Energy Rebates And Tax Deductions For Businesses Web 18 d 233 c 2020 nbsp 0183 32 In order to facilitate investment in low carbon energy sources such as renewables and meet such ambitions many governments are incentivising investment

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many Web Total Impact on Tax Liability Assuming the business has a federal corporate tax rate of 21 the net impact of depreciation deductions is calculated as Therefore the total reduced tax liability for 2025 from

Energy Rebates And Tax Deductions For Businesses

Energy Rebates And Tax Deductions For Businesses

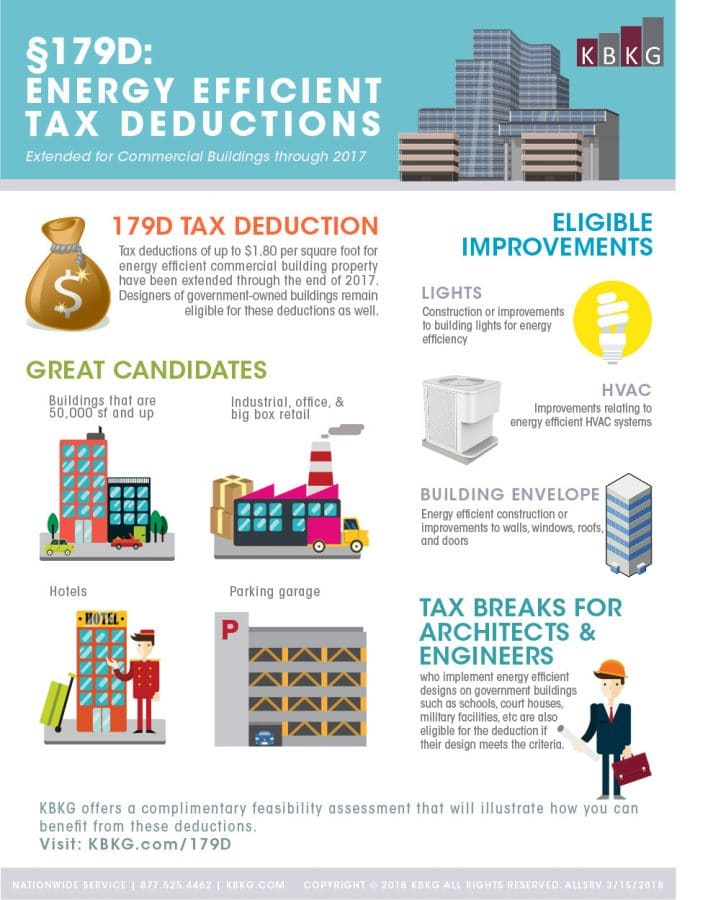

https://www.kbkg.com/wp-content/uploads/179D-v3-726x900.jpg

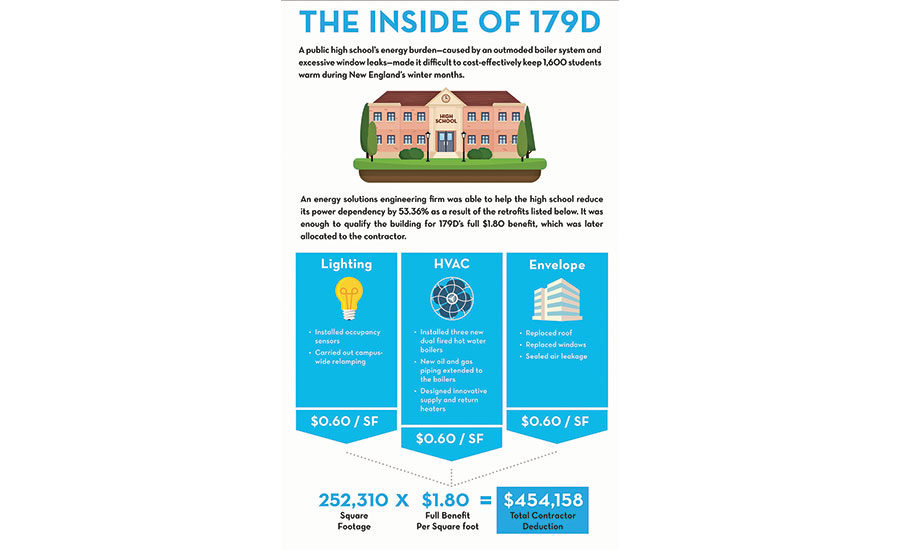

How Energy Efficient Building Deductions Can Save Money For Contractors

https://www.enr.com/ext/resources/Issues/National_Issues/2016/February/22-Feb/Energy-Efficient-Buildings.jpg?t=1455737447&width=900

