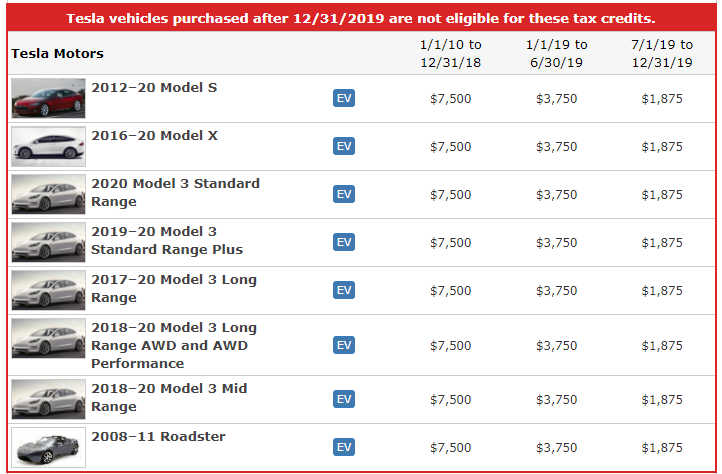

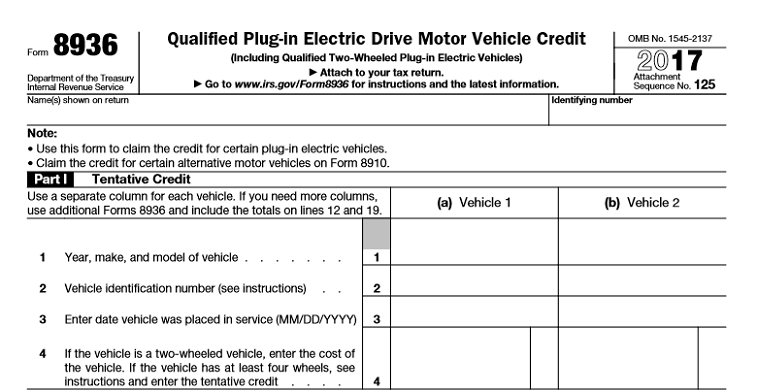

Electric Vehicle Rebate Federal Form Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 10 janv 2023 nbsp 0183 32 Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year Use Form 8936 to figure your credit for Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

Electric Vehicle Rebate Federal Form

Electric Vehicle Rebate Federal Form

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

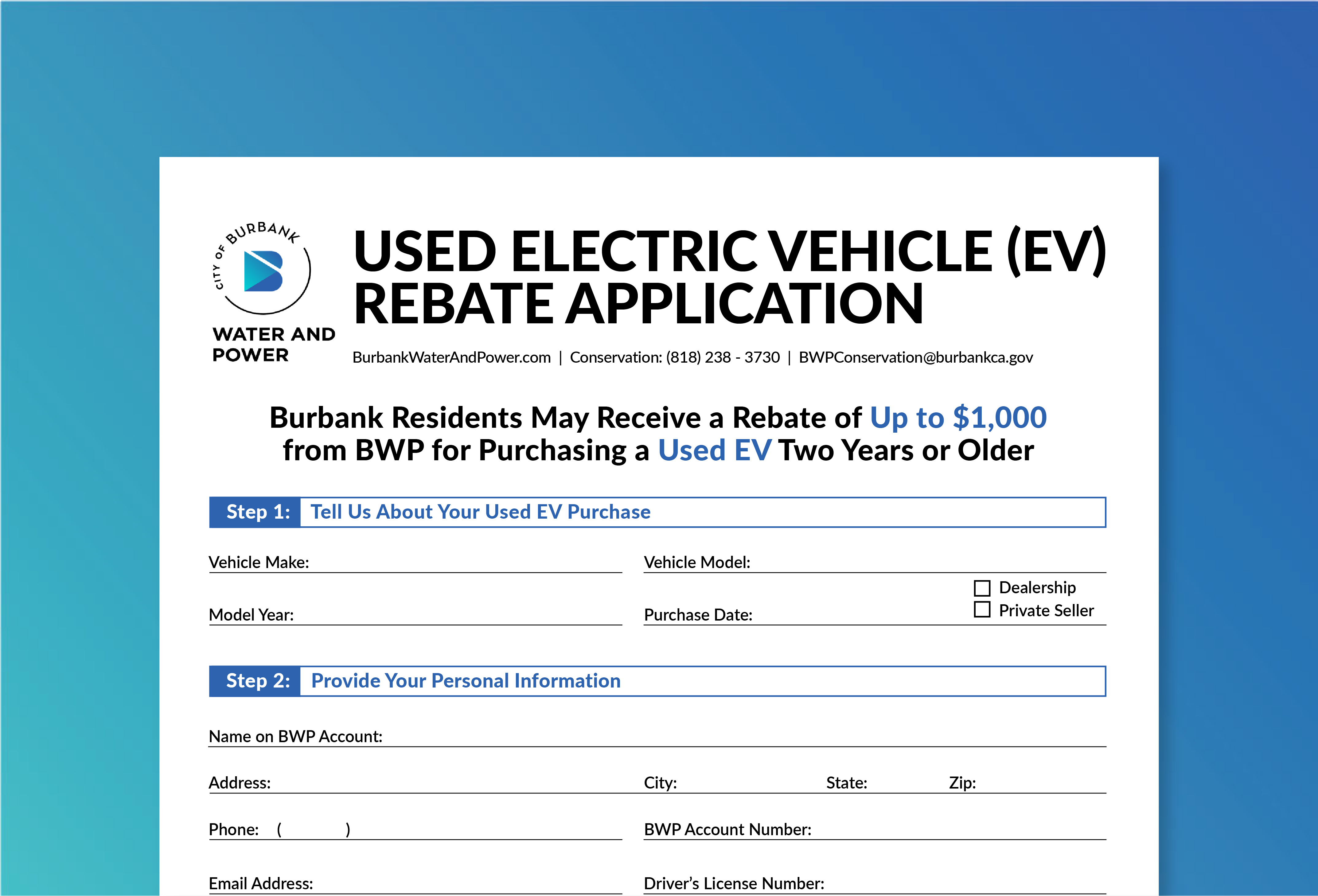

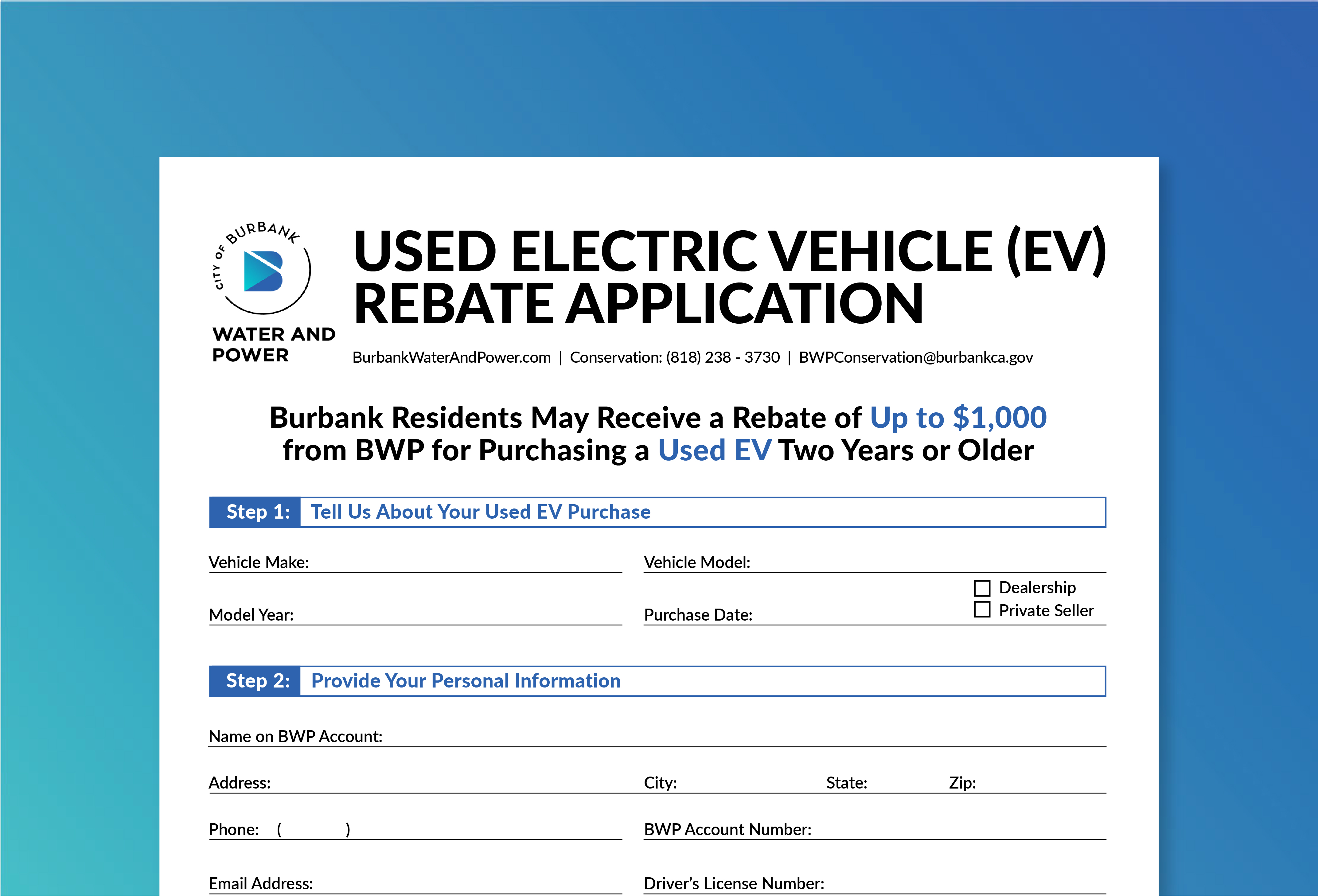

Used Electric Vehicle Rebate

https://www.burbankwaterandpower.com/images/2020/11/03/usedev_application_images-01.jpg

Illinois Electric Vehicle Rebate PaymentGrant Refund Cheque Funny

https://funnyinterestingcool.com/download/file.php?id=435

Web Clean Vehicle Tax Credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Web 26 juin 2023 nbsp 0183 32 To claim the credit on Form 8936 with your 2022 tax return you need to have purchased a qualifying plug in electric vehicle prior to January 1 2023 The credit for personal vehicles is non refundable Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500

Download Electric Vehicle Rebate Federal Form

More picture related to Electric Vehicle Rebate Federal Form

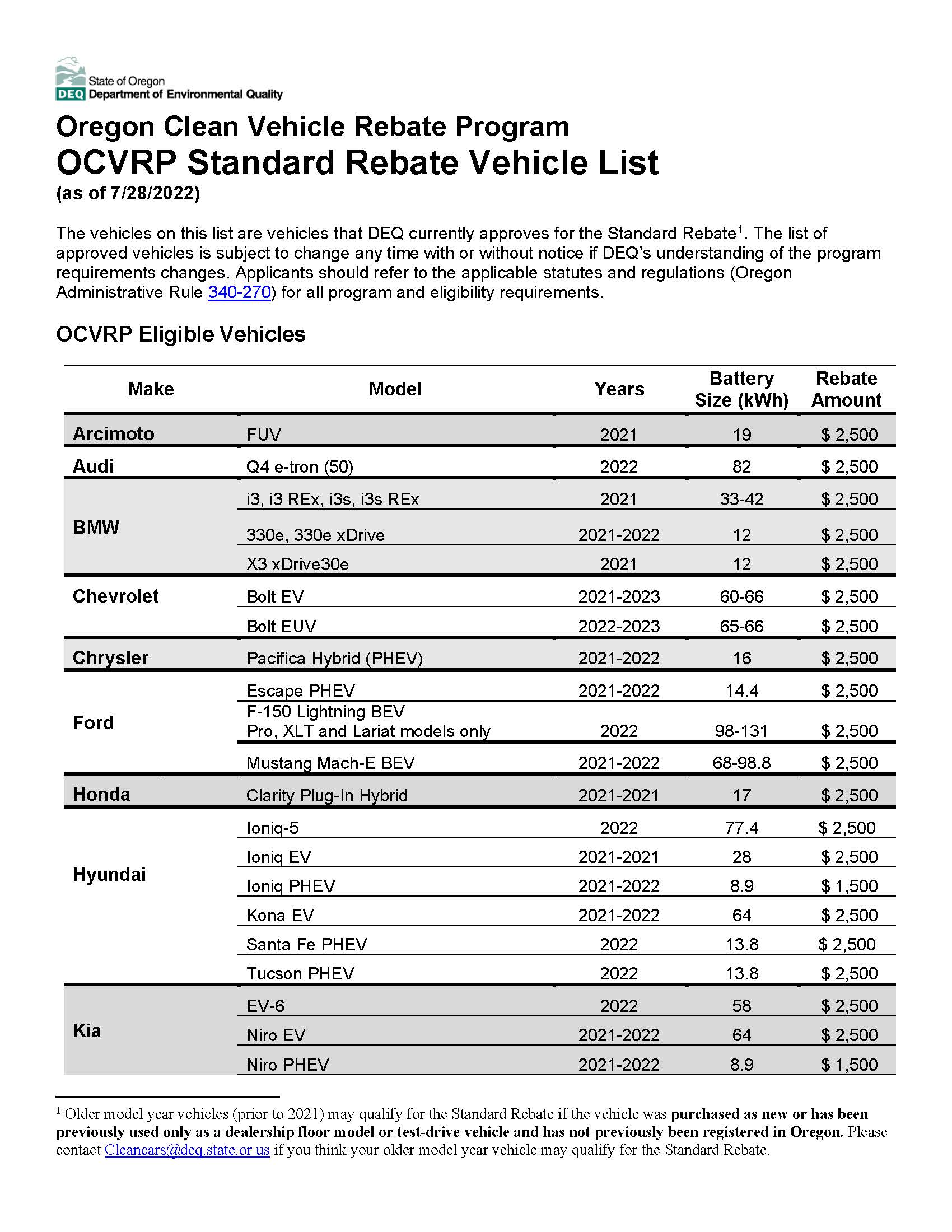

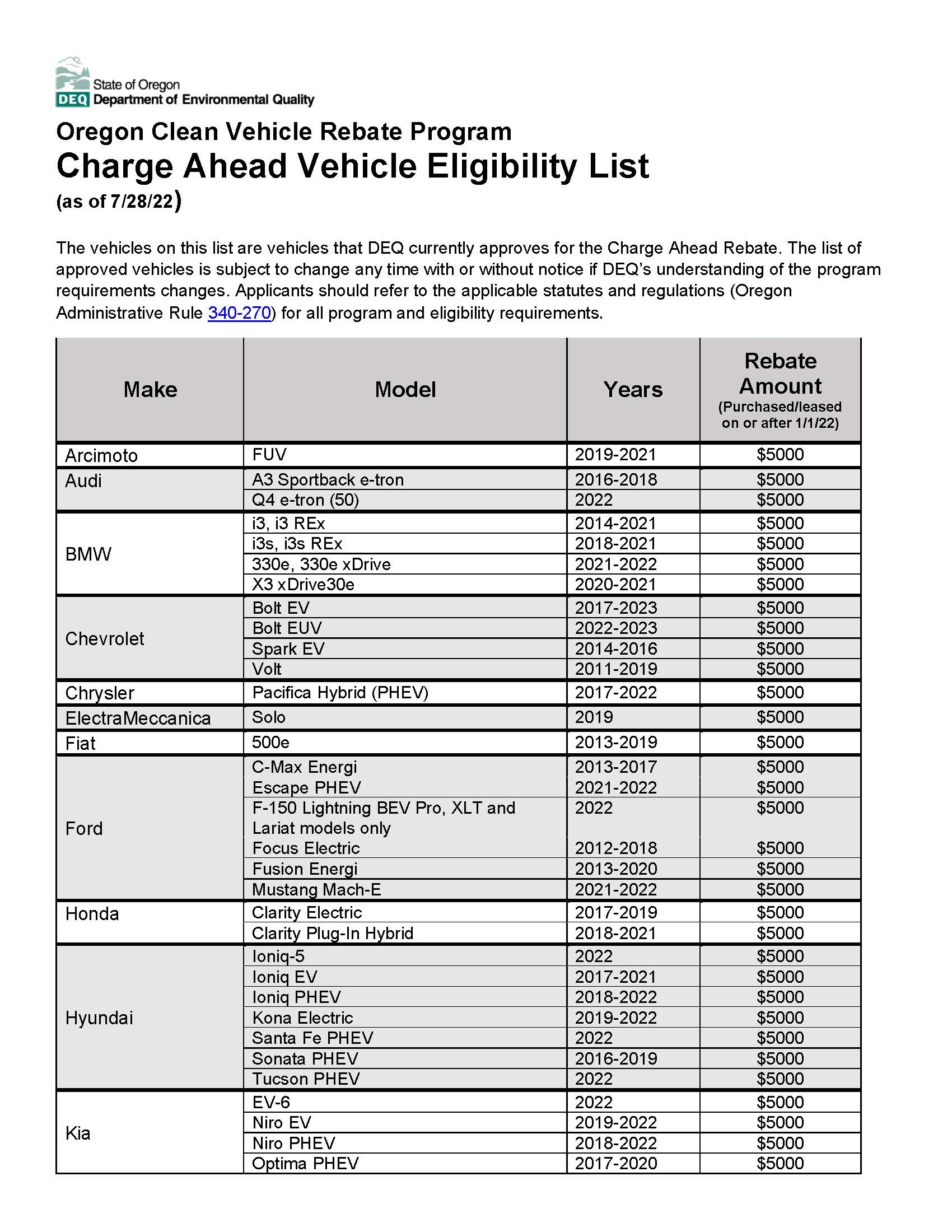

Electric Vehicle Rebates EClips Extra

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-ocvrp-standard-rebate-vehicle-eligibility-list.jpg

Federal Electric Vehicle Rebate ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/federal-electric-vehicle-rebates-announced-youtube-3.jpg

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell Web 25 ao 251 t 2022 nbsp 0183 32 The EV tax credit is a federal incentive designed to