Ei Rebate 2024 Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification and Appliance Rebates will put money directly About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Ei Rebate 2024

Ei Rebate 2024

http://www.maxcraft.ca/blog/wp-content/uploads/2020/05/ei-rebate-1.jpg

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

January 2024 Table of Contents o How rebates will be provided to eligible recipients o The state s expectation for which party is carrying the cost between the point of sale transaction and reimbursement by the state o Maximum time allowed for rebate reimbursement from the state and how the On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

Download Ei Rebate 2024

More picture related to Ei Rebate 2024

Continental Tire Rebate August 2022 2023 Tirerebate

https://www.tirerebate.net/wp-content/uploads/2022/06/continental-tires-rebate-best-tire-deal-at-lamb-s-tire-automotive-5.jpg

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

Alcon Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Under the Employment Insurance Act and the EI Regulations an employer s EI premiums may be reduced when employees are covered by a qualified short term disability plan that reduces the EI benefits that would be payable if such a plan didn t exist The Canada Employment Insurance Commission the Commission presents its summary of the 2024 Actuarial Report on the Employment Insurance Premium Rate This is one of the Commission s responsibilities as defined per section 66 31 of the Employment Insurance Act the Act The Commission is responsible for administering the Act

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our

Green Mountain Power GMP s Successful Rebate Programs Continue In 2024 And Income Eligible GMP

https://electricenergyonline.com/EI/ShareNews.png?i=v6

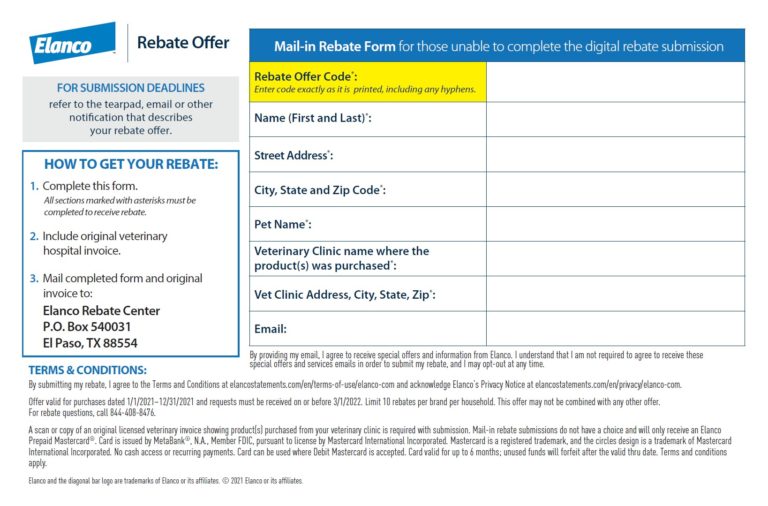

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

https://i0.wp.com/www.elancorebate.net/wp-content/uploads/2023/05/Elanco-Trifexis-Rebate-Form.png?fit=1174%2C813&ssl=1

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.energy.gov/scep/home-energy-rebates-programs

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification and Appliance Rebates will put money directly

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

Green Mountain Power GMP s Successful Rebate Programs Continue In 2024 And Income Eligible GMP

