Energy Efficient Rebates 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump Tax The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page Question Categories

Energy Efficient Rebates 2024

Energy Efficient Rebates 2024

https://www.acostainc.com/wp-content/uploads/2022/11/iStock-9124253381-1536x921.jpg

Unlocking Energy Efficient Rebates Your Comprehensive Guide USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Energy-Efficient-Rebates.png?ssl=1

Reasons Why Utility Companies Offer Energy Rebates And Home Insulation Techniques You Can Do To

https://geo-insulation.com/wp-content/uploads/2021/03/energy-efficient-5019261_1920.jpg

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Here s how making energy efficiency part of your 2024 New Year s Resolutions could help you lower your energy costs and save our planet Resolution 1 Save Money Thanks to the Department of Energy s Savings Hub you can easily help determine what clean energy and energy efficiency incentives for home upgrades and appliances are best for you

Download Energy Efficient Rebates 2024

More picture related to Energy Efficient Rebates 2024

Robert s Hawai i Receives 200 000 In Federal Rebates For 10 Energy efficient School Buses News

https://media.mauinow.com/file/mauinow/2022/03/Roberts-Hawaii-school-bus.jpg

What Energy Rebates In The Inflation Reduction Act Mean For You

https://cdn.thepennyhoarder.com/wp-content/uploads/2022/08/17150611/Energy-Efficient-Rebates-final.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

