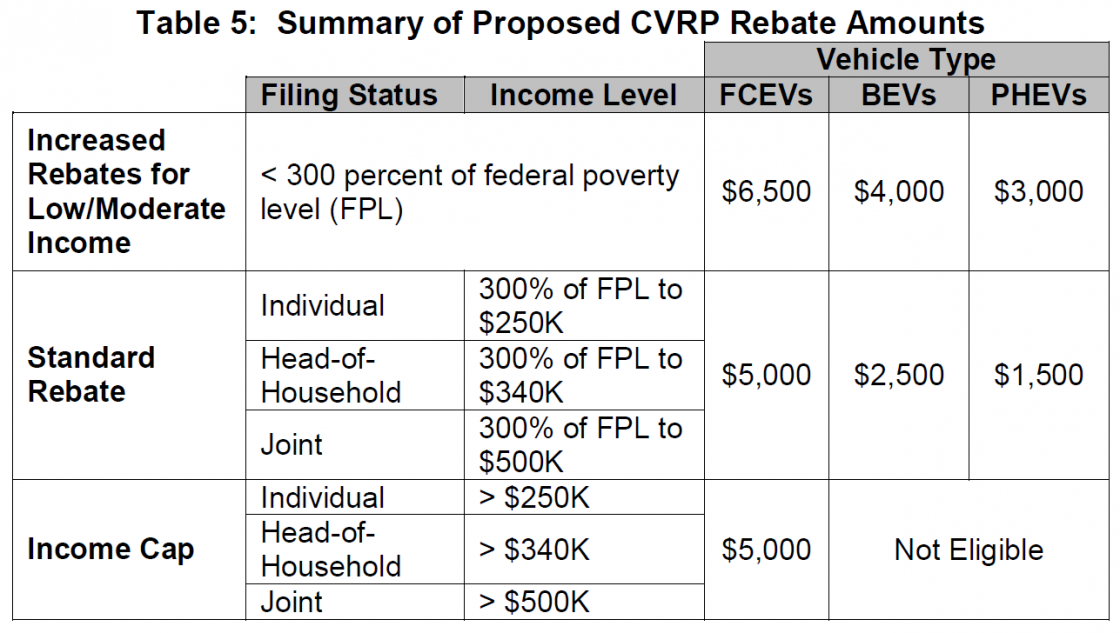

Electric Vehicle Rebate Income Limit Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in

Web 22 ao 251 t 2022 nbsp 0183 32 Sedans have to be under 55 000 to qualify and the cost of trucks vans and sports utility vehicles can t exceed 80 000 The price Web 25 ao 251 t 2022 nbsp 0183 32 If you meet the income requirements and buy a qualifying vehicle you must claim the electric vehicle EV tax credit on your

Electric Vehicle Rebate Income Limit

Electric Vehicle Rebate Income Limit

https://i0.wp.com/www.fordrebates.net/wp-content/uploads/2023/05/ontario-electric-vehicle-rebate-eligibility-electricrebate.jpg?fit=720%2C1280&ssl=1

