Electric Vehicle Tax Credit 2024 We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Jun 17 2024 Save Article Marc Urbano

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024 2024 EV Credit Point of Sale Claiming the EV Tax Credit EV Leases Home EV Chargers Other IRA Tax Credits By Kelley R Taylor last updated 16 July 2024 in Features A federal EV tax

Electric Vehicle Tax Credit 2024

Electric Vehicle Tax Credit 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bVuC1.img?w=1600&h=1067&m=4&q=93

How To Figure The Electric Vehicle Tax Credit For 2023

https://www.motorbiscuit.com/wp-content/uploads/2023/01/HyundaiIoniq5.webp?w=1200

EU Says US Electric Vehicle Tax Credit Could Break WTO Rules AP News

https://storage.googleapis.com/afs-prod/media/495896f14369410ba1333acb29935c1d/3000.jpeg

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

Download Electric Vehicle Tax Credit 2024

More picture related to Electric Vehicle Tax Credit 2024

Electric Vehicle Tax Credit Explained Rhythm

https://www.gotrhythm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F81o0exmdkv18%2F1Ih7Xkv6V29tej0lozgZnI%2F69087ff2f2f4a2c9e28b5d50b26157fa%2FEVBlog_TaxCredit.jpg&w=3840&q=100

Why The Electric Vehicle Tax Credit Was Removed OsVehicle

https://cdn.osvehicle.com/do_any_electric_cars_qualify_for_new_tax_credit.jpg

Toyota Electric Vehicle Tax Credits Ran Out Before The BZ4X EV Had A Chance

https://www.motorbiscuit.com/wp-content/uploads/2022/07/Toyota-Electric-Vehicle-Tax-Credits.jpg

What Is the Electric Vehicle EV Tax Credit The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a vehicle that Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

[desc-10] [desc-11]

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

https://www.caranddriver.com/news/g43675128/cars...

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By Jack Fitzgerald Updated Jun 17 2024 Save Article Marc Urbano

https://www.nerdwallet.com/article/taxes/ev-tax...

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

What To Know About 2024 Changes To The Electric Vehicle Tax Credit

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

What To Know About 2024 Changes To The Electric Vehicle Tax Credit

2023 Electric Vehicle Tax Credit BenefitsFinder

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit What To Know For 2020 Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit What To Know For 2020 Action News Jax

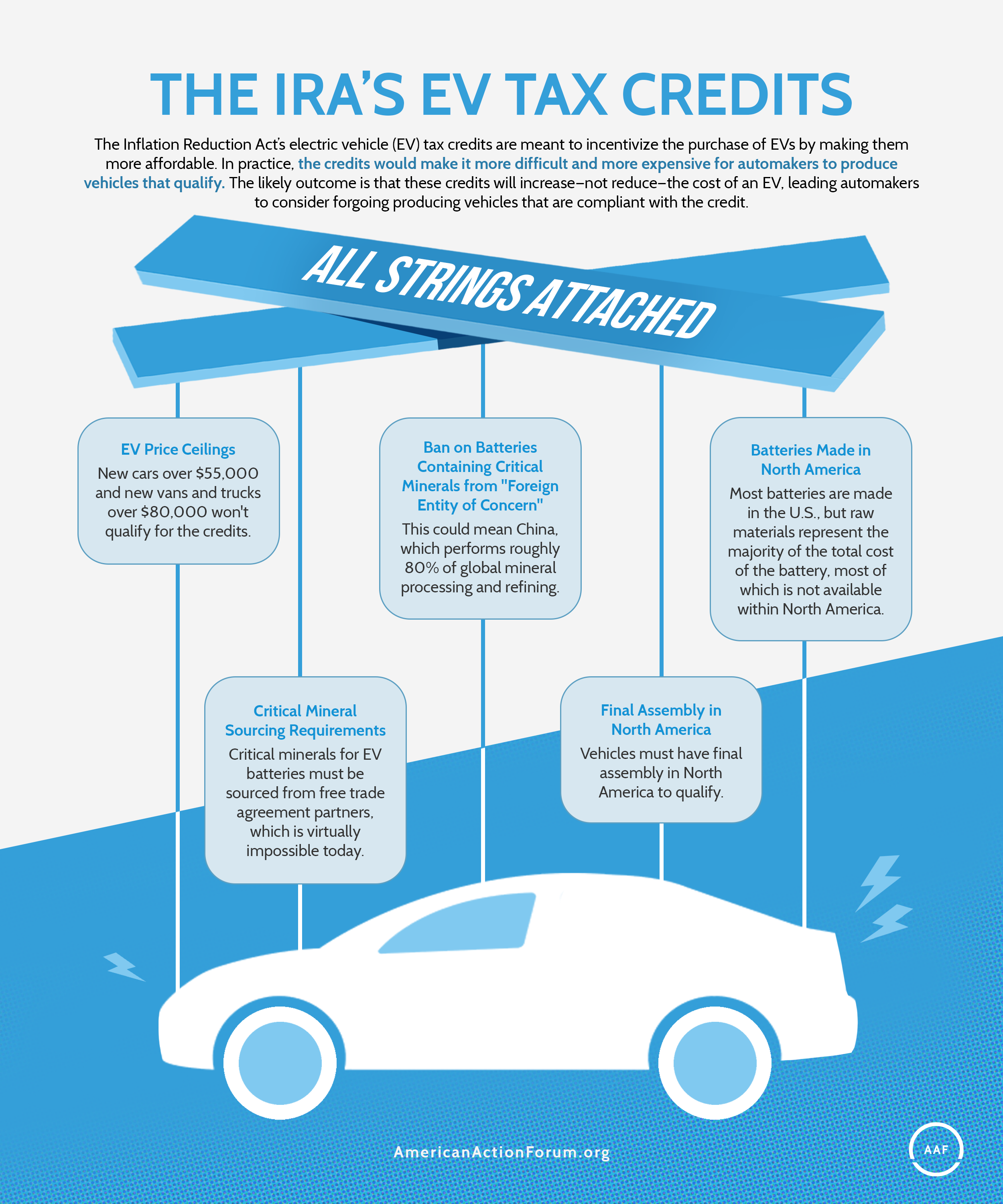

The IRA s EV Tax Credits AAF

Demystifying The 2023 Electric Vehicle Tax Credit New Vs Used And How

Electronic Vehicle Tax Credit 2023 Electric Vehicles Tax Credit Program

Electric Vehicle Tax Credit 2024 - A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an