Electric Vehicle Charging Stations Tax Credit A recently expired federal tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Act a move that will give taxpayers up to 1 000 in a tax

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

Electric Vehicle Charging Stations Tax Credit

Electric Vehicle Charging Stations Tax Credit

https://www.e-m-i.com/wp-content/uploads/2021/06/Car-Charging-scaled.jpeg

Electric Vehicle EV Charging Stations NYREER New York Renewable

https://www.nyreer.com/wp-content/uploads/2019/09/CPDisp8_Au2_UK_AV_Frnt_C1_REV.jpg

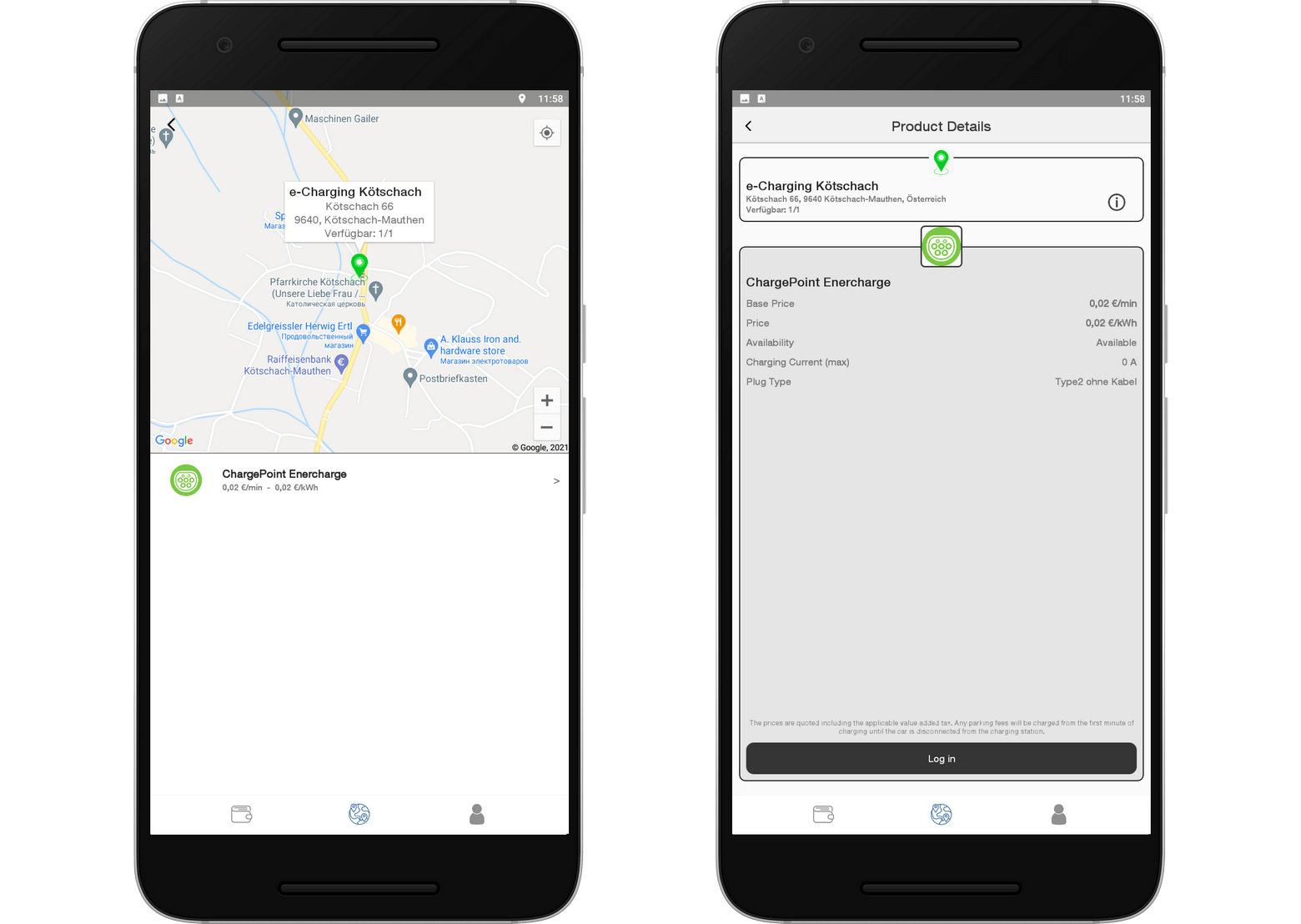

Electric Vehicle Charging Stations App Cogniteq

https://d1zhyf4obee6da.cloudfront.net/s3fs-public/2021-12/e-charging App 2_0.png

The new Section 30C tax credit provides a headline credit for up to 30 percent of the cost of a qualified alternative fuel vehicle refueling station subject to a 100 000 per station limit IRC 30C a b You may qualify for the EV charger credit when you file your taxes in 2024 if you purchased installed and began using an EV charger at your residence during the most recent tax year

This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses If you purchase EV charging equipment for your principal residence you may be eligible for a tax credit for the charging station This credit is generally 30 of the item s cost up to 1 000 Eligibility is based on the installation location being in an eligible census tract

Download Electric Vehicle Charging Stations Tax Credit

More picture related to Electric Vehicle Charging Stations Tax Credit

BREAKING Electric Car Charging Station Tax Credit Extended But At

http://www.plugincars.com/sites/default/files/Blink_Level_2_BART_Commercial.jpg

Refuel Electric Vehicle Solutions Combines EV Charging Stations With

https://rednews.com/wp-content/uploads/ELECTRIC-CHARGING-STATION.jpg

Letting Charging Stations Collect More Predictable Fees Would Spur

https://i.pinimg.com/originals/f4/dc/aa/f4dcaaed90fc90dae599ecf99a11799e.png

Save up to 1 000 on charging your EV at home The U S federal tax credit gives individuals 30 off the cost of a ChargePoint Home Flex EV charging station plus installation up to 1 000 You must claim the credit on your federal tax return If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit For more information on how to qualify see Publication 5866 New Clean Vehicle Tax Credit Checklist PDF

For tax years beginning after 2022 applicable entities such as certain tax exempt and governmental entities can elect to treat the alternative fuel vehicle refueling property credit as a payment of income tax See Applicable Entities Transfer of alternative fuel vehicle refueling property credit Your EV charging equipment may be eligible for the federal electric vehicle charging station tax credit Here s how to claim it and other incentives to consider

MSU Research Drives Smart Planning Policies For Electric Vehicle

https://msutoday.msu.edu/-/media/assets/msutoday/images/2022/msu-research-drives-smart-planning-policies-for-ev-charging-stations/hero-ev-charging-station.jpg?rev=9c3779e4298a4d39b16cfc093162ad27

Federal Tax Credits For EV Charging Stations Installation Extended

https://www.clippercreek.com/wp-content/uploads/2020/01/Tax-Credit-Extended_20200115.jpg

https://www.forbes.com/advisor/personal-finance/ev-charger-tax-credit

A recently expired federal tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Act a move that will give taxpayers up to 1 000 in a tax

https://www.kiplinger.com/taxes/605201/federal-tax...

To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

Electric Car Charging Stations Along I 95 Mauro quiett

MSU Research Drives Smart Planning Policies For Electric Vehicle

Electric Vehicle Charging Stations By 2G Engineering

Electric Vehicle Charging Stations The University Of Tulsa

ELECTRIC VEHICLE CHARGING STATION

Electric Vehicle Charging Regulation GET transform

Electric Vehicle Charging Regulation GET transform

The Only Wall mounted Commercial EV Charger You Need Level 2 22kW

Using The EZMT To Equitably Plan For Electric Vehicle Charging Stations

Expanding Our Electric Vehicle Charging Station Network Waterloo

Electric Vehicle Charging Stations Tax Credit - You may qualify for the EV charger credit when you file your taxes in 2024 if you purchased installed and began using an EV charger at your residence during the most recent tax year