Seresto Rebate Form PrintableRebateForm

Printable Alcon Rebate Form 2023 Printable Forms Free Online

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

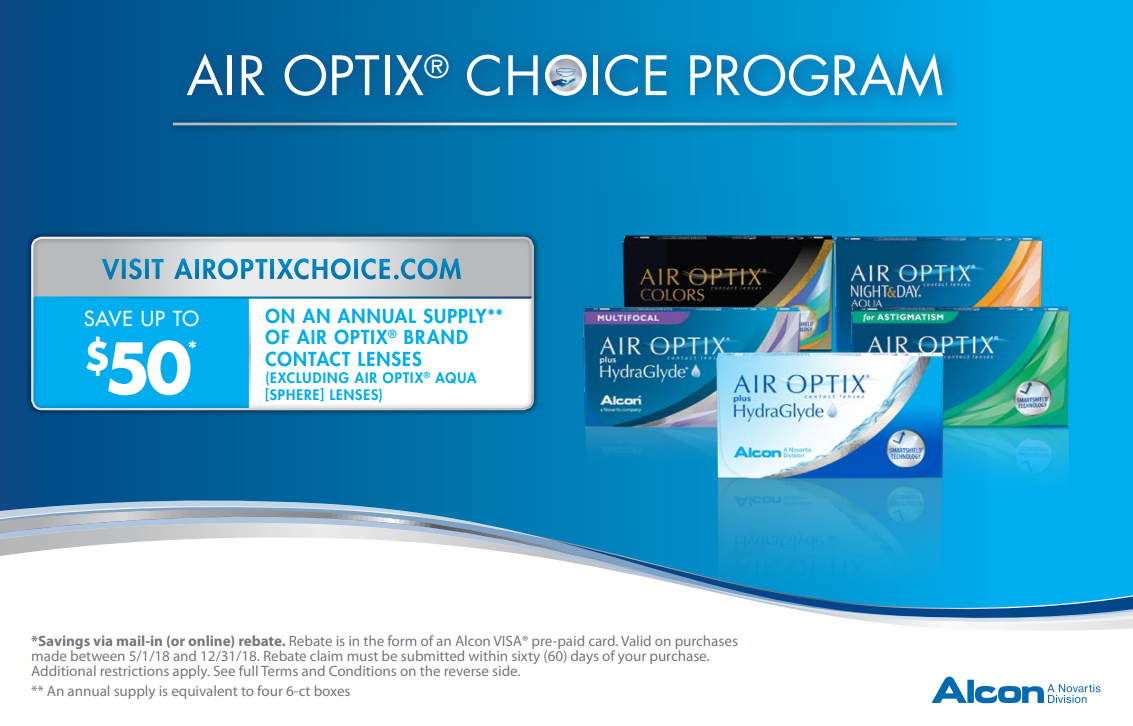

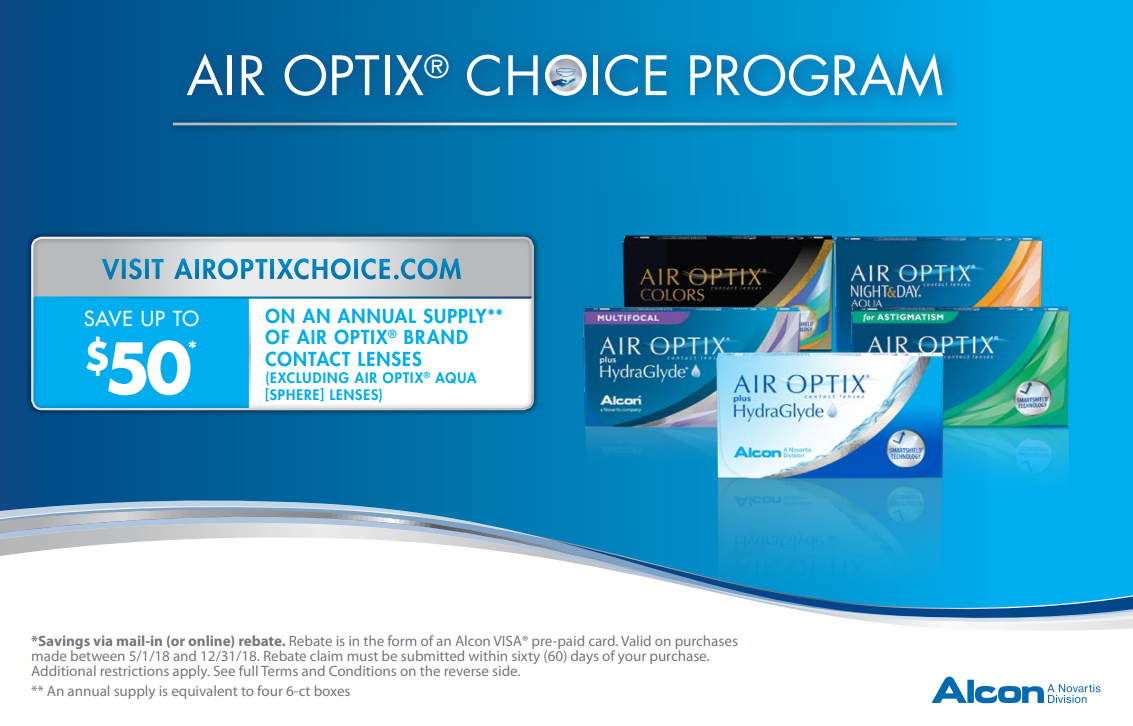

Rebate Air Optix Printable Rebate Form

Rebate Air Optix Printable Rebate Form

