Enhanced Star Rebate Checks 2024 Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

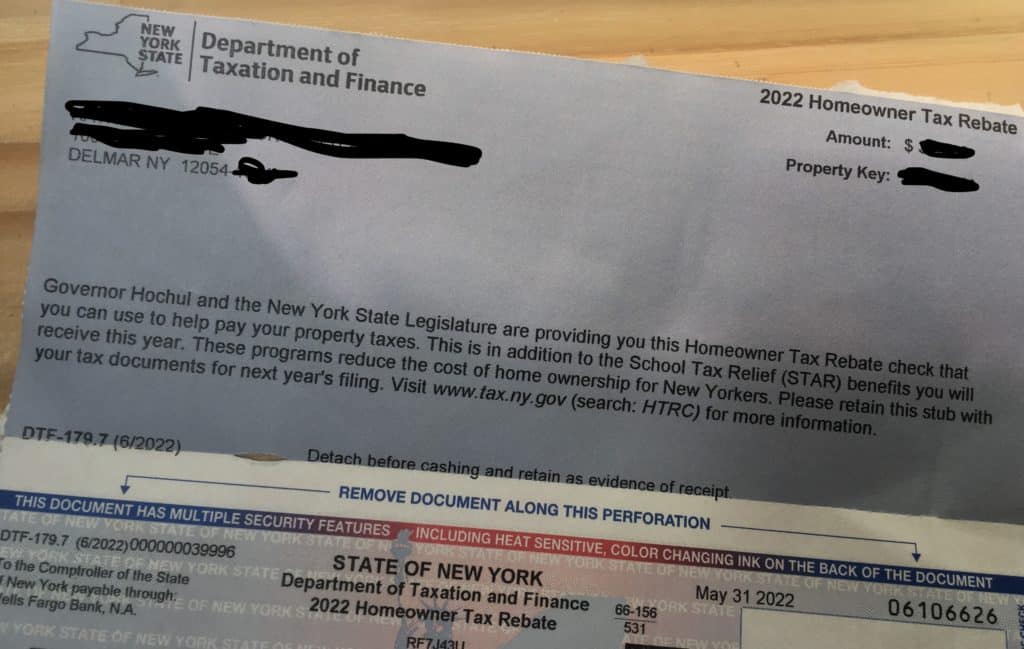

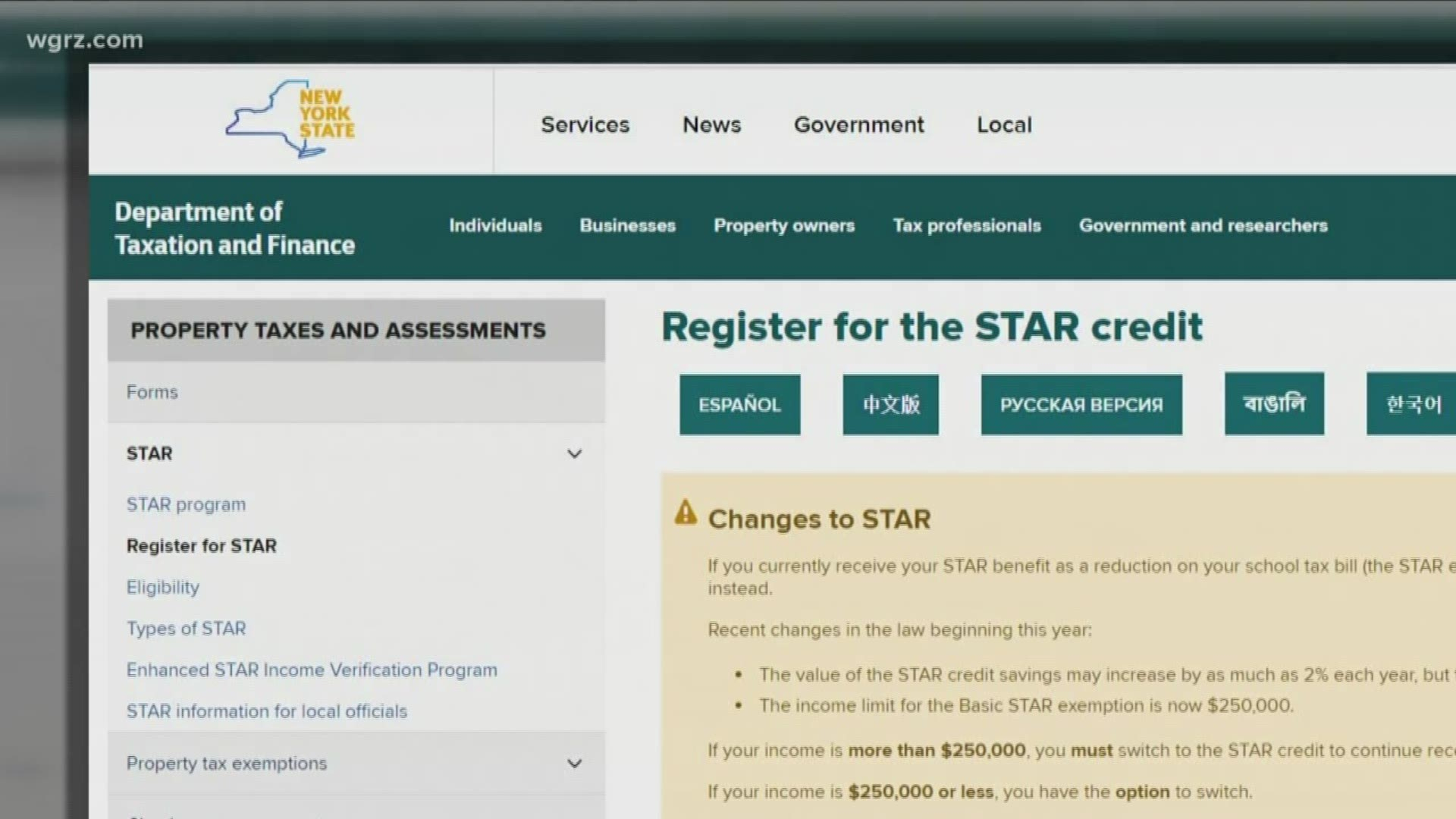

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York 1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

Enhanced Star Rebate Checks 2024

Enhanced Star Rebate Checks 2024

https://cdn.newsday.com/ace/c:ODhjMDY5ZTAtNmM4ZC00:MDkzNjE2/landscape/1280

Enhanced STAR For Seniors There Is An Important Change To Know This Year New York State

https://southieshuttle.com/1e826dc9/https/922ca8/www.gannett-cdn.com/-mm-/df31719036d130ec817ed80e90bcc4e4d19b6901/c=0-19-506-305/local/-/media/2015/06/27/Westchester/B9317874171Z.1_20150627094031_000_GIUB6QIST.1-0.jpg?auto=webp&format=pjpg&width=1200

Star Rebate Checks Exploring The Eligibility And Further Details

https://www.eduvast.com/wp-content/uploads/2023/10/MONEY.jpg

Didn t have Basic or Enhanced STAR for tax year 2015 2016 or The deadline to submit an application to transfer to E STAR for the 2024 2025 tax year is March 15 2024 and want to receive STAR as a credit rebate check you must request that the NYC Department of Finance remove the STAR Exemption from your property first The STAR benefit program provides eligible homeowners with a break on their property taxes through an up front savings that comes directly off their tax bill the STAR exemption or a

The Enhanced STAR program is for New York state residents 65 and older whose property is their primary residence The income limit for this program for 2024 is 98 700 The Bulletin Seagulls The STAR program provides eligible homeowners with relief on their school property taxes There are two types of STAR exemptions The Basic STAR exemption is available to all eligible homeowners with incomes below 250 000 regardless of the owners age

Download Enhanced Star Rebate Checks 2024

More picture related to Enhanced Star Rebate Checks 2024

Mount Vernon Star Rebate Checks 2022 StarRebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/mount-vernon-star-rebate-checks-2022-starrebate.jpg?w=1960&ssl=1

Nys Star Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

Long Island Star Rebate Checks RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/nassau-county-rebate-checks-keyrole-1.jpg