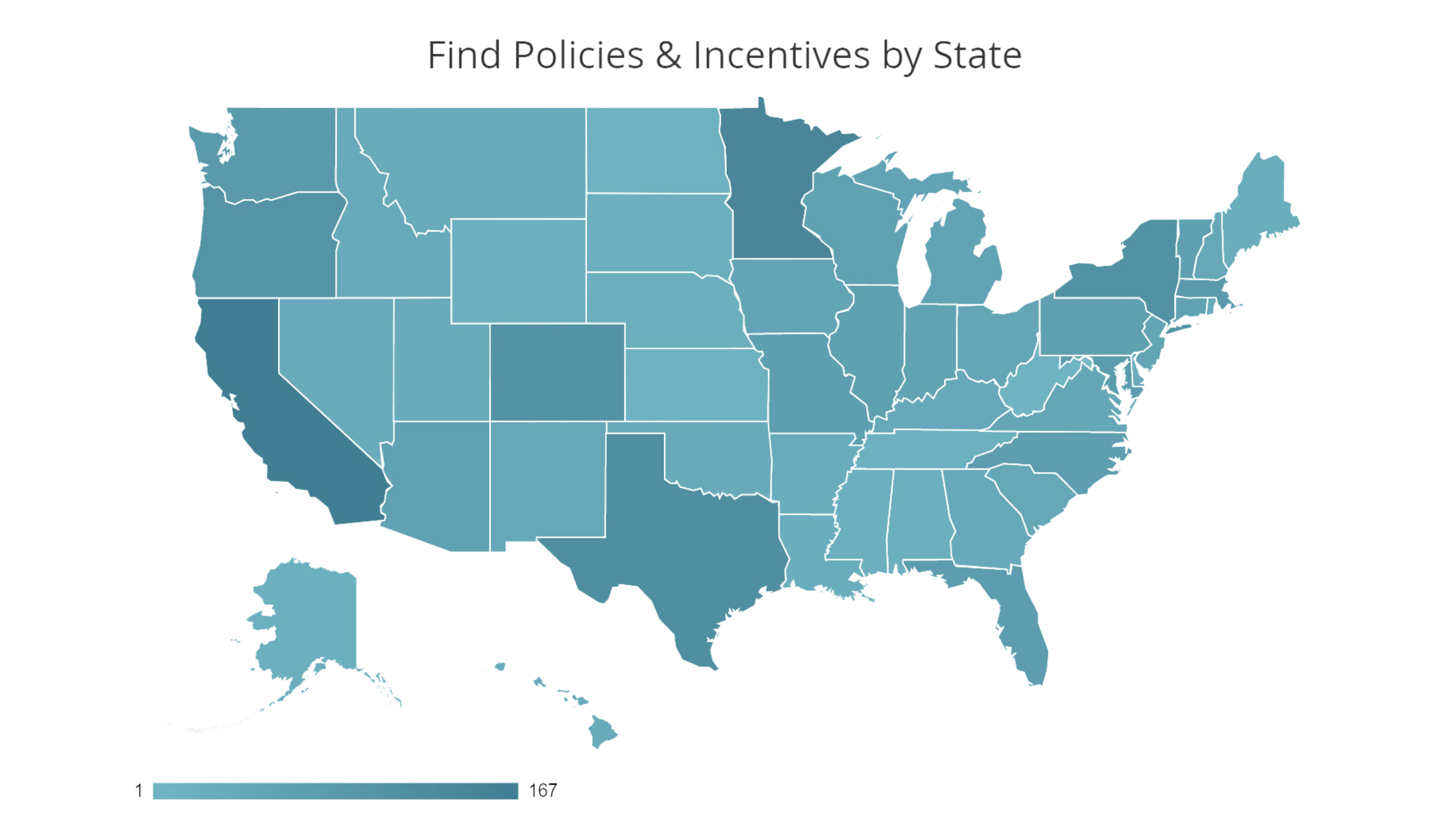

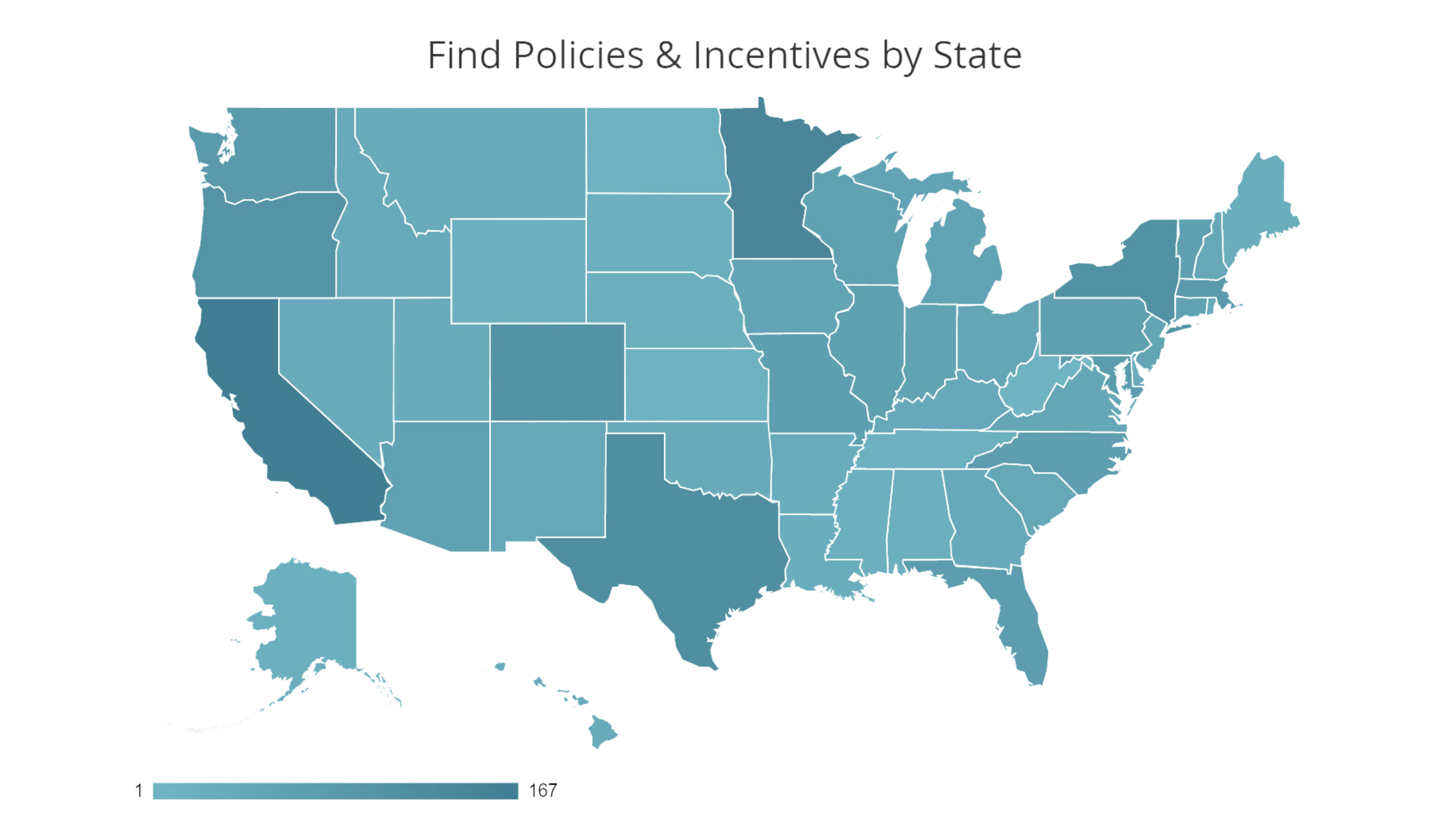

Updated as of January 24 2024 Program Agency Description Deadline Link renewable energy systems and make energy efficiency improvements Varies See page 19242 of the notice Energy Efficiency and Electrification Rebates for 2024 Update Per the latest guidance from the US Department of Energy the home electrification rebates listed below are expected to be available in some areas in the second half of 2024 and available in most areas by early 2025

The Inflation Reduction Act of 2022 has a bunch of incentives aimed at helping you make your home more energy efficient This year and next a few more incentives will roll out Kara Saul Rinaldi IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Energy Efficient Rebates

http://island-home-energy-retrofit.ca/files/packed/19qqau0jh9mbc9pr0a1hzjtjsqgzzeqjs8gxebf6kho525t3pwrvqs82nsd1q5w7qhczsaqr3tet8hgzani8firoz227c01woojsb2n8j3dv37nsv5glh7jm0w9p9s2dxdh462d3ruirh7fwsfsg5hak10kzuvuiaspvkzgapgk9x4yhv2zzw4l2fjlkv0ymkg70lf89c74hnjayhkoqtrzl2mzalcktbrh45zeipdlw2b9l3snr56zf1maufsfbnpzpswmagxmhzana83xf6pxyph7f531.png

Types Of Rebates To Help Construction Companies Buildertrend

https://buildertrend.com/wp-content/uploads/2022/10/3-Rebates-waiting-for-you-1.png

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump Tax

Extra Tax Benefits For Installing Energy Efficient Lighting

Energy Efficient Rebates

Room Air Conditioners ENERGY STAR

Energy Efficiency Rebates

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

Blog SawHorse Design Build

Blog SawHorse Design Build

New Carrier EcoHome Program Helps Maximize Inflation Reduction Act s Impact On Consumers And

Incentives And Rebates For Residential Energy Efficiency Improvements In Virginia Local Energy

Everything You Need To Know Alberta Energy Efficiency Rebates Infographic Energy Efficiency

Energy Efficient Rebates 2024 - OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways