Effects Of Tax On Consumers This policy brief reviews how tax policies impact individuals and businesses using some examples from major tax reforms in the last several decades Taxation affects individual and family decisions on work savings and their

The most well known taxes are ones levied on the consumer such as Government Sales Tax GST and Provincial Sales Tax PST The government also sets Bernd Hayo Professor at the University of Marburg discusses the reaction of consumers to an unanticipated tax change Fiscal policy the increase and decrease of either

Effects Of Tax On Consumers

Effects Of Tax On Consumers

https://www.thetwilighttutor.co.uk/uploads/6/5/6/9/65692207/ad-valorem-tax_orig.png

Effect Of Tax Depending On Elasticity Economics Help

https://www.economicshelp.org/wp-content/uploads/2008/05/tax-on-inelastic-demand-500x521.jpg

Market Equilibrium

https://microecon.bharatbhole.com/static/views/demand_supply_eqm/figures/acemoglu_effect_taxes_ch10.png

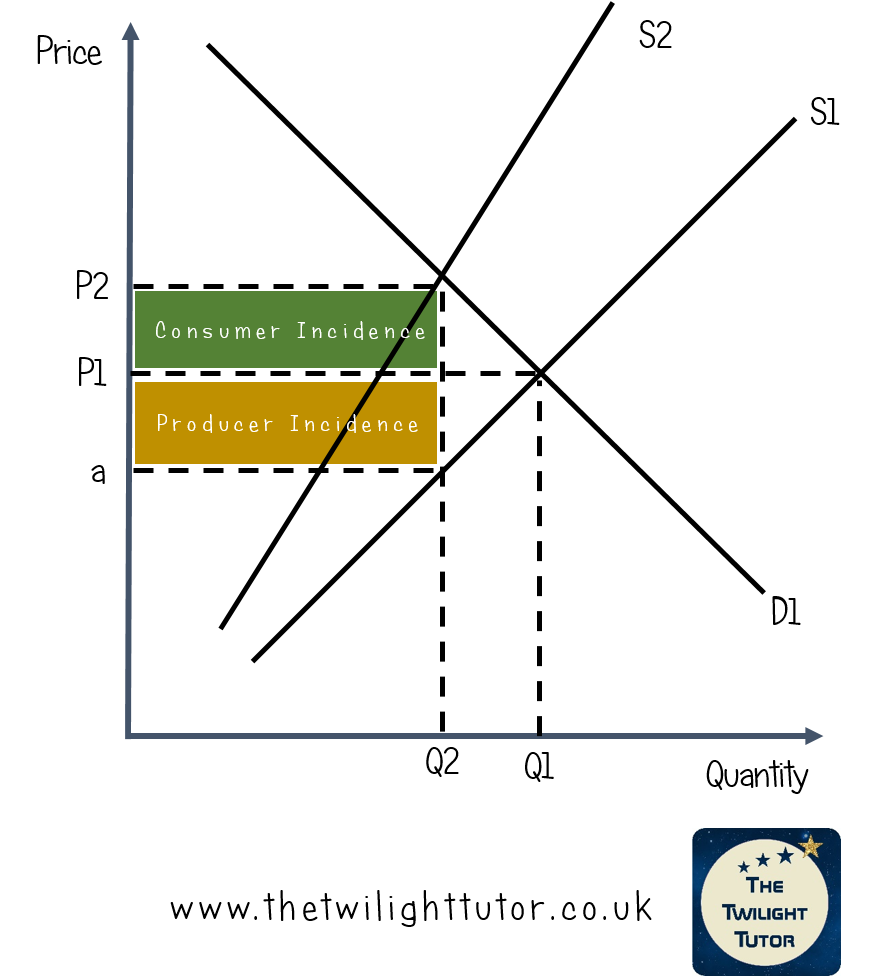

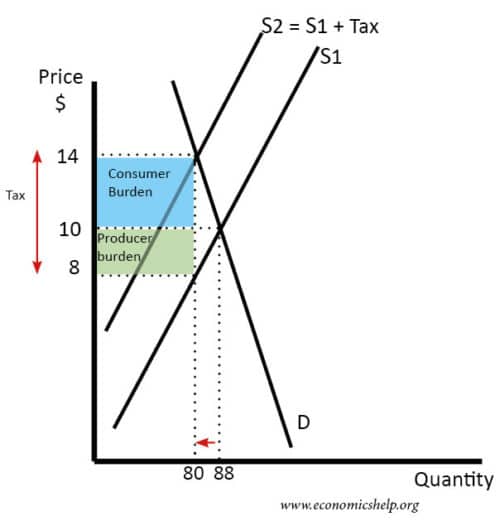

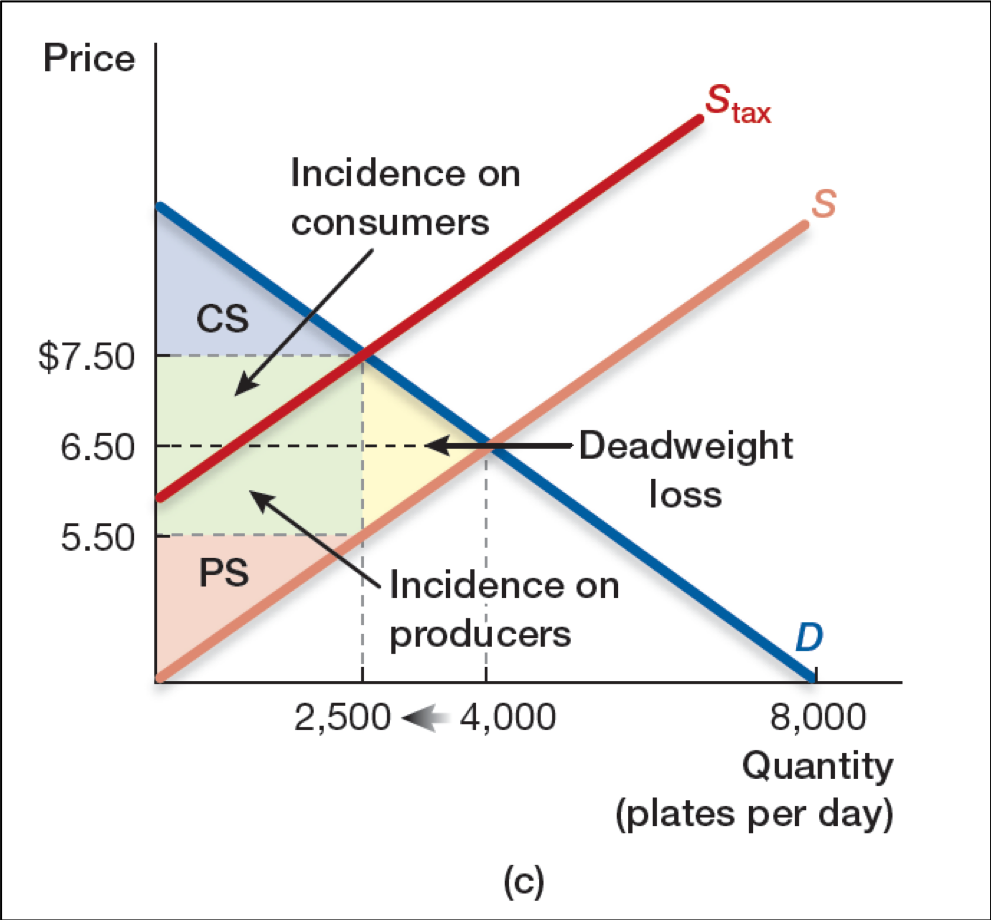

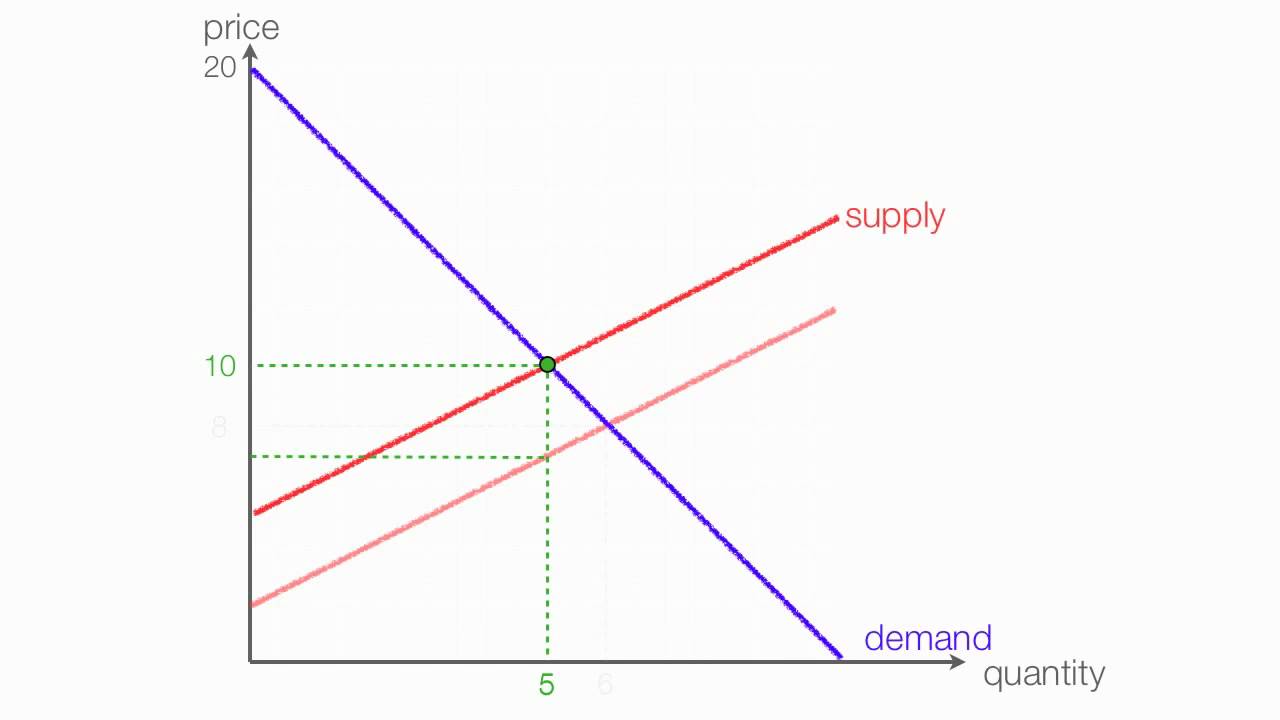

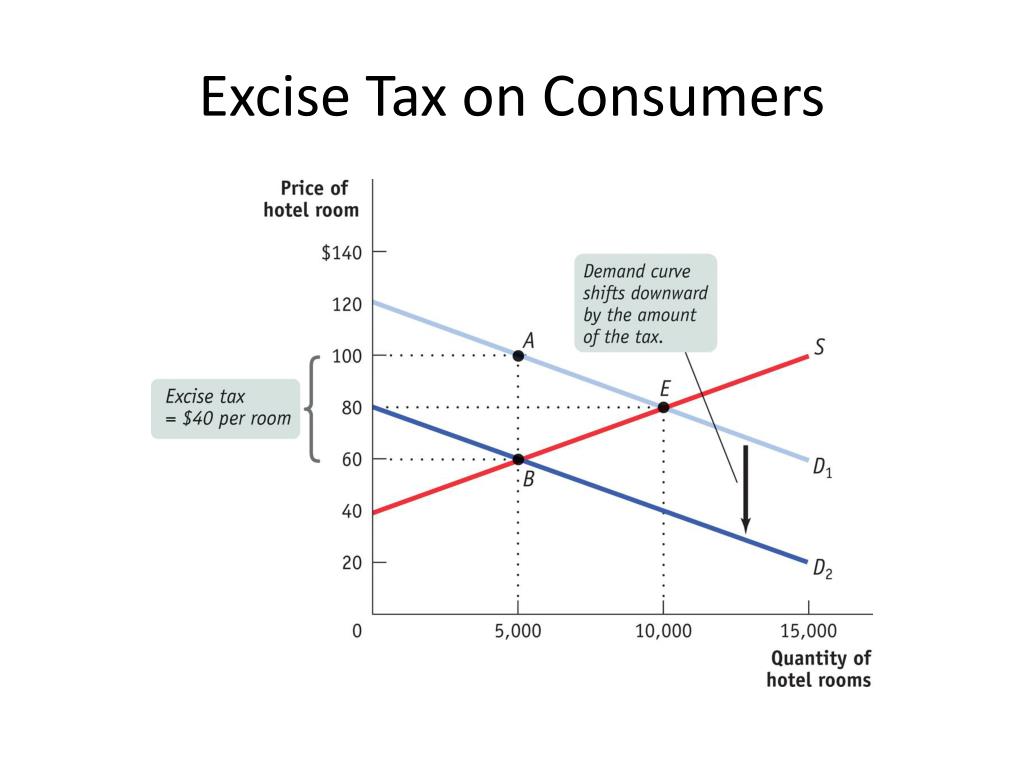

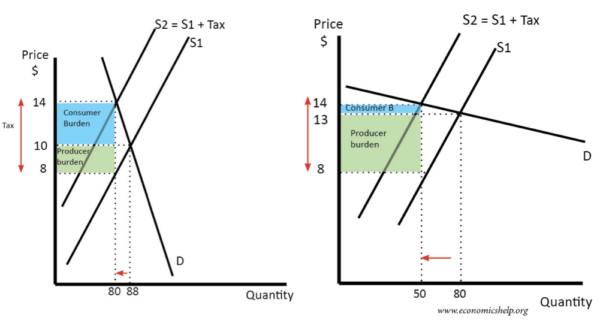

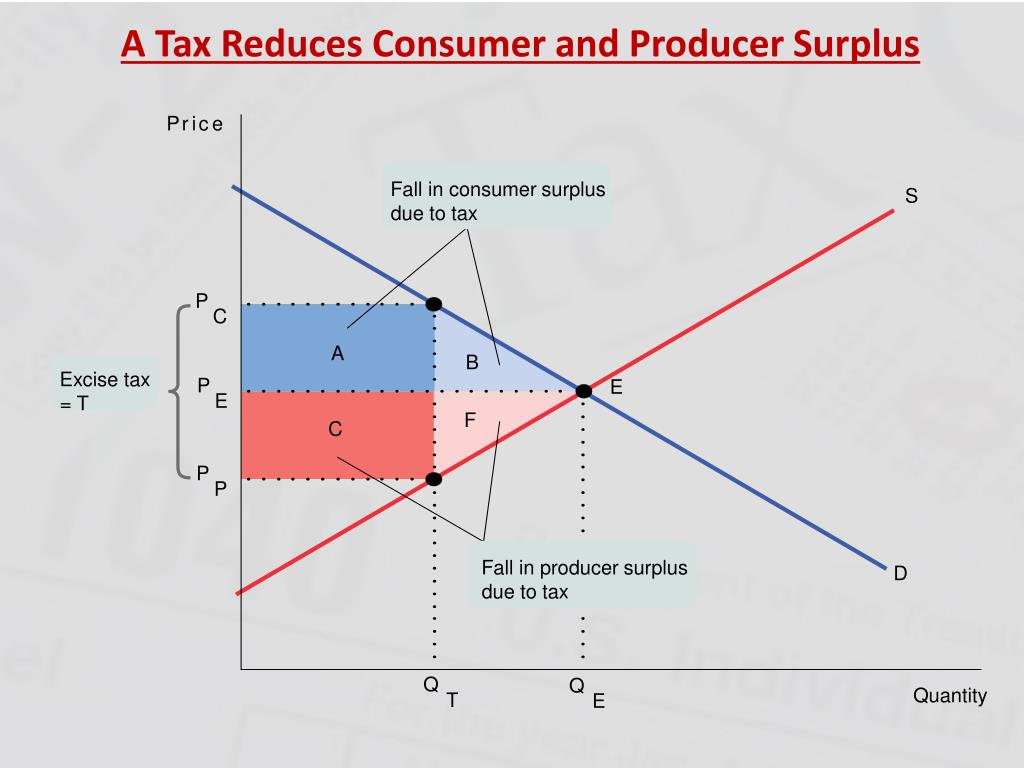

