Energy Star Insulation Tax Credit Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 There are currently Federal tax credits for the cost of insulation only for up to 30 of the cost not to exceed 1 200 Products that air seal reduce air leaks can also qualify as long as they come with a Manufacturers Certification Statement including weather stripping spray foam in a can designed to air seal and caulk designed to air

Energy Star Insulation Tax Credit

Energy Star Insulation Tax Credit

https://www.energystar.gov/sites/default/files/ES-HU-Subpage_Headers-AtticInsulation.png

Energy Star Insulation

https://estarinsulation.com/wp-content/uploads/2022/10/home.jpeg

Related Image Energy Star Insulation Orange County

https://i.pinimg.com/originals/50/4e/fa/504efaf6fa5c5849605615fb63259655.jpg

Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act 5 ways to save in 2023 with home energy tax credits Publication 5886 A Clean Energy Tax Incentives for Individuals PDF If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Who Can Claim the Credits

Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost 30 of cost 30 of cost up to 2 000 per year 30 of cost 30 of cost up to 600 30 of cost up to 600 30 of cost up to 600 Insulation materials

Download Energy Star Insulation Tax Credit

More picture related to Energy Star Insulation Tax Credit

Federal Tax Credit For Attic Insulation Bird Family Insulation

https://birdinsulation.com/wp-content/uploads/elementor/thumbs/IMG_3358-pze8n0tf8snl7o1gxaaq5ak87jitysx13y600w87m0.jpg

ENERGY STAR Ask The Experts Products ENERGY STAR

https://www.energystar.gov/sites/default/files/styles/blog_large/public/assets/images/ATE-Article-25-Header.png?itok=ZVlQmS9k

Insulation Tax Credit For 2023 Insulwise

https://www.insulwise.com/wp-content/uploads/2023/06/Insulwise-insulation-tax-credit-2023-1024x512.jpg

Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying renewable energy sources Are energy tax credits refundable Energy tax credits aren t refundable tax credits For full details see the Energy Star website Here are the improvements Central air conditioning 300 tax credit Air source heat pumps 300 tax credit Gas propane or oil boiler

The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Updates will be applied for 2023 and remain effective through 12 31 2032 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 There s no better way to save energy and money around the house than taking advantage of these 2023 home energy tax credits for solar panels heat pumps insulation and more

Image Result For Reflective Vapor Barrier Radiant Barrier Foil

https://i.pinimg.com/originals/24/cd/04/24cd04d4735f39def86477b12a33f7b9.jpg

Virginia Tax Credits Rebates Savings Richmond Spray Foam

http://richmondsprayfoam.com/images/slider15.jpg

https://www.energystar.gov/about/federal_tax_credits

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Insulation Tax Benefits Rebates Credits TruTeam

Image Result For Reflective Vapor Barrier Radiant Barrier Foil

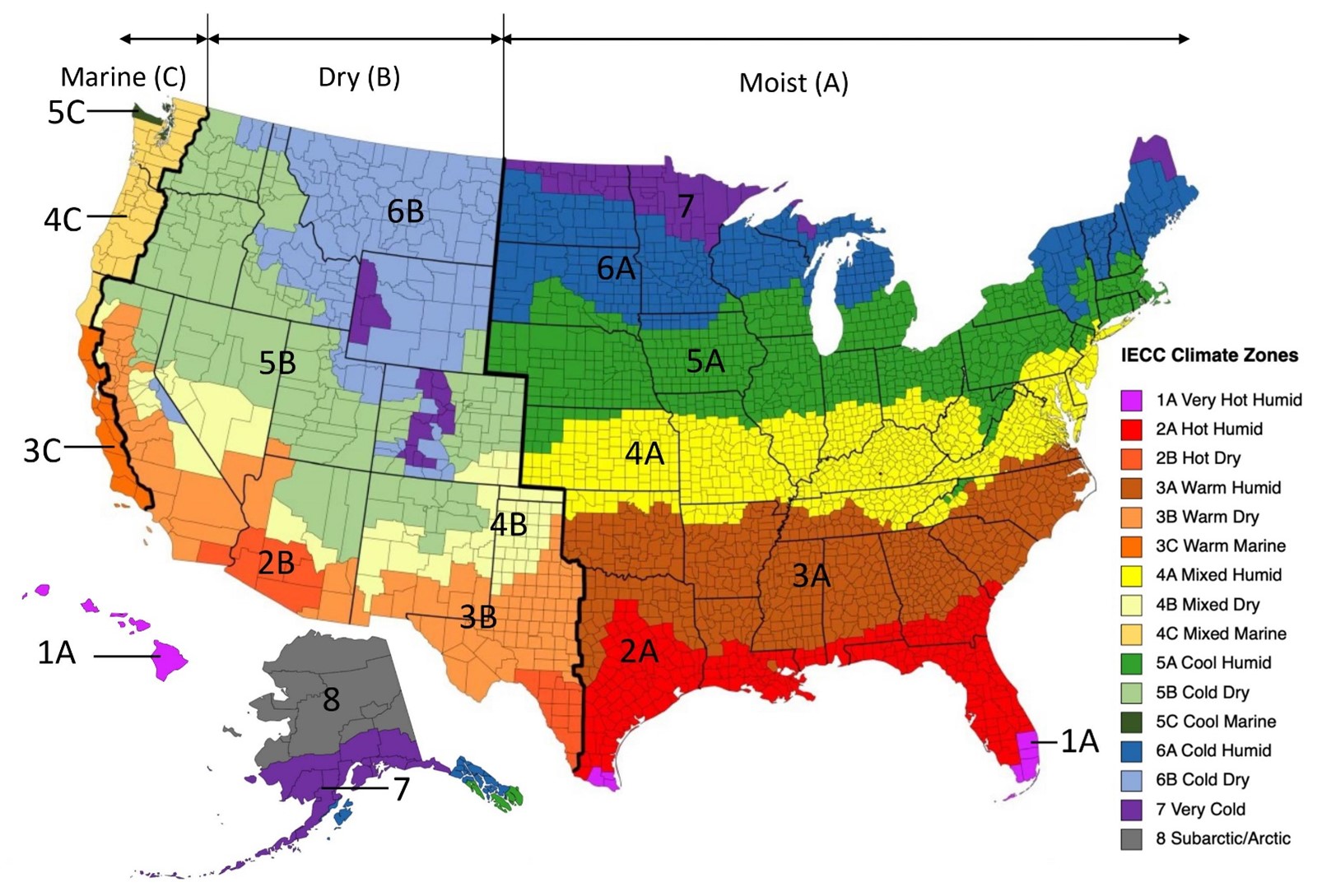

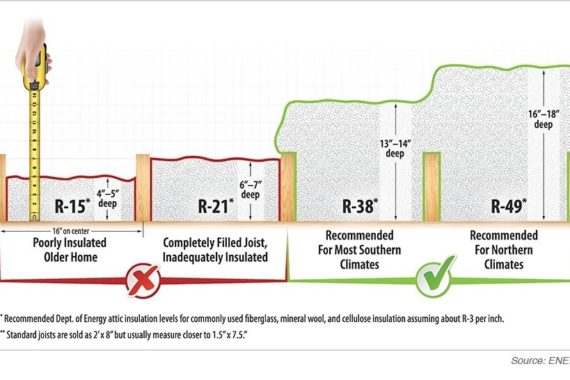

Recommended Home Insulation R Values ENERGY STAR

Insulation Tax Credits Eligible For Insulation Tax Credit

All Star Insulation Better Business Bureau Profile

Top 5 Insulation Questions TMC Engineering Ltd

Top 5 Insulation Questions TMC Engineering Ltd

Recommended Home Insulation R Values ENERGY STAR Insulation R

How Much Insulation Do You Need Urban Insulation Corp

Energy Efficient Insulation Go Green DIY

Energy Star Insulation Tax Credit - The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is