Traderider Rebate Program Verify Trade ID

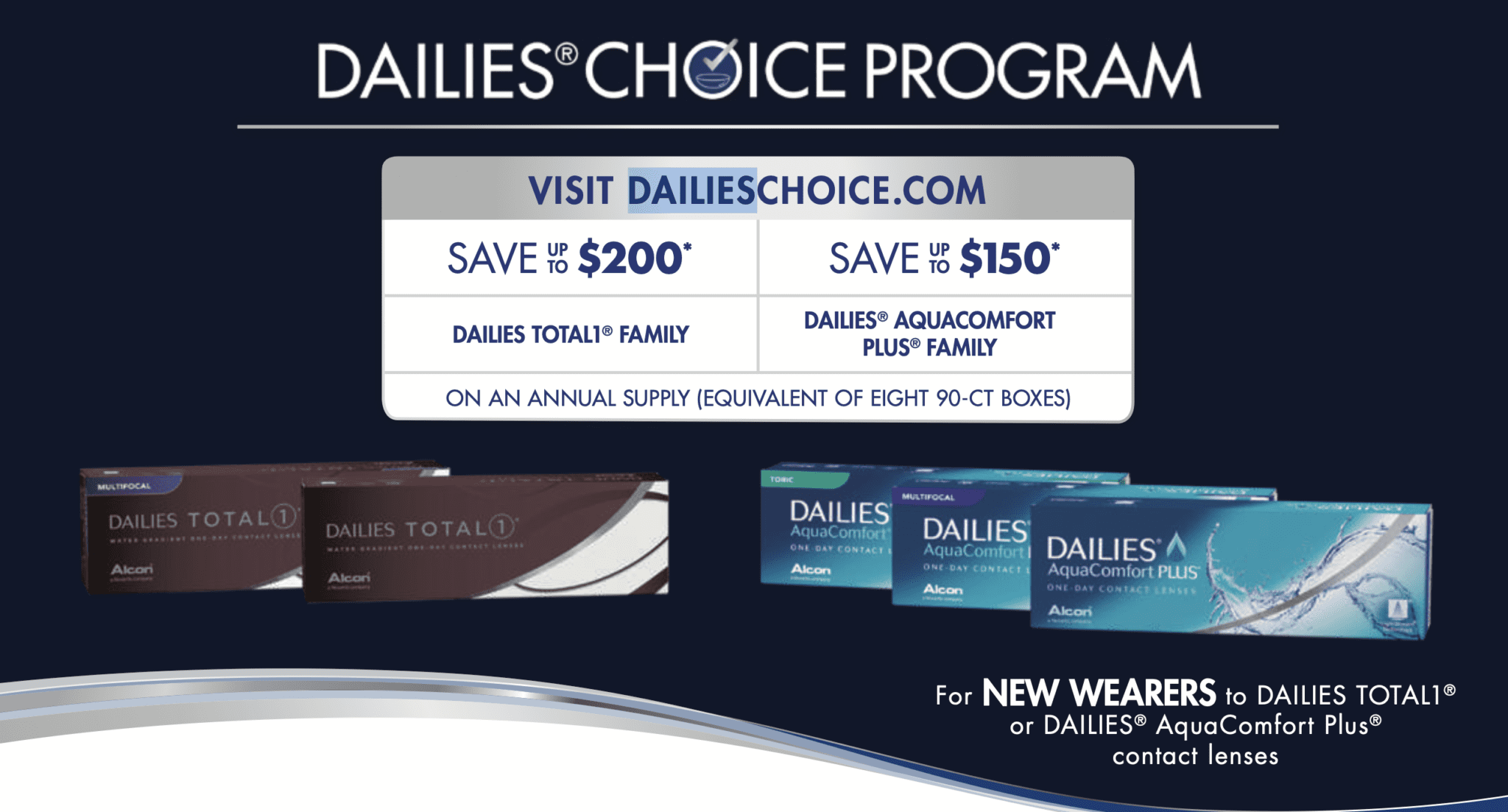

Dailies Total 1 Rebate Form Printable Rebate Form

Buy Sports Illustrated Swimsuit Planner 2023 2024 Sports Illustrated Swimsuit 2023 2024

Ei Rebate 2024 - What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead