Electrical Rebates 2024 Business use of home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible clean energy expenses is as follows Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead What EVs are eligible for tax credit in 2024 See the list Electric Vehicles Add Topic Which EVs qualify for a 7 500 tax credit in 2024 See the updated list Bailey Schulz USA TODAY 0 00

Electrical Rebates 2024

Electrical Rebates 2024

https://website-assets.enable.com/images/seo/page_electrical.png

Power Rebates For Washing Machines PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/clothes-washer-rebate-program-new-rebates-available-scaled.jpg?fit=1656%2C2560&ssl=1

2024 YouTube

https://i.ytimg.com/vi/ADcbdB8rYXw/maxresdefault.jpg

The High Efficiency Electric Homes and Rebates Act When HEEHRA rebates roll out in late 2024 qualified Americans will be able to save up to 8 000 on a heat pump for space heating and cooling For some that covers 100 of the cost of a major appliance which will also save them hundreds of dollars a year in energy costs For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

These GM Ford And Tesla EVs Will Lose Their Tax Credit On January 1 2024 It s The Best Time Ever To Buy An Electric Car It s Also The Most Confusing Fire Sale New Tesla Model 3 The 2024 Electric Vehicle Tax Credit part of the Inflation Reduction Act brings a renewed boost for EV buyers including those interested in fuel cell electric vehicle options also known as fuel cell vehicles The new changes include the following The elimination of manufacturer sales caps

Download Electrical Rebates 2024

More picture related to Electrical Rebates 2024

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Non Residential Rebates Electrical District No 3

https://www.ed3online.org/home/showpublishedimage/1040/637799965558700000

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 ARE HOME ENERGY REBATES FUNDS CURRENTLY AVAILABLE FOR HOUSEHOLDS 6 Is There A Website Where Households Can Apply For Home Energy Rebates 7 I NEED A HOME ENERGY UPGRADE NOW Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state energy EV tax credit changes for 2024 The IRS updated its electric vehicle tax credit rules as of Jan 1 which makes it easier to see immediate savings on an EV purchase Practically speaking buyers

CAT Rebates W L Inc

https://wl-parts.com/wp-content/uploads/2021/10/Cat-Rebates-WL-Flyer.png

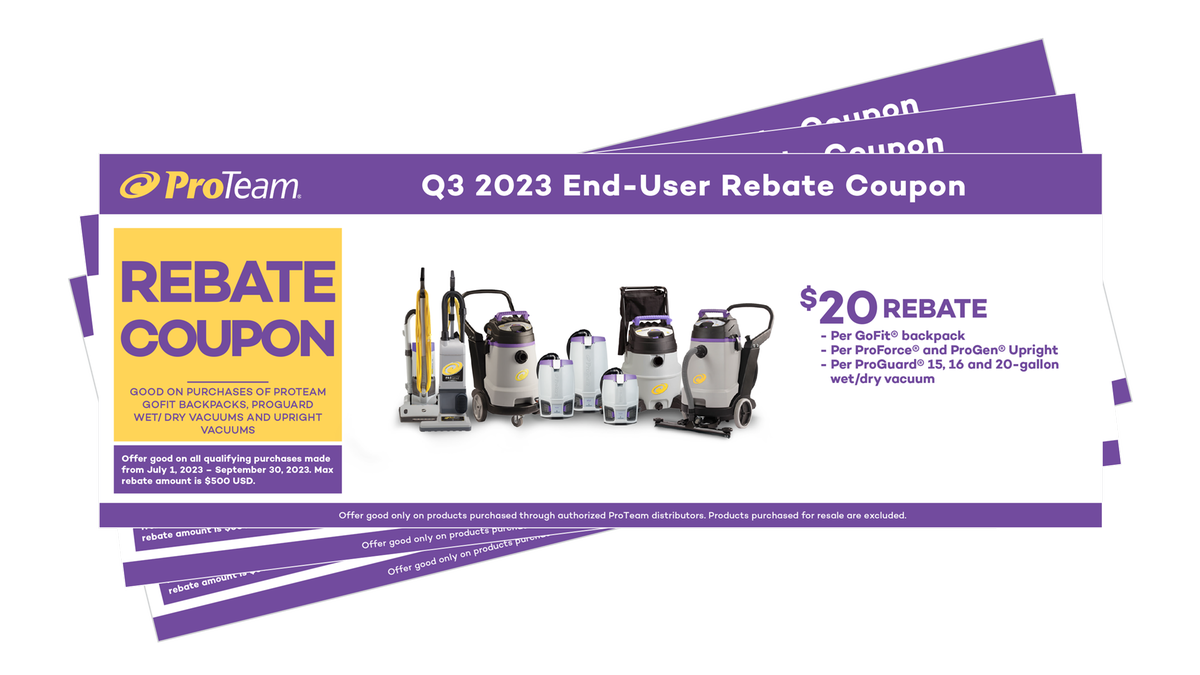

Manufacturer Rebates CleanFreak

https://cdn.shopify.com/s/files/1/0624/3270/6740/files/rebates-q3-full-line.png?v=1686831920

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Business use of home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible clean energy expenses is as follows Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

CAT Rebates W L Inc

How Do Home Rebates Work DC MD VA Home Rebates

NWC Tryouts 2023 2024 NWC Alliance

Milwaukee Tool Rebates Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Can I Combine Solar Rebates With Other Incentives In South Australia

Primary Rebate South Africa Printable Rebate Form

Electrical District No 3 Home

Electrical Rebates 2024 - For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate