Energy Tax Rebates 2024 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022

SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways

Energy Tax Rebates 2024

Energy Tax Rebates 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits Affect My Refund Fabalabse

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

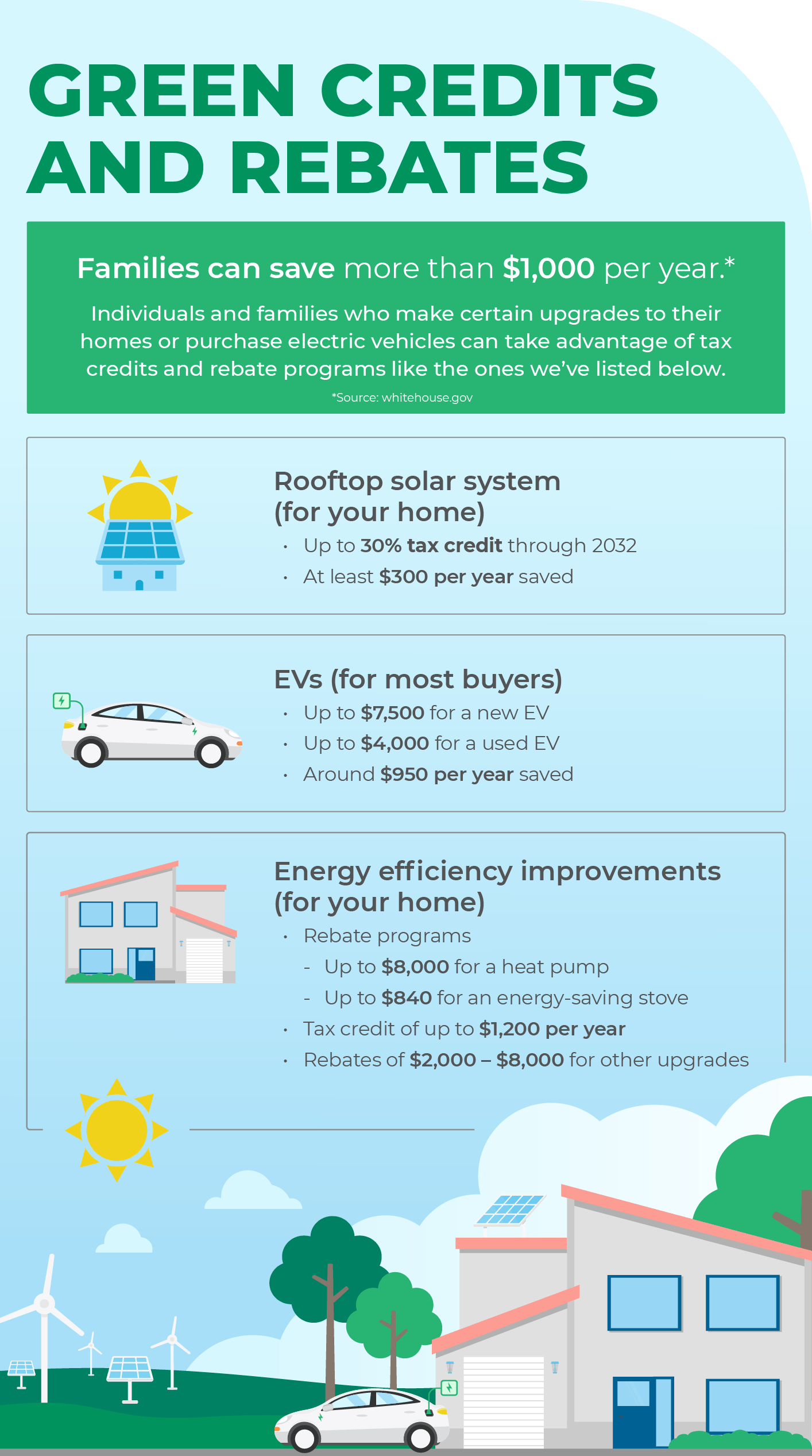

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Home Improvement HVAC Heat Pump Tax Credit Advertiser Disclosure Heat Pump Tax Credit 2024 What You Need To Know By Kimberly Dawn Neumann Contributor Reviewed By Kristin Salaky Editor

Formerly called the nonbusiness energy property credit the energy efficient home improvement credit now provides taxpayers 30 back with limits for the installation of certain Energy Energy tax incentives have the potential to drive investment that will support more than one where construction begins in 2023 and 15 percent in 2024 and later years For more information on these tax credits as well as related rebates administered by the Department of Energy please visit CleanEnergy gov

Download Energy Tax Rebates 2024

More picture related to Energy Tax Rebates 2024

How To Get Energy Efficiency Improvement Rebates Air Assurance

https://images.squarespace-cdn.com/content/v1/58adb3f25016e12237d1f5e2/1572291829160-3JUC7RPM78BK9MUJKJ4A/ke17ZwdGBToddI8pDm48kBNRt0cg4WAanfWojlHLplx7gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1US6IfA3z_hZ3gTROHXzj40oiauNtBL88ZRQhKg2xy4MQPt_AAiqPvsV6TvkS6kIncw/Tax+Rebates_iStock-1055975774.jpg

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

https://assets.solar.com/wp-content/uploads/2022/09/energy-efficient-tax-credits-and-rebates-e1662140600355.jpeg

NJ ANCHOR Property Tax Rebates Who Can Qualify In 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

The Inflation Reduction Act s clean energy tax incentives were designed to further this approach and provide place based bonuses for investing in low income communities and communities that have historically depended on the fossil fuel industry for jobs or been harmed by pollution rising to 12 5 for facilities where construction begins Program Overview Questions 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Energy Efficiency Rebates and Tax Credits in 2024 Home Electrification From the IRA By Sam Wigness Dec 22 2023 From the windows to the walls The recently signed Inflation Reduction Act is creating energy efficiency rebates and tax credits for all kinds of home electrification upgrades Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass stoves

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022

https://www.energy.gov/scep/home-energy-rebates-programs

SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News

Energy Tax Credits For 2023 One Source Home Service

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

A Guide To 2020 Tax Energy Credits Rebates Supreme Plumbing Heating And Cooling

A Guide To Tax Credits For And Clean Energy And Energy Efficient Home Improvements In 2023 Orchard

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit For Air Conditioners Kobie

Registration Provincial Rebates

Registration Provincial Rebates

Incentives And Rebates For Residential Energy Efficiency Improvements In Virginia Local Energy

Inflation Reduction Act Of 2022 Clean Vehicle Energy Credit Bregante Company LLP

Rebates Tax Incentives Residential Renewable Energy Tax Credit Green Investments

Energy Tax Rebates 2024 - The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings