Eligibility Recovery Rebate Credit Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements Web 13 janv 2022 nbsp 0183 32 Yes if you meet the eligibility requirements to claim the 2021 Recovery Rebate Credit The amount of your credit may include up to 1 400 for a qualifying dependent you are claiming on your 2021 return

Eligibility Recovery Rebate Credit

Eligibility Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

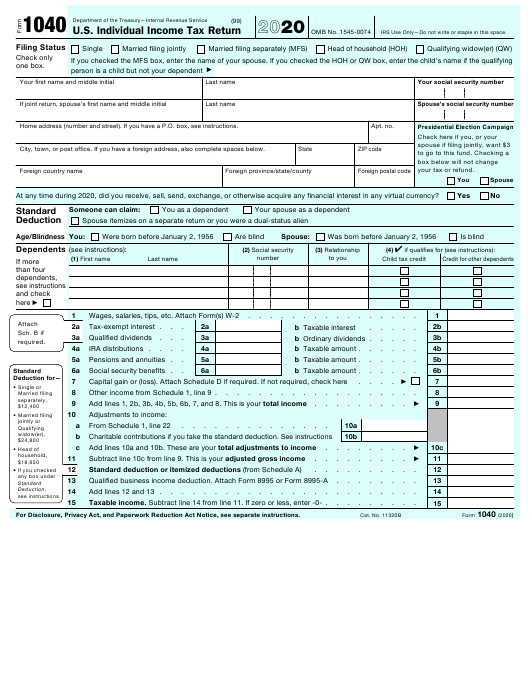

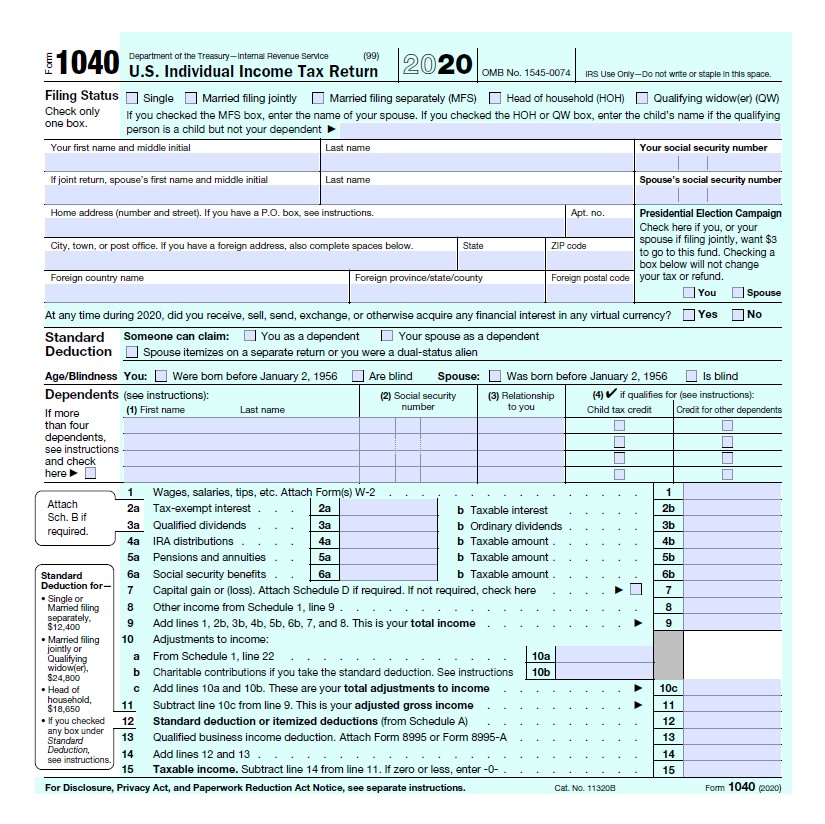

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Recovery Rebate Eligibility Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-1.png

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint Web 1 d 233 c 2022 nbsp 0183 32 If the result is zero or a negative amount you don t qualify for any additional credit on your 2020 tax return If your result is a positive amount then you are eligible for a 2020 Recovery Rebate Credit

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the Web 16 nov 2022 nbsp 0183 32 Check eligibility for Recovery Rebate Credit IR 2021 49 March 2 2021 WASHINGTON The Internal Revenue Service reminds first time filers and those who usually don t have a federal filing requirement to consider filing a 2020 tax return They

Download Eligibility Recovery Rebate Credit

More picture related to Eligibility Recovery Rebate Credit

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20282e140c0de200b-800wi

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Web 12 oct 2022 nbsp 0183 32 You re generally eligible to claim the recovery rebate credit if in 2021 you Were a U S citizen or U S resident alien Web The eligibility criteria for the RRC is generally the same as for EIPs except that the RRC is based on tax year 2020 information instead of the tax year 2019 or tax year 2018 information used for EIP1 and tax year 2019 information used for EIP2

Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments Investing Stocks Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing season 99 3 of the time the Treasury Inspector General for Tax Administration

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

Tax Time Guide Didn T Get Economic Impact Payments Check Eligibility

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/tax-time-guide-didn-t-get-economic-impact-payments-check-eligibility-6.png

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

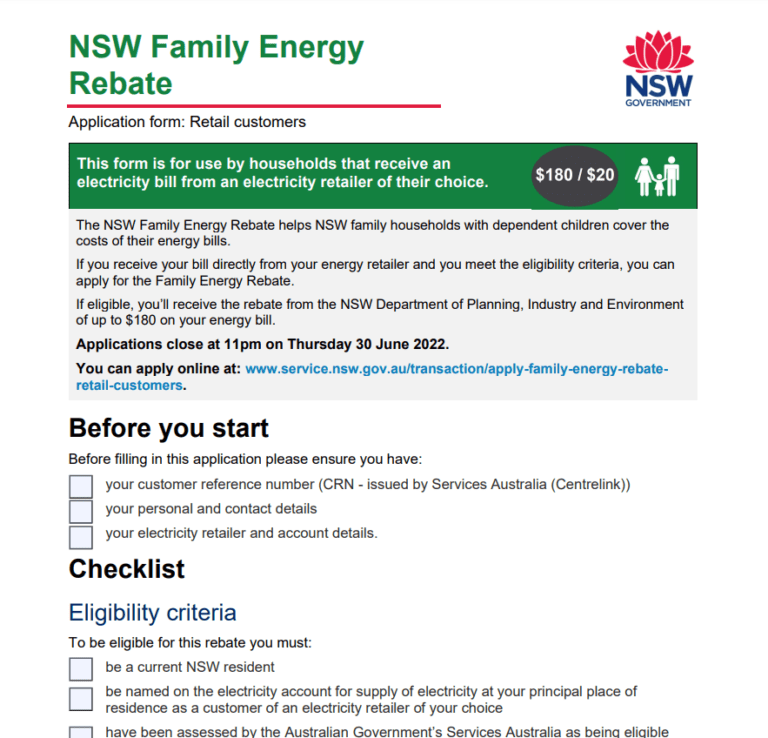

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

How To Figure The Recovery Rebate Credit Recovery Rebate

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Cares Act Recovery Rebate Credit Recovery Rebate

Eligibility Recovery Rebate Credit - Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint