Effective Tax Rate In Netherlands Generally private and public companies with Dutch residency are subject to corporate income tax on their worldwide income Corporate tax rate is based upon taxable amount which equals taxable profit in the corresponding year minus deductible losses In 2018 for taxable amount below 200 000 a 20 tax rate was applicable Taxable amount of 200 000 and above was taxed at a 25 tax rate The corporate tax rates are both due to decrease by 1 percentage poin

In 2023 the basic rate will be 36 93 and the top rate will be 49 50 for income above 73 031 As of January 1 2024 the basic rate will increase slightly to 36 97 and the The standard CIT rate is 25 8 There are two taxable income brackets A lower rate of 19 15 in 2022 applies to the first income bracket of EUR 200 000

Effective Tax Rate In Netherlands

Effective Tax Rate In Netherlands

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAHqqji.img

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg)

All You Need To Know About Dutch Income Taxes News In The Netherlands

https://www.reuters.com/resizer/Wb1b2sq_iwwqEC-F3i7NeUiECS8=/1920x1005/smart/filters:quality(80)/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg

15k Salary Effective Tax Rate V s Marginal Tax Rate NL Tax 2024

https://nl.icalculator.com/img/og/NL/100.png

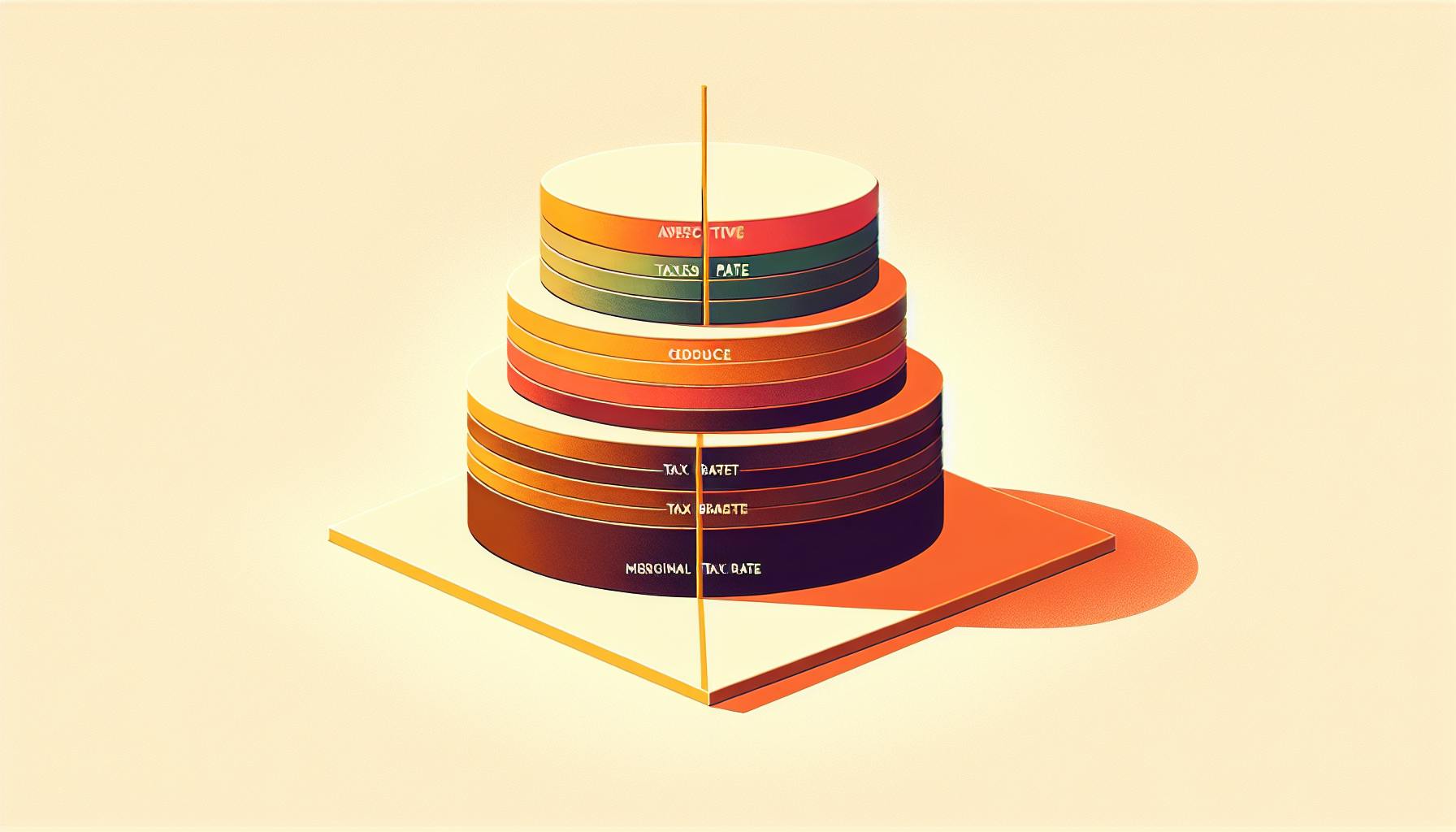

The Dutch Minimum Taxation Act 2024 also known as Pillar Two provides for a minimum effective tax rate of 15 per jurisdiction for large international enterprises Welcome to our comprehensive guide to understanding the effective tax rate and marginal tax rate on a 90 000 00 annual taxable income in Netherlands based on the 2024 Tax

If you live in the Netherlands and earn a gross annual salary of 45 400 or 3 783 per month your monthly net salary will be 2 983 This results in an effective tax rate of A handy overview of the most relevant tax rates applicable to individuals in the Netherlands including the 2022 rates the Dutch personal income tax the Dutch

Download Effective Tax Rate In Netherlands

More picture related to Effective Tax Rate In Netherlands

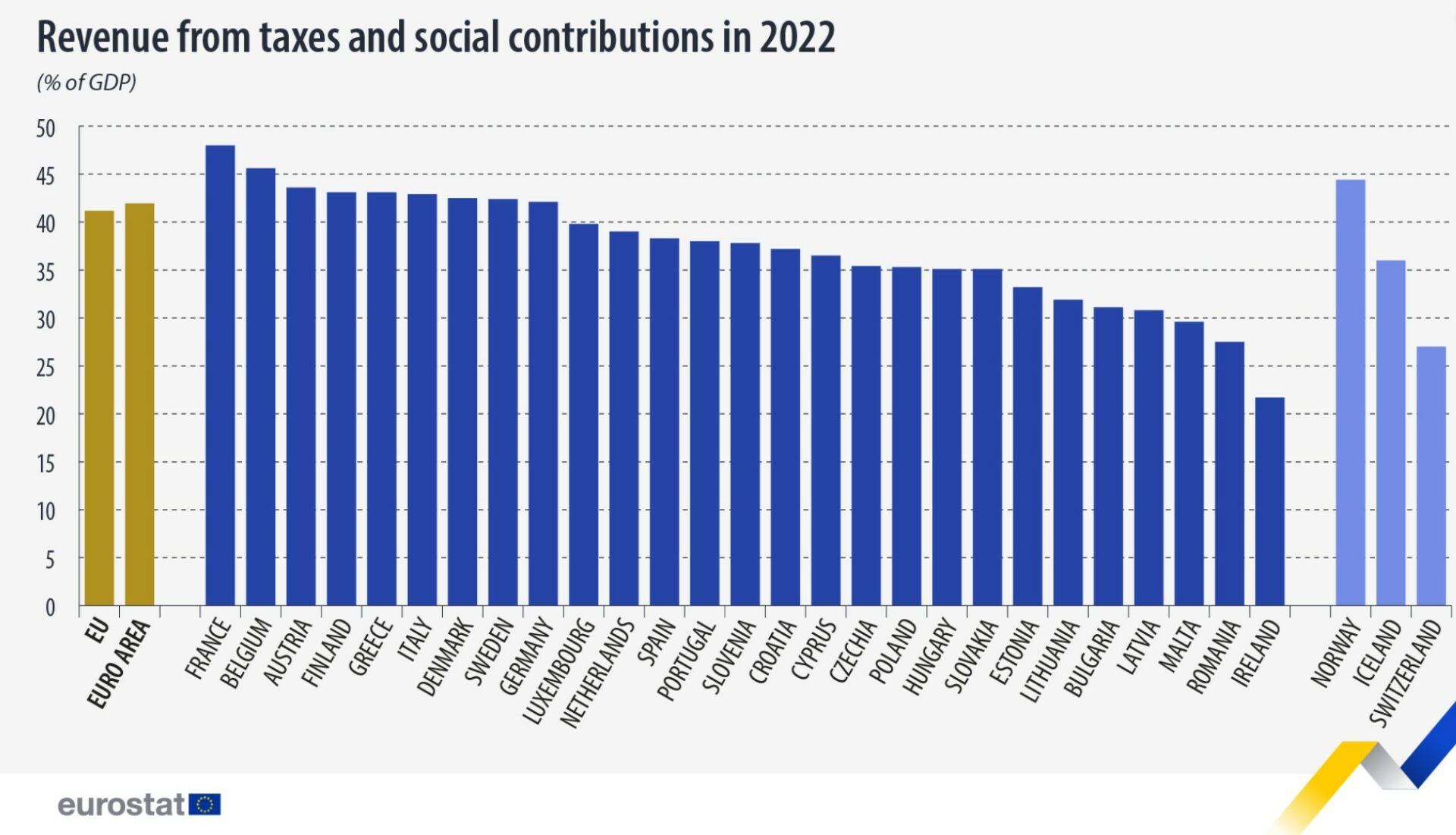

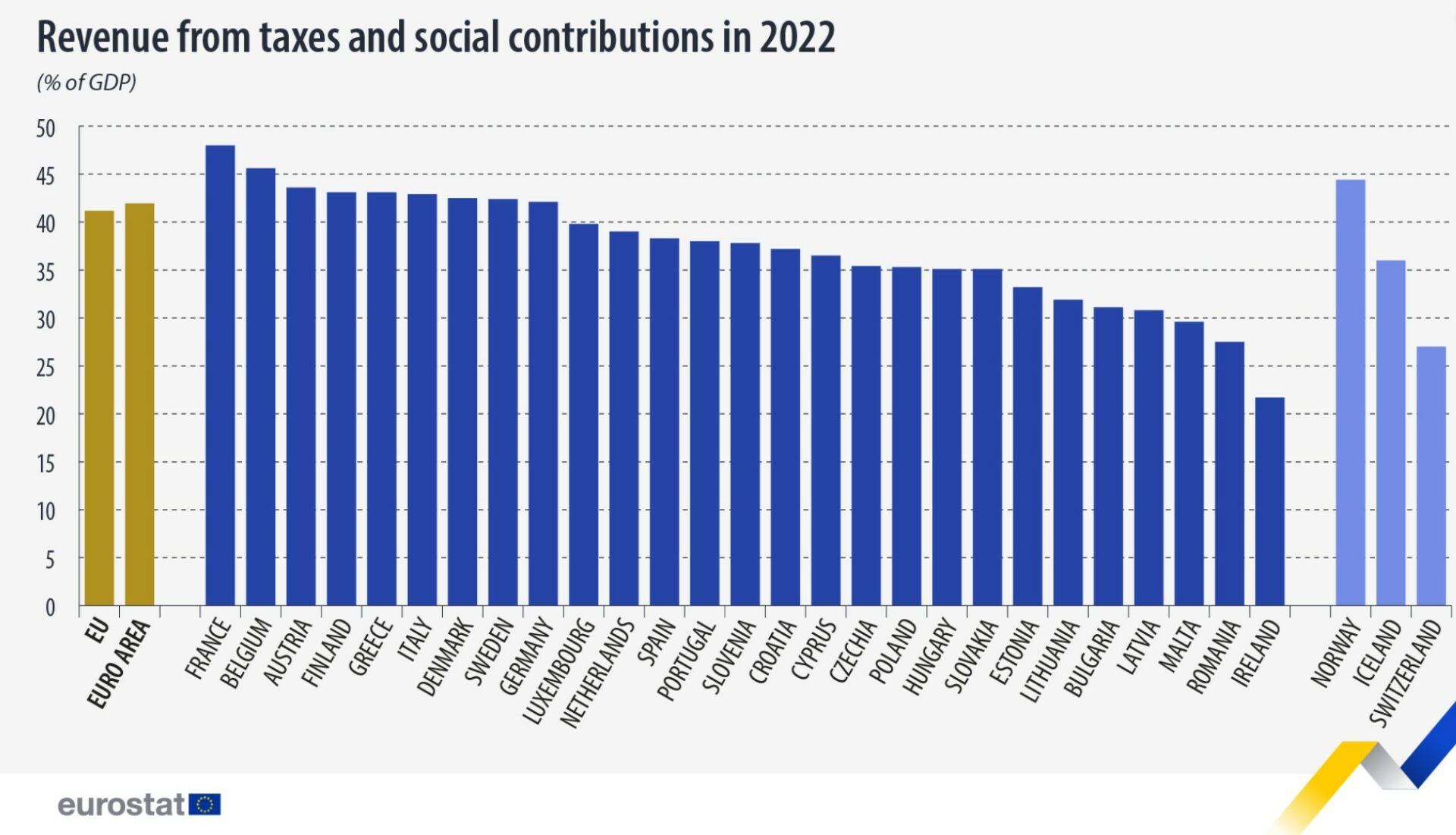

Tax Rate In Europe Vs US How Do They Differ

https://qubit-labs.com/wp-content/uploads/2023/10/Tax-Rate-in-Europe-vs-US-–-How-Do-They-Differ_-1-scaled.jpg

12 5k Salary Effective Tax Rate V s Marginal Tax Rate BA Tax 2024

https://ba.icalculator.com/img/og/BA/100.png

25k Salary Effective Tax Rate V s Marginal Tax Rate CD Tax 2024

https://cd.icalculator.com/img/og/CD/100.png

The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 35 048 2023 31 891 The annual taxable salary for other 31 rowsFor people above the pension age the social security component is reduced Additionally there are income dependent deductions and tax credits for incomes up to

