Energy Star Rebates 2024 Building envelope components To qualify building envelope components must have an expected lifespan of at least 5 years Qualified components include new Exterior doors that meet applicable Energy Star requirements

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Energy Star Rebates 2024

Energy Star Rebates 2024

https://i1.wp.com/energystarrebates.com/wp-content/uploads/2021/08/favpng_family-royalty-free-stock-photography-istock.png?w=1800&ssl=1

EnergyStar Logo

https://olivia.mn.us/wp-content/uploads/2015/02/EnergyStar_WH.jpg

Room Air Conditioners ENERGY STAR

https://www.energystar.gov/sites/default/files/ES_ME_2024_small-01_0.png

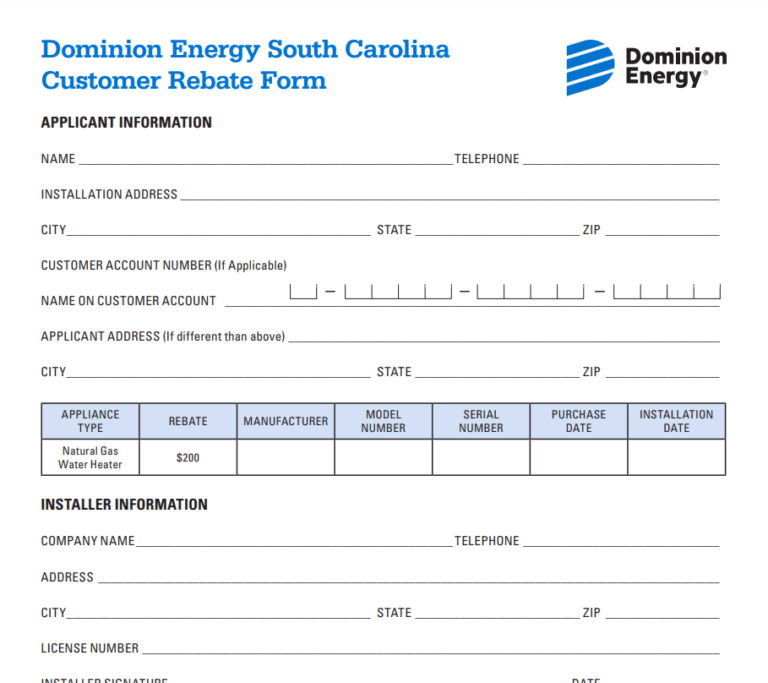

Home Performance with ENERGY STAR 2024 Customer Rebate Application Valid through Dec 31 2024 I Customer Information II Participating Contractor Information Company Name Contact Name III Home Performance Measures Final 2024 Recognition Criteria Monitors ENERGY STAR Most Efficient 2024 Criteria Correction PDF 264 KB ENERGY STAR Most Efficient 2024 Final Criteria Cover Letter Revised 12 2023 PDF 416 KB ENERGY STAR Most Efficient 2024 Criteria Stakeholder Comments and Responses PDF 218 KB ASHP ENERGY

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and Tax Credits for Homeowners ENERGY STAR You are here Home About ENERGY STAR Federal Tax Credits Tax Credits for Homeowners Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032

Download Energy Star Rebates 2024

More picture related to Energy Star Rebates 2024

.jpeg)

ENERGY STAR Canada

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/images/energystar/es_can_he_bil_e_col(1).jpeg

Clean Air Council Blog Archive Save Money And Energy With ENERGY STAR Rebates

https://cleanair.org/wp-content/uploads/6-PECO-Collage-01.png

Registration Energy Star Rebates

https://i1.wp.com/energystarrebates.com/wp-content/uploads/2021/08/kisspng-smartphone-mobile-phones-pda-female-old-people-5ac21f44639d60.0837161615226714284081.png?w=746&ssl=1

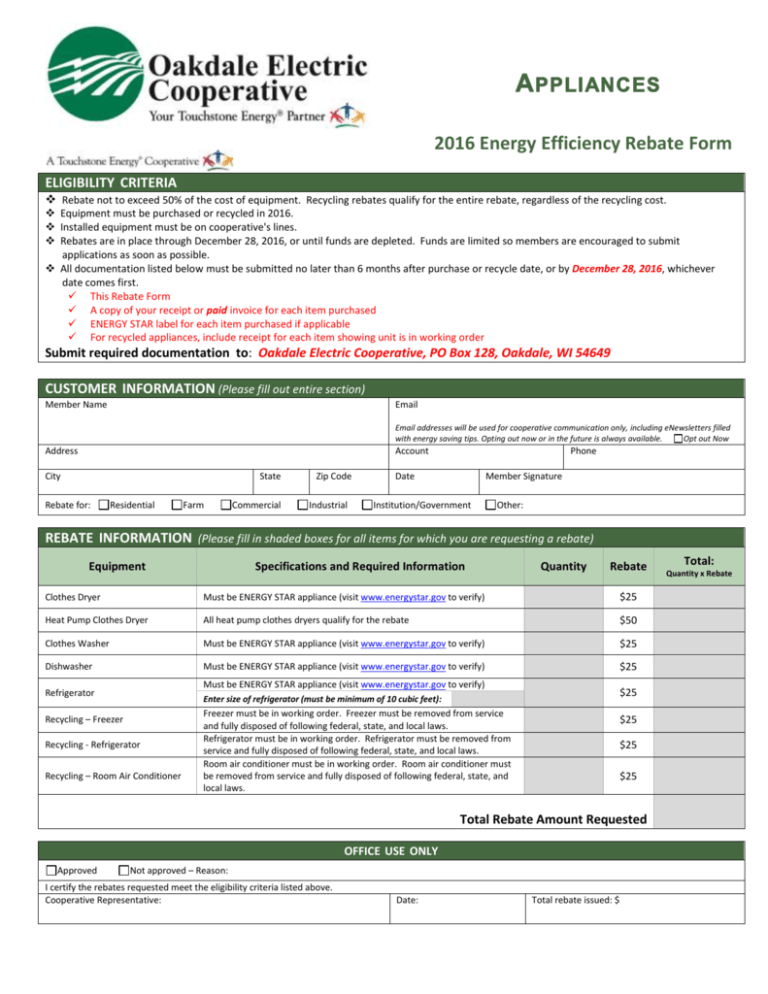

January 2024 Table of Contents The 8 8 billion Home Energy Rebates HER program provides an unprecedented opportunity for states territories and Tribes to make American homes more comfortable while reducing How will the bidder ensure that the Energy Star certification requirement if applicable for heating cooling and water Purchase must be made between January 1 2024 and December 31 2024 Rebate is a limited time offer while funds are available and may be subject to change at any time Rebate must be postmarked or submitted online no later than 20 Rebate ENERGY STAR

SECTION 1 Customer Information SECTION 2 Electric Measures Products must be new and in working condition Refurbished products are not eligible for incentives Signature The ENERGY STAR Appliance Rebate Application cannot be processed unless all of the appropriate fields on this application are complete About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Rebate Info The Best Commercial Deep Fryers In The World

https://ultrafryer.com/wp-content/uploads/2019/02/UF-Energy-Star-Rebate-Maps.jpg

Application Energy Star Rebate Form

https://s3.studylib.net/store/data/007063414_1-7c0c1ae81a07f163c48ffd165d883f6f-768x994.png

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Building envelope components To qualify building envelope components must have an expected lifespan of at least 5 years Qualified components include new Exterior doors that meet applicable Energy Star requirements

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Common HVAC Questions Samsung HVAC

Rebate Info The Best Commercial Deep Fryers In The World

Energy Star Appliances Rebates Explained

Mn Energy Rebate Forms Printable Rebate Form

Energy Star Rebates City Of Redwood Falls

HEEHRA The High Efficiency Electric Home Rebate Program Guide

HEEHRA The High Efficiency Electric Home Rebate Program Guide

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit For Air Conditioners Kobie

How To Save With ENERGY STAR Window Rebates Harvey Windows Doors

Energy Rebates YouTube

Energy Star Rebates 2024 - SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News