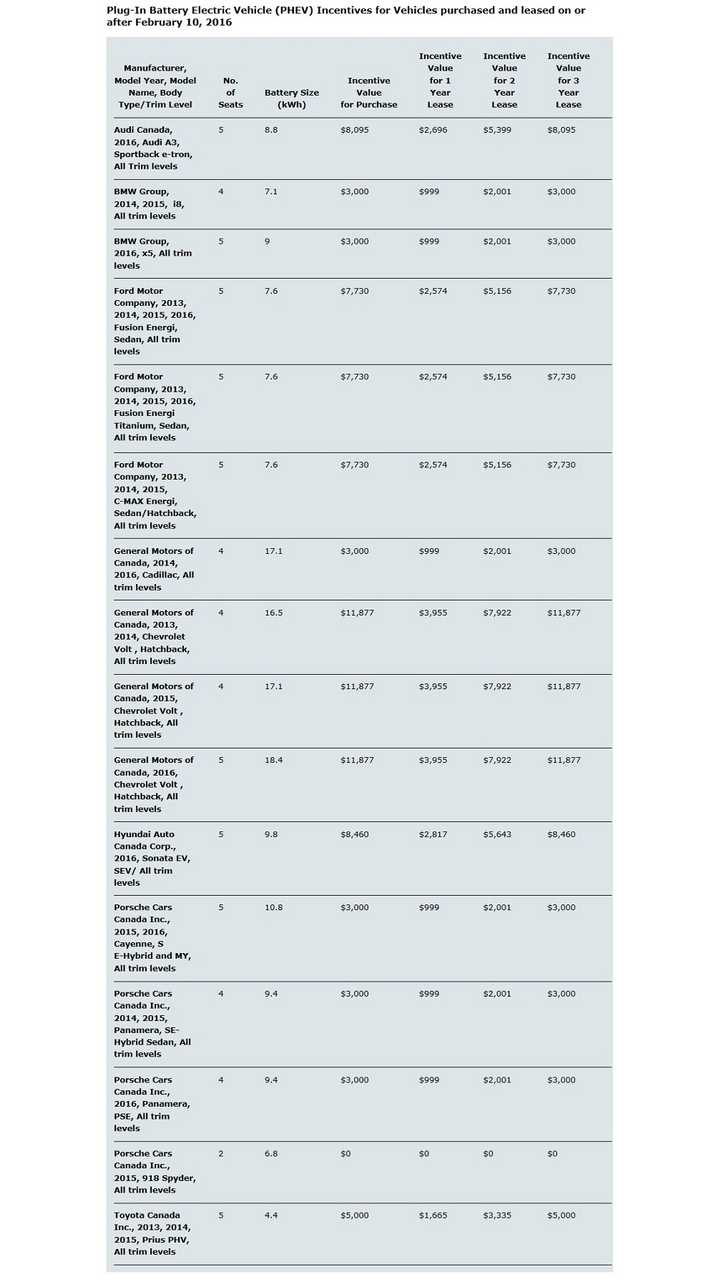

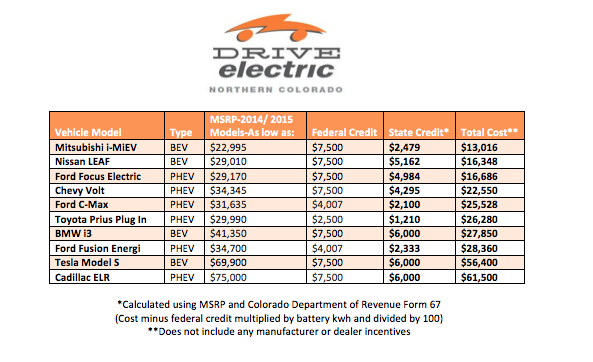

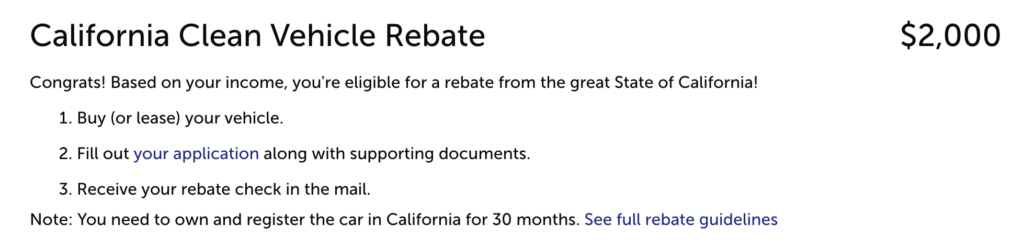

Ca Electric Car Rebate Income ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/california-income-based-electric-vehicle-rebate-program-expected-to-4.jpg

Ca Electric Car Rebate Income Limit ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/key-states-rethink-electric-car-subsidies-bestride-1.png

Web 2 sept 2022 nbsp 0183 32 Price matters but not until January 1 New battery electric cars that cost more than 55 000 do not qualify for the EV tax credit That price threshold rises to Web 5 sept 2023 nbsp 0183 32 The credit of up to 7 500 for certain electric vehicles called clean vehicles is supposed to encourage more people to use EVs However a year has

Web 16 ao 251 t 2022 nbsp 0183 32 The new legislation also targets used electric vehicles which for the first time qualify for a credit of up to 4 000 if the pre owned vehicle costs 25 000 or less Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Download Electric Vehicle Rebate Income Limit

More picture related to Electric Vehicle Rebate Income Limit

Ontario Electric Vehicle Rebate Eligibility ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/ontario-canada-boosts-electric-vehicle-incentive-program-up-to-14-000-16.jpg

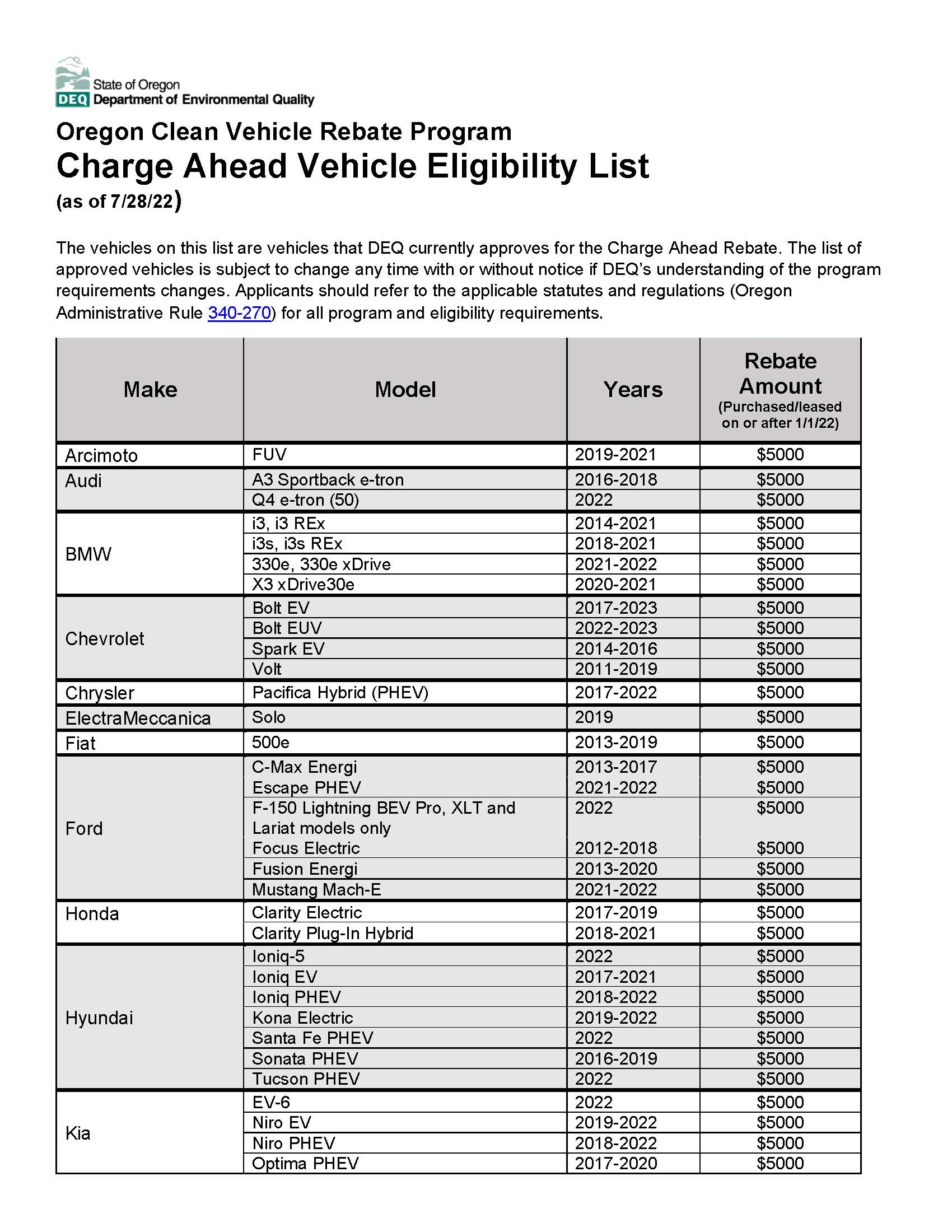

Electric Vehicle Rebates EClips Extra

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-charge-ahead-vehicle-eligibility-list.jpg

