Education Rebate In Income Tax Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

Web 14 avr 2017 nbsp 0183 32 Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Education Rebate In Income Tax

Education Rebate In Income Tax

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Rebate In Income Tax Ultimate Guide

https://lh6.googleusercontent.com/V-Vll753sLaCzJIQJfpfrdUH6geIv1Ad7kCiVAgX0UOg34X4YS_4goDP4ijfHdI3xWXK49DAYSOc4OZgf7gXkRt7tqEUbn9tEKr371cu2FncnHq1ZFPoEEBzbfxsFPqFs065SsqWCKzqJ9yg_965

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the Web 5 janv 2023 nbsp 0183 32 Tuition fees exemption in Income Tax 2022 23 under section 80C is Rs 1 5 lakh pa University college and school admission fees paid one time Tuition fees

Web 22 juil 2019 nbsp 0183 32 Deduction for Children Education amp Tuition Fees Tax Benefits Under Section 80C India s literacy rate is 77 70 2021 and 2022 To further promote Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Download Education Rebate In Income Tax

More picture related to Education Rebate In Income Tax

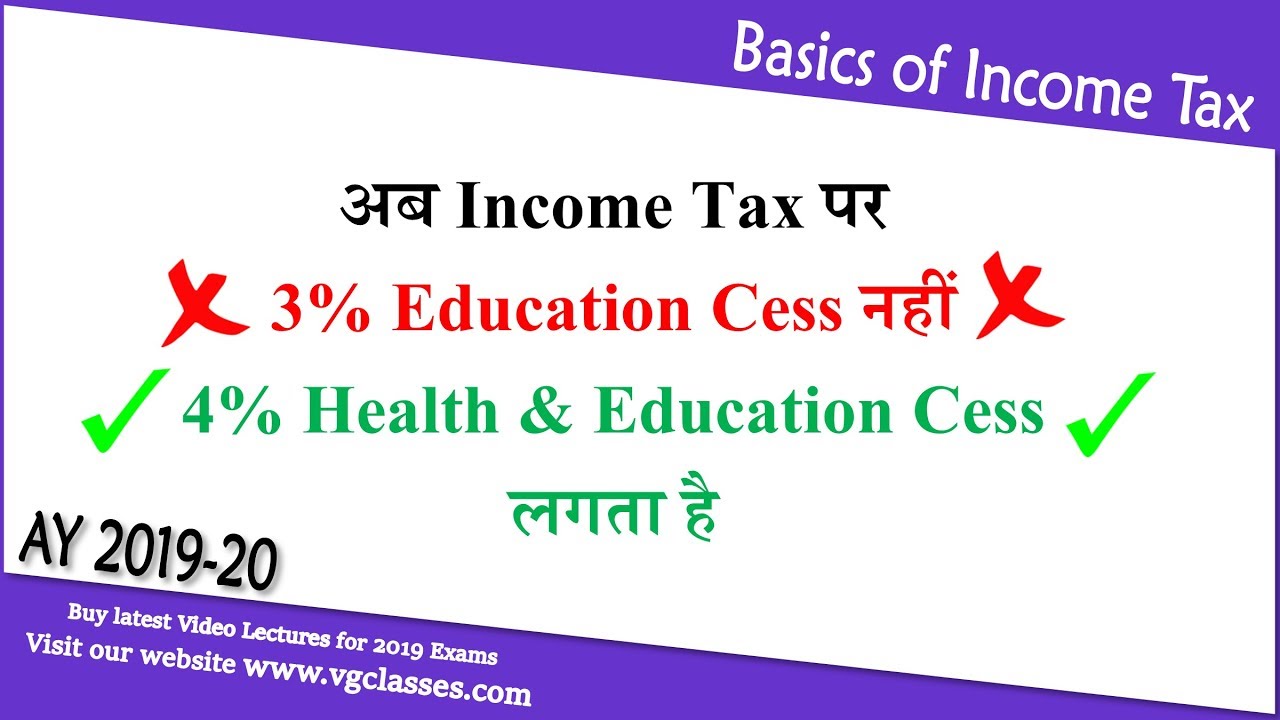

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

https://i.ytimg.com/vi/M_QfCuqh8wI/maxresdefault.jpg

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

https://teachersbuzz.in/wp-content/uploads/2020/05/TAX2BRebate.png

Web The allowance is provided to a person employed in India only The allowance in the form of education fees deduction in income tax is provided only when expenses are incurred Web 27 f 233 vr 2023 nbsp 0183 32 Updated 27 02 2023 10 21 02 AM If your employer provides you children education allowance as a part of your salary structure for the payment of education or

Web 31 mai 2023 nbsp 0183 32 What is section 80E of Income Tax Section 80E is the income tax deduction from taxable income which covers the deduction on the interest component Web 6 avr 2021 nbsp 0183 32 Le montant de la r 233 duction d imp 244 t est 233 gal 224 61 euros pour un enfant au coll 232 ge 153 euros pour un enfant au lyc 233 e 183 euros pour un enfant en enseignement

Province Of Manitoba Education Property Tax

https://www.manitoba.ca/asset_library/en/edupropertytax/ept-banner.jpg

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

https://i.pinimg.com/originals/e2/d1/83/e2d183f21594bbfe69cbb07158bc7fb1.jpg

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions

Rebate Under Section 87A AY 2021 22 CapitalGreen

Province Of Manitoba Education Property Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Pin On Tigri

Pin On Tigri

Section 87A Tax Rebate Under Section 87A

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Education Rebate In Income Tax - Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has