Electric Vehicle Credit Income Limit 2023 Verkko 20 jouluk 2023 nbsp 0183 32 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The

Verkko 6 lokak 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit Verkko 26 jouluk 2022 nbsp 0183 32 Starting January 1 many Americans will qualify for a tax credit of up to 7 500 for buying an electric vehicle The credit part of changes enacted in the Inflation Reduction Act is

Electric Vehicle Credit Income Limit 2023

Electric Vehicle Credit Income Limit 2023

https://images.prismic.io/peopleforbikes/3cf0950d-9ef1-4b8d-ad26-654db3ad0ff4_iStock-1276091849.jpg?auto=compress,format

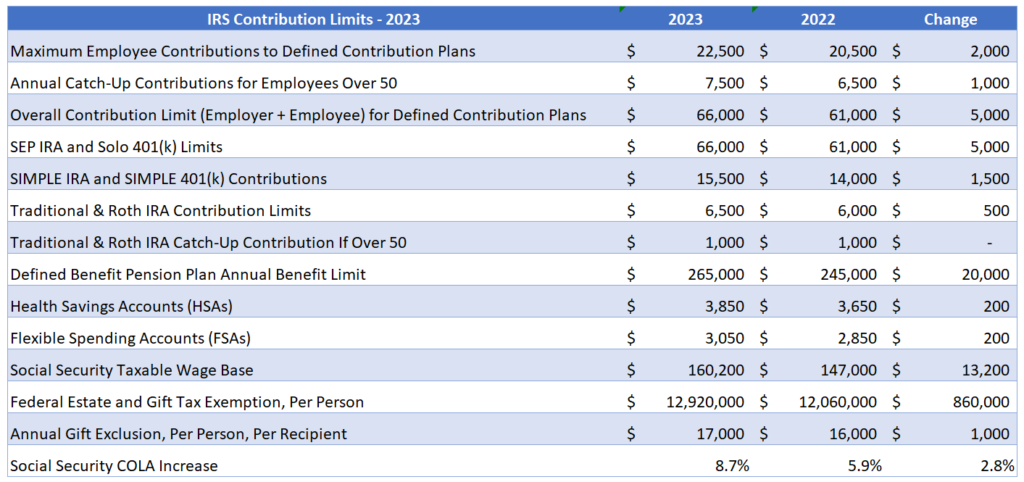

2023 IRS Contribution Limits And Tax Rates

https://darrowwealthmanagement.com/wp-content/uploads/2022/10/2023-IRS-Retirement-Limits-1024x482.png

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

https://www.gannett-cdn.com/-mm-/322f5d74305547090bc274f56107e40846bee274/c=0-154-3000-1849/local/-/media/2017/12/18/DetroitFreeP/DetroitFreePress/636492030183827062-IMG-2017-Chevrolet-Bolt-2-1-1-.JPG?width=3200&height=1680&fit=crop

Verkko 16 jouluk 2023 nbsp 0183 32 A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain Verkko 7 tammik 2023 nbsp 0183 32 The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of household That s a big chunk of

Verkko 7 elok 2023 nbsp 0183 32 For qualifying vehicles placed in service between Jan 1 and April 17 2023 the credit can be up to 2 500 base amount plus 417 for a vehicle with at least 7 kilowatt hours of battery capacity Verkko 26 jouluk 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit

Download Electric Vehicle Credit Income Limit 2023

More picture related to Electric Vehicle Credit Income Limit 2023

Universal Credit Income Limit What It Is In 2022

https://www.your-benefits.co.uk/wp-content/uploads/2022/08/comppexels-nataliya-vaitkevich-8927654-1-e1659619292835.jpg

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Verkko 21 jouluk 2023 nbsp 0183 32 The EV tax credit is a federal incentive to encourage consumers to purchase EVs Residents who meet the income requirements and buy a vehicle that satisfies the price battery and assembly Verkko 12 huhtik 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500

Verkko 7 marrask 2023 nbsp 0183 32 How the 2023 EV Tax Credit Works The electric vehicle tax credit works by lowering your tax bill on a dollar for dollar basis So if you owe the IRS 5 000 and you qualify for an EV tax credit amount of 3 500 you d only be Verkko 20 huhtik 2023 nbsp 0183 32 Just 11 electric cars from four automakers Tesla General Motors Ford Motor and Volkswagen now qualify for the full tax credit several others can qualify for a partial 3 750 credit

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

Income Limit For 7500 Electric Vehicle Credit Todrivein

https://todrivein.com/wp-content/uploads/2023/06/income-limit-for-7500-electric-vehicle-credit_featured_photo.jpeg

https://www.nerdwallet.com/.../ev-tax-credit-electric-vehicle-tax-credit

Verkko 20 jouluk 2023 nbsp 0183 32 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The

https://www.irs.gov/newsroom/topic-b-frequently-asked-questions-about...

Verkko 6 lokak 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit

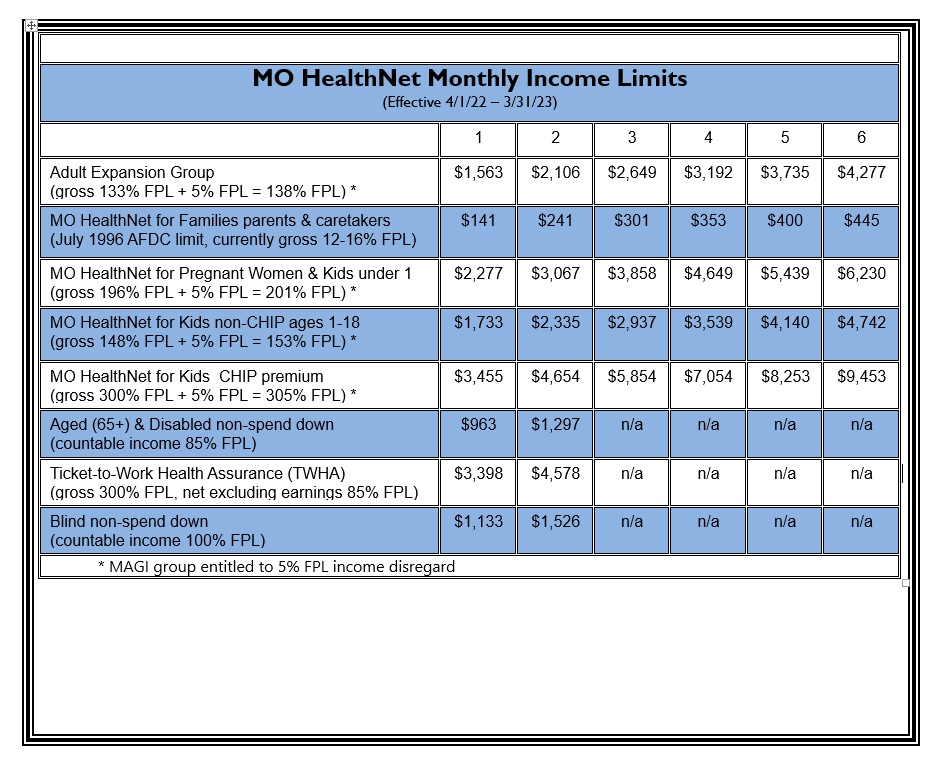

Redetermination Form Medi Cal MC 216 262 Instructions MAGI FPL

Child Tax Credit Income Limit 2024 Credits Zrivo

Applying For MO HealthNet Medicaid Dmh mo gov

Your First Look At 2023 Tax Brackets Deductions And Credits 3

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Earned Income Tax Credit EITC Who Qualifies

Frequently Asked Questions 2023 Clean Energy And Electric Vehicle Tax

Electric Vehicle Credit Income Limit 2023 - Verkko 7 tammik 2023 nbsp 0183 32 The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of household That s a big chunk of