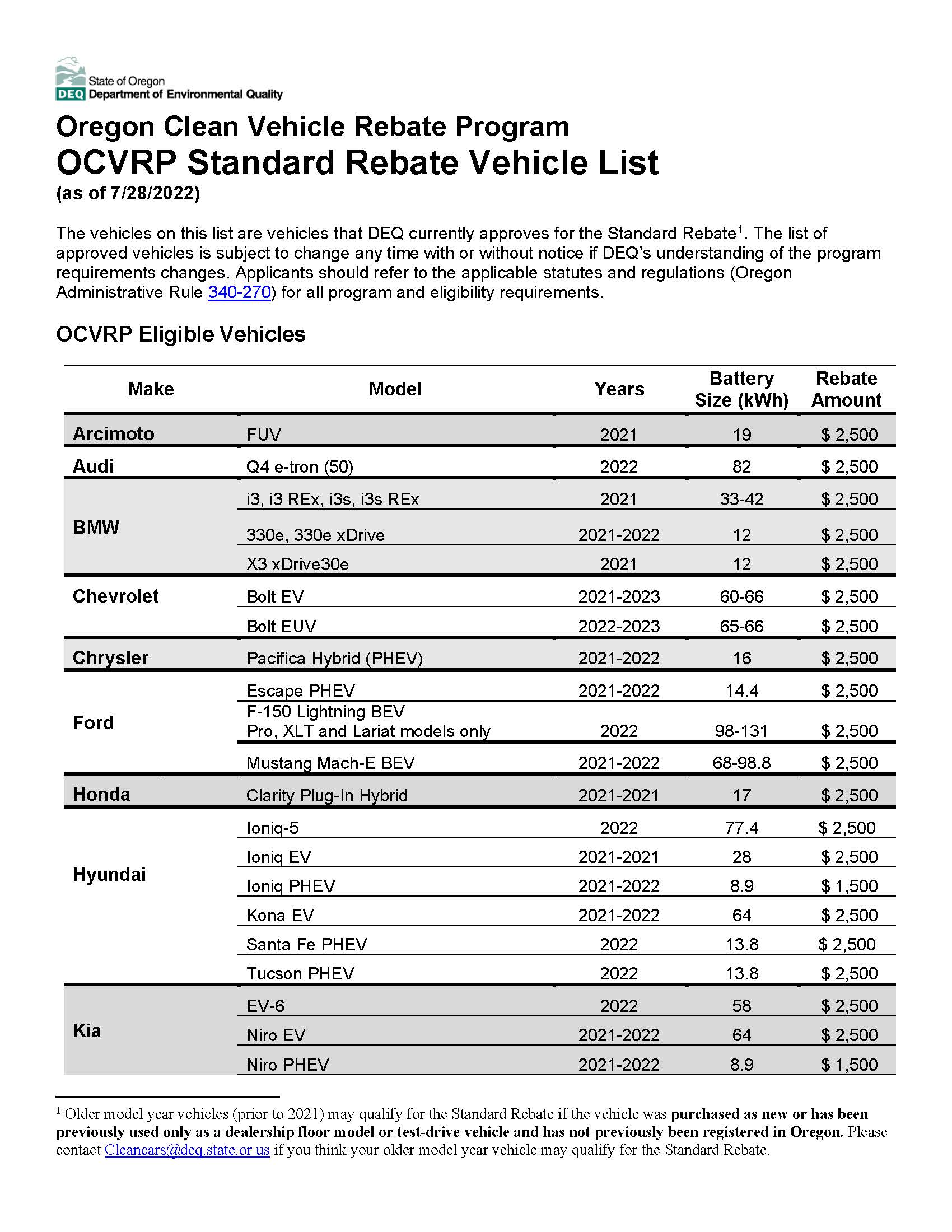

Electric Vehicle Rebates EClips Extra

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-ocvrp-standard-rebate-vehicle-eligibility-list.jpg

