Electric Scooter Income Tax Benefit Verkko 8 hein 228 k 2021 nbsp 0183 32 Advantages of switching to Electric Vehicle EVs Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles

Verkko 11 syysk 2020 nbsp 0183 32 The tax value of on the job charging is currently 30 euros per month This benefit will also be valid for a limited period 2021 2023 quot Tax subsidies for electric cars aim to reduce emissions as much as possible In rechargeable hybrids emissions depend on how much they are charged and used with electricity Verkko 19 helmik 2023 nbsp 0183 32 The benefit is available for electric two wheelers and four wheelers Calculating the deduction amount under 80EEB If you buy an electric car priced at 22 lakh and avail of a vehicle loan

Electric Scooter Income Tax Benefit

Electric Scooter Income Tax Benefit

https://taxguru.in/wp-content/uploads/2022/05/Tax-Benefit-from-Electric-Vehicle.jpg

Income Tax Benefit Available On Home Loan Repayment SMFG Grihashakti

https://i.ytimg.com/vi/3Xy_a1N0TVw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGA8gZShBMA8=&rs=AOn4CLBytft4_znxKZAV42SgSlCN41OV_g

Solved 2 EJ Company s Taxable Income In Four Previous Years Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/56a/56afedef-cacb-4e5f-9a43-a87b2c6770b5/phpzGNXP7.png

Verkko 25 syysk 2023 nbsp 0183 32 What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB Verkko 19 lokak 2023 nbsp 0183 32 You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return

Verkko 12 elok 2019 nbsp 0183 32 Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric bikes and car To get the tax benefit under Section 80EEB you must satisfy the following conditions Verkko The amount of the credit is 10 percent of the cost of any qualified 2 wheeled plug in electric vehicle placed in service by the taxpayer during the taxable year and cannot exceed 2 500 A qualified 2 wheeled plug in electric vehicle is a new vehicle with two wheels that Is capable of achieving a speed of 45 miles per hour or greater

Download Electric Scooter Income Tax Benefit

More picture related to Electric Scooter Income Tax Benefit

Electric Vehicle Income Tax

https://www.jagranimages.com/images/newimg/19022023/19_02_2023-income_tax_ev_23334228.jpg

10 New Colours Unique REVERSE MODE In Ola Electric Scooter As Company

https://cdn.zeebiz.com/sites/default/files/2021/08/11/156300-olafresh.jpg

Tax2win India Online Presentations Channel

https://www.slideserve.com/photo/789764.jpg

Verkko 19 helmik 2021 nbsp 0183 32 Capital allowances Businesses that invest in electric vehicles with zero emissions benefit from enhanced capital allowances From 1st April 2021 businesses purchasing new cars with 0g km CO2 emissions can claim 100 First Year Allowance FYA The purchase of a used electric car won t be eligible for FYA Verkko 4 maalisk 2021 nbsp 0183 32 Electric vans The taxable benefit for having the private use of a zero emission van reduces from April 2021 to nil Please note that for non electric vans there is no taxable benefit at all if the van is only used for business journeys and ordinary commuting irrespective of fuel type

Verkko FAME 2 Subsidy on Electric Scooter Phase II of this subsidy aims to support 1 million electric two wheelers during the tenure of the subsidy The said number of registered vehicles will get a subsidy of Rs 20 000 each from the government Verkko 20 marrask 2021 nbsp 0183 32 The credit was capped at a maximum of 7 500 and will apply to electric motorcycles that meet certain minimum requirements To qualify the electric motorcycles need to have at least 2 5 kWh of

Electric Car Tax Breaks Proactive Accounting

https://www.proactive-accounting.com/wp-content/uploads/2022/05/benefit-in-kind-rates-2402298.jpg

Line 15000 Tax Return What Is Means How To File It Financial Ox

https://i0.wp.com/financialox.com/wp-content/uploads/2023/03/tax-software-scaled.jpg?w=1610&ssl=1

https://taxguru.in/income-tax/purchase-electric-vehicle-tax-benefits...

Verkko 8 hein 228 k 2021 nbsp 0183 32 Advantages of switching to Electric Vehicle EVs Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles

https://yle.fi/a/3-11539664

Verkko 11 syysk 2020 nbsp 0183 32 The tax value of on the job charging is currently 30 euros per month This benefit will also be valid for a limited period 2021 2023 quot Tax subsidies for electric cars aim to reduce emissions as much as possible In rechargeable hybrids emissions depend on how much they are charged and used with electricity

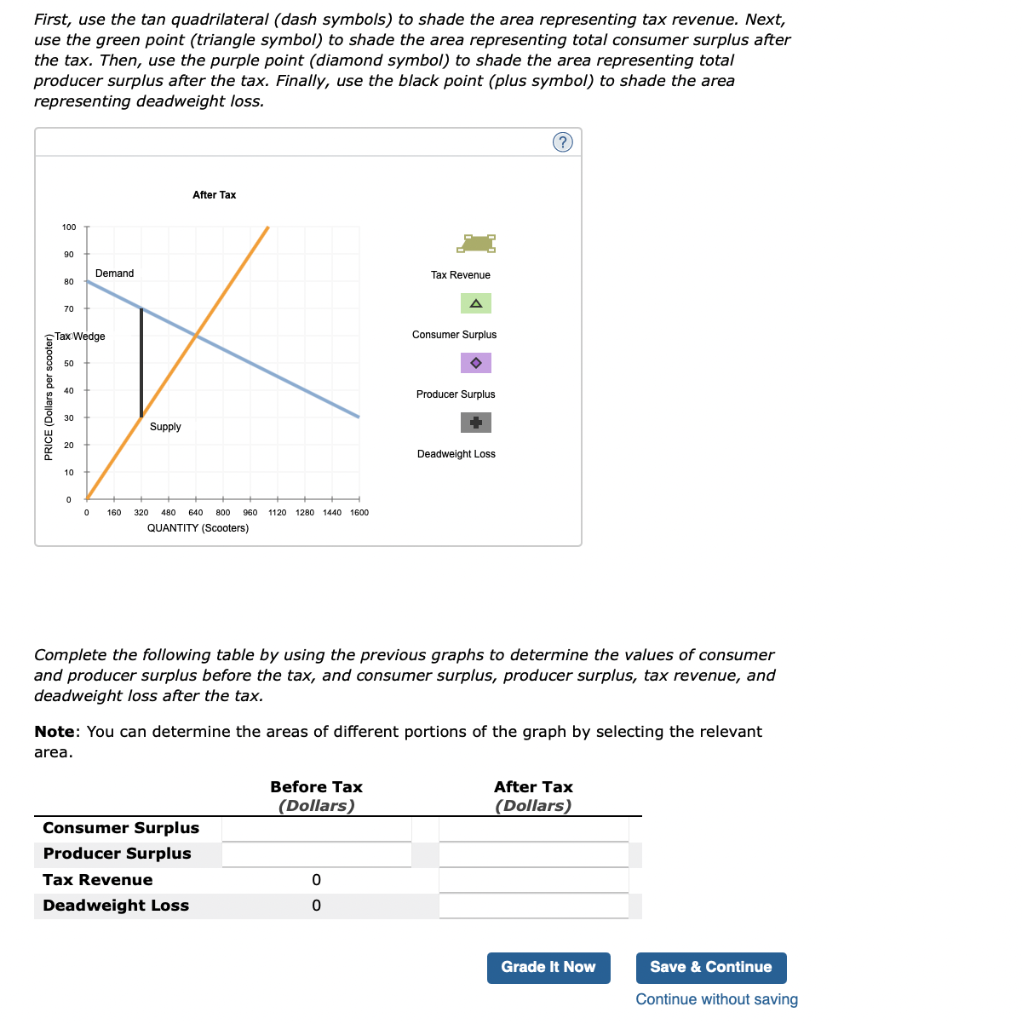

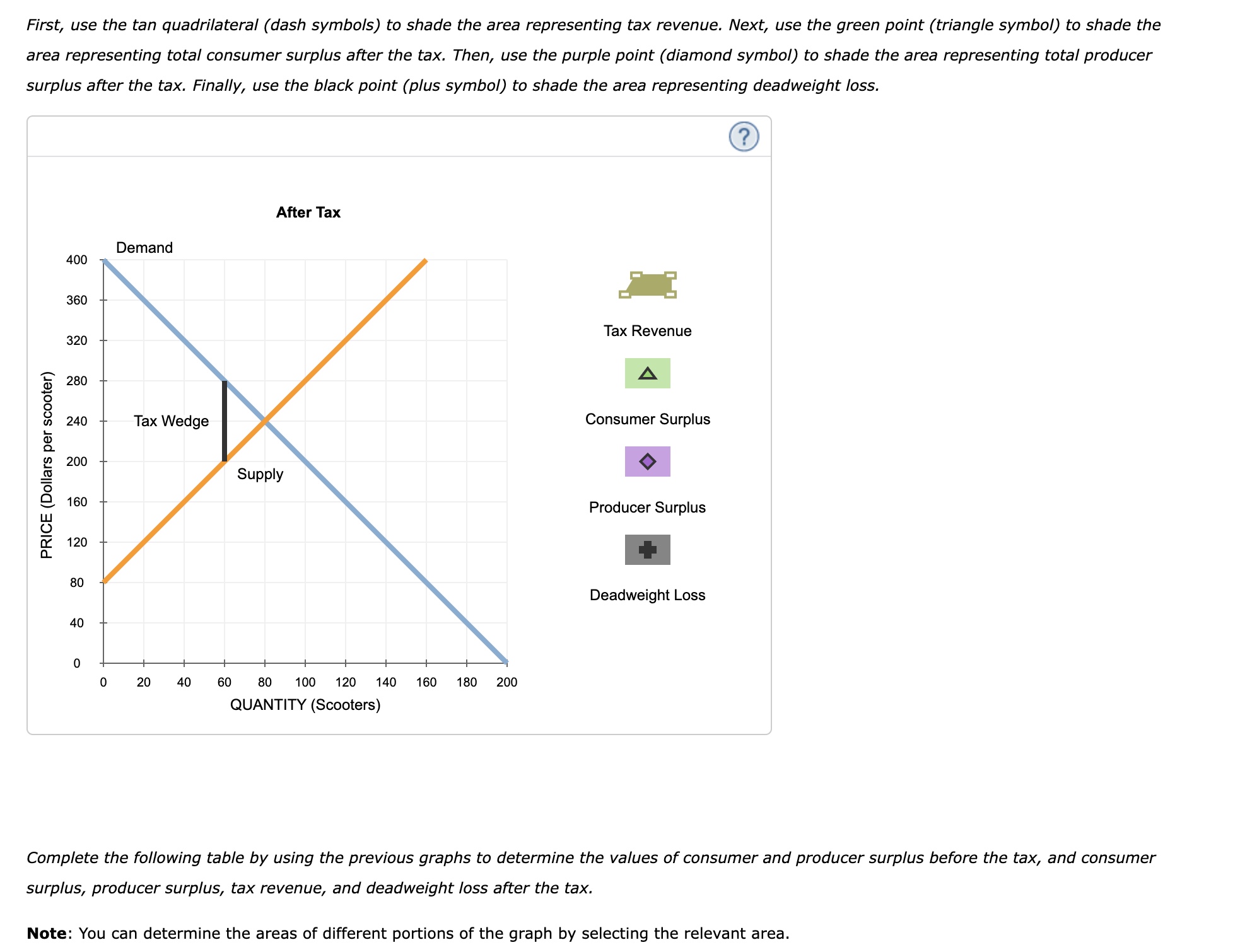

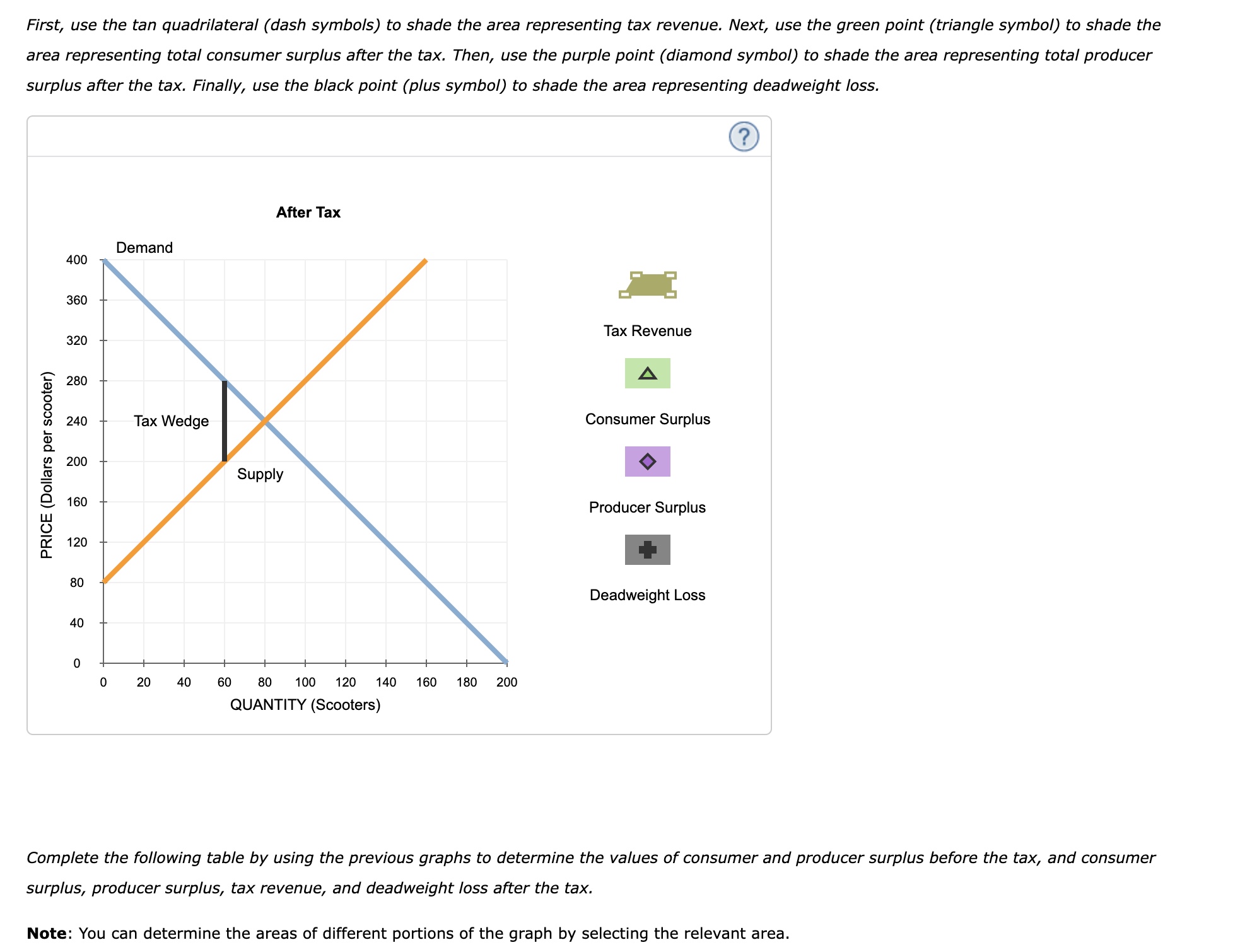

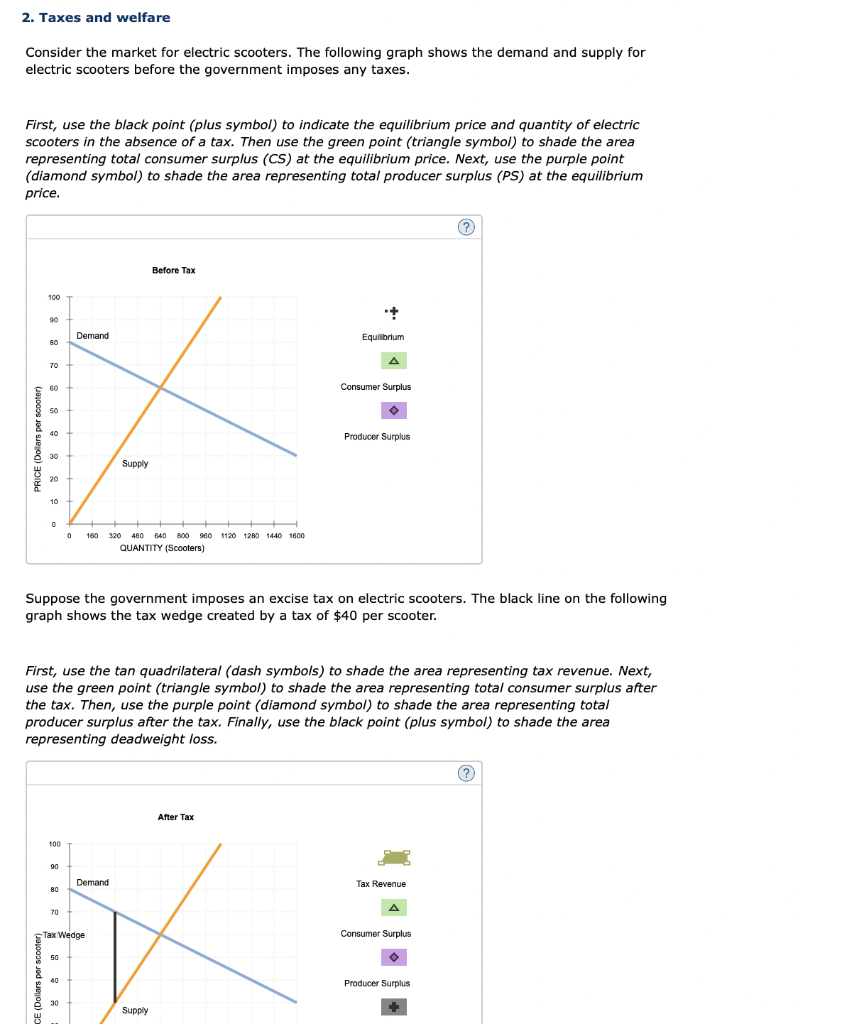

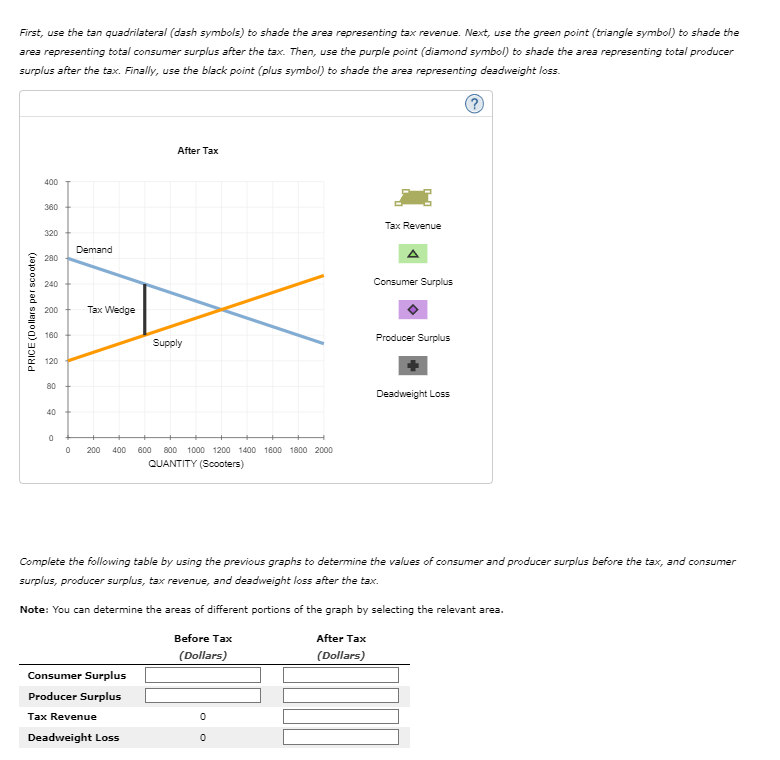

Solved 2 Taxes And Welfare Consider The Market For Electric Chegg

Electric Car Tax Breaks Proactive Accounting

Income Tax Benefits On Housing Loan In India

Unique Uber Annual Statement Gross Profit Income

How To Build A Passive Income Business With Electric Scooter Rentals

Solved 2 Taxes And Welfare Consider The Market For Electric Chegg

Solved 2 Taxes And Welfare Consider The Market For Electric Chegg

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

Solved 2 Taxes And Welfare Consider The Market For Electric Chegg

Solved 2 Taxes And Welfare Consider The Market For Electric Chegg

Electric Scooter Income Tax Benefit - Verkko 12 elok 2019 nbsp 0183 32 Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric bikes and car To get the tax benefit under Section 80EEB you must satisfy the following conditions