Electric Car Purchase Tax Credit If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to Qualifying clean energy vehicle buyers are eligible for a tax credit of up to 7 500 Internal Revenue Service Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles

Electric Car Purchase Tax Credit

Electric Car Purchase Tax Credit

https://phantom-marca.unidadeditorial.es/6935d35c15b4387c78a06b5c1e7e3ea6/crop/89x0/1156x711/f/jpg/assets/multimedia/imagenes/2023/02/19/16767981217503.png

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more Does that new EV or PHEV you re eyeing qualify for the EV tax credit Here s a guide to walk you through the EV tax credit process Step 1 Where the EV is assembled matters For

Update On May 3 2024 the Treasury and the IRS unveiled final rules for the federal electric vehicle tax credit a key step in the Biden administration s plan to accelerate the adoption Buying an electric car You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some

Download Electric Car Purchase Tax Credit

More picture related to Electric Car Purchase Tax Credit

Facts About Electric Car Tax Credits Signature Auto Group NYC

https://www.signatureautoworld.com/wp-content/uploads/2022/09/Electric-Car-Tax-Credits.jpg

Car Purchase Tax Incentives To Promote Car Consumption Xinhua English

https://imgeconomy.gmw.cn/attachement/jpg/site2/20220706/f44d30753da4242f2c1e03.jpg

HMRC Company Car Tax Rates 2020 21 Explained

https://blog-media.vimcar.com/uk-blog/uploads/2021/04/21142208/Optimized-210419_car-taxes-1024x683.jpg

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation Reduction Act s enactment on August 16 2022

A tax credit of up to 7 500 Until the end of 2023 the credit is received when you file your taxes the following year Starting in 2024 the credit is given at the point of sale The Act You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return Instead

How To Make Sense Of The Federal Tax Credit If You Just Bought An

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

https://www.nerdwallet.com/article/taxes/ev-tax...

People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

Car Purchase Tax Creative Image picture Free Download 501046695 lovepik

How To Make Sense Of The Federal Tax Credit If You Just Bought An

Tax Credit For Electric Vehicle Buyers To Be Available At Time Of

What s The True Cost Of Electric Versus Gas Vehicles The Environment

How To Write Off Taxes On New Car Purchase Tax Relief Center In 2021

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

Electric Car Tax Credit Everything That You Have To Know Get

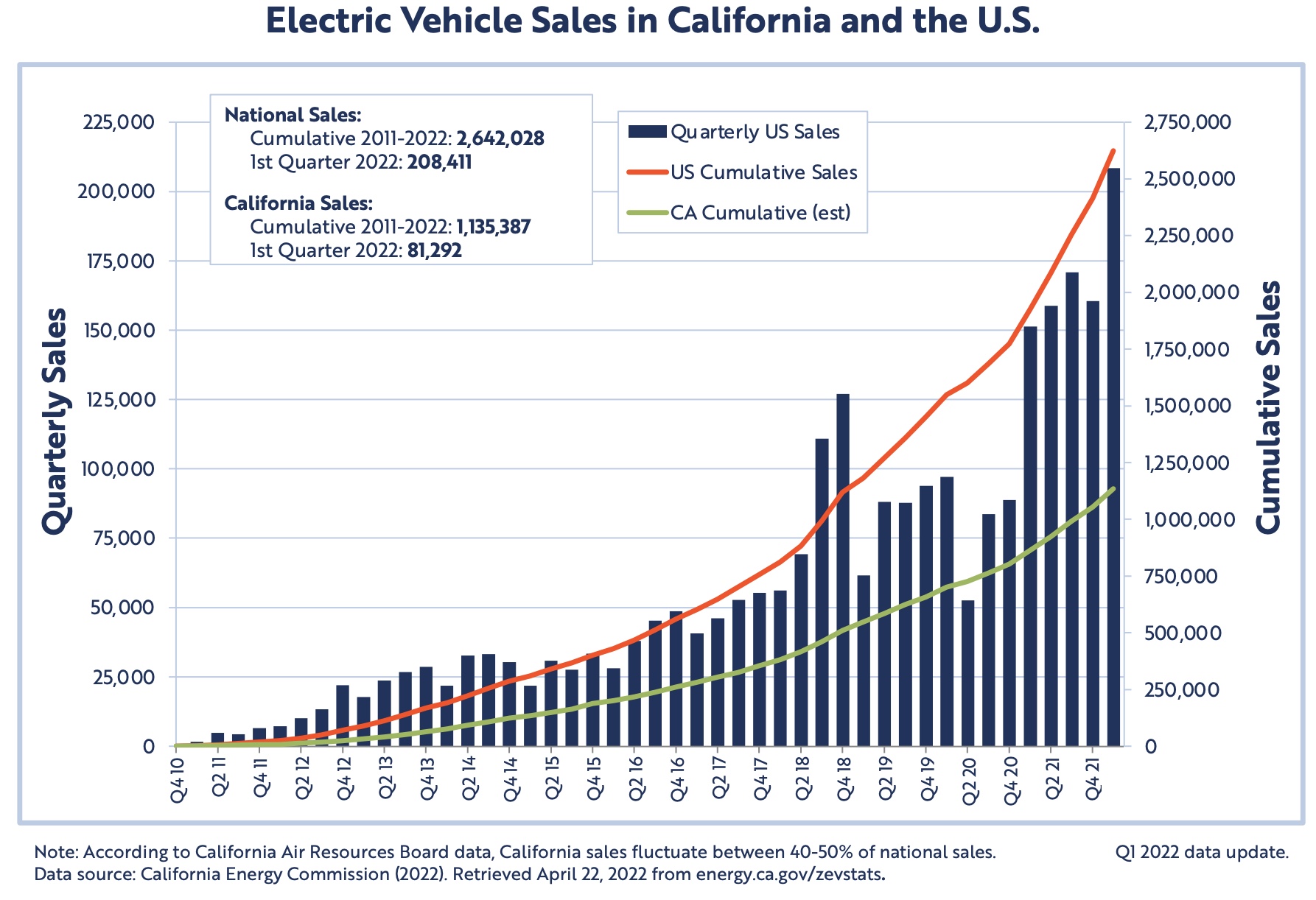

US Electric Car Sales Jumped To An Impressive Record High Last Quarter

GST Proforma Invoice Format In India 100 Free GST Billing Software

Electric Car Purchase Tax Credit - Buying an electric car You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some