encourage people to purchase EVs Residents who meet the income requirements and who buy a vehicle that satisfies the price battery and

Web 5 sept 2023 nbsp 0183 32 A used previously owned electric vehicle must meet the following requirements to qualify for the up to 4 000 federal EV tax credit Have a sale price of Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for

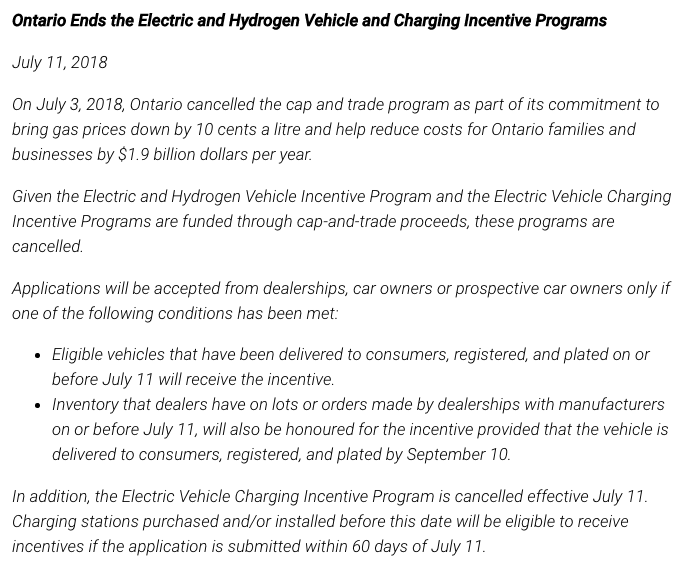

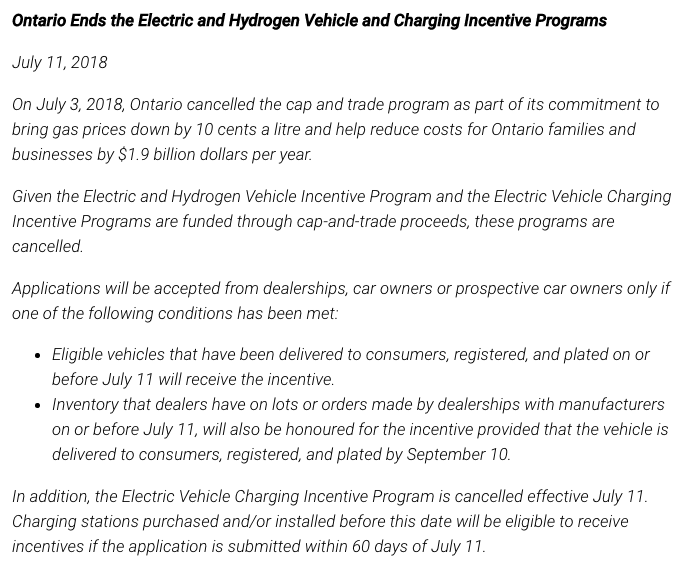

Ontario Electric Vehicle Rebate Cancelled ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/ontario-s-electric-car-rebate-program-cancelled-echargesolutions-ca-10.png

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year Use Form 8936 to figure your credit for

The Florida Hybrid Car Rebate Save Money And Help The Environment

Ontario Electric Vehicle Rebate Cancelled ElectricRebate

Illinois EV Purchase Rebate Share Deals Tips FORUM LEASEHACKR

Federal Rebate On Electric Cars ElectricCarTalk

Electric Vehicle Rebates EClips Extra

Here s Which Electric Vehicles Qualify In BC For A Rebate Urbanized

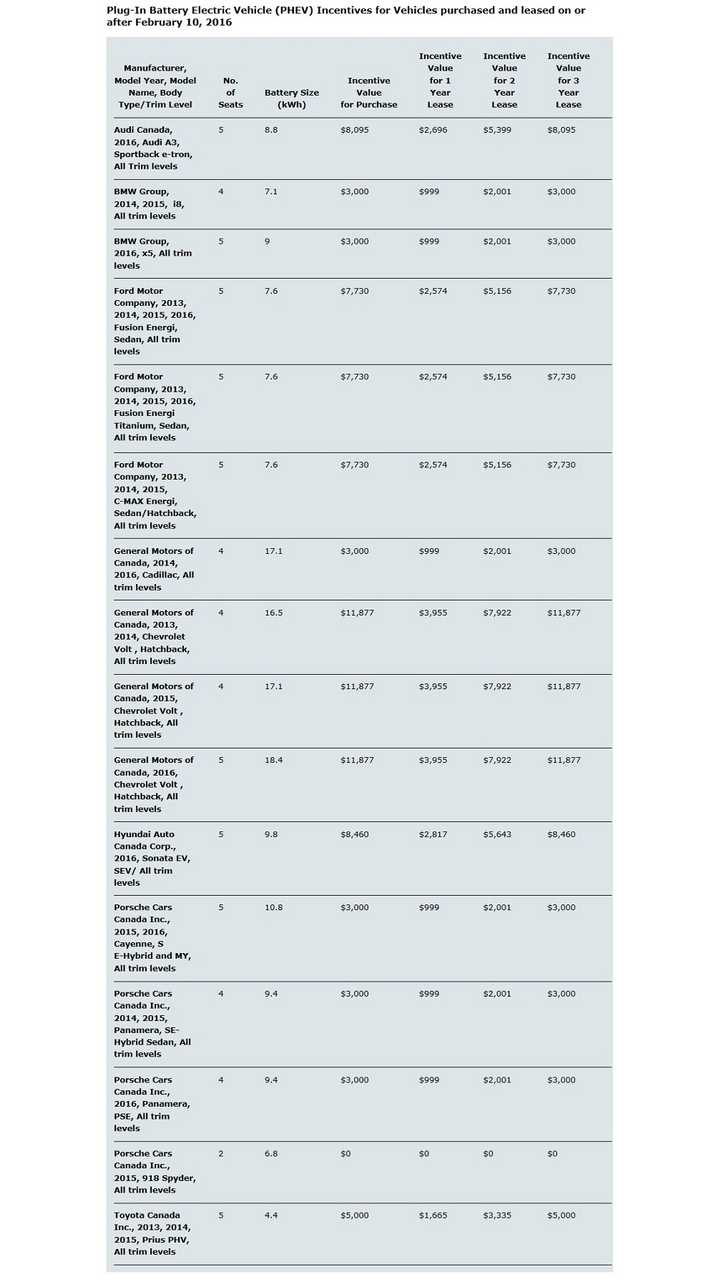

Here s Which Electric Vehicles Qualify In BC For A Rebate Urbanized

Ontario Electric Vehicle Rebate Eligibility ElectricRebate

Federal Electric Car Rebate Rules ElectricRebate

PDF Disparities And Equity Issues In Electric Vehicles Rebate Allocation

Electric Vehicle Rebate Federal Form - Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a