Dutch tax rates are updated every year Here you can find an overview of various tax rates in 2023 Use this information for your financial planning and tax matters Turnover The tax rate for income from savings and investments is increased to 31 Expats with the 30 ruling can opt in the tax return to be exempted from taxation on

Belgium Has Second Highest Tax Rate In EU

https://api.brusselstimes.com/wp-content/uploads/2023/10/8f74cfa9-screenshot-2023-10-31-122120.jpg

47 5k Salary Effective Tax Rate V s Marginal Tax Rate BV Tax 2024

https://bv.icalculator.com/img/og/BV/100.png

https://en.wikipedia.org/wiki/Taxation_in_the_Netherlands

Generally private and public companies with Dutch residency are subject to corporate income tax on their worldwide income Corporate tax rate is based upon taxable amount which equals taxable profit in the corresponding year minus deductible losses In 2018 for taxable amount below 200 000 a 20 tax rate was applicable Taxable amount of 200 000 and above was taxed at a 25 tax rate The corporate tax rates are both due to decrease by 1 percentage poin

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg?w=186)

https://taxsavers.nl/dutch-tax-system/2023-2024

In 2023 the basic rate will be 36 93 and the top rate will be 49 50 for income above 73 031 As of January 1 2024 the basic rate will increase slightly to 36 97 and the

