Employment Termination Payment Tax Rate You usually pay a lower rate of tax on ETPs if you receive the payment within 12 months of your termination ETPs have up to 3 tax treatments Tax free if

Tax and NICs rates after termination Reporting termination payments to HMRC Do payments made on termination always qualify for the 30 000 exemption ETPs are concessionally taxed meaning a portion of the ETP may be tax free and the recipient may also receive a tax offset so that payments of an ETP that are

Employment Termination Payment Tax Rate

Employment Termination Payment Tax Rate

https://oxonaccountancy.co.uk/wp-content/uploads/2022/08/a6f09071-7b62-4ad7-b515-68dd100b5da8.jpg

Employment Termination Payments Aspire Consulting

https://aspire-ca.com.au/wp-content/uploads/2016/01/Employment-Termination-Payment.jpg

Changes To Tax Treatment Of Termination Payments Mill Accountancy

https://www.millaccountancy.co.uk/wp-content/uploads/2020/07/57eac6a9-dafb-4863-a703-2e91fe089187.jpg

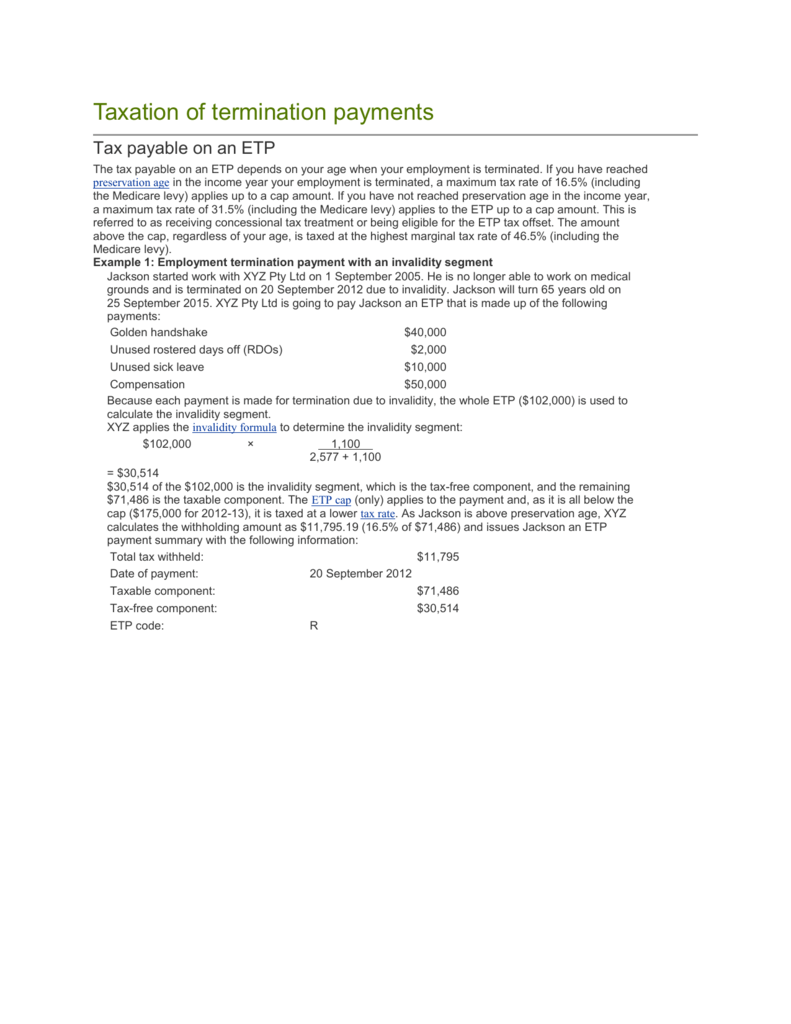

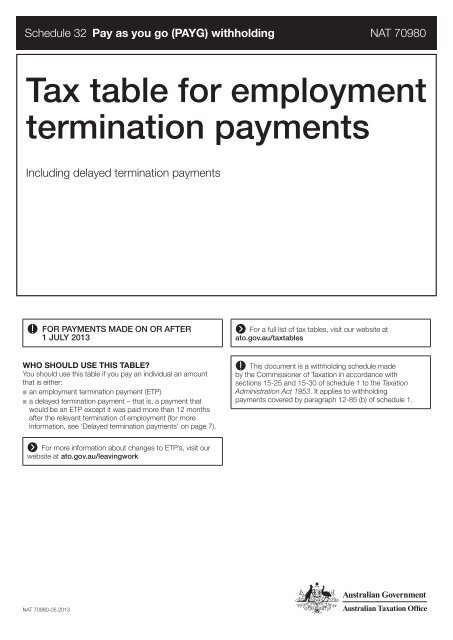

NAT 70980 Tax table for employment termination payments Including delayed termination payments FOR PAYMENTS MADE ON OR AFTER 1 JULY 2013 WHO How ETPs are Taxed In many countries including Australia employment termination payments are subject to specific tax treatment In Australia for example the tax treatment of ETPs is governed by the Income Tax

Apply the appropriate tax rate Depending on the payment type and the employee s age apply the concessional tax rate to the taxable component Tax Return Considerations for Any amount that exceeds 180 000 is taxed at the top marginal rate of 46 5 ETP tax for life benefit and death benefit termination payments Employers need to bear in mind that

Download Employment Termination Payment Tax Rate

More picture related to Employment Termination Payment Tax Rate

Gold Coast Expert Accountants Taxtation Employment Oculus

https://www.oculusgroup.com.au/wp-content/uploads/2017/11/pexels-photo-288477-Medium-1024x768.jpg

HMRC Clarifies Commencement Provisions For Termination Payment Tax

https://athelstanaccounting.com/wp-content/uploads/2018/02/2017-11-24-371537.jpg

Tax Rules On Redundancy Or Employment Termination Payments

https://www.etax.com.au/wp-content/uploads/2016/07/Employment-Termination-Payment.jpg

As below So if your total genuine redundancy payment is less than this you won t pay any tax on the payment at all If you are below the preservation age you pay tax at 30 You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your employer gives you non

The first 30 000 of a payment which is paid in connection with the termination of employment is tax free as long as it is not otherwise taxable as earnings Any excess What is an etp Withholding rates for ETPs Delayed termination payments Preservation age ETP reporting Payments that are ETPs Tax treatment of ETPs ETPs can have

How Is Your Employment Termination Payment Taxed In Australia

https://www.odintax.com/wp-content/uploads/2023/06/tax-on-employment-termination-payment.jpg

Taxation Of Termination Payments Taxable Component

https://s3.studylib.net/store/data/009430706_1-7e3e31de886d87b190f28f79b4615a49.png

https://www.ato.gov.au/individuals-and-families/...

You usually pay a lower rate of tax on ETPs if you receive the payment within 12 months of your termination ETPs have up to 3 tax treatments Tax free if

https://www.lewissilkin.com/en/Insights/Frequently...

Tax and NICs rates after termination Reporting termination payments to HMRC Do payments made on termination always qualify for the 30 000 exemption

COMING SOON Termination Payment Tax Reform

How Is Your Employment Termination Payment Taxed In Australia

Tax Table For Employment Termination Payments Australian

Termination Letter Without Cause Gratis

Termination Letter

Employment Termination Payment ETP

Employment Termination Payment ETP

PDF Guide To Payments On Termination Of Employment And Genuine

Employment Termination Agreement Template Free To Use

Unused Leave Payout On Termination PS Support

Employment Termination Payment Tax Rate - Overview Create a pay item for an employment termination payment ETP type R or O then add the pay item to an employee s final payslip After posting the pay run file it with