Enact A Value Added Tax And Partial Rebate Meaning Web Value added tax VAT has been a feature of EU law for almost five decades 1 VAT is a exploitation of immovable property must be regarded as a taxable person within the

Web How and when deductions are made The basic rule Taxable persons businesses make good their right to deduct input VAT when making their VAT return for the relevant period Web 9 oct 2020 nbsp 0183 32 A value added tax or VAT is a tax on products or services when sellers add value to them In some countries VAT is called goods and services tax or GST

Enact A Value Added Tax And Partial Rebate Meaning

Enact A Value Added Tax And Partial Rebate Meaning

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Business Concept Meaning Value Added Tax With Inscription On The Sheet

https://thumbs.dreamstime.com/b/business-concept-meaning-value-added-tax-inscription-sheet-204769909.jpg

A Value Added Tax Contrasted With A National Sales Tax UNT Digital

https://digital.library.unt.edu/ark:/67531/metadc810427/m1/1/high_res/

A value added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid It is si Web 19 juin 2023 nbsp 0183 32 A value added tax VAT is paid at every stage of a product s production from the sale of the raw materials to its final purchase by a consumer Each assessment

Web 7 oct 2021 nbsp 0183 32 The meaning of VALUE ADDED TAX is an incremental excise that is levied on the value added at each stage of the processing of a raw material or the Web quot input tax quot has the meaning assigned to it in article 22 2 and quot input tax credit quot has the meaning assigned to it in article 22 3 quot intra community acquisition quot has the meaning

Download Enact A Value Added Tax And Partial Rebate Meaning

More picture related to Enact A Value Added Tax And Partial Rebate Meaning

The Value Added Tax Is Wrong For The United States The Heritage

http://www.heritage.org/sites/default/files/~/media/images/reports/2010/b2503/b2503_chart1_750px.jpg

Value Added Tax Fai Business A Malta

https://doingbusinessinmalta.com/images/faibusinessamalta/VALUE_ADDED_TAX_ENG.jpg

Accountants Carlisle Diagrams

http://www.davidporthouse.co.uk/wp-content/uploads/2014/11/VATdiagram.gif

Web 31 d 233 c 2016 nbsp 0183 32 To address this this paper first shows that a tax innovation such as the introduction of a VAT reduces the marginal cost of public funds if and only if it also leads Web 21 mars 2023 nbsp 0183 32 Collecting and managing taxes is a critical keystone to protecting a country s financial intensity and developing a country s tax system where value added tax VAT

Web 8 juil 2020 nbsp 0183 32 Value added tax or VAT is the tax you have to pay when you buy goods or services The standard rate of VAT in the UK is 20 with about half the items Web The value added tax VAT is among the most widely used tax in struments in the world and one which is often lauded for its efficiency simplicity and ability to raise revenue It

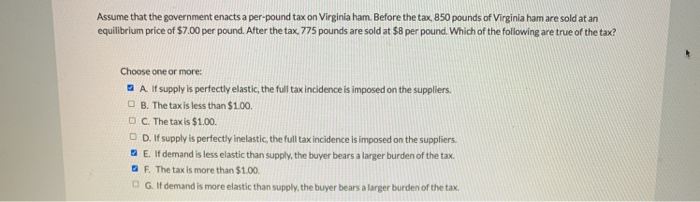

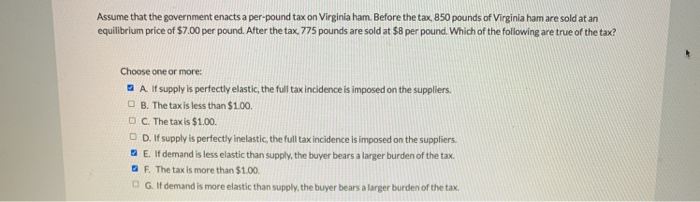

Solved Assume That The Government Enacts A Per pound Tax On Chegg

https://media.cheggcdn.com/study/548/548eade7-f746-4e24-af9f-c25d33154bbb/image.png

