Electric Scooter Tax Deduction Verkko The standard workspace deduction 920 in 2023 has no effect on the tax credit for electricity If you deduct your workspace expenses according to the actual expenses including the electricity consumption in the workspace

Verkko 26 helmik 2020 nbsp 0183 32 Two options to write off the total purchase of your bike scooter or motorcycle The IRS lets you write off the total purchase price of a lot of depreciable items in the year that you bought it For example say I bought an eBike for 4 000 and 80 of my use is for delivery Verkko For an E scooter with a minimum value of 2 500 applies a 13 5 deduction of half of the purchase price you can subtract from your profits Therefore you will pay less taxes over your profits However the MIA regulation does not apply to the E bike bike with electric pedal assistance Arbitrary depreciation Vamil

Electric Scooter Tax Deduction

Electric Scooter Tax Deduction

https://i.ytimg.com/vi/8YGA1J0osW4/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLCC0RxXFiqSh49yRRQdWOauPuqxMg

Ola Electric Scooter Registration Process Completed Ola Electric

https://i.ytimg.com/vi/V2f81VI1wC0/maxresdefault.jpg

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

https://sherlockwealth.com/wp-content/uploads/2022/05/Tax-offset-v-tax-deduction-.jpg

Verkko Internal Revenue Code Section 30D g currently provides a credit for qualified 2 wheeled plug in electric vehicles The amount of the credit is 10 percent of the cost of any qualified 2 wheeled plug in electric vehicle placed in service by the taxpayer during the taxable year and cannot exceed 2 500 Verkko 14 toukok 2010 nbsp 0183 32 The Honda CBF125 costs around 163 2 300 Plenty of small scooters will do over 100 miles per gallon Road tax is 163 15 a year One thing to factor in the cost of purchasing a scooter or motorbike

Verkko 20 marrask 2021 nbsp 0183 32 Electric bicycles received their first ever nod from the federal government in the form of a 30 tax credit of their own The tax credit is capped at a maximum of 900 and would only apply Verkko 31 tammik 2022 nbsp 0183 32 The following web article discusses business expense deduction options for bikes scooters used as part of how you make money Bottom line no you

Download Electric Scooter Tax Deduction

More picture related to Electric Scooter Tax Deduction

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

300 PCS 2 In 1 Scooter Invoice PDF

https://imgv2-1-f.scribdassets.com/img/document/550944210/original/6ed4f7c5fe/1666314635?v=1

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Verkko 28 lokak 2021 nbsp 0183 32 There s good news in the latest version of the White House budget deal the proposed federal tax credit for new electric bike purchases has survived the most recent round of Congressional Verkko 1 p 228 iv 228 sitten nbsp 0183 32 You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit had dropped to 26 in 2021 but

Verkko 3 kes 228 k 2019 nbsp 0183 32 Are electric scooters deductible on federal taxes Yes you would treat the scooter as a wheelchair Based on the IRS publication you can include in medical expenses amounts you pay for a wheelchair used mainly for the relief of sickness or disability and not just to provide transportation to and from work Verkko 28 helmik 2023 nbsp 0183 32 Any individual who has taken a loan to purchase an electric vehicle can claim a deduction under Section 80EEB However the following eligibility criteria and conditions must be satisfied to claim the deduction

Offshore Tax With HTJ tax Sonnet

https://artwork.captivate.fm/34785155-54ea-4b86-ad90-11e478281ec0/gS3gEqrtrgJ_LBJ1GbRjrPc1.png

Do You Qualify For A Vehicle Sales Tax Deduction

https://www.toptaxdefenders.com/hs-fs/hubfs/Depositphotos_138271860_s-2019.jpg?width=1500&name=Depositphotos_138271860_s-2019.jpg

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko The standard workspace deduction 920 in 2023 has no effect on the tax credit for electricity If you deduct your workspace expenses according to the actual expenses including the electricity consumption in the workspace

https://entrecourier.com/delivery/delivery-contractor-taxes/expenses/...

Verkko 26 helmik 2020 nbsp 0183 32 Two options to write off the total purchase of your bike scooter or motorcycle The IRS lets you write off the total purchase price of a lot of depreciable items in the year that you bought it For example say I bought an eBike for 4 000 and 80 of my use is for delivery

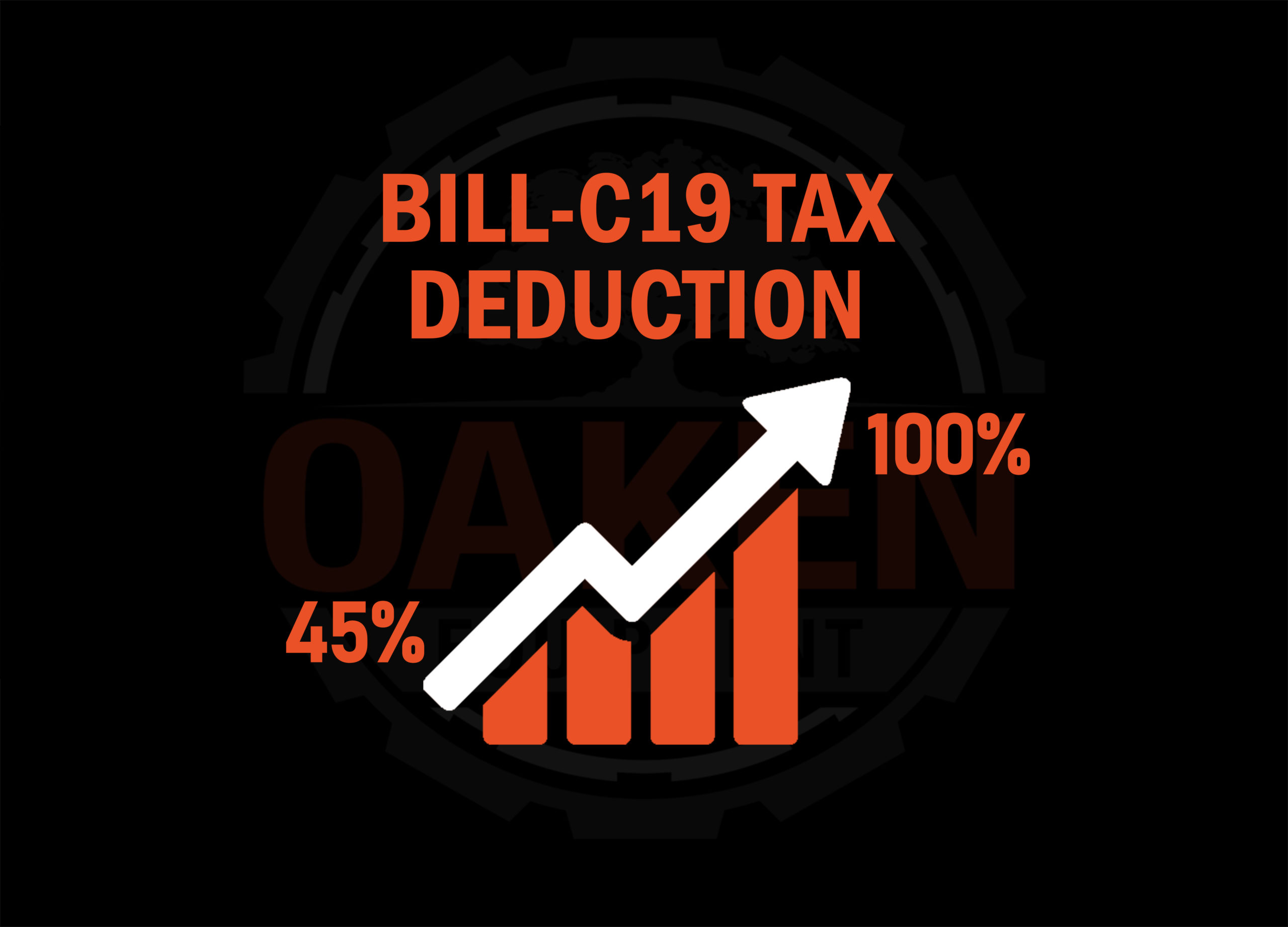

Bill C19 Is The Largest Ever Tax Deduction Oaken Equipment

Offshore Tax With HTJ tax Sonnet

Premium Photo Tax Deduction

Tax Deduction PDF

60V 34Ah I Power Lithium Ion Electric Scooter Battery

Kurzstudie Tax Deduction Scheme Belgien EUKI

Kurzstudie Tax Deduction Scheme Belgien EUKI

What Will My Tax Deduction Savings Look Like The Motley Fool

Tax Benefits On Electric Car Bike Scooter Loan How To Get Tax

Buy Y XF Folding Electric Scooter Rechargeable Seated Motorized

Electric Scooter Tax Deduction - Verkko 20 marrask 2021 nbsp 0183 32 Electric bicycles received their first ever nod from the federal government in the form of a 30 tax credit of their own The tax credit is capped at a maximum of 900 and would only apply