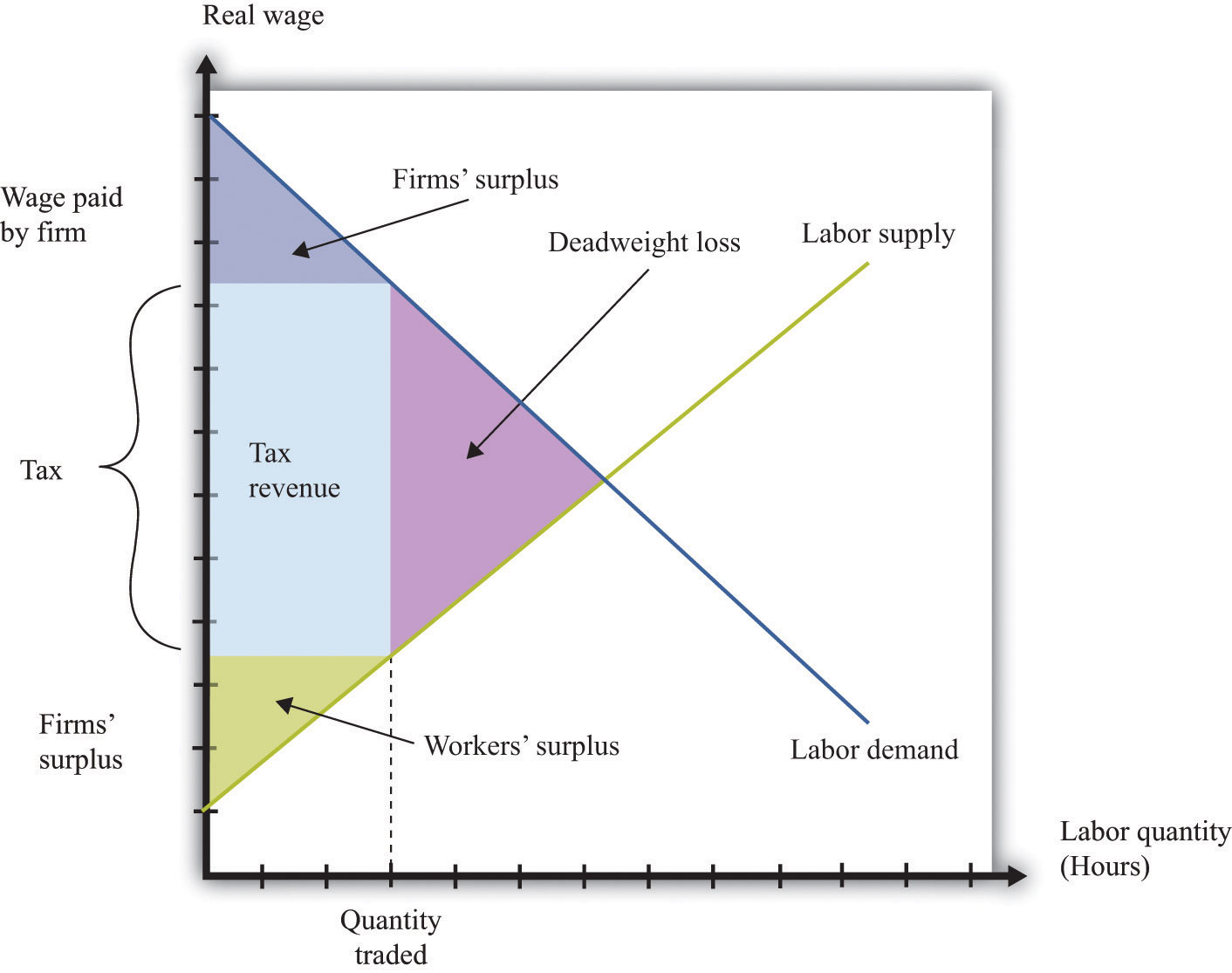

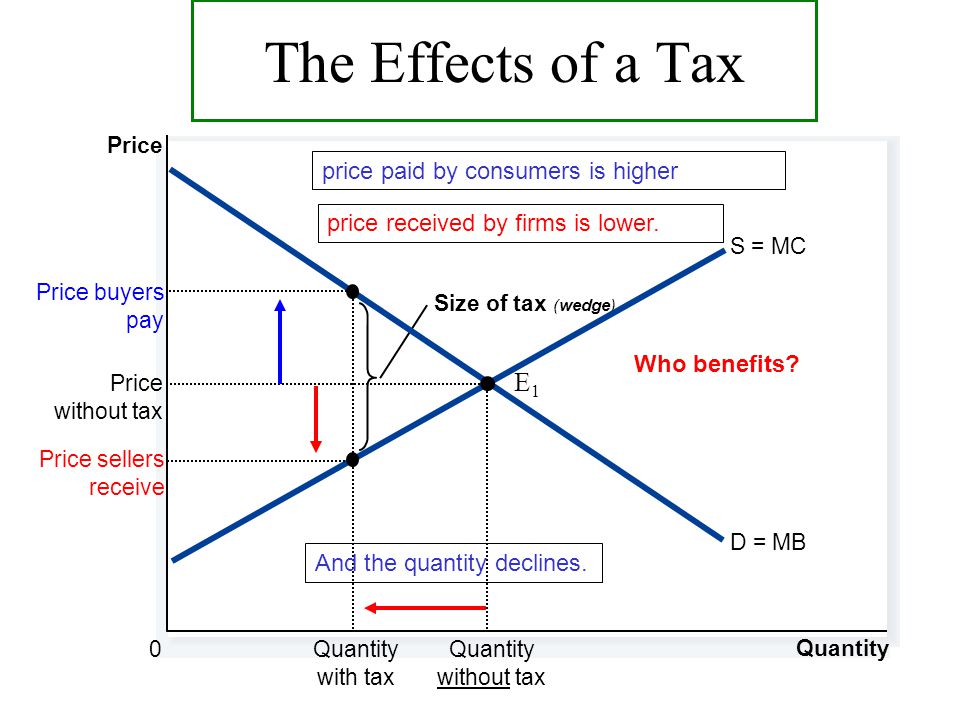

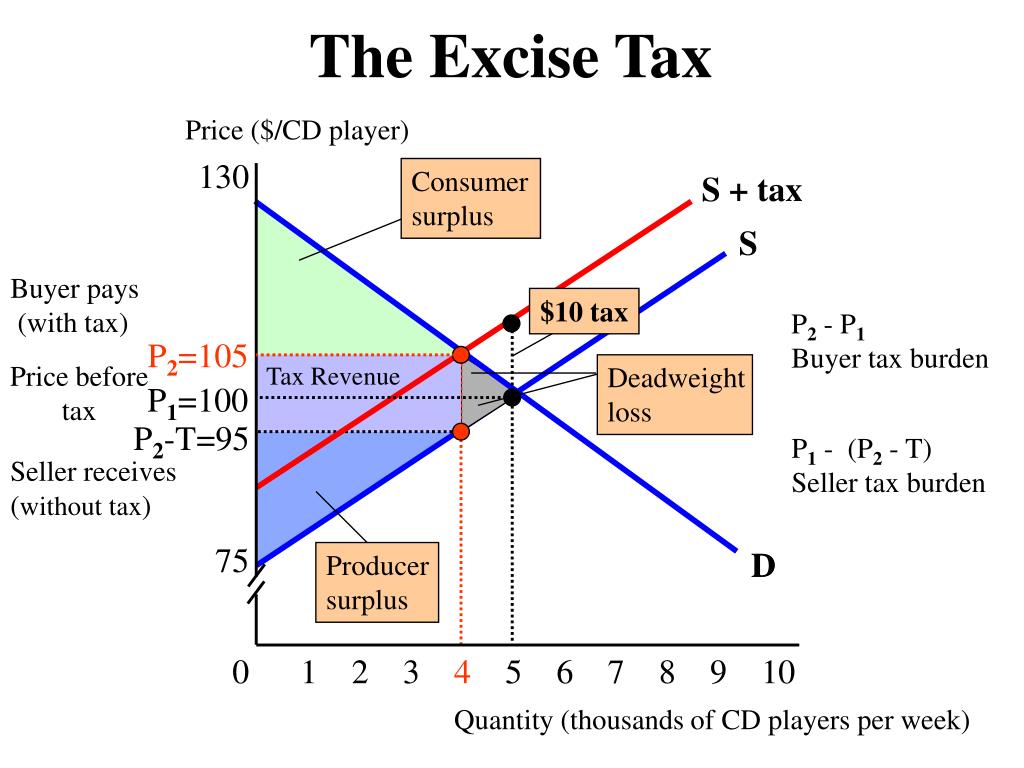

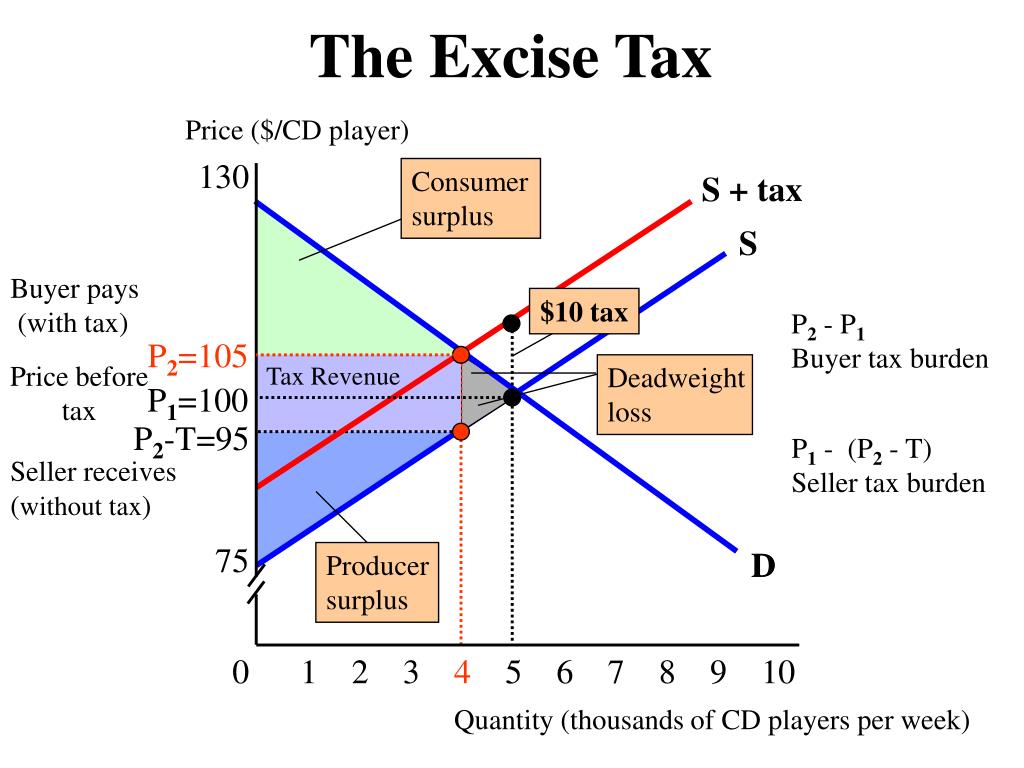

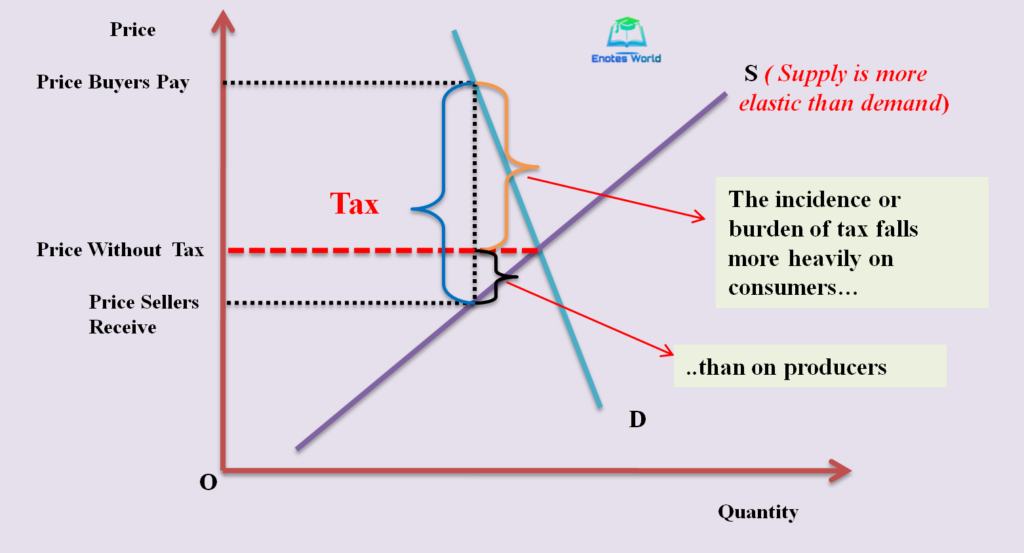

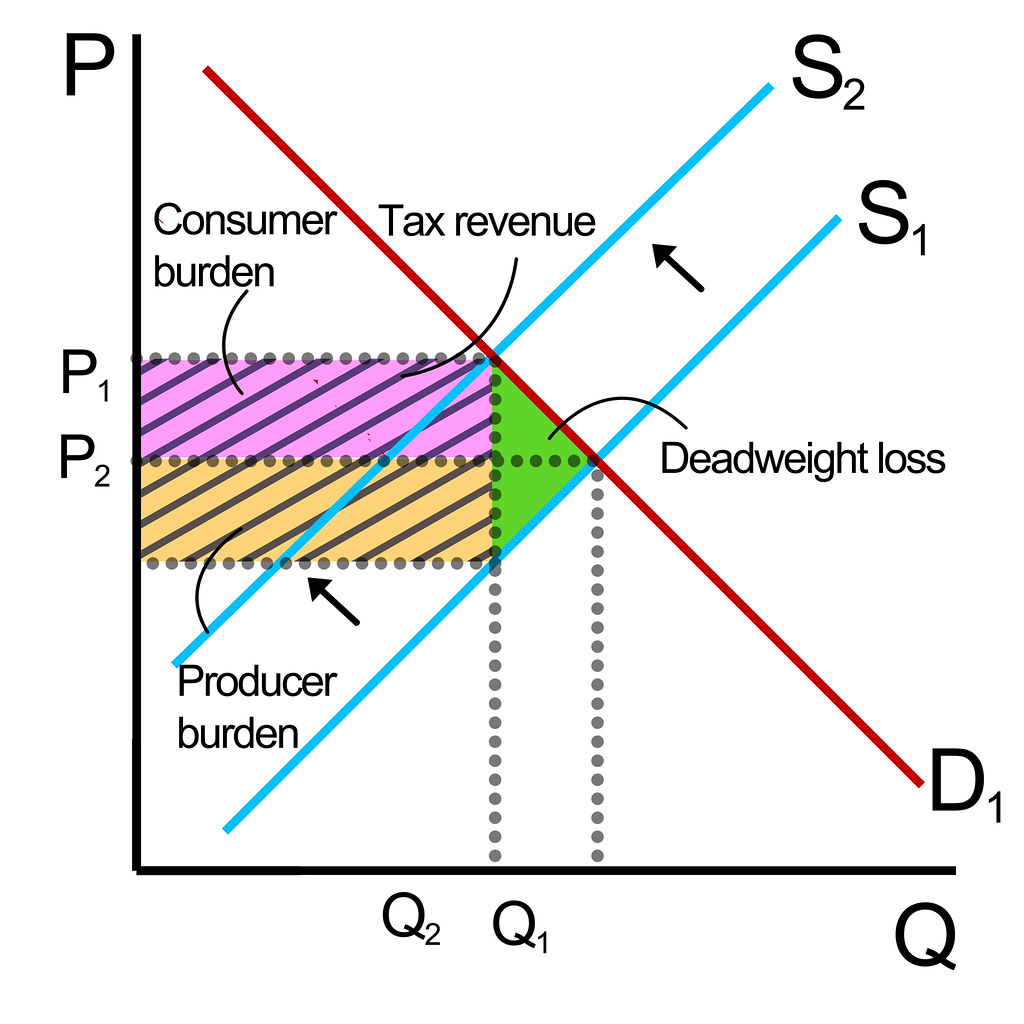

Consumers do not respond uniformly to taxes the impact of taxes and tax related frames are more salient to some groups of consumers than others Two variables in There are two main effects of a tax a fall in the quantity traded and a diversion of revenue to the government These are illustrated in Figure 5 4 Revenue and deadweight loss First the revenue is just the amount of the tax times the

