Energy Star Appliance Rebates 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

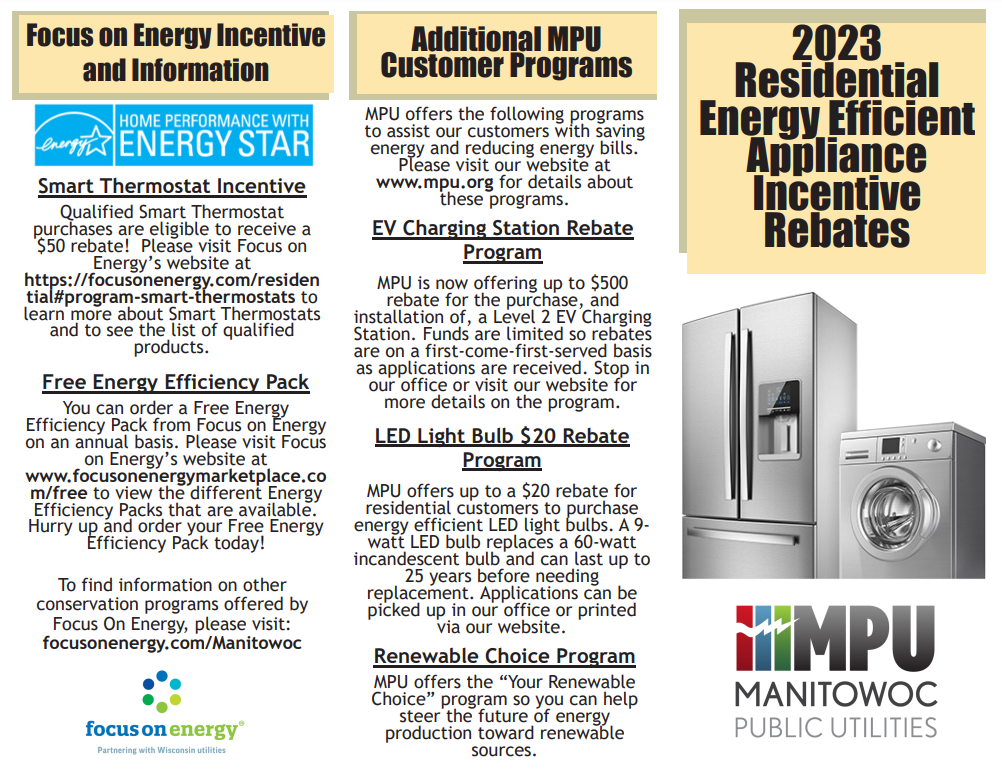

This program is available to Otter Tail Power MN residential and small commercial customers who have installed qualifying electric dehumidifiers air purifiers heat pump water heaters induction cooktops refrigerators freezers dishwashers clothes washers and clothes dryers including heat pump clothes dryers Rebate details Requirements Must have an active member account with EEA to qualify for rebate Application form must be completed and submitted within 90 days from purchase date no exceptions Rebate will be issued as a credit on your electric account Please allow 6 to 8 weeks for credit to appear

Energy Star Appliance Rebates 2024

Energy Star Appliance Rebates 2024

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/energy-star-appliance-rebates-energysavenewwest-save-energy-save.jpg

Registration Energy Star Rebates

https://i1.wp.com/energystarrebates.com/wp-content/uploads/2021/08/favpng_family-royalty-free-stock-photography-istock.png?resize=1024%2C832&ssl=1

