Energy Efficient Appliances Tax Credit 2022 Verkko 19 lokak 2023 nbsp 0183 32 The old rules apply for 2022 essentially extending the previous credit by one year Afterwards the credit for the costs of installing certain energy efficient

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit Verkko 30 jouluk 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower

Energy Efficient Appliances Tax Credit 2022

Energy Efficient Appliances Tax Credit 2022

https://www.walkerreid.com/wp-content/uploads/2017/12/Kitchen-cooking-appliances.jpg

What Are The Best Energy Efficient Appliances For A New Home

https://nlhomestampa.com/wp-content/uploads/2020/08/energy-efficient-appliances.jpeg

Benefits Of An Energy Efficient Appliance Bone Heating And Cooling

https://boneheatingandcooling.com/wp-content/uploads/energy-efficient-appliances-1536x1152.jpeg

Verkko 21 jouluk 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub Verkko 22 jouluk 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs

Verkko 11 jouluk 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet Verkko 14 huhtik 2023 nbsp 0183 32 Electric Vehicle Tax Credit The IRA includes a 7 500 consumer tax credit for electric vehicle purchases you are eligible if your adjusted gross income is up to 150 000 for individuals or

Download Energy Efficient Appliances Tax Credit 2022

More picture related to Energy Efficient Appliances Tax Credit 2022

Do Energy Efficient Appliances Really Save Money

https://www.homeselfe.com/wp-content/uploads/2022/09/Do-Energy-Efficient-Appliances-Really-Save-Money.jpg

![]()

Energy Efficient Loads Open Source Solar Project

http://www.opensourcesolar.org/w/images/thumb/c/c2/Loadsicon.png/1200px-Loadsicon.png

How To Maintain Energy Efficient Appliances

https://ecosideoflife.com/wp-content/uploads/2023/05/maintain-scaled.jpg

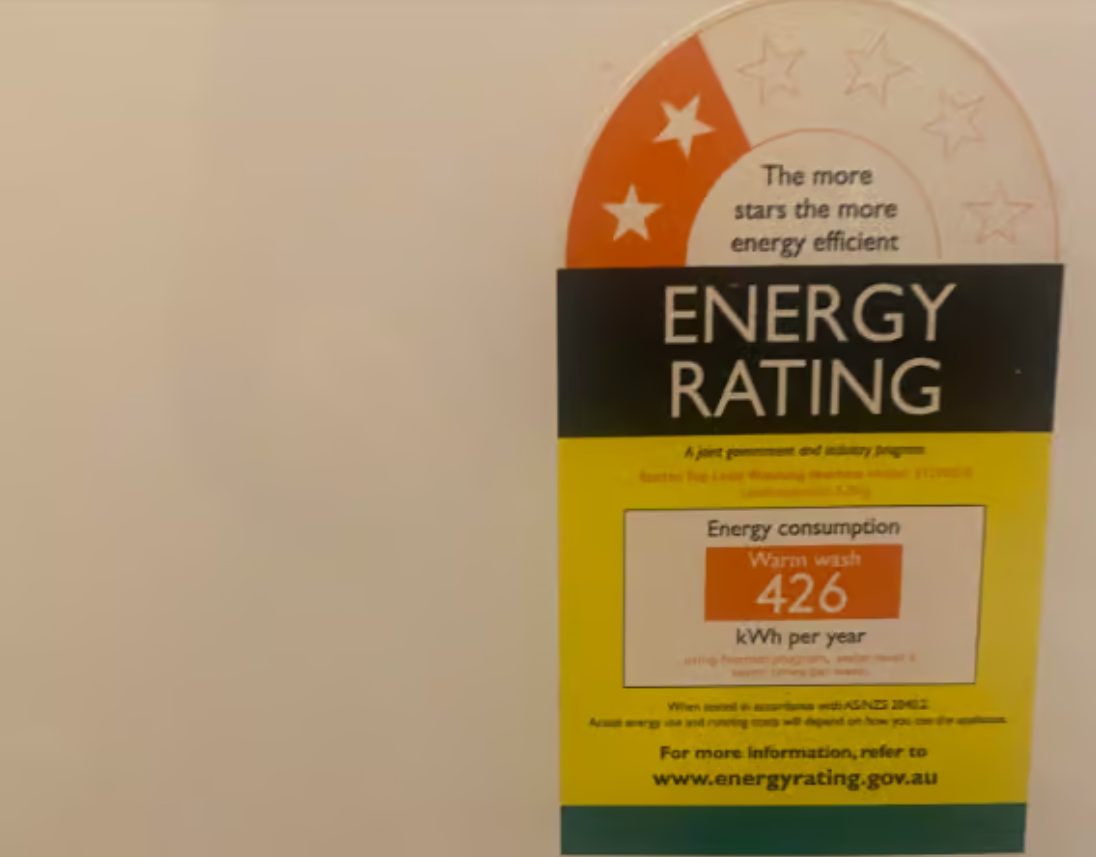

Verkko Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement Verkko Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement

Verkko 12 jouluk 2023 nbsp 0183 32 taxes tax law Save More with Tax Credits for Energy Efficient Home Improvements Tax credits for energy efficient home improvements are extended and expanded because of the Verkko 19 elok 2022 nbsp 0183 32 The credit amount for installing clean household energy such as solar wind or geothermal has been raised from 26 to 30 from 2022 to 2032 It then falls

Energy Efficient Home Appliances Report United Nations Development

https://www.undp.org/sites/g/files/zskgke326/files/styles/banner_image_desktop/public/migration/lb/energyef.PNG?h=4b2bd860&itok=fFbkYl7j

Tips For Choosing Energy Efficient Appliances Mr Sparky Electrical

https://www.mrsparky.com.au/wp-content/uploads/2023/08/mrsparky-blog-energy-saving.png

https://turbotax.intuit.com/tax-tips/going-green/are-energy-efficient...

Verkko 19 lokak 2023 nbsp 0183 32 The old rules apply for 2022 essentially extending the previous credit by one year Afterwards the credit for the costs of installing certain energy efficient

https://www.irs.gov/credits-deductions/energy-efficient-home...

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit

Energy Efficient Appliances India Saves 39 000KWh Since March Rollout

Energy Efficient Home Appliances Report United Nations Development

Understanding Rental Property Appliance Depreciation FortuneBuilders

Are Energy Efficient Appliances Tax Deductible TurboTax Tax Tips

7 Energy Efficient Appliances Green Energy Futures

Why Use Energy Efficient Appliances Solenco South Africa

Why Use Energy Efficient Appliances Solenco South Africa

Green And Profitable Sustainability Initiatives That Drive Success In

Electric Kiwi Blog Appliance Usage Guide

5 Ways To Make Your Home More Energy Efficient Busy Being Jennifer

Energy Efficient Appliances Tax Credit 2022 - Verkko Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost