Eligibility For Child Care Tax Credit The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents A qualifying individual for the child and dependent care credit is Your dependent qualifying child who was under age 13 when the care was provided Your spouse who was physically or mentally incapable of self care and lived with you for more than half of the year or

Eligibility For Child Care Tax Credit

Eligibility For Child Care Tax Credit

https://i0.wp.com/zobuz.com/wp-content/uploads/2020/05/The-Child-Tax-Credit.jpg

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit To qualify for the child and dependent care credit you must have paid someone such as a daycare provider to care for one or more of the following people A child age 12 or younger at the end of the year whom you claim as a

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to report the claim on your tax return LAST UPDATED January 10 2024 You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to 1 000 every 3 months if a child is disabled up to

Download Eligibility For Child Care Tax Credit

More picture related to Eligibility For Child Care Tax Credit

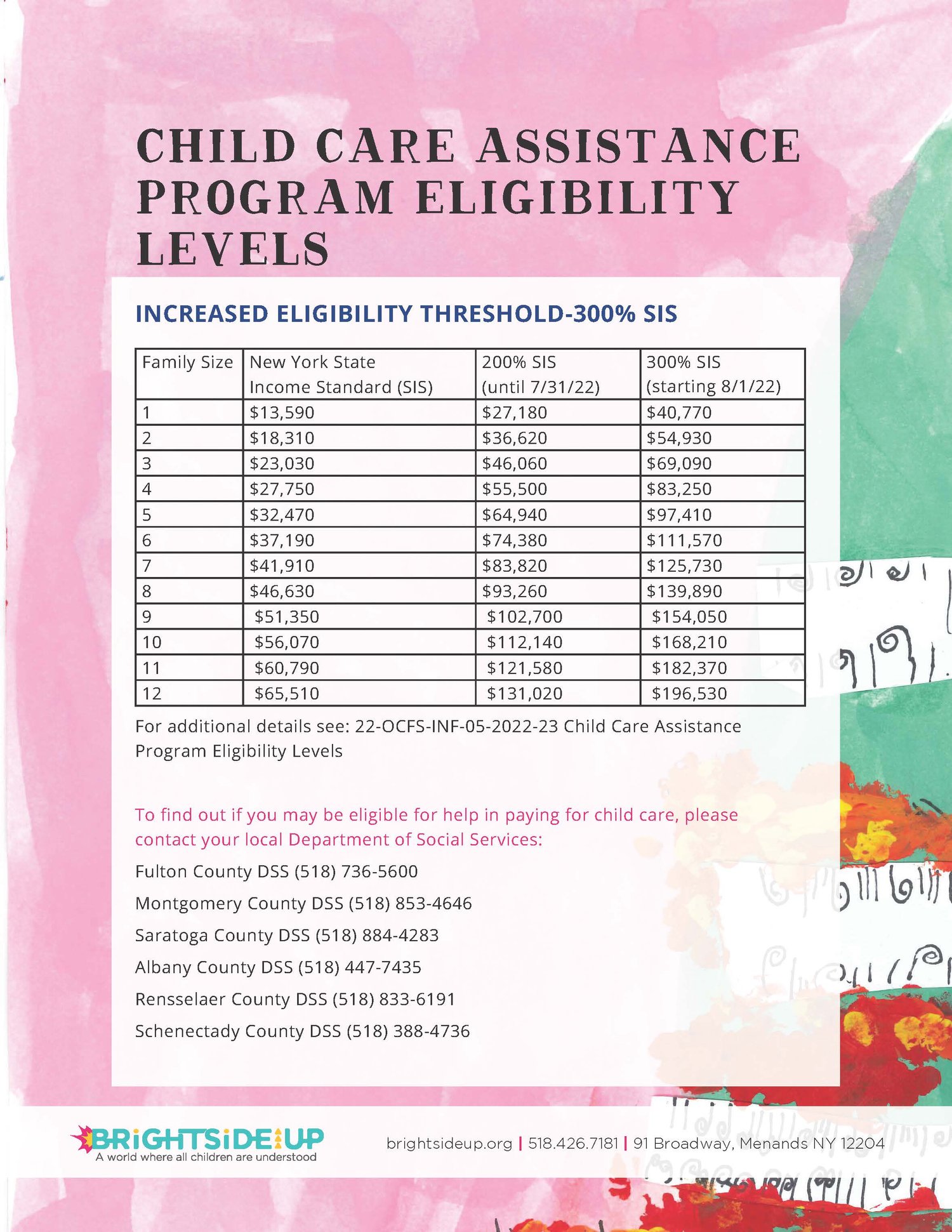

CHILD CARE ASSISTANCE PROGRAM ELIGIBILITY LEVELS Brightside Up

http://static1.squarespace.com/static/5d4dbe9778e49900019f60a6/t/62ded69bed15ac5d0572df4f/1658771186160/eligibility-threshold-chart_300%25SIS.jpg?format=1500w

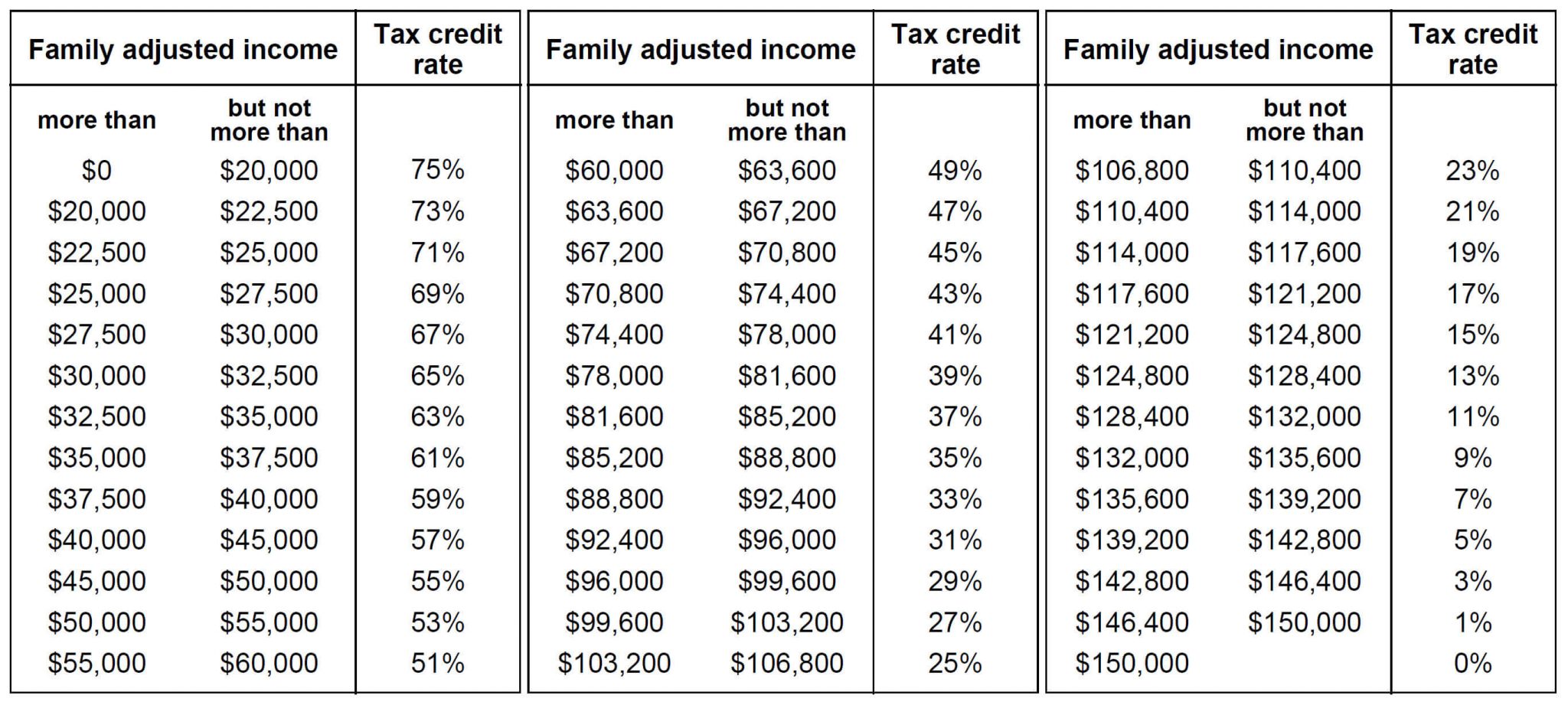

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

The Child and Dependent Care Credit helps working people offset care costs for children or dependents with disabilities To claim the credit taxpayers must complete Form 2441 a two page document that reports child and dependent care expenses as part of a federal income tax return and is used to determine the amount of More help with claiming the Child Care Tax Credit If you think you qualify for the Child Care Tax Credit or other tax credits like the Earned Income Tax Credit or deductions get help 500 750 1 250 or 3 500 Approval and loan amount based on expected refund amount eligibility criteria and underwriting If approved funds will be

If eligible you can claim certain child care expenses as a deduction on your personal income tax return Related information Income Tax Package Form T778 Child Care Expenses Deduction for 2023 Income Tax Folio S1 F3 C1 Child Care Expense Deduction Date modified 2024 01 23 If you have children or other dependents under the age of 17 you likely qualify for the Child Tax Credit In 2021 it was temporarily expanded as part of the American Rescue Plan which was signed by President Biden in March of that year to help families deal with the financial hardships stemming from the COVID 19 pandemic

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit-800x534.jpg

FSA Or Tax Credit Which Is Best To Save On Child Care

https://blog.havenlife.com/wp-content/uploads/2018/06/FSA-or-tax-credit_-Which-is-best-to-save-on-child-care_.jpg

https://www.nerdwallet.com/article/taxes/qualify...

The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

10 2019 Child Tax Credit Worksheet Worksheets Decoomo

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

2023 Estimated Monthly Income Eligibility Levels For Florida Healthy

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Does The Child And Dependent Care Credit Phase Out Completely Latest

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Eligibility For Child Care Tax Credit - All families with incomes up to 125 000 will save up to one half the cost of their eligible child care expenses getting back up to 4 000 for one child and 8 000 for two or more children when