The STAR exemption will now be in the form of a Rebate Check to the property owner New York State has a web based application to do this or you can call in and register Representatives of the New York State Department of Taxation and Finance can assist you in the process On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

ENERGY STAR Rebate Finder Find rebates and special offers near you on ENERGY STAR certified products Products that earn the ENERGY STAR label meet strict energy efficiency specifications set by the U S EPA helping you save energy and money while protecting the environment STAR credit check If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year If you qualify for Enhanced STAR you ll automatically receive a check for the Enhanced benefit You don t need to register again in future years 01 09 2024 8 25 am Contact Erie County Real Property

Assembly Votes To Stop STAR Rebate Checks

https://www.lohud.com/gcdn/-mm-/8a48a681c5b9a04f25a76b47e5f8b076fc056dfa/c=0-315-5609-3484/local/-/media/2015/02/28/Westchester/Westchester/635606802247653349--POUBrd-03-31-2014-Daily-1-A006-2014-03-30-IMG--JR-072910-E-albany-1-1-306.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Homeowners Still Waiting For STAR Rebate Checks WRGB

https://cbs6albany.com/resources/media/c1f77bb7-254e-4a02-b545-96bc4303747c-large16x9_STAR.JPG?1483485283967

https://www.syracuse.com/politics/2023/09/when-will-new-york-state-mail-you-a-star-check-heres-how-to-find-out.html

Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

https://www.nyc.gov/site/finance/property/landlords-star.page

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York

Ny Star Rebate Checks RebateCheck

Assembly Votes To Stop STAR Rebate Checks

STAR Rebate Check Fiasco What You Need To Know WSTM

STAR Rebate Checks Come To Some Homeowners In Time For Governor s June Primary Syracuse

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Star Rebate Checks 2023 Schedule RebateCheck

Star Rebate Checks 2023 Schedule RebateCheck

Assembly Votes To Stop STAR Rebate Checks Wgrz

Hochul Wants To Revive STAR Rebate Checks More Top Stories Good Morning CNY For Jan 28

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Enhanced Star Rebate Checks 2024 - Didn t have Basic or Enhanced STAR for tax year 2015 2016 or The deadline to submit an application to transfer to E STAR for the 2024 2025 tax year is March 15 2024 and want to receive STAR as a credit rebate check you must request that the NYC Department of Finance remove the STAR Exemption from your property first