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 30 nov 2021 nbsp 0183 32 For individuals the maximum income would be 250 000 and for single income households the income limit would be 375 000

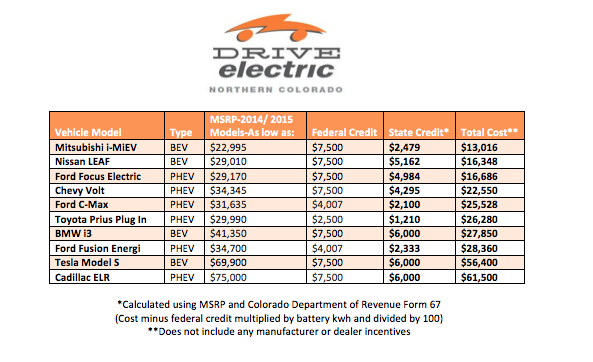

Income Tax Rebate On Electric Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/eligible-vehicles-for-tax-credit-drive-electric-northern-colorado.png

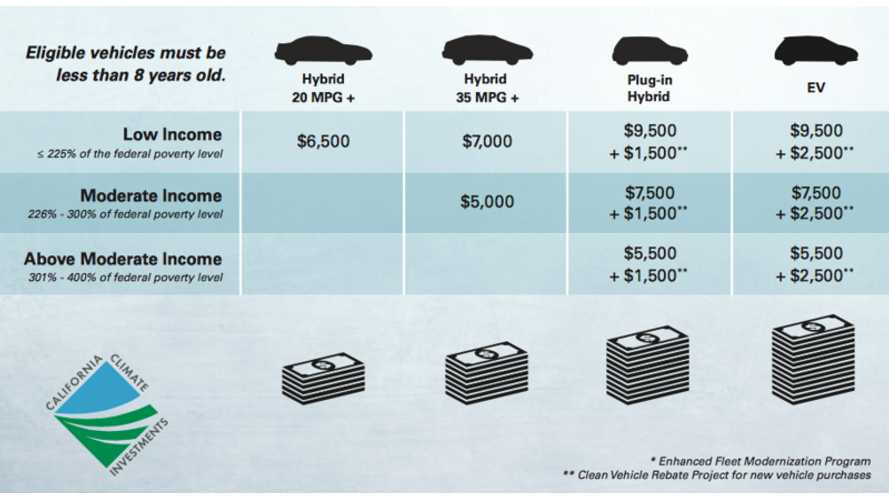

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

https://www.irs.gov/newsroom/topic-b-frequently-asked-questions-about...

Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in

https://www.npr.org/2022/08/22/1118052620

Web 22 ao 251 t 2022 nbsp 0183 32 Sedans have to be under 55 000 to qualify and the cost of trucks vans and sports utility vehicles can t exceed 80 000 The price

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

Income Tax Rebate On Electric Car 2022 Carrebate

Ca Electric Car Rebate Income Limit ElectricRebate

Income Tax Rebate On Electric Car 2023 Carrebate

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

Electric Vehicle Rebates For Lower income Buyers Go Virtually Unused In

Electric Vehicle Rebates For Lower income Buyers Go Virtually Unused In

Ca Electric Car Rebate Income Limit 2022 Carrebate

Ontario Electric Vehicle Rebate Cancelled ElectricRebate

Electric Vehicle Rebate Program Clean Fuels Michigan

Electric Vehicle Rebate Income Limit - Web 2 sept 2022 nbsp 0183 32 Price matters but not until January 1 New battery electric cars that cost more than 55 000 do not qualify for the EV tax credit That price threshold rises to