Electric Vehicle Tax Credit California In addition to federal tax credits California has also implemented several incentive programs to kick start the popularity of EVs These include rebates and tax

Buyers who purchase an EV in California may qualify for a Federal Electric Car Tax Credit of up to 7 500 Many air quality districts and various utility companies in the state offer incentives Use this tool to find California generally available and qualifying tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle

Electric Vehicle Tax Credit California

Electric Vehicle Tax Credit California

https://nationalinterest.org/sites/default/files/main_images/2020-06-30T123515Z_938727344_RC2OJH9BT163_RTRMADP_3_PSA-CITROEN-LAUNCH.JPG.jpg

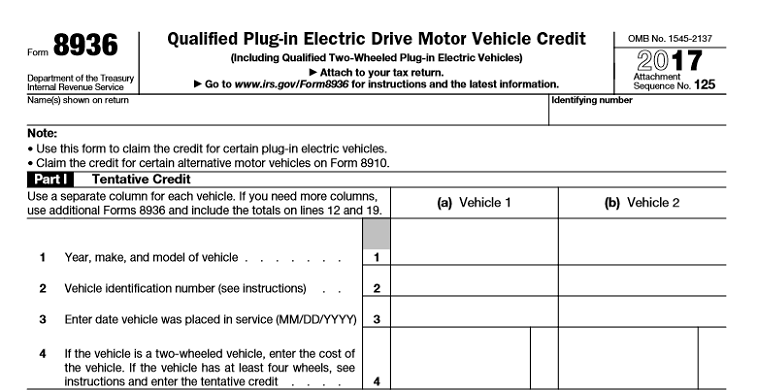

How To Receive A Tax Credit On Your Electric Vehicle Colvin Electric

https://colvinelectric.com/wp-content/uploads/2019/03/AdobeStock_191818438-e1551736282603.jpeg

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 The Plug In Electric Drive Vehicle Credit 30D provides credit between 2 500 and 7 500 in nonrefundable tax credit for qualifying vehicles All electric vehicles must have been purchased

Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to 7 500 Please note Sales or use tax is due on the total selling Your new electric vehicle could qualify for up to 7 500 If you bought it after April 18 2023 the vehicle needs to meet battery and mineral requirements to get the full

Download Electric Vehicle Tax Credit California

More picture related to Electric Vehicle Tax Credit California

A Complete Guide To The Electric Vehicle Tax Credit

https://media.greenmatters.com/brand-img/LLCNxkrsa/1600x838/electric-vehicle-tax-credit-1579212286451.jpg

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

How Electric Vehicle Tax Credit Works Web2Carz

https://www.web2carz.com/images/articles/201610/electric_vehicle_tax_credit_1476984869_800x600.jpg

A substantial tax credit for battery electric hydrogen fuel cell and plug in hybrid electric vehicles ranging from 2 500 7 500 may be available depending on the battery capacity If you lease the credit goes to the California s Clean Vehicle Rebate Program which offers as much as 7 000 in rebates to buy or lease a new plug in hybrid electric vehicle battery electric vehicle or a fuel cell

The Clean Vehicle Rebate Project CVRP is closed effective November 8 2023 CVRP offered up to 7 500 to purchase or lease a new plug in hybrid electric vehicle PHEV EV Ownership Owning an electric vehicle is more practical than ever before Find out how an EV can fit your lifestyle See the Benefits of Owning an EV Did you know California

2023 Electric Vehicle Tax Credit BenefitsFinder

https://benefitsfinder.com/wp-content/uploads/sites/4/2023/02/electric-vehicle-tax-credits-1024x684.jpg

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

https://www.mcgillhillgroup.com/FS/CO/3732/electric-vehicle-tax-credits.jpg

https://www.caranddriver.com/features/a31267652/...

In addition to federal tax credits California has also implemented several incentive programs to kick start the popularity of EVs These include rebates and tax

https://cars.usnews.com/.../california-ev-tax-…

Buyers who purchase an EV in California may qualify for a Federal Electric Car Tax Credit of up to 7 500 Many air quality districts and various utility companies in the state offer incentives

What You Need To Know About Electric Vehicle Tax Credits Elmers Auto

2023 Electric Vehicle Tax Credit BenefitsFinder

These 19 Plug In Electric Cars Qualify For Full 7 500 Tax Credit

A Complete Guide To The Electric Vehicle Tax Credit

Summary Of The Electric Vehicle Tax Credit

Which Electric Cars Qualify For The New EV Tax Credit

Which Electric Cars Qualify For The New EV Tax Credit

Electric Car Tax Credit 2022 Electric Car Tax Credits What s Available

The State Of Electric Vehicle Tax Credits Clean Charge Network

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Electric Vehicle Tax Credit California - Low income residents of California can take advantage of the DCAP when they purchase or lease a new or used clean vehicle CARB says DCAP s coverage