Electric Two Wheeler Tax Benefit The 2021 update of ACEA s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 EU member states looking at tax benefits related to vehicle acquisition and ownership as well as company cars and purchase incentives such as bonus payments or premiums for

Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric bikes and car To get the tax benefit under Section 80EEB you must satisfy the following conditions Advantages of switching to Electric Vehicle EVs Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the rate of EVs from 12 to 5

Electric Two Wheeler Tax Benefit

Electric Two Wheeler Tax Benefit

https://www.rushlane.com/wp-content/uploads/2020/10/electric-two-wheeler-sales-sep-2020.jpg

Electric Two wheeler Companies Say Govt Subsidy Plan Would Incentivise

https://cdn.dnaindia.com/sites/default/files/2018/07/10/702757-electric-two-wheelers-071018.jpg

Can I Claim Income Tax Benefit On A Two Wheeler Loan WordPlop

https://www.wordplop.com/wp-content/uploads/2020/04/Income-Tax-Benefit-on-a-Two-Wheeler-Loan.png

The benefit is available for electric two wheelers and four wheelers Calculating the deduction amount under 80EEB If you buy an electric car priced at 22 lakh and avail of a vehicle loan of Even two wheeler purchased will offer the tax benefit to the taxpayers The most important part the benefit is available only to an Individual The businessmen can claim interest paid towards any business assets purchased as deduction against its income

Internal Revenue Code Section 30D g currently provides a credit for qualified 2 wheeled plug in electric vehicles The amount of the credit is 10 percent of the cost of any qualified 2 wheeled plug in electric vehicle placed in service by the taxpayer during the taxable year and cannot exceed 2 500 GST rate for electric vehicles is reduced to 5 from 12 Upon RC renewal after 15 years a tax will be applied but electric cars are exempt from the green tax The Promotion of Electric Vehicles

Download Electric Two Wheeler Tax Benefit

More picture related to Electric Two Wheeler Tax Benefit

Electric Two wheeler Makers Oppose Proposed Incentives

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2018/06/14/692992-electrictwowheeler-061418.jpg

Electric Two Wheelers EV To Increase By 78 In 2030 Redseer Report

https://www.mediainfoline.com/wp-content/uploads/2022/07/sales-electric-two-wheelers-ev-increase-redseer-report.jpg

Electric Two wheeler Sales Promoting Eco Friendly Travel

https://electricvehicles.in/wp-content/uploads/2021/02/download-1.jpg

The deduction is available only once to a taxpayer and for the purpose of purchasing an electric two wheeler or four wheeler You can claim this deduction benefit only if you are financing the purchase of an electric vehicle for the first time You also need to take an auto loan to buy an electric vehicle from a recognised financial institution Conditions to Claim Deductions u s 80EEB The electric vehicle loan must be taken from a financial institution or an NBFC The loan must be sanctioned between April 1 2019 and March 31 2023 The taxpayer can claim a deduction on the loan for the purchase of a 2 wheeler as well as a 4 wheeler

Electric vehicle buyers in India can get income tax benefits under Section 80EEB Buying an electric vehicle with a vehicle loan brings you income tax benefits and tax benefits on GST Eligible taxpayers can avail of tax benefits in the form of a deduction of interest amount of the loan under Section 80EEB Do not forget to buy two wheeler insurance for your vehicle to secure it against various perils of driving on public roads

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Malaysia Electric Two Wheeler Market 2019 Global Industry Analysis

https://www.articletrunk.com/wp-content/uploads/2019/02/electric-two-wheeler.jpg

https://www.acea.auto/fact/overview-electric...

The 2021 update of ACEA s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 EU member states looking at tax benefits related to vehicle acquisition and ownership as well as company cars and purchase incentives such as bonus payments or premiums for

https://emicalculator.net/tax-benefits-on-loans...

Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric bikes and car To get the tax benefit under Section 80EEB you must satisfy the following conditions

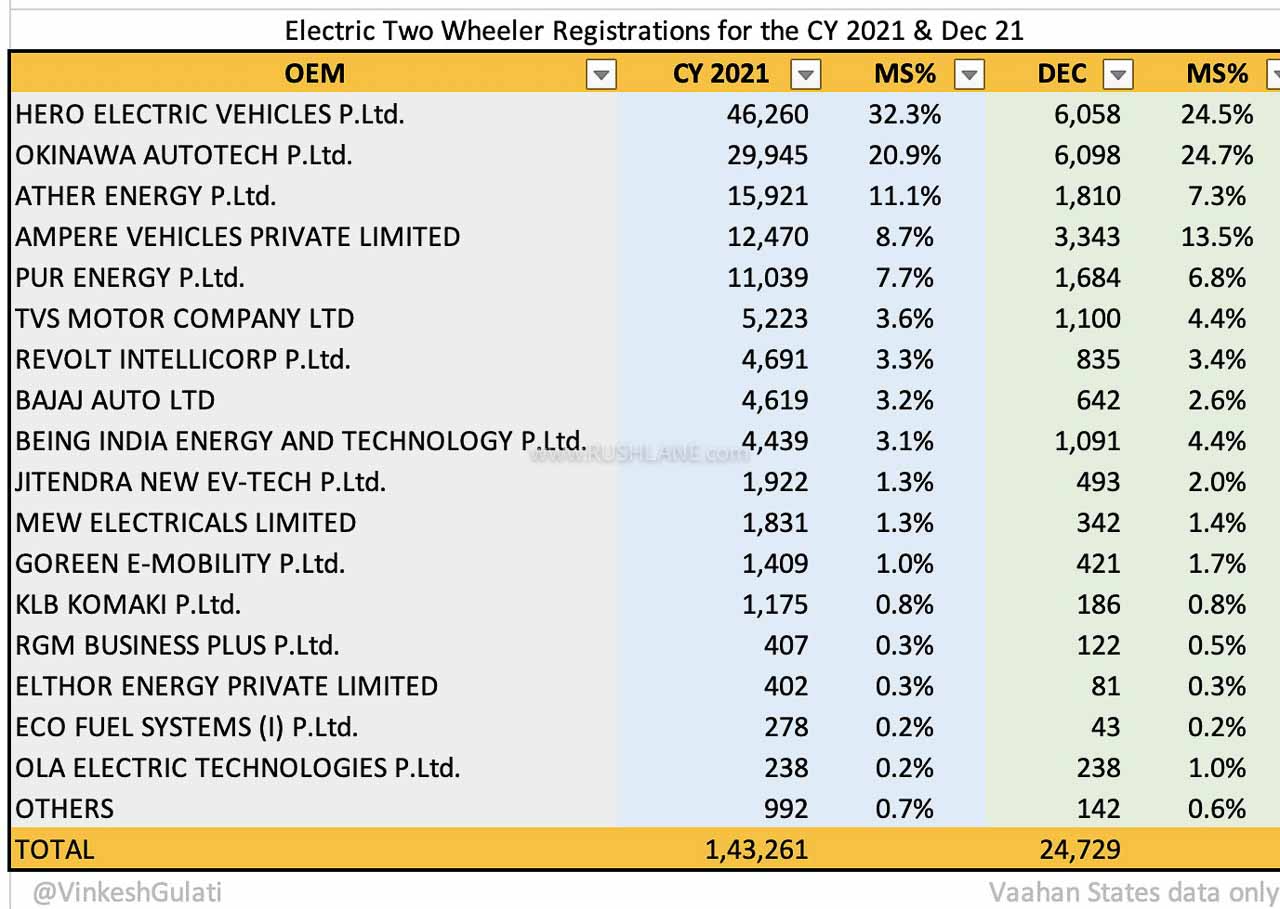

Electric Two Wheeler Sales Dec 2021 Hero Electric Ather TVS Revolt

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Tax Benefit From Electric Vehicle

Triumph Buys Electric Off Road Two Wheeler Brand OSET Autonoid

Electric Two wheeler Sales At 2 544 Units In September 2020 Autocar India

Electric Two Wheeler Sales In India Aug 2022 BikeChuno

Electric Two Wheeler Sales In India Aug 2022 BikeChuno

Indian Two Wheeler Electric Vehicle Startups Revolutionizing The

Electric Two wheeler Prices Slashed Post Recent FAME II Subsidy

Buying An Electric Vehicle Here s How Much TAX BENEFIT You Can Claim

Electric Two Wheeler Tax Benefit - 1 Get a tax rebate on interest paid on a vehicle loan taken to purchase an electric vehicle It can be availed for both two wheeler and cars 2 The exemption limit is only up to Rs 1 5 lakhs of the annual interest amount 3 The exemption can be availed only on the purchase of your first electric bike and not on the second or third one 4