This video introduces the idea of the tax burden and demonstrates how taxes impact both consumers and producers Look closely at the graphs towards the end of the video to graphically see how different elasticities cause the tax Economists discuss how taxes impact incentives for individuals and firms as well as how they both respond to different marginal tax rates Each tax decision has to be weighted

Download Effects Of Tax On Consumers

More picture related to Effects Of Tax On Consumers

E C O N G E O G B L O G Tax Economics Unit 1 3

https://4.bp.blogspot.com/-llMT-cqArVs/VTu-zgOte0I/AAAAAAAAGoU/R0HJuGiVndA/s1600/Slide061.jpg

How To Calculate Excise Tax And The Impact On Consumer And Producer

https://i.ytimg.com/vi/XPIT74FrXBM/maxresdefault.jpg

PPT Microeconomics Graphs PowerPoint Presentation Free Download ID

https://image1.slideserve.com/3246464/excise-tax-on-consumers-l.jpg

These changes are known as the incidence of the tax a tax mostly borne by buyers in the form of higher prices or by sellers in the form of lower prices net of taxation There are two main effects of a tax a fall in the quantity traded and a Two conclusions stand out First consumers will be more likely to boost spending if the change in tax liabilities is permanent Second consumers will wait to increase spending until a tax

Tax affects economic growth by reducing consumer spending and lowering incentives to invest But different fiscal policies have variable overall economic effects with Tax policy and the news An empirical analysis of taxpayers perceptions of tax related media coverage and its impact on tax compliance Journal of Behavioral and Experimental

Tax Incidence Macroeconomics With Prof Dolar

https://s3-us-west-2.amazonaws.com/courses-images/wp-content/uploads/sites/2043/2015/07/14031817/CNX_Econ_C05_025.jpg

Effect Of Tax Depending On Elasticity Economics Help

https://www.economicshelp.org/wp-content/uploads/2012/11/tax-depends-elasticity-600x320.png

https://siepr.stanford.edu/publications/po…

This policy brief reviews how tax policies impact individuals and businesses using some examples from major tax reforms in the last several decades Taxation affects individual and family decisions on work savings and their

https://pressbooks.bccampus.ca/uvicecon103/chapter/4-6-taxes

The most well known taxes are ones levied on the consumer such as Government Sales Tax GST and Provincial Sales Tax PST The government also sets

PPT Tax Incidence And Deadweight Loss PowerPoint Presentation Free

Tax Incidence Macroeconomics With Prof Dolar

11 Taxes Simply Economics

CHART OF THE DAY There s No Link Between Capital Gains Tax Rates And GDP

Why Is There A Deadweight Loss From Taxation Socratic

PPT Demand And Supply PowerPoint Presentation Free Download ID 1811415

PPT Demand And Supply PowerPoint Presentation Free Download ID 1811415

Elasticity And Tax Incidence Application Of Demand Supply Analysis

Economics Graph tax burden Marika Shimomura Flickr

Tax Incidence supply demand diagrams

Effects Of Tax On Consumers - Economists discuss how taxes impact incentives for individuals and firms as well as how they both respond to different marginal tax rates Each tax decision has to be weighted