Education Tax Rebate Eligibility Web 29 ao 251 t 2023 nbsp 0183 32 Credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less

Web 20 juin 2017 nbsp 0183 32 You can get the full education tax credit if your modified adjusted gross income or MAGI was 80 000 or less in 2022 160 000 Web 16 ao 251 t 2023 nbsp 0183 32 This interview will help you determine if your education expenses qualify for a tax benefit Information You ll Need Filing status Student s enrollment status Your

Education Tax Rebate Eligibility

Education Tax Rebate Eligibility

https://pbs.twimg.com/media/Fp2Ja69XwAAwfSR.jpg

New Mexico Tax Rebate 2023 Eligibility How To Claim And Deadlines

https://printablerebateform.net/wp-content/uploads/2023/04/New-Mexico-Tax-Rebate-2023-768x678.png

How To Check Your Tax Rebate Eligibility Tax Rebate Check 2023 Tax

https://www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-Check-2023.jpg

Web If you pay qualified education expenses in both 2022 and 2023 for an academic period that begins in the first 3 months of 2023 and you receive tax free educational Web 13 f 233 vr 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education

Web 23 nov 2022 nbsp 0183 32 Up to 1 000 40 of the tax credit may be refunded except to certain taxpayers who are under age 24 as of the end of the tax year The AOTC is limited to the first four years of Web 31 mai 2023 nbsp 0183 32 The American Opportunity Credit can save you up to 2 500 in tax for the education expenses of each eligible student To qualify the student must pursue a degree at a school that is eligible to participate in

Download Education Tax Rebate Eligibility

More picture related to Education Tax Rebate Eligibility

IRS Payroll Tax Rebates For 2020 2021 2022 Free ERTC Eligibility Test

https://i.pinimg.com/originals/e2/db/66/e2db66d275f5ed0f7f7e858563b8fa87.jpg

Colorado Rent Rebate Eligibility Application Process FAQs Rent Rebates

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/04/Colorado-Rent-Rebate.jpg?ssl=1

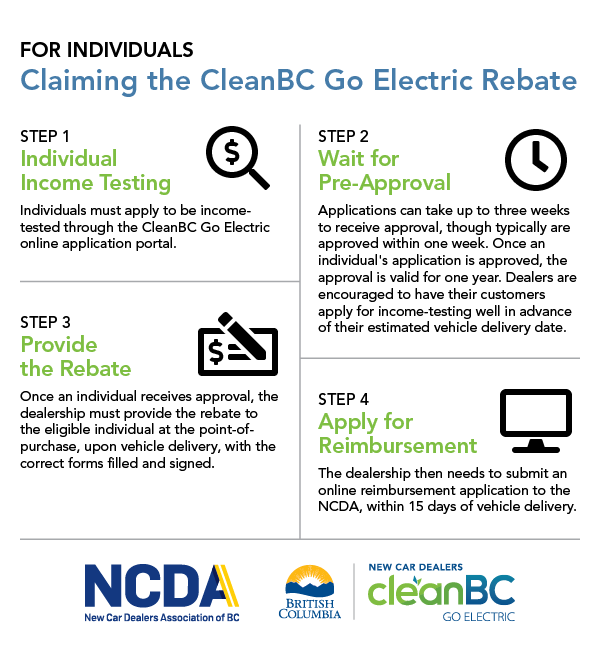

Rebate Eligibility Criteria CleanBC Go Electric Passenger Vehicle

https://newcardealersgoelectric.ca/wp-content/uploads/Individuals-CleanBC-Rebate-Program-Infographic.png

Web 27 janv 2023 nbsp 0183 32 Can I still claim an education credit for tax year 2022 A19 Yes You can still claim the AOTC if you did not receive a Form 1098 T because the school is not Web 22 juil 2021 nbsp 0183 32 Taxpayers who pay for higher education in 2021 can see these tax savings when they file their tax return next year If taxpayers their spouses or their dependents

Web 15 juin 2023 nbsp 0183 32 What expenses qualify for an education credit Do tuition and related expenses paid to attend a private high school qualify for an education credit If I pay Web 31 mars 2022 nbsp 0183 32 Families with college students might be eligible for certain tax deductions or credits on their 2021 taxes But accounting for them properly can be a challenge

California Ev Rebate Lease Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/california-ev-rebate-eligibility-2022-rebate2022.jpeg?fit=1035%2C487&ssl=1

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

https://www.irs.gov/newsroom/tax-benefits-for-education-information-c…

Web 29 ao 251 t 2023 nbsp 0183 32 Credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less

https://www.nerdwallet.com/article/loans/stude…

Web 20 juin 2017 nbsp 0183 32 You can get the full education tax credit if your modified adjusted gross income or MAGI was 80 000 or less in 2022 160 000

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

California Ev Rebate Lease Californiarebates

Alcon Choice Rebate Code 2023 Printable Rebate Form

Owners Of Pricey Properties Pocketed Big Bucks From Tax Cuts Promised

Washington State Tax Rebate Printable Rebate Form

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Virginia State Tax Rebate 2023 Eligibility Application And Deadline

2023 ERTC Eligibility Assessment Rebate Application New Online CPA

Star Rebate Check Eligibility StarRebate

Education Tax Rebate Eligibility - Web 23 nov 2022 nbsp 0183 32 Up to 1 000 40 of the tax credit may be refunded except to certain taxpayers who are under age 24 as of the end of the tax year The AOTC is limited to the first four years of