Education Loan Tax Exemption Section Section 80E tax exemption limits The interest component of the education loan can be deducted from your income just as

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on Education Loans interest allows tax deduction u s 80E of the Income Tax Act Know the tax benefits deductions you can avail on an Education Loan One time Offer Get ET Money Genius at 80 OFF at 249 49

Education Loan Tax Exemption Section

Education Loan Tax Exemption Section

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Home Loan 5 Tax Exemption Tax Planning

https://i.ytimg.com/vi/JobN18Awu0E/maxresdefault.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

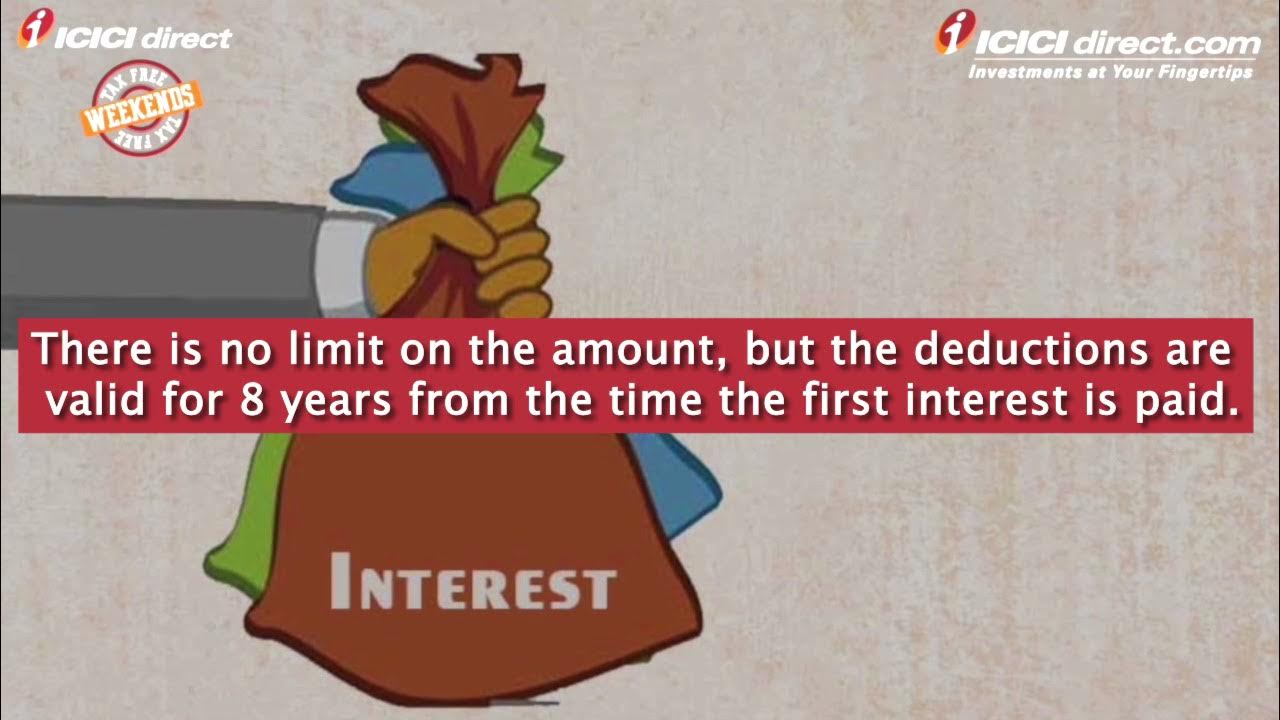

If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Income Tax Section 80E Tax Exemption on Interest on Education Loan The education industry in India is reportedly estimated to reach US 144 billion by 20201

Download Education Loan Tax Exemption Section

More picture related to Education Loan Tax Exemption Section

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

https://i.ytimg.com/vi/wRKbC9lu6Y0/maxresdefault.jpg

Tax Exemption On Education Loan Section 80E Explained

https://www.wemakescholars.com/uploads/blog/Tax-Exemption-Section-80E.webp

Education Loan Tax Deduction Under Section 80E YouTube

https://i.ytimg.com/vi/6Ns_j6qe4_E/maxresdefault.jpg

What is 80E in Income Tax Education loan not only helps you in financing your MS abroad but it can also help you save some tax The 80E section of the Income The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component

But can parents claim a tax deduction on their child s education loan Parents who have taken an education loan for their child s higher education in India In the above case since you are in the 30 tax bracket the tax exemption on the interest paid will be to the tune of Rs 92 700 including surcharge and cess Therefore this

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

https://i.ytimg.com/vi/AClmtGiZ3mw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGH8gLCgmMA8=&rs=AOn4CLBah_8pJ0s4zNv7DqcQ0sB9rKw6SQ

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

https://images.livemint.com/img/2022/01/23/original/tax_1642957579591.png

https://cleartax.in/s/section-80e-deduction...

Section 80E tax exemption limits The interest component of the education loan can be deducted from your income just as

https://tax2win.in/guide/sec-80e-deduction...

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

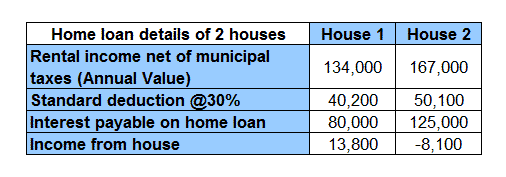

What Are The Income Tax Benefits On Mortgage Loan Loanfasttrack

Education Loan A Student s Guide To Taking And Repaying An Education

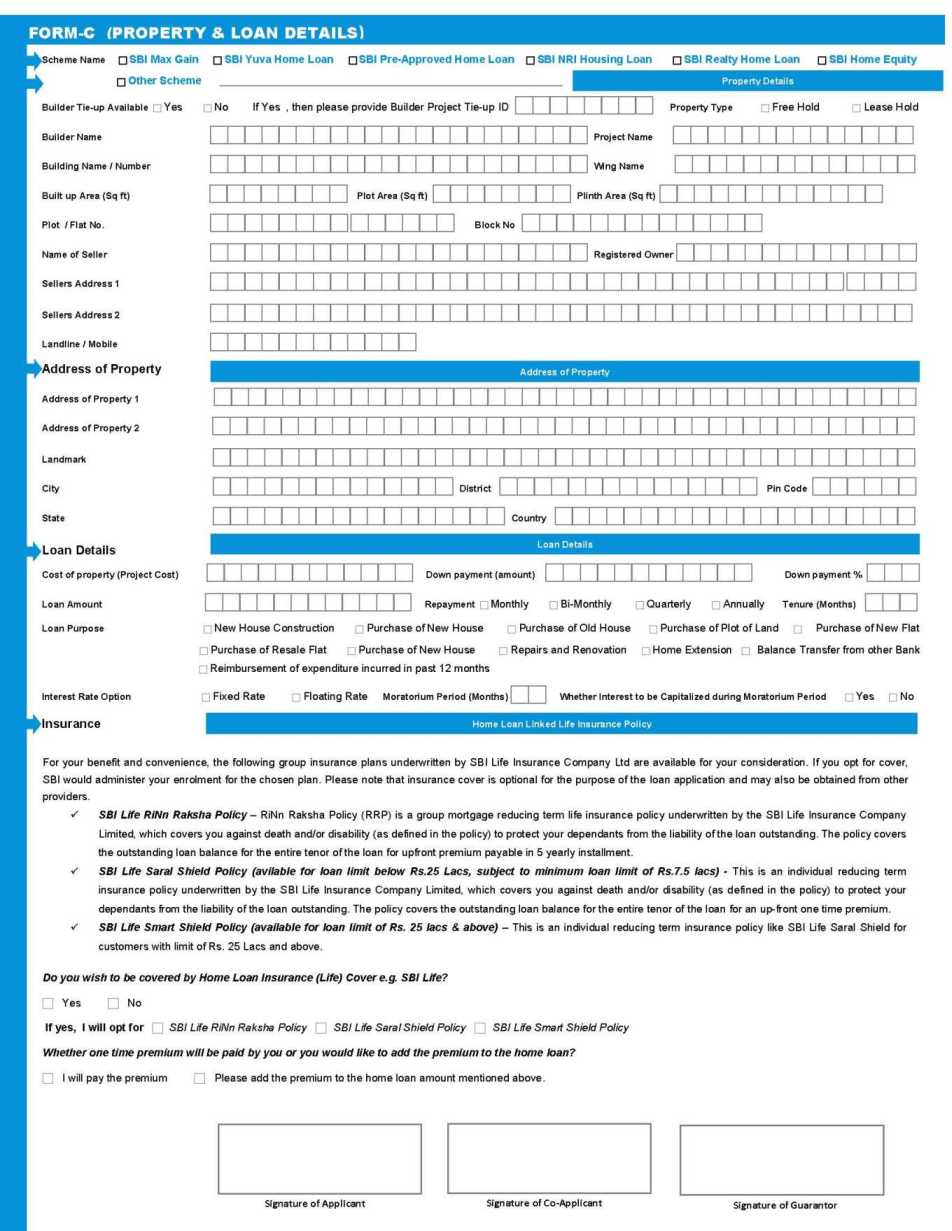

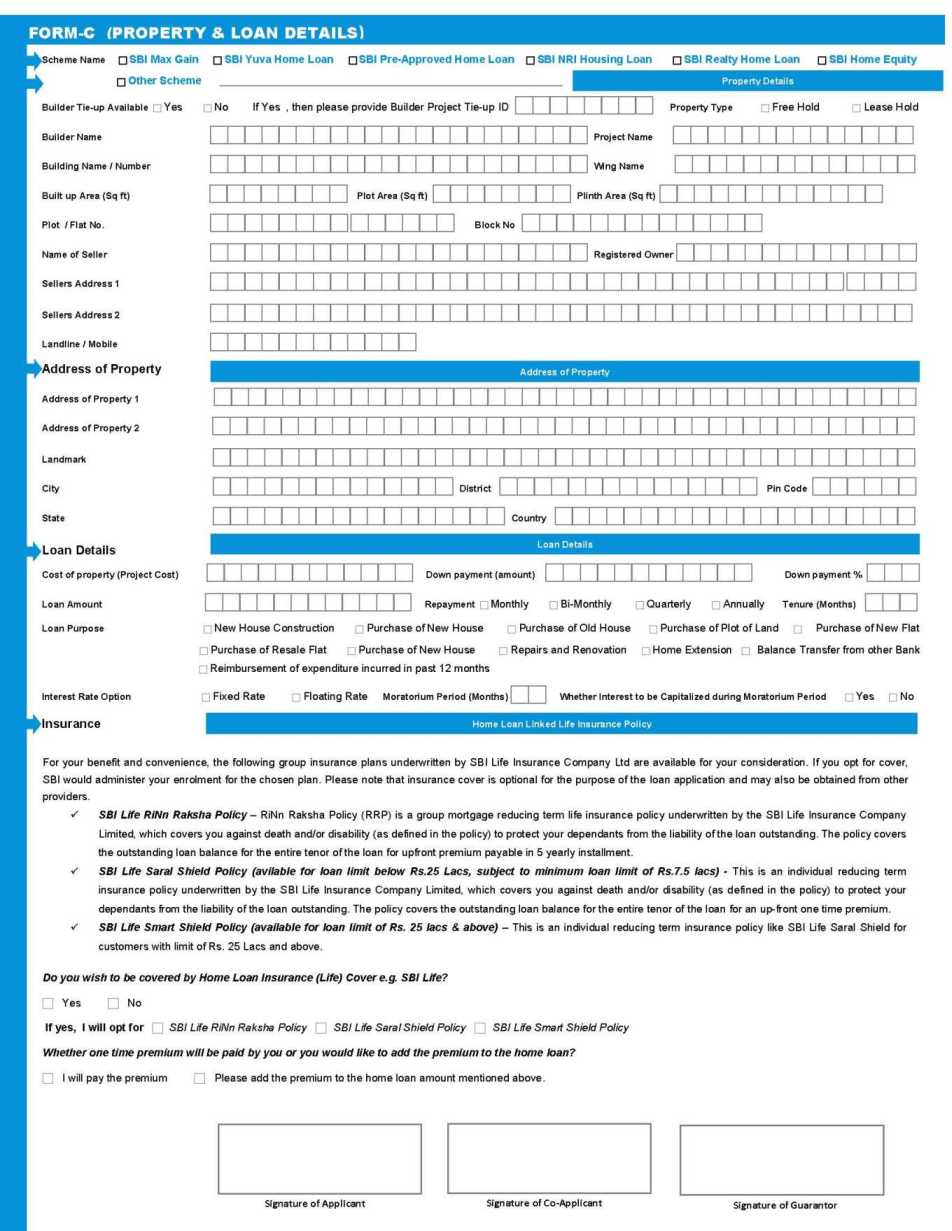

ECS Form SBI Home Loan 2023 2024 EduVark

ECS Form SBI Home Loan 2023 2024 EduVark

Site Loan Tax Exemption COOKING WITH THE PROS

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

All You Need To Know On Exempted Income In Income Tax Ebizfiling

Education Loan Tax Exemption Section - Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings