Employment Tax Deduction Employers generally must withhold federal income tax from employees wages To figure out how much tax to withhold use the employee s Form W 4 Employee s Withholding Certificate the appropriate method and the appropriate withholding table described in Publication 15 T Federal Income Tax Withholding Methods

Here are 15 big self employment tax deductions and tax benefits that could slash tax bills for freelancers contractors other people who work for themselves Get step by step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax

Employment Tax Deduction

Employment Tax Deduction

https://fourpillarfreedom.com/wp-content/uploads/2020/02/selfEmp1.png

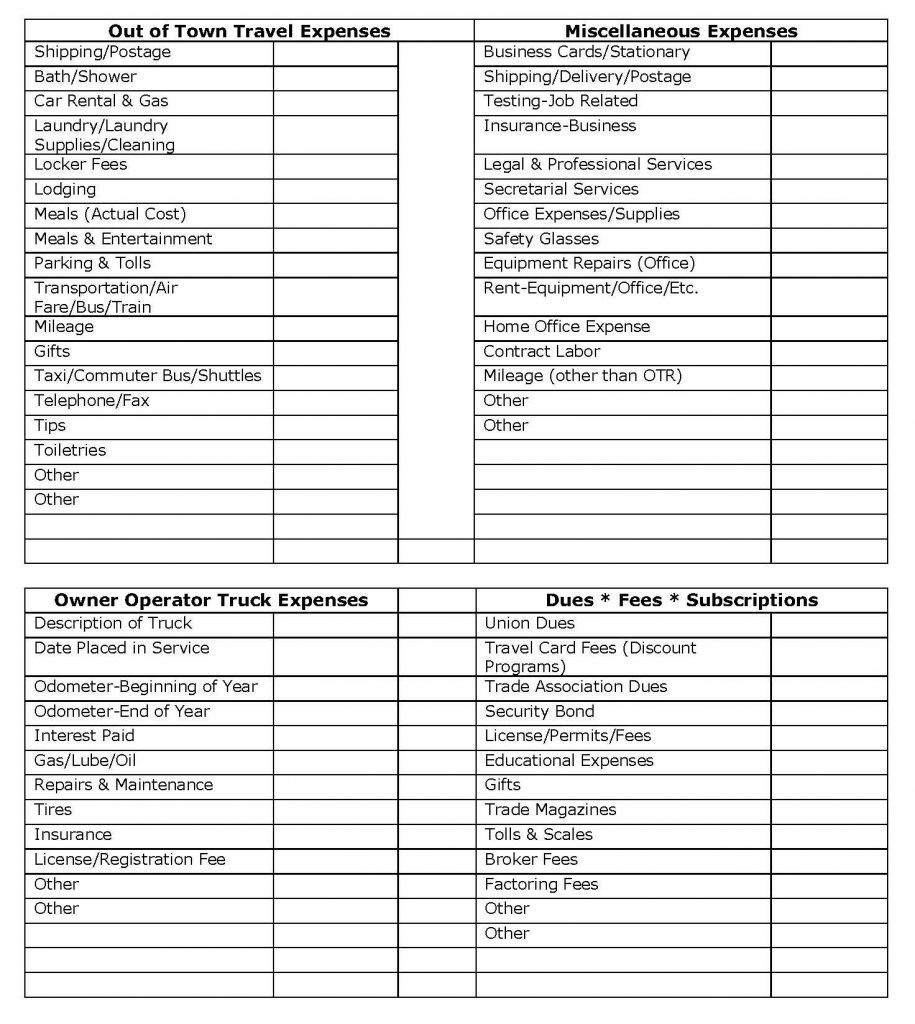

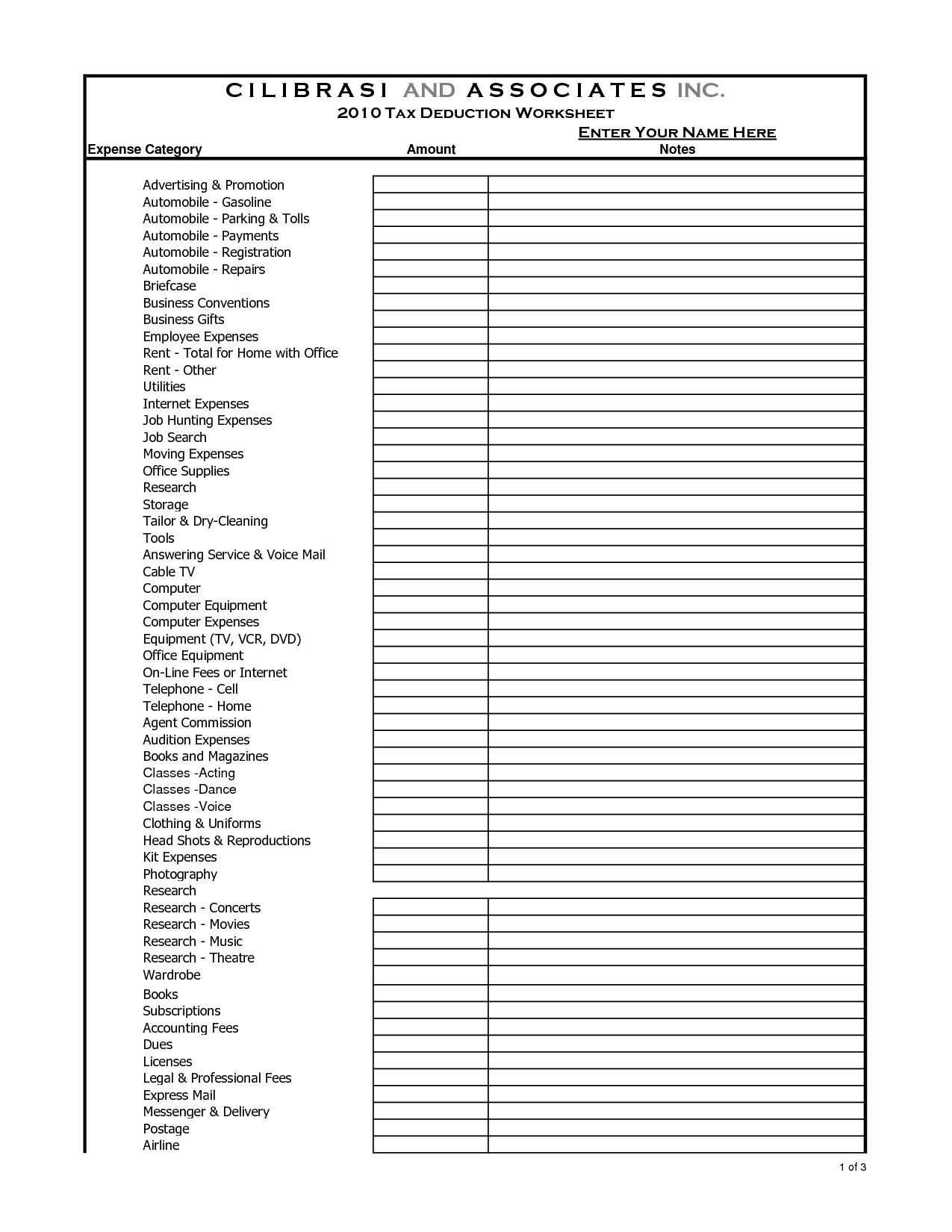

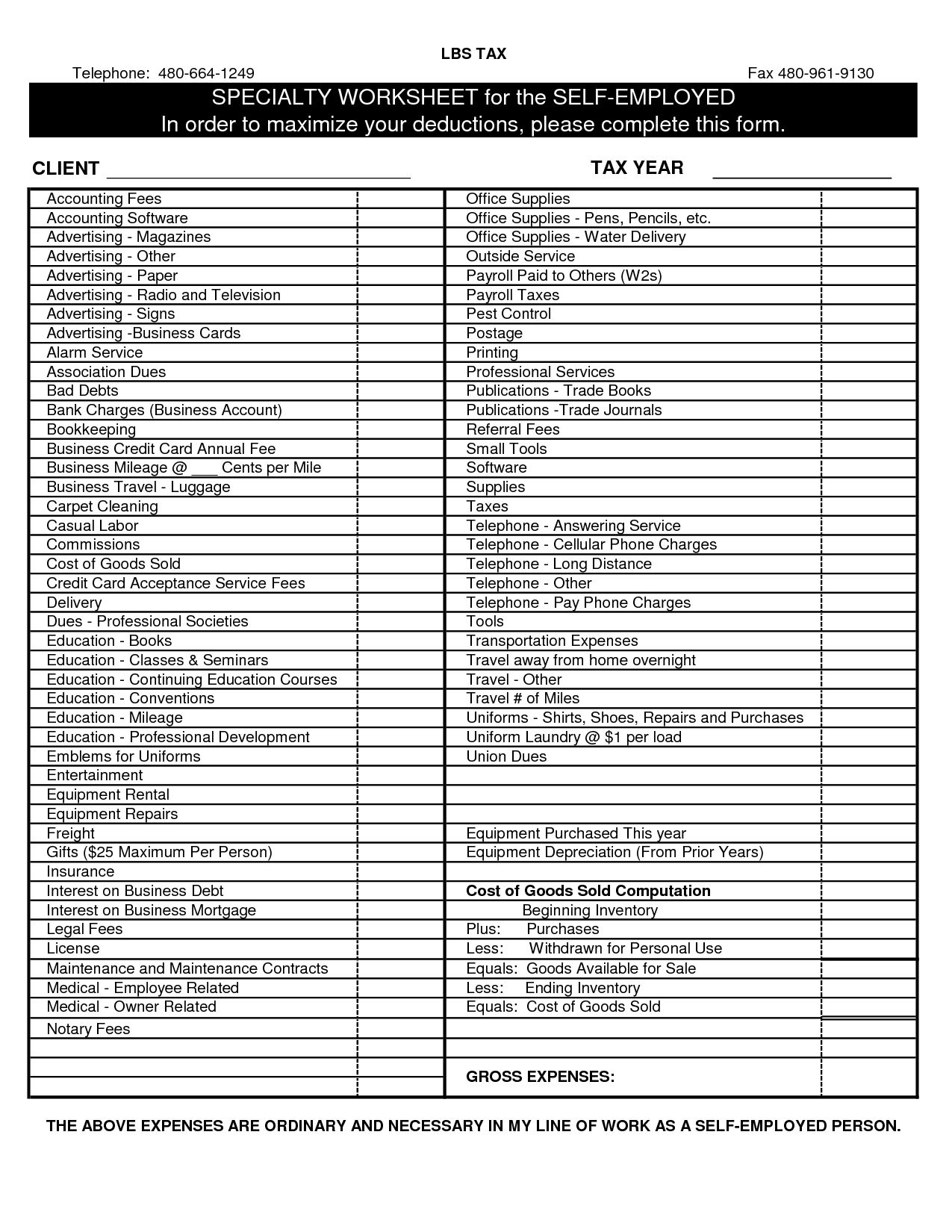

The Epic Cheatsheet To Deductions For The Self Employed Business Tax

https://i.pinimg.com/originals/97/3e/4c/973e4c899b2a2b818392a4e6b089d78e.png

Self Employed Tax Deductions Worksheet Soccerphysicsonline Db excel

https://db-excel.com/wp-content/uploads/2019/09/self-employed-tax-deductions-worksheet-soccerphysicsonline-6.jpg

