Eis Income Tax Relief Rules Income Tax relief Individuals who subscribe for shares in an EIS qualifying company will receive tax relief of 30 on the cost of the shares which is offset

In order to encourage investment in EIS companies the government offers tax reliefs These can give total tax reliefs of up to 94 of the sum invested EIS cash subscription Income tax relief Maximum investment for relief You can claim up to 30 income tax relief on EIS investments of up to 1 million per tax year 1 This increases to 2 million per

Eis Income Tax Relief Rules

Eis Income Tax Relief Rules

https://www.thompsontarazrand.co.uk/wp-content/uploads/2019/02/2019-02-14-986505-1.jpg

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

How To Claim EIS Income Tax Relief Key Business Consultants

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/11/Claiming-EIS-Income-Tax-Relief-Step-by-Step-Guide.jpg

Investors in EIS can benefit from five different tax reliefs if they invest in an EIS qualifying company income tax relief tax free growth loss relief capital gains deferral and 30 relief on Income Exemption from CGT on any gains after three years from the investment Capital Gains Tax deferral when gains are reinvested in other EIS eligible companies Loss relief when

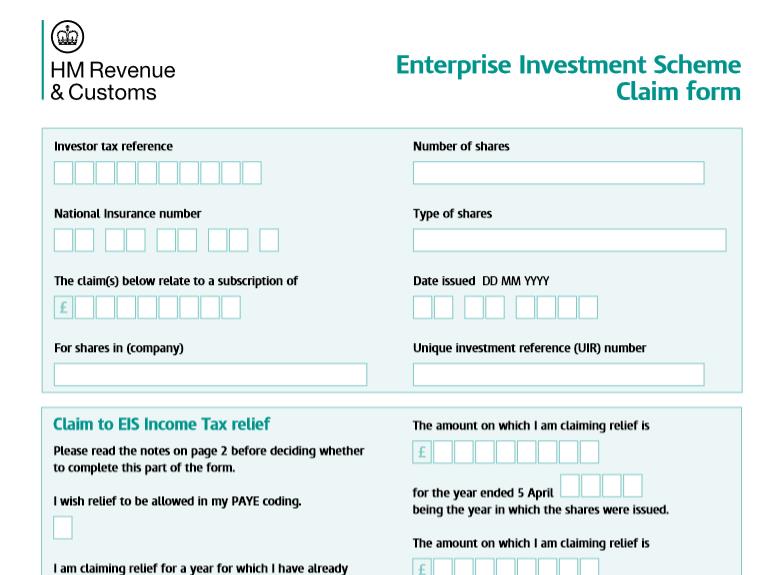

How do I claim EIS income tax relief You can normally claim EIS tax relief when you file your tax return You ll either reduce your tax bill for the year or receive a refund for tax you ve already paid See our step by step The investor can benefit from the following tax reliefs EIS income tax relief CGT exemption loss relief against CGT or income tax CGT deferral relief These reliefs

Download Eis Income Tax Relief Rules

More picture related to Eis Income Tax Relief Rules

EIS Tax Relief Change Accountants

https://www.change-accountants.com/sites/default/files/styles/banner_image/public/bigstock-Tax-Taxing-Taxation-Taxable-Ta-109426616.jpg?itok=Z9W2TILH

What Is SEIS And EIS Tax Relief Schemes In The UK Startups Investment

https://images.squarespace-cdn.com/content/v1/5ce3f8b34c89640001311321/1630575034607-C6NI0Y4YKVY72J9RJLOS/SEIS+and+EIS+Tax+Relief+Schemes-01.jpg

Income Tax Relief With EIS SIES YouTube

https://i.ytimg.com/vi/ncs7UDMeNKw/maxresdefault.jpg

1 The company must be eligible First and foremost the company you invest in must be eligible for EIS for you to claim tax benefits To be eligible for EIS a company The tax reliefs available to investors in enterprise investment scheme EIS qualifying companies are Income tax relief of up to 30 of the sum invested Exemption from

1 What is EIS income tax relief EIS income tax relief is a core tax incentive available under the Enterprise Investment Scheme EIS It enables EIS and Income Tax relief Under EIS you get 30 back of the amount you invest as a reduction in your Income Tax bill For example say you invested

Tax Cuts Fiscal Drag And Why EIS Income Tax Relief Is More Desirable

https://www.syndicateroom.com/images/banners/articles-banners-eis-income-tax-relief.png

EIS Income Tax Relief What Is It And How Does It Work GCV

https://www.growthcapitalventures.co.uk/hubfs/Shutterstock_98140295.jpg#keepProtocol

https://www.rossmartin.co.uk/seis-eis/560...

Income Tax relief Individuals who subscribe for shares in an EIS qualifying company will receive tax relief of 30 on the cost of the shares which is offset

https://www.bdo.co.uk/en-gb/insights/tax/corporate...

In order to encourage investment in EIS companies the government offers tax reliefs These can give total tax reliefs of up to 94 of the sum invested EIS cash subscription

How To Claim EIS Relief On Your EIS Fund Investments MMC

Tax Cuts Fiscal Drag And Why EIS Income Tax Relief Is More Desirable

Tax Relief On SEIS And EIS Investments

.jpg)

EIS Tax Relief EIS Scheme Explained

How To Claim Working From Home Tax Relief On Self Assessment

How To Claim EIS Income Tax Relief Step by step Guide How To Claim

How To Claim EIS Income Tax Relief Step by step Guide How To Claim

EIS SEIS Tax Relief Schemes Expect More Go Further

Here s How To Claim EIS Tax Reliefs This Tax Year

How Do I Claim An EIS Loss Relief On My Taxes KBC

Eis Income Tax Relief Rules - Relief must be claimed within the first five years of issue Otherwise you will not be able to claim EIS relief However if you are unable to claim within this timeframe any shares