Enhanced Star Rebate Checks 2024 Schedule Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

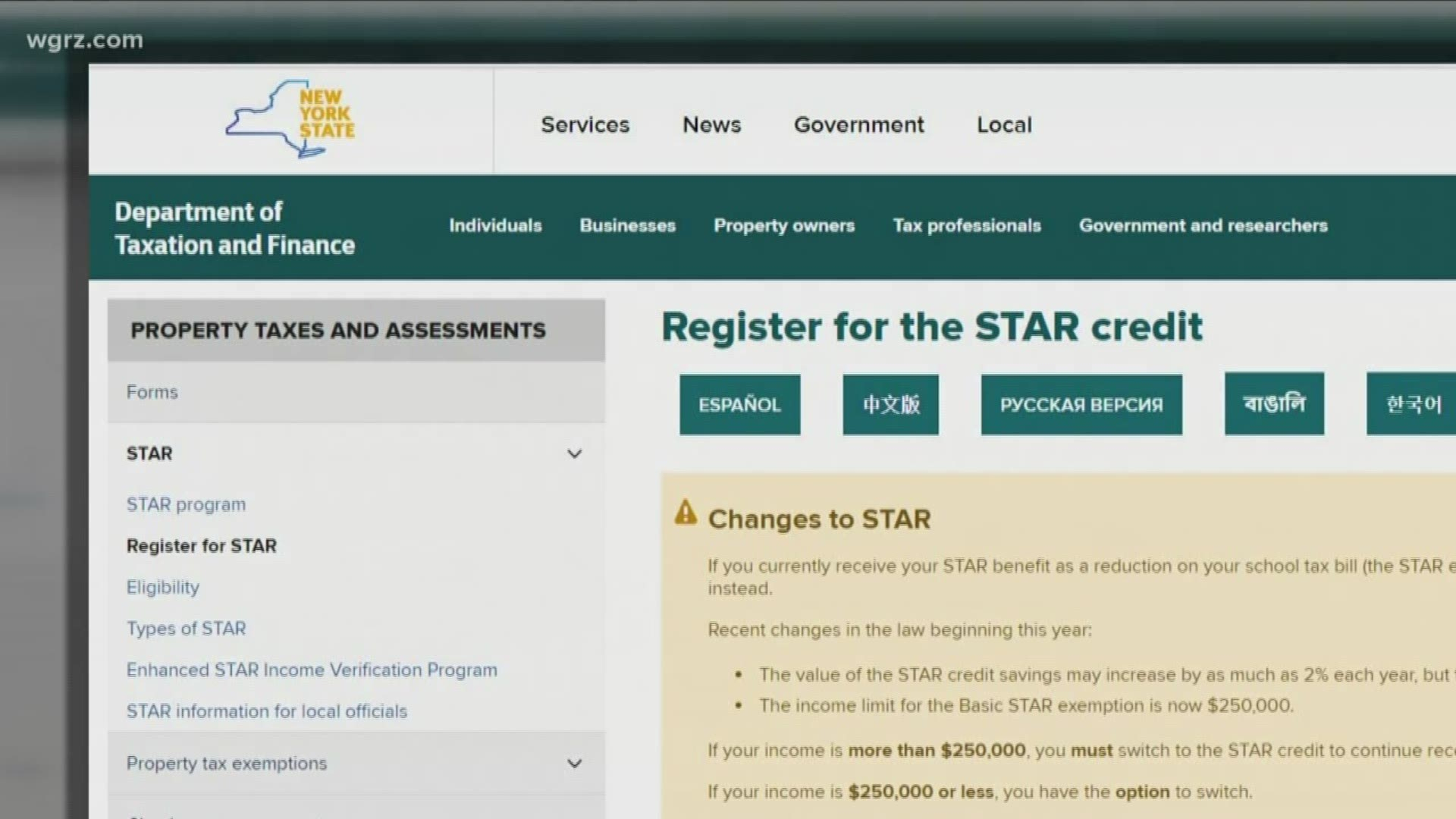

A STAR exemption which is a reduction on your school tax bill or a STAR credit which is paid to you by check or direct deposit You will continue to receive a STAR credit or STAR exemption as long as you are qualified Want to learn more about the STAR program Visit our frequently asked questions 1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

Enhanced Star Rebate Checks 2024 Schedule

Enhanced Star Rebate Checks 2024 Schedule

https://www.eduvast.com/wp-content/uploads/2023/10/MONEY-1024x576.jpg

New Law Requires Seniors To Verify Income To Keep Enhanced STAR Tax Rebate Newsday

https://cdn.newsday.com/ace/c:ODhjMDY5ZTAtNmM4ZC00:MDkzNjE2/landscape/1280

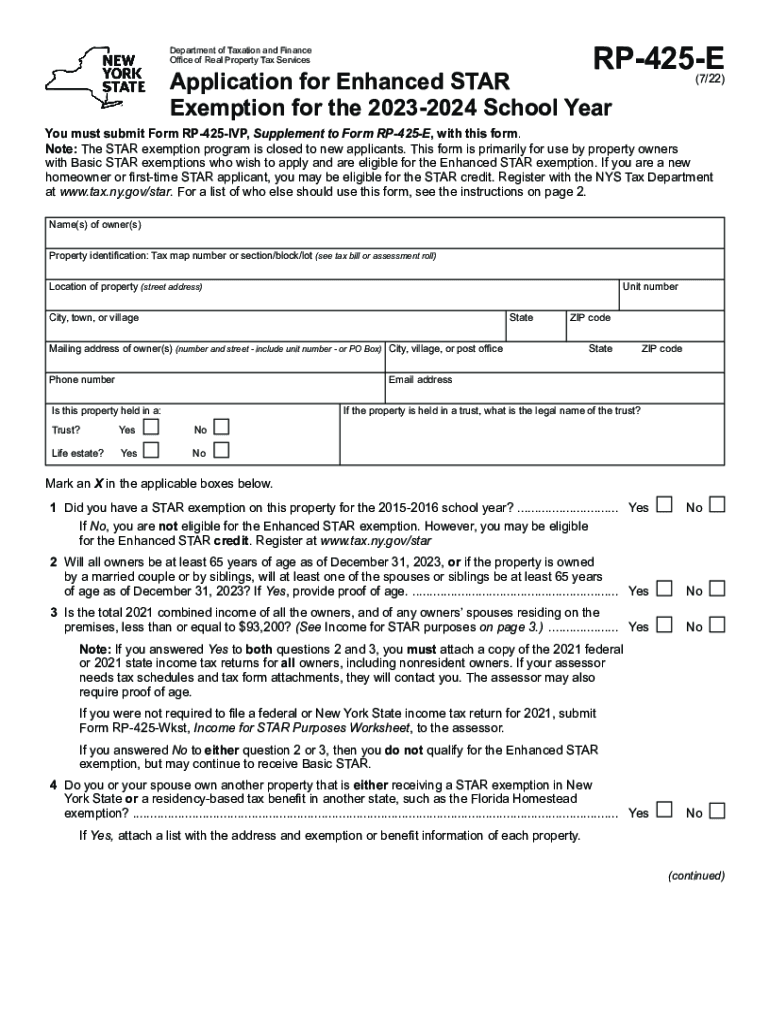

Enhanced Star Program Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/625/624625208/large.png

Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers STAR exemption and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of the homeowners existing STAR Didn t have Basic or Enhanced STAR for tax year 2015 2016 or The deadline to submit an application to transfer to E STAR for the 2024 2025 tax year is March 15 2024 and want to receive STAR as a credit rebate check you must request that the NYC Department of Finance remove the STAR Exemption from your property first

If your STAR check hasn t shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online Services Account or by September 8 2022 Albany NY Governor Hochul Announces 475 Million in Tax Relief for 1 8 Million Low Income New Yorkers and Families New Yorkers Who Received Empire State Child Credit and or the Earned Income Credit to Automatically Receive Checks New Yorkers Can Check Eligibility Here

Download Enhanced Star Rebate Checks 2024 Schedule

More picture related to Enhanced Star Rebate Checks 2024 Schedule

Star Rebate Checks 2023 Schedule RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/when-do-star-rebate-checks-go-out-starrebate.jpg

Assembly Votes To Stop STAR Rebate Checks

https://www.lohud.com/gcdn/-mm-/8a48a681c5b9a04f25a76b47e5f8b076fc056dfa/c=0-315-5609-3484/local/-/media/2015/02/28/Westchester/Westchester/635606802247653349--POUBrd-03-31-2014-Daily-1-A006-2014-03-30-IMG--JR-072910-E-albany-1-1-306.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Star Rebate Checks 2023 Schedule RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/when-will-ny-homeowners-get-new-star-rebate-checks-syracuse.jpg

New York state homeowners have until December 31 to apply for a rebate that could offer a check of 1 400 or more CHARLY TRIBALLEAU AFP via Getty Images Those who qualify for the Enhanced STAR The STAR savings amount is the lesser of The STAR exemption amount multiplied by the school tax rate excluding any library levy portion divided by 1000 or The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York How to check the status of your STAR property tax rebate By Susan Arbetter New York State PUBLISHED 2 55 PM ET Aug 29 2022 If you haven t yet received your STAR property tax rebate check there s an easy way to find out what its status is Simply visit this website https www8 tax ny gov SCDS scdsGateway

Mount Vernon Star Rebate Checks 2022 StarRebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/mount-vernon-star-rebate-checks-2022-starrebate.jpg?w=1960&ssl=1

Enhanced STAR Changes Causing Confusion WHAM

https://13wham.com/resources/media/411dde02-33ed-4383-8b05-cee20908598c-large16x9_starrebate.jpg?1568947069037

https://www.syracuse.com/politics/2023/09/when-will-new-york-state-mail-you-a-star-check-heres-how-to-find-out.html

Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

https://www.tax.ny.gov/pit/property/star/

A STAR exemption which is a reduction on your school tax bill or a STAR credit which is paid to you by check or direct deposit You will continue to receive a STAR credit or STAR exemption as long as you are qualified Want to learn more about the STAR program Visit our frequently asked questions

STAR Rebate Check Fiasco What You Need To Know WSTM

Mount Vernon Star Rebate Checks 2022 StarRebate Rebate2022

Nys Star Rebate Check 2023 RebateCheck

Long Island Star Rebate Checks RebateCheck

This Is An Attachment Of 2023 Ford Maverick Canada Release Date And Colors 2023 2024 Ford From

Stimulus Check 2023 Which States Are Sending Rebate Payments Kiplinger

Stimulus Check 2023 Which States Are Sending Rebate Payments Kiplinger

Homeowners Still Waiting For STAR Rebate Checks WRGB

Hochul Wants To Revive STAR Rebate Checks More Top Stories Good Morning CNY For Jan 28

Ny Star Rebate Checks RebateCheck

Enhanced Star Rebate Checks 2024 Schedule - If your STAR check hasn t shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online Services Account or by