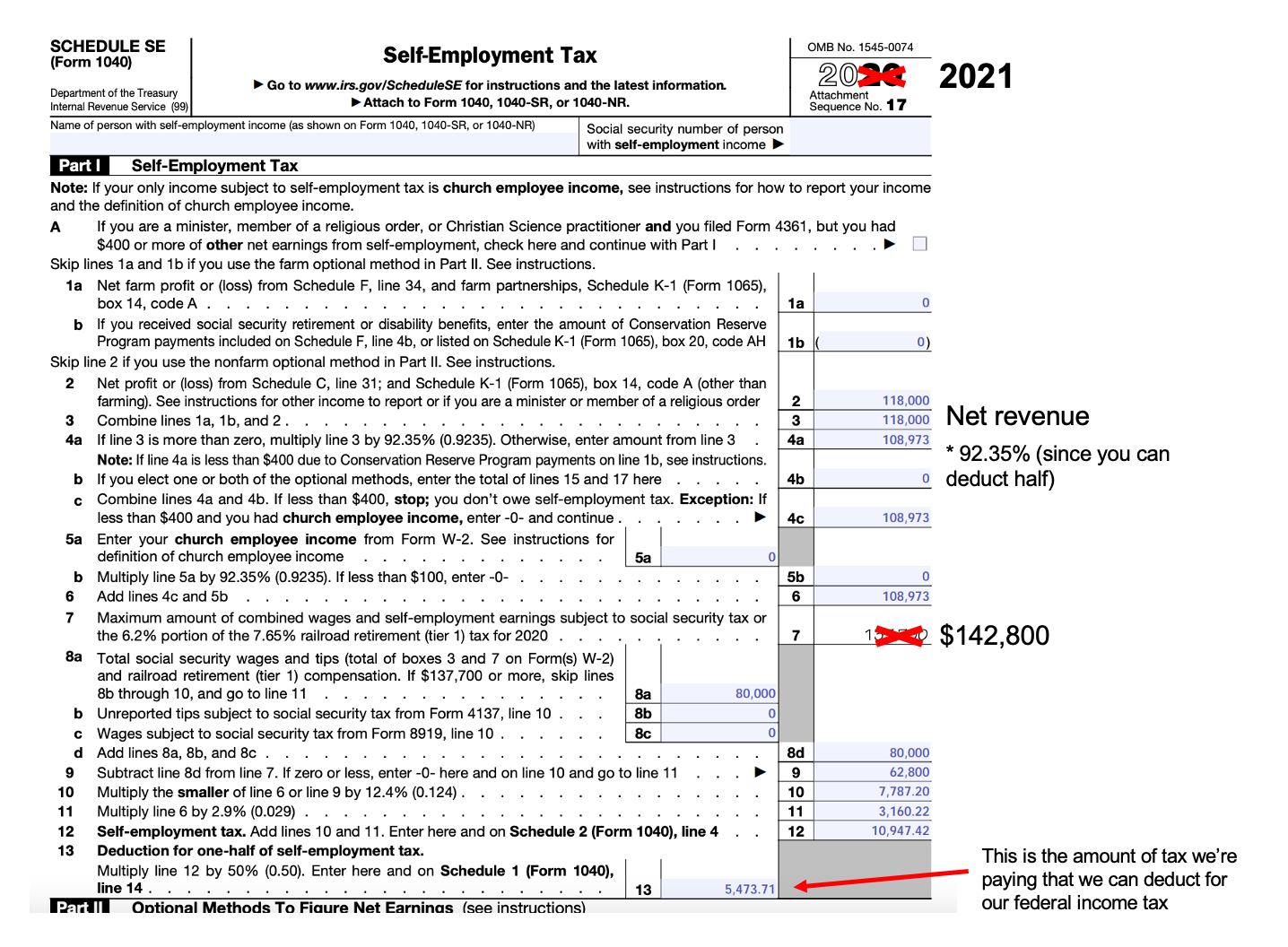

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide 1 Self Employment Tax Deduction What It Is The self employment tax refers to the Social Security and Medicare taxes that self employed people like freelancers independent contractors

You can deduct 50 of your self employment tax on your income taxes You may need to pay self employment tax if you re a freelancer an independent contractor or a small business owner Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy

Download Employment Tax Deduction

More picture related to Employment Tax Deduction

Business Tax List Of Business Tax Deductions

http://www.anchor-tax-service.com/s/cc_images/cache_2322148.jpg?t=1395580511

Employee Income Tax Deduction Form 2023 Employeeform

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/07/pdf-form-16a-tax-deduction-certificate-pdf-download-instapdf.jpg

17 Self employed Tax Deductions To Lower Your Tax Bill In 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/top-self-employed-tax-deductions.png

There are a variety of payroll taxes some paid by employers some by employees and some by both But in all cases it s up to employers to calculate withhold and deposit them When employers do not properly deduct payroll taxes from employee wages they may face a variety of consequences Under section 16 a taxpayer may deduct the amount paid on account of an employment tax or professional tax Here Article 276 2 of the Constitution specifies the employment tax

[desc-10] [desc-11]

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

10 Home Based Business Tax Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/01/tax-deduction-worksheet_472300.png

https://www.irs.gov/.../understanding-employment-taxes

Employers generally must withhold federal income tax from employees wages To figure out how much tax to withhold use the employee s Form W 4 Employee s Withholding Certificate the appropriate method and the appropriate withholding table described in Publication 15 T Federal Income Tax Withholding Methods

https://www.nerdwallet.com/article/taxes/self...

Here are 15 big self employment tax deductions and tax benefits that could slash tax bills for freelancers contractors other people who work for themselves

Printable Tax Organizer Template

Printable Itemized Deductions Worksheet

Realtor Tax Deductions Worksheet Complete With Ease AirSlate SignNow

Self Employed Tax Refund Calculator JaceDillan

Nurse Tax Deduction Worksheet Fill Online Printable Fillable Blank

Request Letter For Tax Certificate For Income Tax SemiOffice Com

Request Letter For Tax Certificate For Income Tax SemiOffice Com

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

2016 Self Employment Tax And Deduction Worksheet Db excel

Self Employment Tax Deduction Worksheet

Employment Tax Deduction - [desc-12]