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

https://www.rotherham.gov.uk/images/Council_Tax_rebate.JPG

Web 1 janv 2023 nbsp 0183 32 Individuals Businesses and Self Employed Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify Web 2 juin 2006 nbsp 0183 32 Section 179D of the Internal Revenue Code allows deductions for energy efficient commercial buildings The following information applies to building upgrades

Web The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

Download Energy Rebates And Tax Deductions For Businesses

More picture related to Energy Rebates And Tax Deductions For Businesses

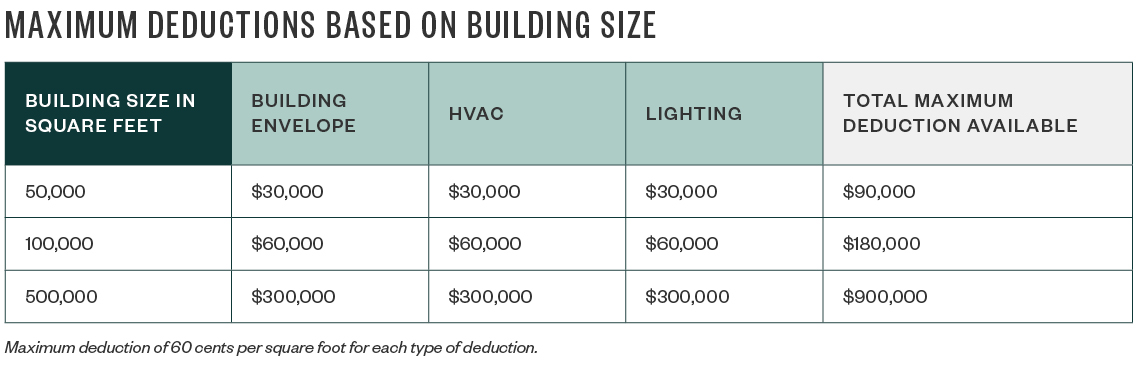

Tax Incentives For Energy Efficient Buildings

https://www.mossadams.com/getmedia/e69ebd6f-cb59-4e48-b33a-20f1833f383a/17-TSG-1547-179D-TBL.jpg?width=1140&height=372&ext=.jpg

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

5 Tips On Energy efficiency Tax Deductions For Businesses St Louis

http://media.bizj.us/view/img/10212562/nativeenergyefficienttaxdeductions*900xx4200-2363-0-219.jpg

Web 30 d 233 c 2022 nbsp 0183 32 Net metering allows electric utility customers to install qualifying renewable energy systems on their properties and to connect them to an electric utility s distribution Web Overview Climate Change Levy Emissions trading Capital allowances on energy efficient items Landfill Tax Aggregates Levy Plastic Packaging Tax Capital allowances on energy

Web 13 f 233 vr 2018 nbsp 0183 32 You could be qualifying for business energy credits if you re using these eligible technologies The tax credit is up to 26 for solar fuel cells and small wind Web Tax Credits Rebates amp Savings Page Tax Credits Rebates amp Savings Page Skip to main content Energy gov Tax Credits Rebates amp Savings Please visit the Database of

Tax Planning Strategies Tips Steps Resources For Planning

https://s3-us-east-2.amazonaws.com/maryville/wp-content/uploads/2020/11/06170712/MVU-BSACC-2020-Q3-Skyscraper-es-Tips-Steps-Resources-v2-3-1000x839.jpg

The Ultimate List Of Tax Deductions For Shop Owners In 2019

https://gusto.com/wp-content/uploads/2018/07/Free-Printable-List-of-Tax-Deductions-for-Shop-Owners.png

https://cms.law/.../tax-incentives-and-measures

Web 18 d 233 c 2020 nbsp 0183 32 In order to facilitate investment in low carbon energy sources such as renewables and meet such ambitions many governments are incentivising investment

https://www.irs.gov/credits-and-deductions-under-the-inflation...

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Tax Planning Strategies Tips Steps Resources For Planning

Energy Efficient Rebates Tax Incentives For MA Homeowners

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

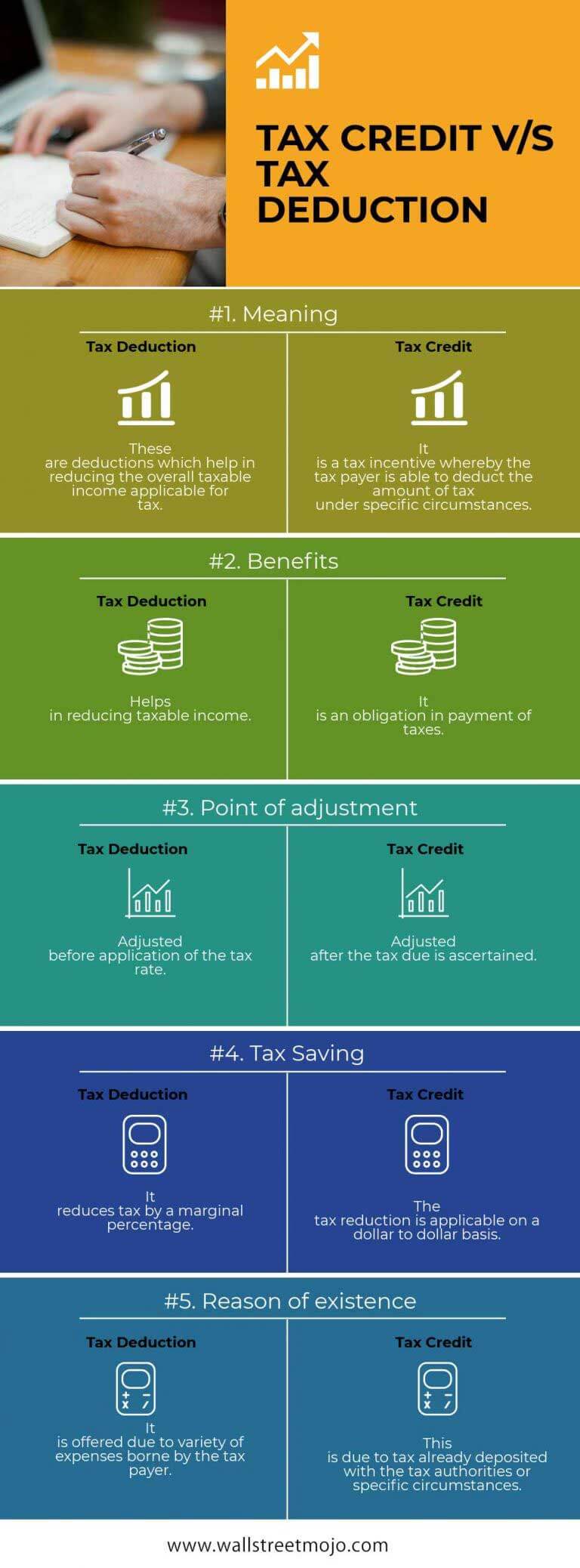

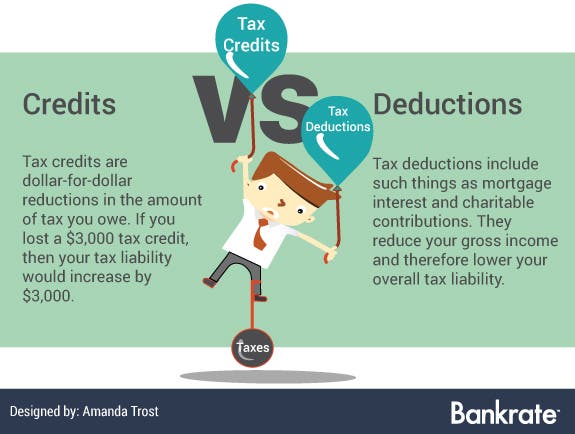

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

Business Tax Credit Vs Tax Deduction What s The Difference

Business Tax Credit Vs Tax Deduction What s The Difference

Tax Deduction Definition TaxEDU Tax Foundation

Do I Have To Have An LLC To Deduct Business Expenses

Used Capital Loss Carryover Will Taxes Go Up 3 000

Energy Rebates And Tax Deductions For Businesses - Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median