Electric Vehicle Tax Rebate India Web 19 janv 2023 nbsp 0183 32 The government may allow an extension in income tax rebate on electric vehicles EVs for two more years as part of its Budget 2023 announcements sources informed CNBC Aawaz In 2019 the

Web 2 janv 2022 nbsp 0183 32 Individuals who purchase EV on loan will be eligible for a tax reduction of Rs 1 5 lakh on the interest charged on the mortgage balance under this provision There are plenty of electric vehicle models on the Web 23 mai 2022 nbsp 0183 32 For a two wheeler for example the 2019 Faster Adoption and Manufacturing of Hybrid and Electric Vehicles FAME II plan offers Rs 15 000 per kWh of battery

Electric Vehicle Tax Rebate India

Electric Vehicle Tax Rebate India

https://paultan.org/image/2022/02/2022-EV-LKM-road-tax-rebate.jpg

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/are-there-still-tax-credits-for-hybrid-vehicles-tax-walls-2.jpg

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

https://images.cnbctv18.com/wp-content/uploads/2022/09/391310908-e1663242150789-1019x573.jpg

Web 5 janv 2023 nbsp 0183 32 Extension of interest deduction on loan to purchase electric vehicles till March 2025 Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for Web 29 juil 2023 nbsp 0183 32 Financial Benefits One of the primary advantages of owning an electric vehicle in India is the potential for substantial financial savings The government of

Web 8 juil 2021 nbsp 0183 32 Most of us don t own electric cars but now s the time to start thinking about the advantages and disadvantages of electric vehicles Advantages of switching to Electric Web 2 f 233 vr 2023 nbsp 0183 32 The Pro EV budget focuses on much needed initiatives such as Customs Duty reduction from 21 to 13 on Lithium Batteries and an extension of the subsidies on EV batteries for one more year and these

Download Electric Vehicle Tax Rebate India

More picture related to Electric Vehicle Tax Rebate India

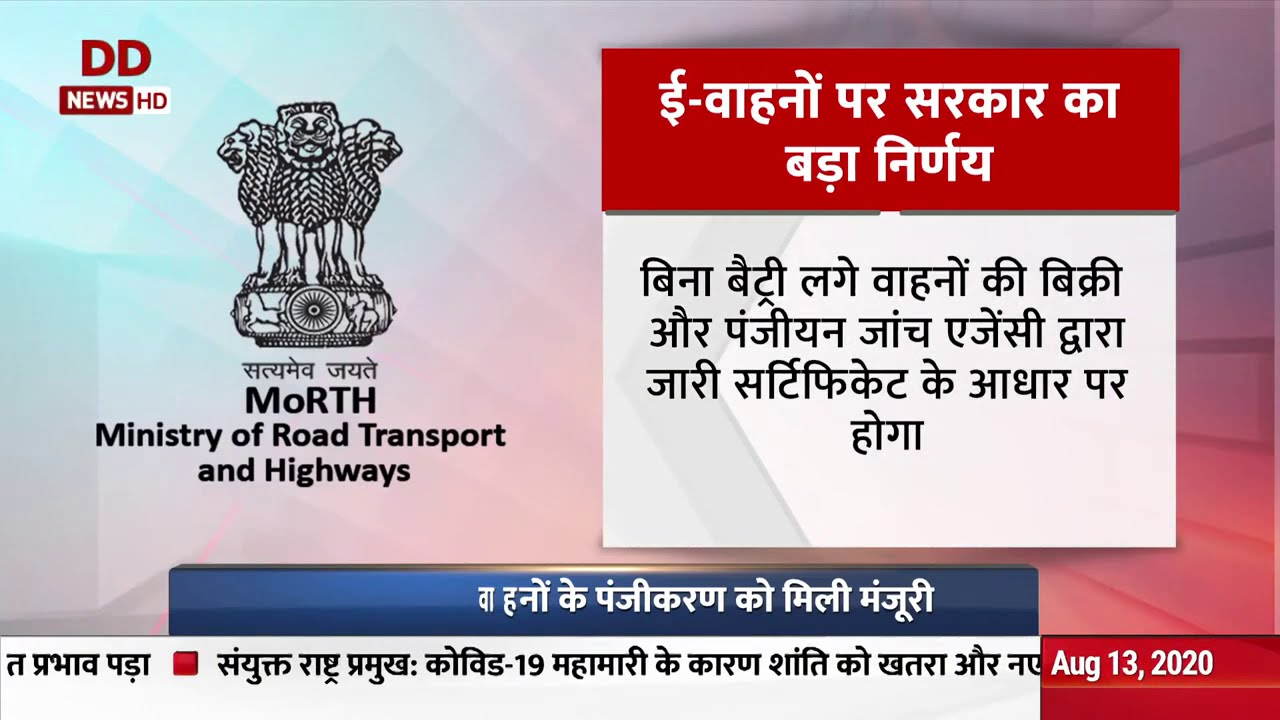

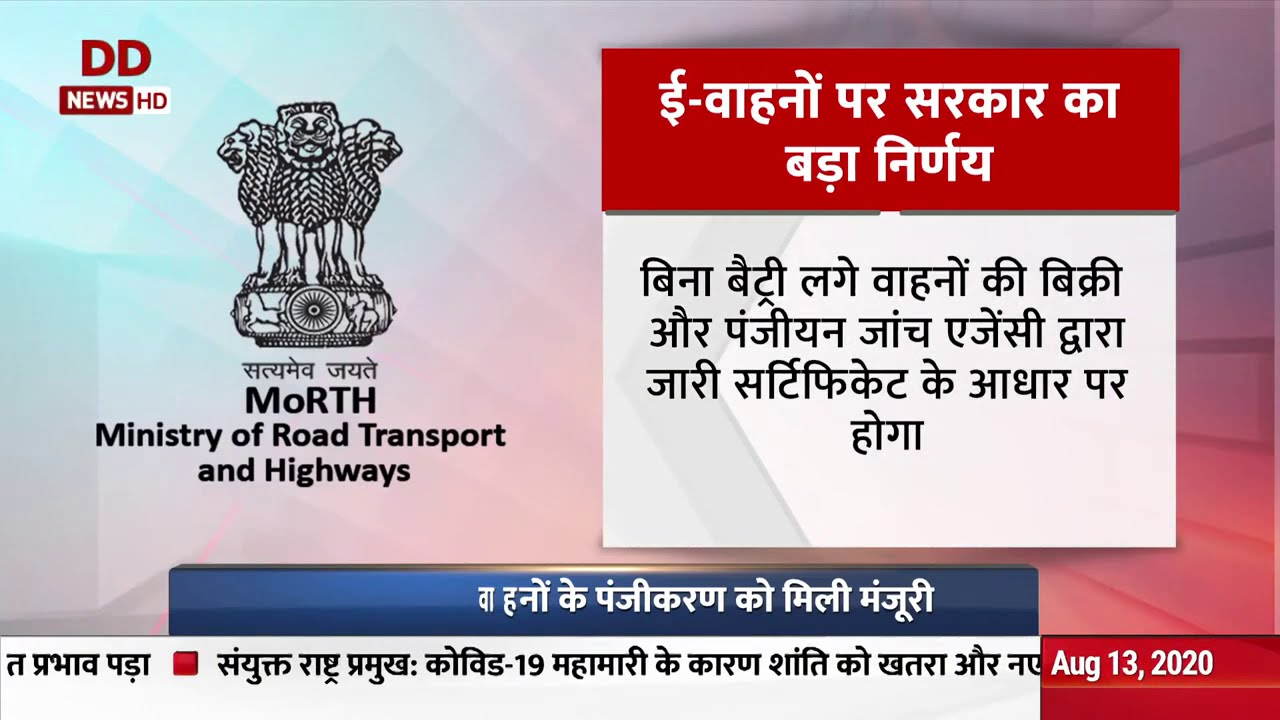

The Government Has Announced Tax Rebates On EV Loans Electric Vehicle

https://i.pinimg.com/originals/3f/f6/74/3ff6741dc3a1544e2b830a1ab072a7a3.png

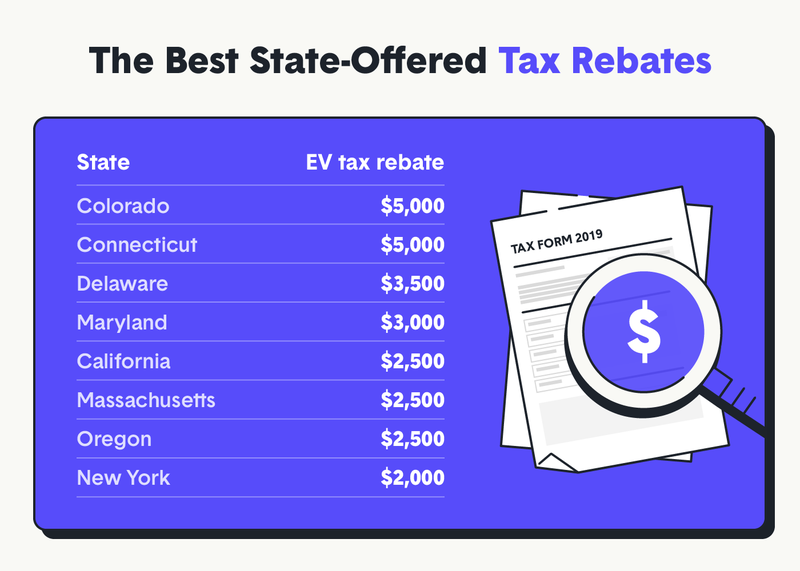

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Tax Rebates For Electric Car 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/going-green-states-with-the-best-electric-vehicle-tax-incentives-the-10.png

Web The key mechanisms for getting incentives are Purchase Incentives Direct discount provided to the user on the cost of the electric vehicle Coupons Financial incentive Web 13 mars 2023 nbsp 0183 32 Section 80EEB of the Income Tax Act offers a tax deduction benefit of up to 1 5 lakh on the interest component of a loan taken to purchase an electric vehicle

Web The government created a new section that includes tax benefits on Electric Vehicles in India The Tax Savings Calculator helps to calculate how much amount in tax would be Web With many benefits EVs are eligible for government incentives in the form of tax rebates and deductions Learn more about India s growing demand for EVs and their tax saving

Govt Rebate For Electric Car 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/govt-allows-registration-of-electric-vehicles-without-batteries-youtube.jpg

What Electric Vehicle Rebates Can I Get RateGenius

https://www.rategenius.com/wp-content/uploads/FF-electric-cars-scaled.jpg

https://www.cnbctv18.com/personal-finance/b…

Web 19 janv 2023 nbsp 0183 32 The government may allow an extension in income tax rebate on electric vehicles EVs for two more years as part of its Budget 2023 announcements sources informed CNBC Aawaz In 2019 the

https://www.dnaindia.com/automobile/report-…

Web 2 janv 2022 nbsp 0183 32 Individuals who purchase EV on loan will be eligible for a tax reduction of Rs 1 5 lakh on the interest charged on the mortgage balance under this provision There are plenty of electric vehicle models on the

Electric Vehicle Tax Credits And Rebates Explained 2021 TrueCar Blog

Govt Rebate For Electric Car 2023 Carrebate

Federal Tax Rebates Electric Vehicles ElectricRebate

Tax Rebate

Tax Benefit On Electric Vehicles Inside Narrative

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Income Tax Rebate On Electric Car 2023 Carrebate

Electric Vehicle Charging Equipment Rebates DNREC Alpha

Every Electric Vehicle Tax Credit Rebate Available By State Local

Electric Vehicle Tax Rebate India - Web 5 janv 2023 nbsp 0183 32 Extension of interest deduction on loan to purchase electric vehicles till March 2025 Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for