Energy Tax Credit Income Limit If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such Beginning January 1 2023 the credit becomes equal to the lesser of 30 of the sum of amounts paid for qualifying home improvements or the annual 1 200 credit limit In addition to the aggregate 1 200 limit annual

Energy Tax Credit Income Limit

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Energy Tax Credit Income Limit

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

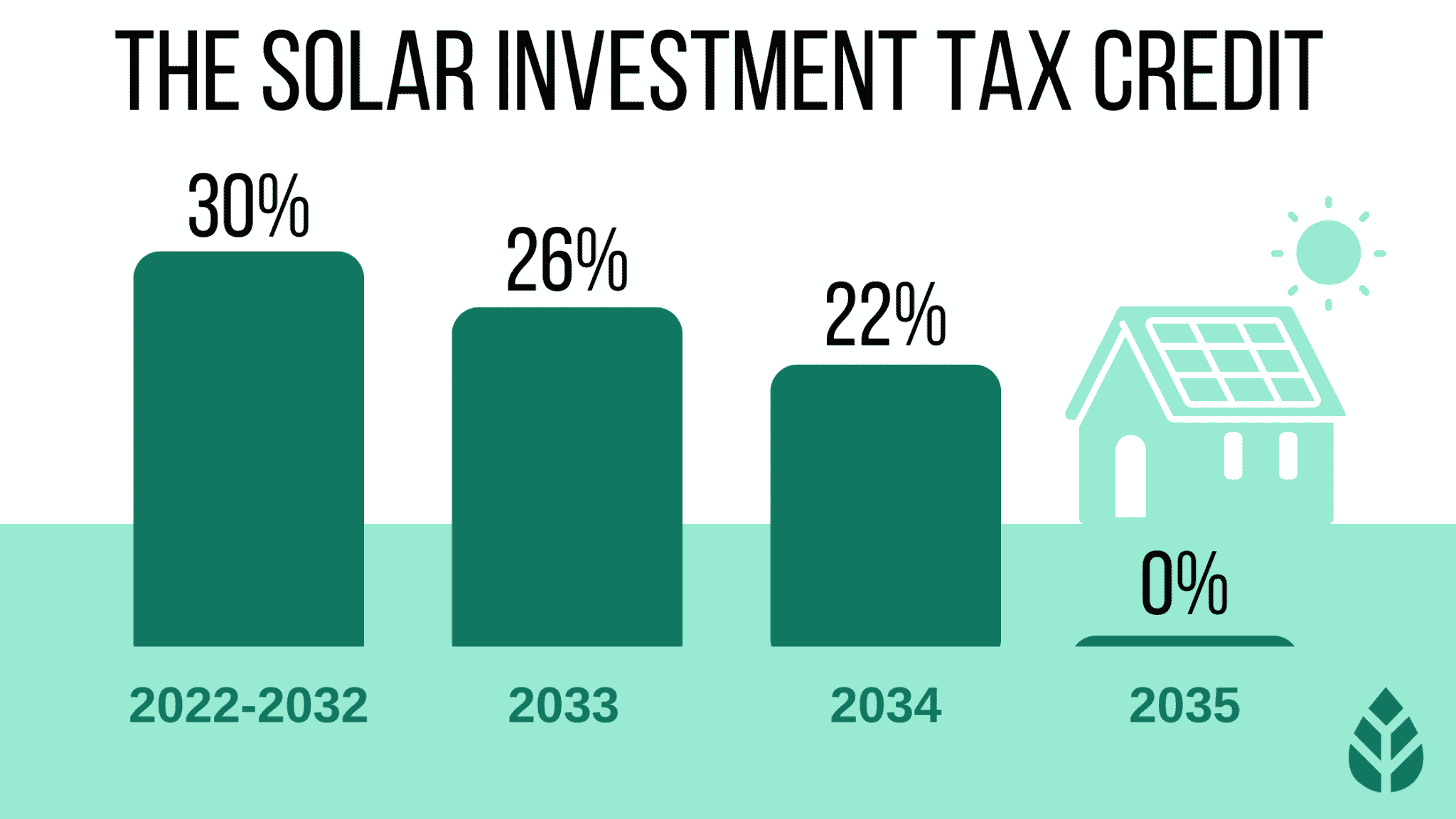

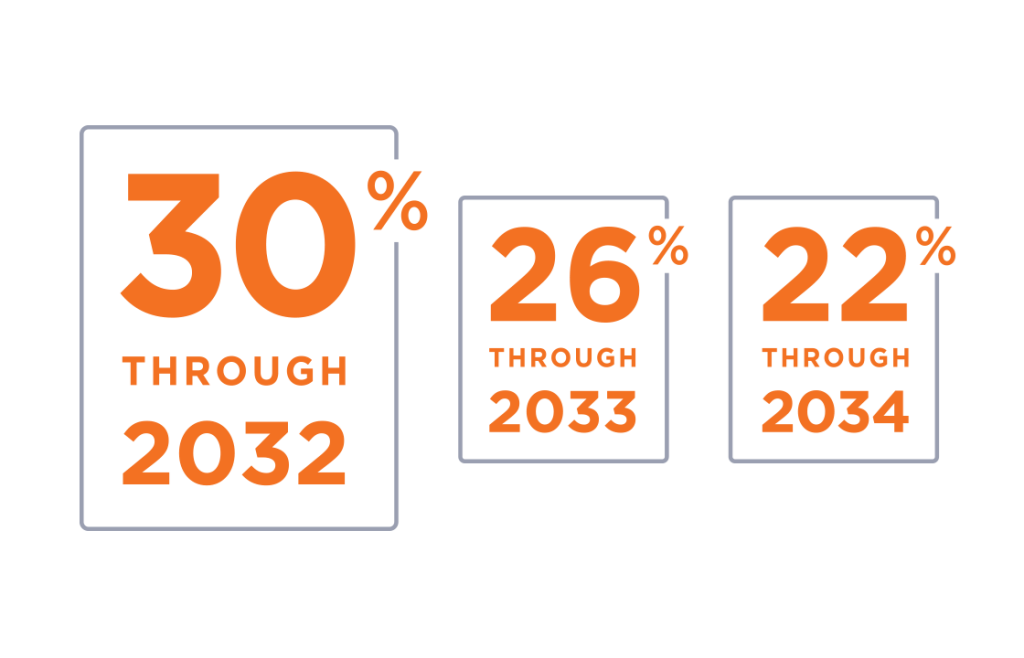

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Child Tax Credit 2023 Income Limit Eligibility Calculator APSBB

https://apsbb.org/wp-content/uploads/2023/05/Child-Tax-Credit-1-1024x580.png

There s a 1 200 annual credit limit for purchasing items such as energy efficient doors or windows and a 2 000 annual credit limit for heat pumps and biomass stoves or boilers You can Energy tax credits reduce the amount of income tax you owe You get the full amount of money you were promised when you pay your taxes

The energy efficient home improvement credit is subject to the following limitations Sec 25C b as amended by the act Annual overall limitation The credit allowed for any tax Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download Energy Tax Credit Income Limit

More picture related to Energy Tax Credit Income Limit

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

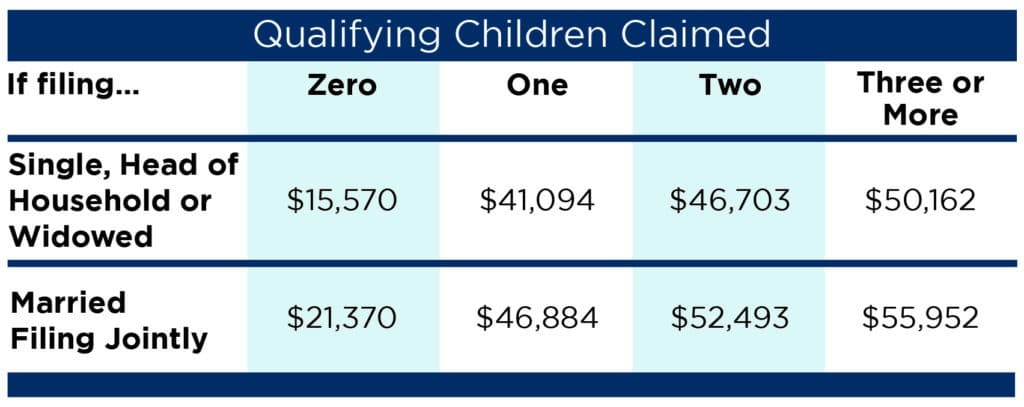

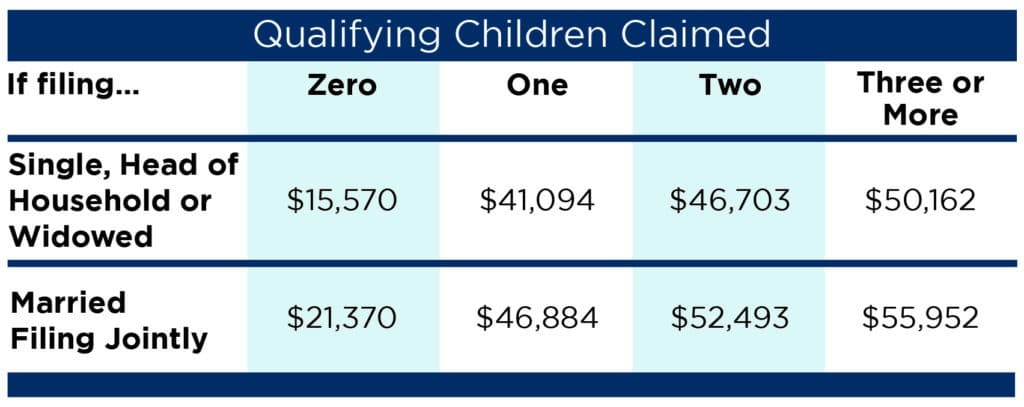

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

Child Tax Credit Income Limit And Age Info View Requirements Khou

https://media.khou.com/assets/KHOU/images/f61d98dd-271b-4a15-aae4-416ea9ba454f/f61d98dd-271b-4a15-aae4-416ea9ba454f_1140x641.jpeg

The energy efficient home improvement credit has a yearly combined limitation of 3 200 2 000 for electric or natural gas heat pump water heaters electric or natural gas heat The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces

What residential energy tax credits qualify for homeowners in 2024 and 2025 Did you make any energy efficient upgrades with new windows a door or a skylight You could be eligible for a tax credit As long as the Energy tax credits offer financial benefits for adopting greener technologies They aim to encourage homeowners to invest in energy efficient improvements These credits can

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

https://gbq.com/wp-content/uploads/2019/05/Qualifying-Children-Claimed-Chart-1024x407.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg?w=186)

https://www.irs.gov › credits-deductions › home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

https://www.irs.gov › credits-deductions › frequently...

How long does a taxpayer have to claim the credit added Jan 17 2025 A2 The credit is allowed for a taxable year for certain amounts a taxpayer pays or incurs during such

Tax Credits Save You More Than Deductions Here Are The Best Ones

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

See The EIC Earned Income Credit Table Income Tax Return Income

Child Tax Credit Income Limit 2024 Credits Zrivo

Geothermal Tax Credits Incentives A B Mechanical

FAQ WA Tax Credit

FAQ WA Tax Credit

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

EV Tax Credit 2024 Credits Zrivo

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

Energy Tax Credit Income Limit - There s a 1 200 annual credit limit for purchasing items such as energy efficient doors or windows and a 2 000 annual credit limit for heat pumps and biomass stoves or boilers You can