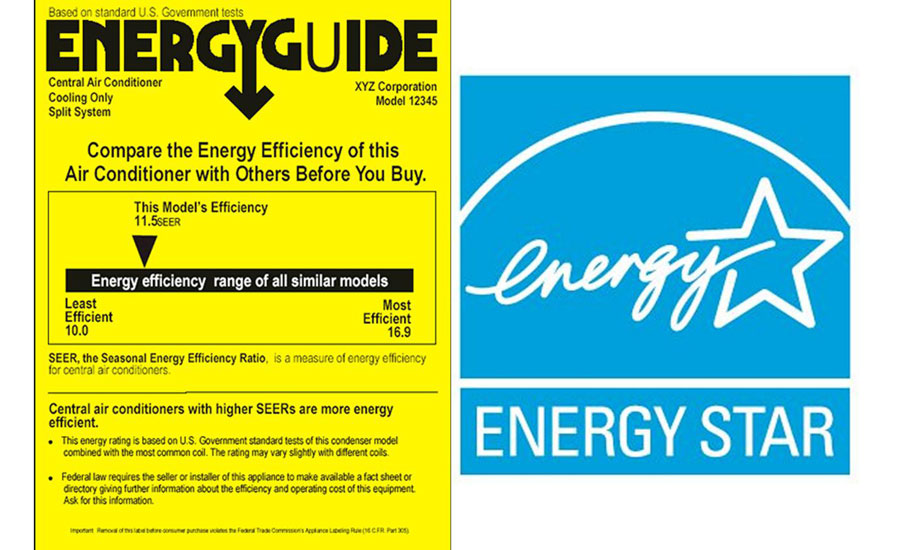

Heating Cooling North Central Public Power District

https://ncppd.com/wp-content/uploads/2018/05/Energy-Star-Guide-ACHR.jpg

By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year 30 of the product cost up to 250 per door 500 maximum in one taxable year 30 of the project costs up to 2 000 for Heat Pump Clothes Dryer ENERGY STAR Certified Electric Customers Only 75 Refrigerators Freezers ENERGY STAR Certified Electric Customers Only Note Compact refrigerators are not eligible for rebate 25 Wi Fi Enabled Thermostat

Appliance products must be installed in 2024 within ECE territory Rebates will be awarded on a first come first served basis Fill out form completely Incomplete forms will not be processed Include your account number and sign Receipt must include model number Rebate will be issued as a credit on your ECE account if under 1 000 Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits

Download Energy Star Appliance Rebates 2024

More picture related to Energy Star Appliance Rebates 2024

Energy Star Appliance Rebate Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Energy-Star-Appliance-Rebate.png

TakeCharge VA Rebates

https://takechargeva.com/img/appliance-rebates2.png

Fillable Online 2018 HELPS Energy Star Appliance Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/488/260/488260759/large.png

Residential Rebates on ENERGY STAR June 30 2024 Rebate application must be submitted within 90 days of purchase and be postmarked or submitted online by July 15 2024 Residential Rebates on ENERGY STAR Certified Appliances Appliance Rebate Application 09 2023 Key Points The Inflation Reduction Act which President Joe Biden signed in August 2022 created rebate programs for consumers tied to energy efficiency There are two initiatives the Home

RESIDENTIAL 2024 REBATE APPLICATION Rebates are available for the purchase of new ENERGY STAR rated appliances purchased between January 1 2024 December 31 2024 A new refrigerator or freezer purchase must include recycling of the older refrigerator or freezer Rebate submittal must follow the guidelines as outlined by the Sealing and Insulation Products 01 01 2022 12 31 2026 up to 125 Mail in Rebate Appalachian Power 1 833 402 2221 Visit website to learn more Appalachian Power offers a mail in rebate on the purchase and installation of sealing and insulation products Offer valid 01 01 2022 through 12 31 2026

MGED Energy Star Appliance Rebates Details Terms Middleborough Gas Electric MA

https://www.mged.com/ImageRepository/Document?documentId=352

Energy Star Appliance Ratings Losing Their Shine

https://www.gannett-cdn.com/-mm-/9d29561db46747a0b147d80ce2ffc7ef5f37d98f/c=252-300-2730-1699/local/-/media/USATODAY/test/2013/09/30/1380573687000-XXX-98501405.jpg?width=2478&height=1399&fit=crop&format=pjpg&auto=webp

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.otpco.com/media/1dwenppp/energy-star-appliance-rebate_2024_pdf-fillable.pdf

This program is available to Otter Tail Power MN residential and small commercial customers who have installed qualifying electric dehumidifiers air purifiers heat pump water heaters induction cooktops refrigerators freezers dishwashers clothes washers and clothes dryers including heat pump clothes dryers Rebate details

Home Rebates Residential Services Xcel Energy

MGED Energy Star Appliance Rebates Details Terms Middleborough Gas Electric MA

Killing Energy Star A Popular Program Lands On The Trump Hit List Yale E360

Claim Your Energy Star Appliance Rebate Mother Earth News

Home Energy Rebates Middleborough Gas Electric MA

ENERGY STAR Appliance Rebates For 2020 Are Back EnergySaveNewWest Save Energy Save Money

ENERGY STAR Appliance Rebates For 2020 Are Back EnergySaveNewWest Save Energy Save Money

Energy Star Appliances Rebates Explained

Energy Star Appliances Rebates Explained

Energy Star Appliances Rebates Explained

Energy Star Appliance Rebates 2024 - Heat Pump Clothes Dryer ENERGY STAR Certified Electric Customers Only 75 Refrigerators Freezers ENERGY STAR Certified Electric Customers Only Note Compact refrigerators are not eligible for rebate 25 Wi Fi Enabled Thermostat