Employee Retention Rebate Web The Employee Retention Credit provides an Eligible Employer with a tax credit that is allowed against certain employment taxes The credit is refundable which means that

Web 27 juil 2023 nbsp 0183 32 The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for businesses and tax Web 28 mai 2023 nbsp 0183 32 The Employee Retention Credit ERC expired for most businesses on Sept 30 2021 except for quot recovery startup businesses quot

Employee Retention Rebate

Employee Retention Rebate

https://i.vimeocdn.com/video/1378562865-ac78f32eb52d1ebb6f0b15f77ce8309521f2bcdd7afde0365a962fb84e6724d2-d

Pin On Favorites

https://i.pinimg.com/originals/e9/cb/5c/e9cb5ca940d1f2cf2cbae7451f48ed4f.png

How To Receive The Largest ERT Tax Credit Rebate Amount Employee

https://i.ytimg.com/vi/WoNWt-ZLEfw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGCUgaShyMA8=&rs=AOn4CLCTbJsy0yU9KiOQfQXZaIIKmls07Q

Web 2 avr 2021 nbsp 0183 32 Thus the maximum employee retention credit available is 7 000 per employee per calendar quarter for a total of 14 000 for the first two calendar quarters Web 12 mai 2021 nbsp 0183 32 The 2020 employee retention credit gives eligible businesses a refundable tax credit of 50 of up to 10 000 in qualified wages paid per employee in 2020 That

Web 24 sept 2022 nbsp 0183 32 LOS ANGELES CA ACCESSWIRE September 24 2022 The Employee Retention Credit ERC or Employee Retention Tax Credit ERTC program is the last Web 1 mars 2021 nbsp 0183 32 For 2020 the employee retention credit can be claimed by employers who paid qualified wages after March 12 2020 and before January 1 2021 and who

Download Employee Retention Rebate

More picture related to Employee Retention Rebate

Social Media Reputation By ERC Tax Group In Dallas TX Alignable

https://pictures.alignable.com/eyJidWNrZXQiOiJhbGlnbmFibGV3ZWItcHJvZHVjdGlvbiIsImtleSI6InNlcnZpY2VzL3BpY3R1cmVzL29yaWdpbmFsLzMwOTQxNDkvQml6IENhcmQgRnJvbnQtcmV2LnBuZyIsImVkaXRzIjp7ImV4dHJhY3QiOnsibGVmdCI6MTksInRvcCI6MCwid2lkdGgiOjEwOTcsImhlaWdodCI6Njg2fSwicmVzaXplIjp7IndpZHRoIjo1ODAsImhlaWdodCI6MzYyfSwiZXh0ZW5kIjp7InRvcCI6MCwiYm90dG9tIjowLCJsZWZ0IjowLCJyaWdodCI6MCwiYmFja2dyb3VuZCI6eyJyIjoyNTUsImciOjI1NSwiYiI6MjU1LCJhbHBoYSI6MX19fX0=

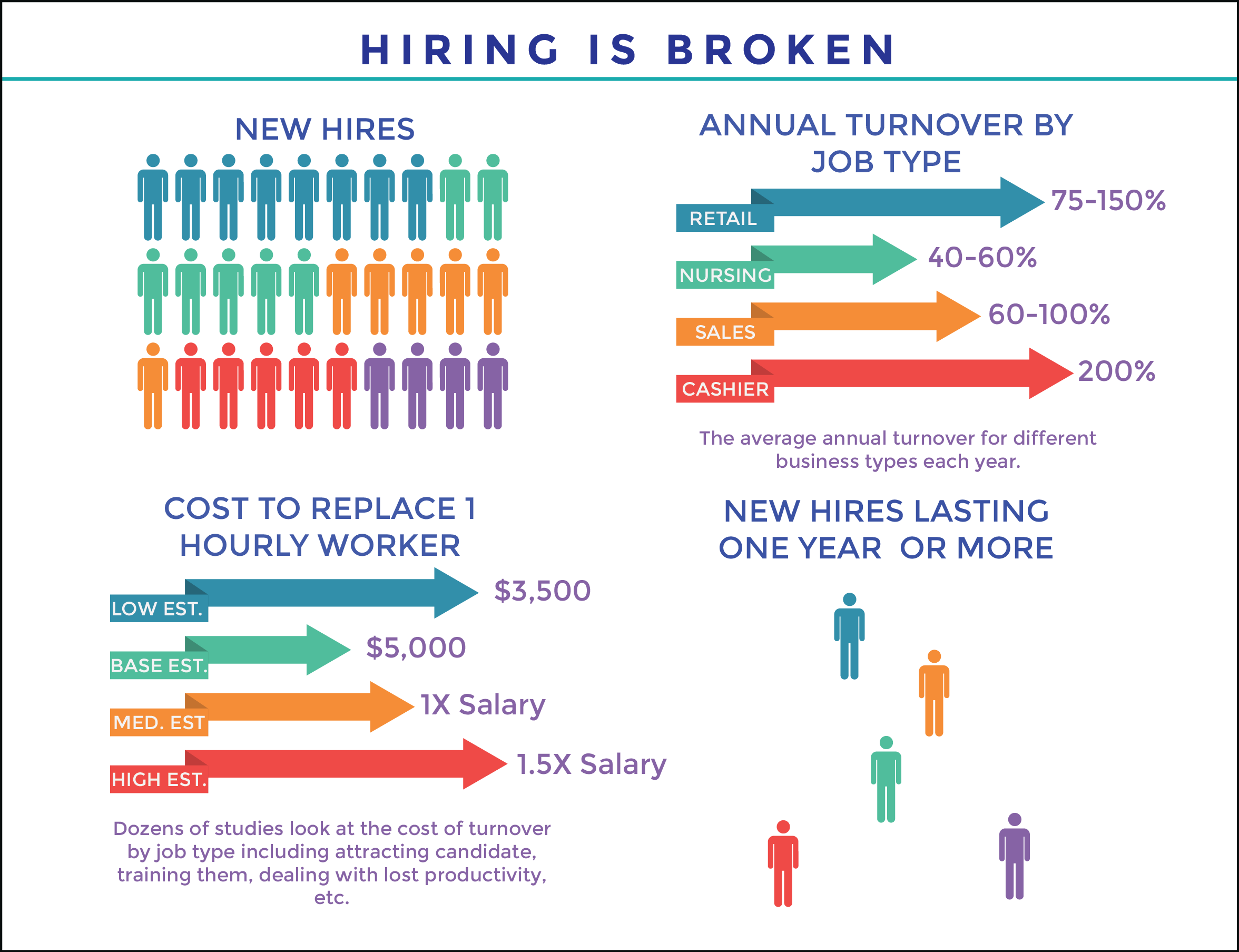

Employee Retention And Turnover Rate Immigrant tw

https://www.talytica.com/wp-content/uploads/2016/02/HiringBrokenTop-6-21.png

Calam o Maximize Employment Retention Rebates For Texas SMBs Get

https://p.calameoassets.com/220910090628-c428487081c593762c3bdf42ac90872c/p1.jpg

Web 26 janv 2021 nbsp 0183 32 IR 2021 21 January 26 2021 The Internal Revenue Service urges employers to take advantage of the newly extended employee retention credit Web 3 ao 251 t 2023 nbsp 0183 32 Retention Bonus A retention bonus is a payment or reward outside of an employee s regular salary that is offered as an incentive to keep a key employee on the job during a particularly crucial

Web 31 d 233 c 2020 nbsp 0183 32 The amount of the credit is 50 of the qualifying wages paid up to 10 000 in total It is effective for wages paid after March 13th and before December 31 2020 Web Employee Retention Credit The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows

The Employee Retention Tax Credit ERTC Rebate Calculator

https://netmorecash.com/images/uploads/848/63ed85e84f5bc_5.jpg?0.7435586479286115

NS Graduate Retention Rebate Good For 2013 Only YouTube

https://i.ytimg.com/vi/XHw8GuGweEw/maxresdefault.jpg

https://www.irs.gov/newsroom/covid-19-related-employee-retention...

Web The Employee Retention Credit provides an Eligible Employer with a tax credit that is allowed against certain employment taxes The credit is refundable which means that

https://www.irs.gov/coronavirus/frequently-asked-questions-about-the...

Web 27 juil 2023 nbsp 0183 32 The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for businesses and tax

Pin On Favorites

The Employee Retention Tax Credit ERTC Rebate Calculator

How To Use A Growth Rebate Programme To Drive Revenue

Businesses Getting Up To 7 Figure Tax Rebates From Employee Retention

The Employee Retention Tax Credit ERTC Rebate Calculator

The Employee Retention Tax Credit ERTC Rebate Calculator

The Employee Retention Tax Credit ERTC Rebate Calculator

30 Form 941 Worksheet 1 Worksheets Decoomo

The Employee Retention Tax Credit ERTC Rebate Calculator

The Employee Retention Tax Credit ERTC Rebate Calculator

Employee Retention Rebate - Web 10 janv 2022 nbsp 0183 32 Employee Retention Credit The Employee Retention Credit ERC is a program created in response to the COVID 19 pandemic and economic shutdown which