Eis Capital Gains Tax Deferral Relief Find out about Capital Gains Tax treatment for Disposal Relief and Deferral Relief for the Enterprise Investment Scheme EIS From HM Revenue Customs Published 4 July

CGT deferral relief Investors with capital gains made up to three years before or one year after an EIS investment is made can claim deferral relief against those gains at up to To receive this relief you must subscribe for EIS shares during the period one year before or three years after selling or disposing of your assets i e gains made three years

Eis Capital Gains Tax Deferral Relief

Eis Capital Gains Tax Deferral Relief

https://media.licdn.com/dms/image/D4E12AQG9HeAgcqCgsQ/article-cover_image-shrink_600_2000/0/1687341745300?e=2147483647&v=beta&t=eKOkZzFUJKp200LQx3wABctE-IWu8_qRHQJ0ZvZmIwo

Enterprise Investment Scheme EIS InfoComm

https://www.infocomm.ky/wp-content/uploads/2022/10/1666731063.jpeg

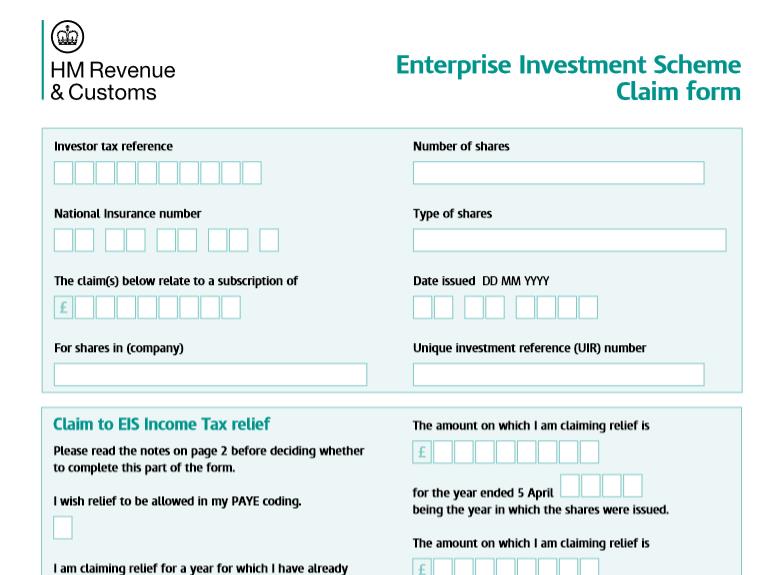

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

Capital Gains Tax deferral relief This is available to individuals and trustees of certain trusts The payment of tax on a capital gain can be deferred where the gain is invested in EIS deferral relief allows taxpayers to reinvest their profits into a qualifying fund or company deferring that tax bill However the incentive is more appealing when we consider that investors can

Capital gains tax exemption Zero CGT to pay when shares are realised usually 20 Capital gains tax deferral Ability to defer the payment of an existing CGT bill to later years Inheritance tax Under deferral relief an individual who sells an asset and reinvests the chargeable gain in subscribing for qualifying EIS shares can defer the capital gains tax liability on the

Download Eis Capital Gains Tax Deferral Relief

More picture related to Eis Capital Gains Tax Deferral Relief

EIS Capital Gains Deferral Relief Selling EIS Shares After 3 Years

https://emvcapital.com/wp-content/uploads/2023/08/Blog-Banner-3-1024x576.png

6 Things To Know About Payroll Tax Deferrals Orcutt Company CPA

https://www.orcuttfinancial.com/wp-content/uploads/2021/01/payroll-taxes-scaled.jpg

When Can I Claim EIS Tax Relief Capital Gains Tax CGT Deferral

https://oxcp.com/wp-content/uploads/2023/03/Business-growth-scaled.jpg

100 000 Capital Gain Invested via EIS Income tax relief 30 30 000 Capital Gains Deferral CGT 20 20 000 Net Cost to Investor 50 000 Shares Sold As with income tax relief to claim capital gains deferral you need to wait until you receive the EIS3 form from the issuing company before you can claim any

Capital gains deferral relief Defer gains throughout investment A gain made on the sale of other assets can be reinvested in EIS shares and deferred over the life of the CGT Deferral Relief is claimed via the capital gains tax summary section of your self assessment tax return and can be claimed upon receipt of your EIS3

What Is EIS Deferral Relief EIS CGT Deferral EMV Capital

https://emvcapital.com/wp-content/uploads/2023/05/EIS-Deferral-Relief-1024x576.png

.jpg?width=2430&height=1620&name=Shutterstock_1751800682 (1).jpg)

EIS Deferral Relief How Can You Benefit As An Investor GCV

https://www.growthcapitalventures.co.uk/hs-fs/hubfs/Shutterstock_1751800682 (1).jpg?width=2430&height=1620&name=Shutterstock_1751800682 (1).jpg

https://www.gov.uk/government/publications/...

Find out about Capital Gains Tax treatment for Disposal Relief and Deferral Relief for the Enterprise Investment Scheme EIS From HM Revenue Customs Published 4 July

https://www.bdo.co.uk/en-gb/insights/tax/corporate...

CGT deferral relief Investors with capital gains made up to three years before or one year after an EIS investment is made can claim deferral relief against those gains at up to

EIS Inheritance Tax Deferral Explained EMV Capital

What Is EIS Deferral Relief EIS CGT Deferral EMV Capital

Here s How To Claim EIS Tax Reliefs This Tax Year

EIS Vs SEIS Considering How To Lower Your Tax Burden But Not Sure

EIS Inheritance Tax Relief Oxford Capital

EIS And SEIS Capital Gains Tax Relief More Valuable Now Than Ever

EIS And SEIS Capital Gains Tax Relief More Valuable Now Than Ever

SEIS EIS Relief For Non Doms Via Business Investment Relief KBC

Capital Gains Tax Deferral Capital Gains Tax Exemptions

EIS Capital Gains Tax Relief An Overview For Investors GCV

Eis Capital Gains Tax Deferral Relief - Capital gains tax exemption Zero CGT to pay when shares are realised usually 20 Capital gains tax deferral Ability to defer the payment of an existing CGT bill to later years Inheritance tax