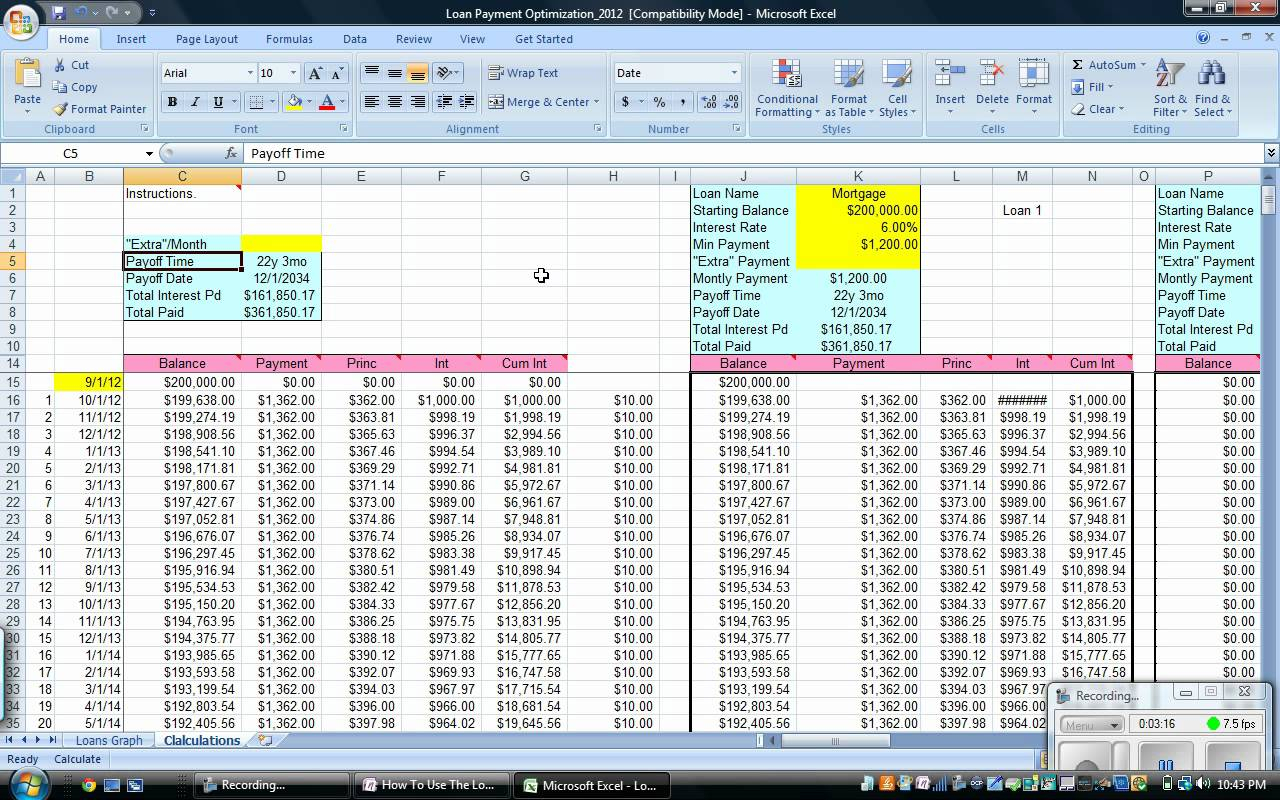

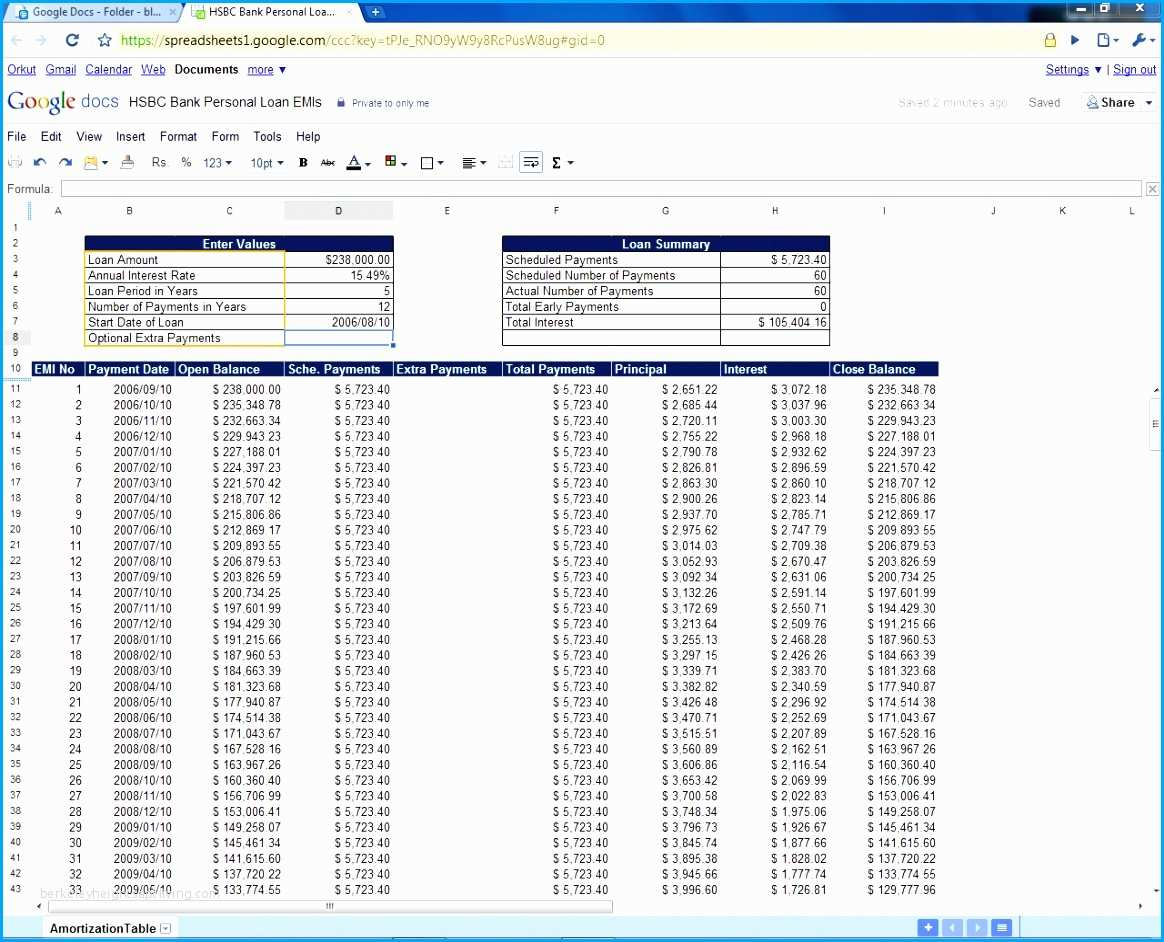

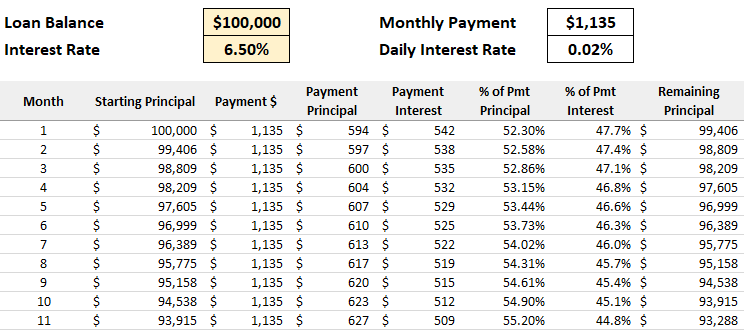

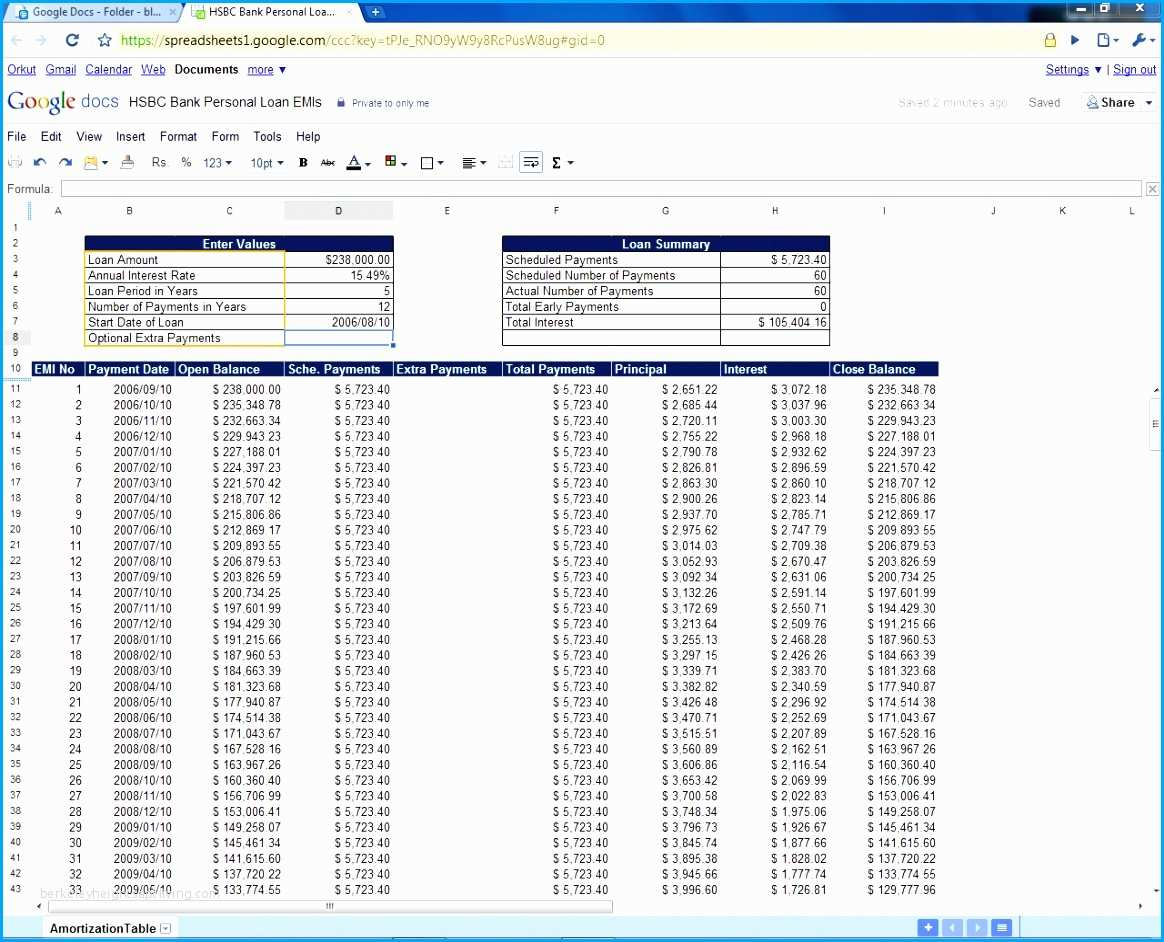

FREE 15 Loan Schedule Samples In MS Word MS Excel Pages Numbers

https://images.sampletemplates.com/wp-content/uploads/2020/07/Student-Loan-Repayment-Schedule.jpg

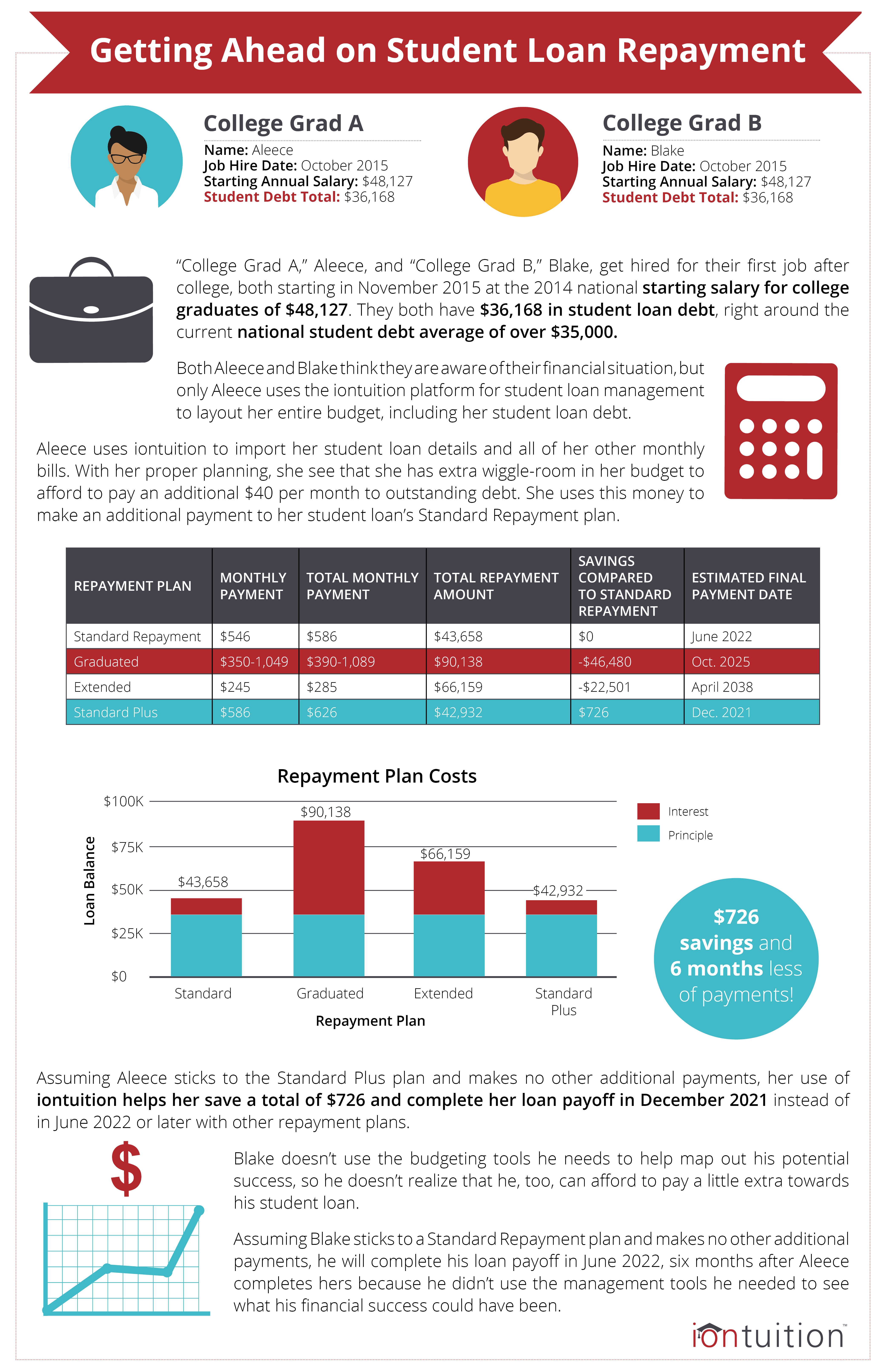

Student Loan Repayment Options Can You Make Repayments During Your

https://i.imgur.com/4K2huRD.png

Web 31 mai 2023 nbsp 0183 32 Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction Web 31 mars 2023 nbsp 0183 32 Due to the benefits of an education loan most students rely on it while pursuing higher education The Government of India also offers tax deductions of up to

Web 12 avr 2019 nbsp 0183 32 An education loan not only funds higher studies but also provides tax benefit on Student loan Under Section 80E of the Income Tax Act the interest part of the loan Web 23 f 233 vr 2018 nbsp 0183 32 Income Tax Benefits On Education Loan Repayment 5 Things To Know The income tax deduction on education loan is only available for up to eight years or

Download Education Loan Repayment Tax Rebate

More picture related to Education Loan Repayment Tax Rebate

Student Loan Excel Sheet Studentqw

https://db-excel.com/wp-content/uploads/2019/01/student-loan-repayment-spreadsheet-intended-for-student-loan-excel-spreadsheet-samplebusinessresume.jpg

Student Loan Repayment Scenario infographic IonTuition Student Loan

https://s28637.pcdn.co/wp-content/uploads/2016/02/Student-Loan-Repayment-Scenario_infographic.png

Best Student Loan Calculator Free Excel Repayment Plan Template

https://i2.wp.com/www.studentloanplanner.com/wp-content/uploads/2017/01/student-loan-calculator-student-loan-planner-image-1-1-1024x419.jpg

Web Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget FY 20 21 How long is Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Web 16 f 233 vr 2021 nbsp 0183 32 4 mins read Yes a loan for education is one of the easiest and quickest ways to finance higher studies You are eligible for tax benefits on education loan Web Section 80E of the Income Tax Act provides significant relief by allowing individuals to claim deductions on the interest paid towards education loan repayment However this

Student Loan Repayment Spreadsheet With Student Loan Amortization

https://db-excel.com/wp-content/uploads/2019/01/student-loan-repayment-spreadsheet-with-student-loan-amortization-schedule-template-unsophisticated-6-loan.jpg

Which Income Driven Repayment Plan Is Right For You Student Loan

https://i.pinimg.com/originals/c1/67/52/c16752d9743d2c61b3948498b961bc7f.png

https://www.etmoney.com/blog/education-loa…

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

https://www.charteredclub.com/section-80e-education-loan

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Excel Student Loan Repayment Calculator Lockqlol

Student Loan Repayment Spreadsheet With Student Loan Amortization

What Does Rebate Lost Mean On Student Loans

How To Get Hundreds Back From The State Just For Paying Your Student

Student Loan Calculator What You Need To Know In 2023 Pusat Kampus

Are Student Loan Payments Tax Deductible 2018 Loan Walls

Are Student Loan Payments Tax Deductible 2018 Loan Walls

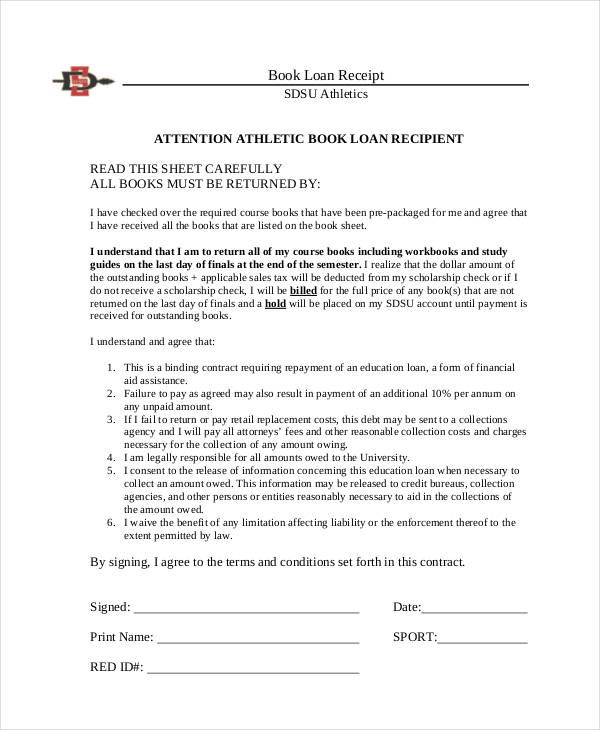

17 Loan Receipt Templates Free Sample Example Format Download

Pin On Financial Aid

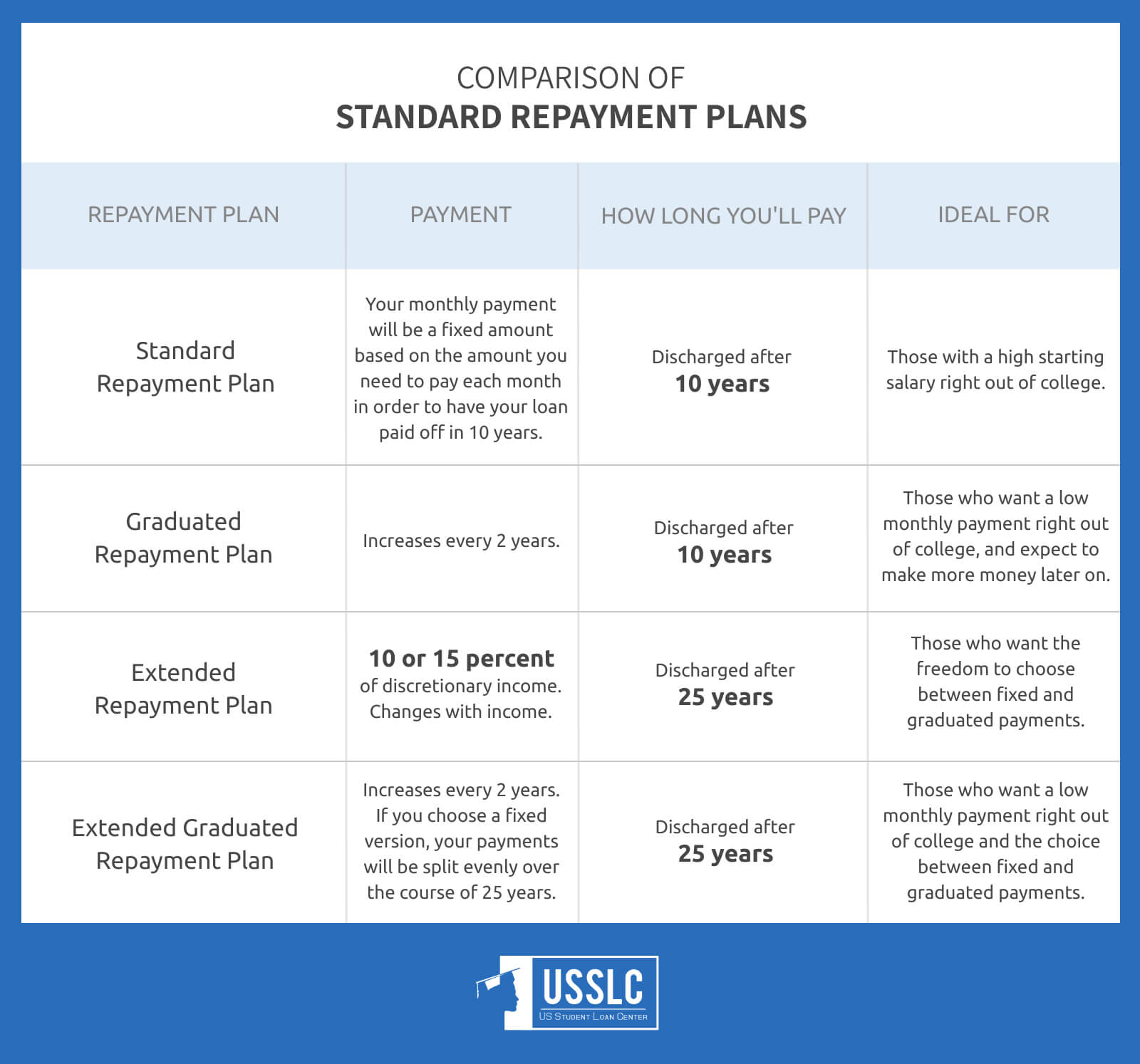

Student Loan Repayment Plan Comparison US Student Loan Center

Education Loan Repayment Tax Rebate - Web The tax exemption is allowed for the year you start repaying the loan and seven subsequent assessment years If the loan has been taken by the parent or spouse they