Netherlands Corporate Tax Rate 2024 Take profit

Belgium Has Second Highest Tax Rate In EU

Taxes In The Netherlands 2023 A Complete Guide Clear Finances

Effective Tax Rate Vs Marginal Tax Rate

Tax Rate In Pdf

Netherlands Personal Income Tax Rate 2023 Take profit

Netherlands Personal Income Tax Rate 2023 Take profit

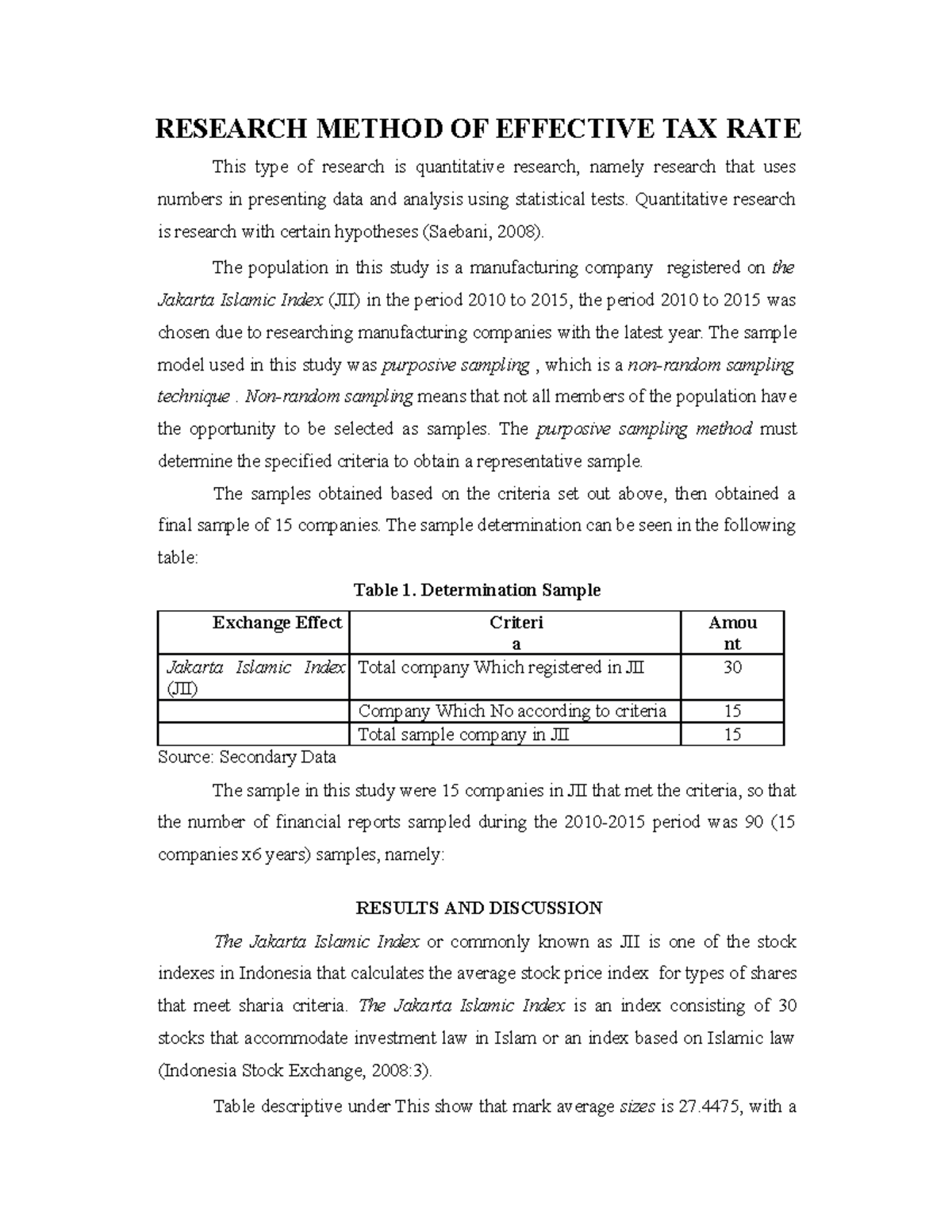

Research Method OF Effective TAX RATE RESEARCH METHOD OF EFFECTIVE

Tax Harvesting Maximising Tax Efficiency In Your Investments

What Is The Effective Tax Rate Definition Example

Effective Tax Rate In Netherlands - If you live in the Netherlands and earn a gross annual salary of 45 400 or 3 783 per month your monthly net salary will be 2 983 This results in an effective tax rate of