Enact A Value Tax And Partial Rebate Web 2 juin 2020 nbsp 0183 32 On 28 May the Court of Justice of the European Union in the World Comm Trading case Case C 684 18 addressed the VAT consequences of rebates for

Web 6 nov 2020 nbsp 0183 32 Residual input tax or non attributable tax 163 10 000 Value excluding VAT of all taxable supplies 163 150 000 Value of exempt supplies 163 75 000 To put this Web 13 juin 2011 nbsp 0183 32 Jun 13 2011 at 01 05 PM Hello All The issue is very critical and request you all to kindly update in case of any solution possible For everybody s information once

Enact A Value Tax And Partial Rebate

Enact A Value Tax And Partial Rebate

https://dot.la/media-library/a-green-truck-driving-down-a-dirt-road.jpg?id=33514512&width=1200&height=600&coordinates=0%2C459%2C0%2C460

Here s How To Claim Montana Tax Rebates Of Up To 2 500

https://www.valuewalk.com/wp-content/uploads/2023/04/Tax-Rebates-from-Minnesota-1536x768.jpeg

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

Web 31 mars 2023 nbsp 0183 32 Value added tax VAT is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added from initial production to Web The standard European Union Value Added Tax ranges from 8 to 27 percent per country Exact rates and purchase minimums change and vary with the type of goods being

Web ou 224 payer dans le cadre des activit 233 s susmentionn 233 es tandis qu une personne en Colombie Britannique qui est vis 233 e par cette d 233 finition a 233 galement droit 224 un Web 30 janv 2020 nbsp 0183 32 A VAT is a national consumption tax like a retail sales tax but collected in small bits at each stage of production It raises a lot of revenue without distorting

Download Enact A Value Tax And Partial Rebate

More picture related to Enact A Value Tax And Partial Rebate

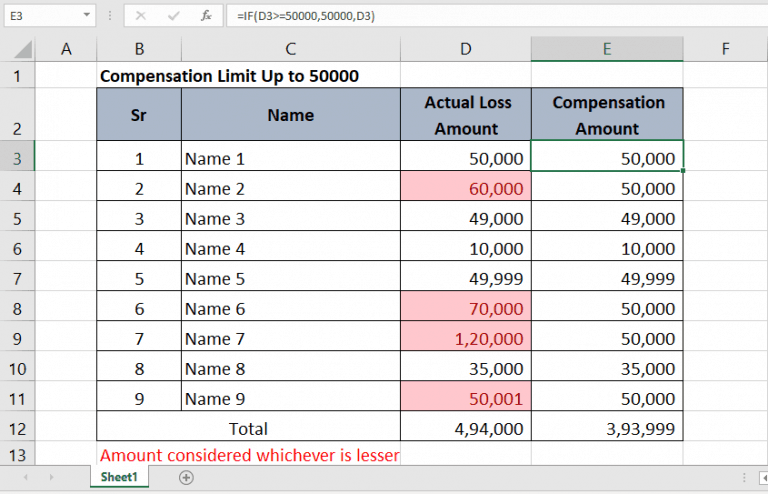

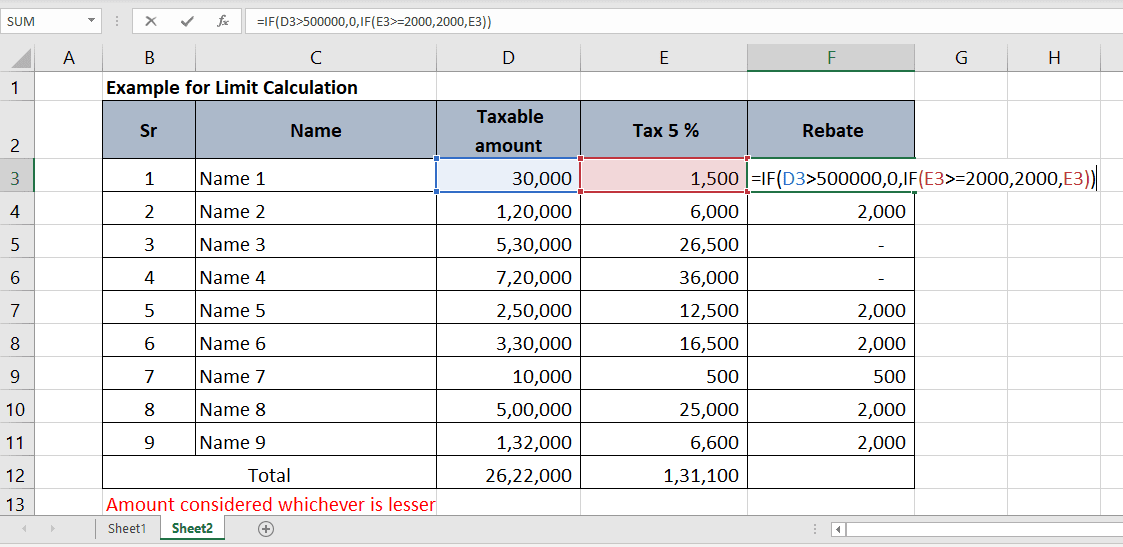

IF Formula In Excel Example For Value Base Calculation Tax Rebate

https://exceldesk.in/wp-content/uploads/2019/12/IF-2BFormula-2BValue-2BLimit-2BCalculation-768x494.png

Both Of The Options That Have Been Tried Suck Balls r

https://i.kym-cdn.com/photos/images/original/002/593/755/06e.jpg

Calculate According To The Maximum Range Of Values From The Excel IF

https://1.bp.blogspot.com/-b0xQboygo9U/XgrP8TK6f3I/AAAAAAAAEb4/Bmqtc0rtWyE_YtBjE0nuQJQ2-ZSjsizkQCEwYBhgL/s1600/IF%2BFormula%2BValue%2BLimit%2BCalculation%2B4.png

Web 17 mai 2023 nbsp 0183 32 A value added tax or VAT is a tax on products or services when sellers add value to them In some countries VAT is called goods and services tax or GST Similar Web value added tax of 50 000 on its sales in a tax period but bought at the same time equipment on which it paid a value added tax of 10 000 in addition to its tax on normal

Web 8 juil 2020 nbsp 0183 32 Value added tax or VAT is the tax you have to pay when you buy goods or services The standard rate of VAT in the UK is 20 with about half the items Web 18 nov 2020 nbsp 0183 32 This paper contributes to the literature of export VAT rebates The literature has mostly focused on VAT rebates effects on exports Theoretically Feldstein and

The Value Of Using Value Creation Models CSR dk

https://csr.dk/sites/default/files/styles/2400px/public/Valuecreation.png?itok=_LYX4E2q

Rebate Word Means Partial Refund And Allowance Stock Image Colourbox

https://d2gg9evh47fn9z.cloudfront.net/1600px_COLOURBOX14816702.jpg

https://mnetax.com/eu-court-reexamines-vat-treatment-of-rebates-38847

Web 2 juin 2020 nbsp 0183 32 On 28 May the Court of Justice of the European Union in the World Comm Trading case Case C 684 18 addressed the VAT consequences of rebates for

https://www.tide.co/blog/business-tips/vat-partial-exemption

Web 6 nov 2020 nbsp 0183 32 Residual input tax or non attributable tax 163 10 000 Value excluding VAT of all taxable supplies 163 150 000 Value of exempt supplies 163 75 000 To put this

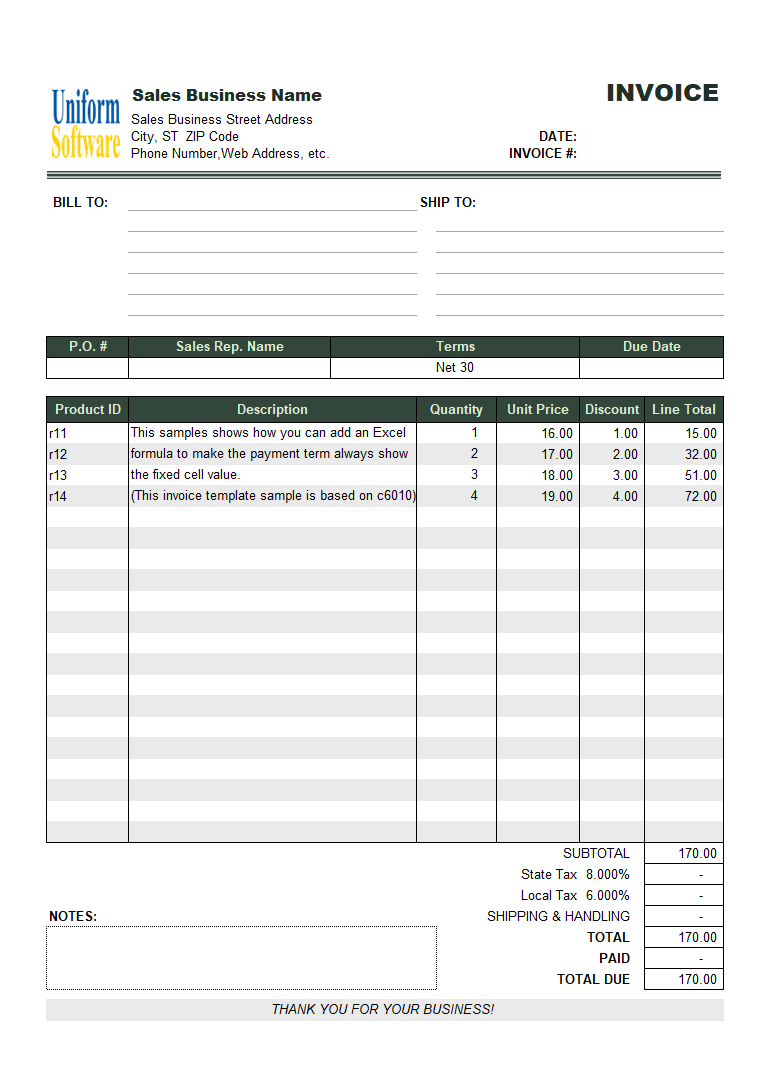

Invoice Sample With Partial Payment And Payment History

The Value Of Using Value Creation Models CSR dk

Solved Cash Flows 1 Identify The Following As Cash Inflows Chegg

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Biden Asks Congress To Enact A Summer Gas Tax Holiday Don t Mess With

IRS Suggests Waiting To File Taxes Because Of State Rebates

IRS Suggests Waiting To File Taxes Because Of State Rebates

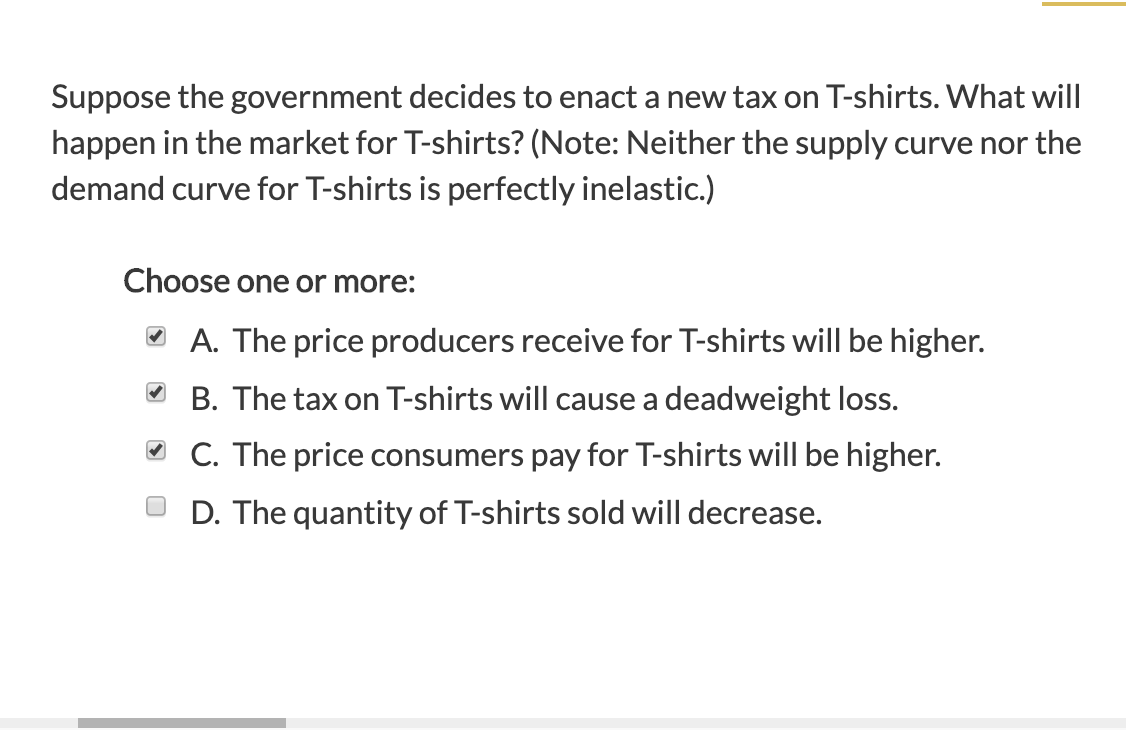

Suppose The Government Decides To Enact A New Tax On T shirts What

Solved 4 Suppose Ontario Is Deciding Whether To Enact A New Chegg

Liz Truss Says She Didn t Get realistic Chance To Enact Tax cutting

Enact A Value Tax And Partial Rebate - Web ou 224 payer dans le cadre des activit 233 s susmentionn 233 es tandis qu une personne en Colombie Britannique qui est vis 233 e par cette d 233 finition a 233 galement droit 224 un