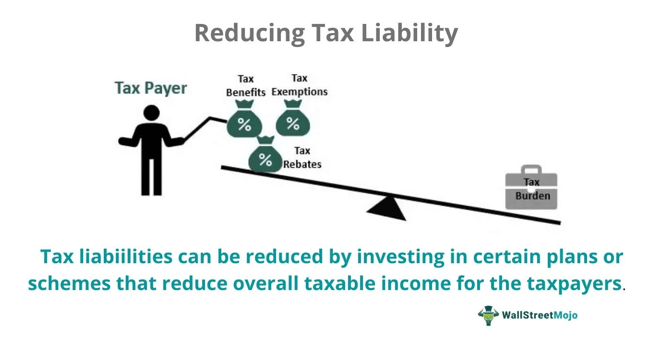

Tax Liability Meaning Formula Calculation How It Works

https://www.wallstreetmojo.com/wp-content/uploads/2022/05/Reducing-Tax-Liability.png

https://curia.europa.eu/jcms/upload/docs/application/pdf/202…

Web Value added tax VAT has been a feature of EU law for almost five decades 1 VAT is a exploitation of immovable property must be regarded as a taxable person within the

https://taxation-customs.ec.europa.eu/vat-deductions_en

Web How and when deductions are made The basic rule Taxable persons businesses make good their right to deduct input VAT when making their VAT return for the relevant period

PPT VALUE ADDED TAX PowerPoint Presentation Free Download ID 1607857

Solved Assume That The Government Enacts A Per pound Tax On Chegg

Difference Between Rebate And Discount Difference Between

Enact A Modern Tax Law Prothom Alo

Difference Between Discount And Rebate Tutor s Tips

Value Added Tax VAT And Its Impact On Revenue Generation In India

Value Added Tax VAT And Its Impact On Revenue Generation In India

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

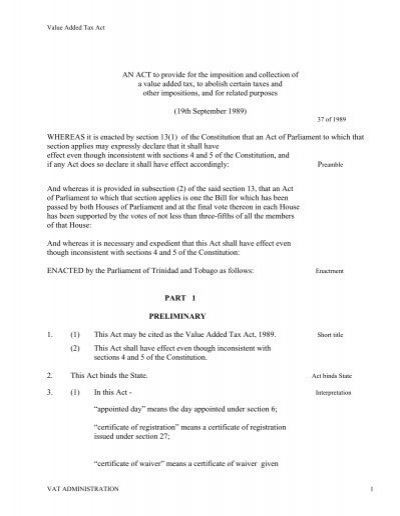

Value Added Tax Act Inland Revenue Division

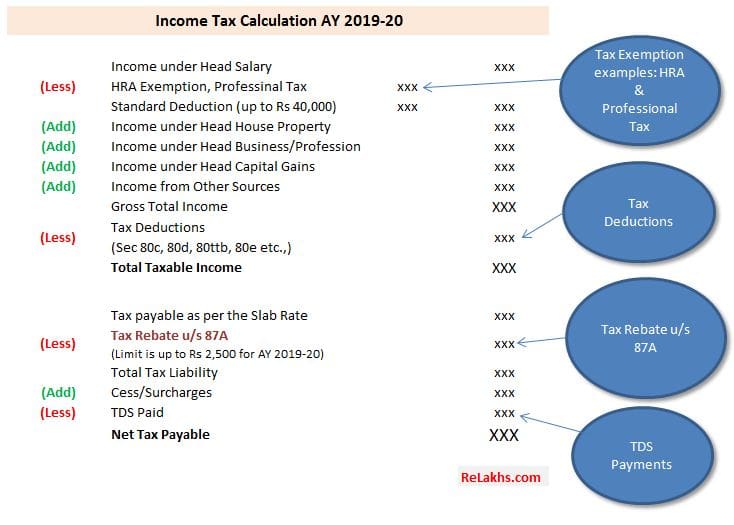

87A Tax Rebate Benefits Are Lost If Non taxable MF LTCG Is Added In ITR

Enact A Value Added Tax And Partial Rebate Meaning - Web in value added tax on its sales in one tax period and paid 40 000 in tax on its mining equipment and min ing rights to others its tax liability for that period would be 60 000