Ertc Tax Rebates Web 27 juil 2023 nbsp 0183 32 The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for businesses and tax

Web Eligible Employers can claim the Employee Retention Credit equal to 50 percent of up to 10 000 in qualified wages including qualified health plan expenses on wages Web 9 mars 2020 nbsp 0183 32 The Employee Retention Tax Credit ERTC is one of many relief provisions included in the CARES Act to encourage to keep

Ertc Tax Rebates

Ertc Tax Rebates

https://p.calameoassets.com/220330072118-87691d412cf688d1bc3c1b895bf300e4/p1.jpg

Franchise Payroll Tax Rebate Eligibility Check Claims Risk Free

https://i.pinimg.com/originals/f4/95/07/f49507d1ca2634104efb375286d9e305.png

Calam o Free Pandemic Tax Credit Estimate For SMBs Non Profits

https://p.calameoassets.com/220623014907-021aa537813f5468f85e487f6aad54d1/p1.jpg

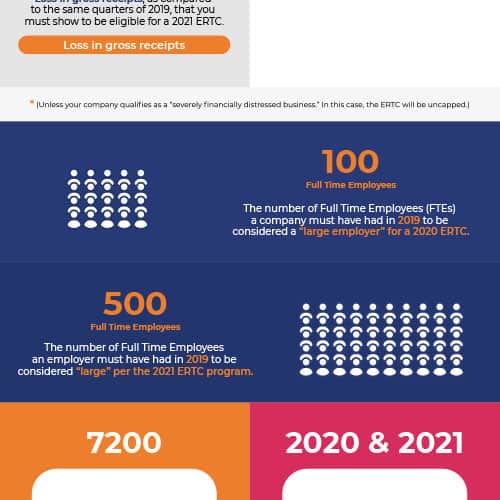

Web 24 sept 2022 nbsp 0183 32 LOS ANGELES CA ACCESSWIRE September 24 2022 The Employee Retention Credit ERC or Employee Retention Tax Credit ERTC program is the last Web The ERTC program is a refundable tax credit for business owners in 2020 and 2021 In 2020 a credit is available up to 5 000 per employee from 3 12 20 12 31 20 by an

Web The ERTC was established by the Coronavirus Aid Relief and Economic Security CARES Act and provides a credit equal to 50 percent of qualified wages and health plan Web The 2020 ERC Program is a refundable tax credit of 50 of up to 10 000 in wages paid per employee from 3 12 20 12 31 20 by an eligible employer THAT S 5 000 PER

Download Ertc Tax Rebates

More picture related to Ertc Tax Rebates

Easy ERTC Tax Rebate Application 2022 Get CPA Help Claiming Covid

https://i.ytimg.com/vi/OEPSbFPtrx8/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGH8gSigZMA8=&rs=AOn4CLDSZNdFMvpTLLQj51sVhaRFjsjmSA

PPT Eligible For ERTC Rebate Know It All Here PowerPoint

https://image6.slideserve.com/11327155/slide1-n.jpg

Calam o Best Free ERTC Eligibility Check Tax Rebate FAQs Answered

https://p.calameoassets.com/220908151612-2c7b1af7d6d4075914b5688acbe54110/p1.jpg

Web 13 avr 2022 nbsp 0183 32 The Employee Retention Tax Credit ERTC program has been amended to expand the eligibility requirements and many small business owners who did not qualify Web Industry leading ERTC claims processor has already helped thousands of employers get over 1 Billion in ERTC rebates Are YOU next How much will YOUR cash rebate be Find out INSTANTLY if your business

Web 5 ao 251 t 2023 nbsp 0183 32 Beware of your business taking false employee retention tax credits ERTC Congress enacted this COVID 19 related payroll tax credit for eligible businesses that Web 0 B Refunds Received 0 Staff Nationwide Don t be left out 75 of businesses we ve successfully gotten millions in funding for had no idea they were qualified to receive it

My Old Copy Backup ERTC Rebate Portal

https://ertcrebateportal.com/wp-content/uploads/2022/05/ERTC-Rebate-Portal-Logo-Transparent.png

Calam o Claim ERTC Payroll Rebates Free New York Tax Credit

https://p.calameoassets.com/220613094125-c6eeeec4dae2b68c6b2bf2bbce6024ed/p1.jpg

https://www.irs.gov/coronavirus/frequently-asked-questions-about-the...

Web 27 juil 2023 nbsp 0183 32 The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for businesses and tax

https://www.irs.gov/newsroom/covid-19-related-employee-retention...

Web Eligible Employers can claim the Employee Retention Credit equal to 50 percent of up to 10 000 in qualified wages including qualified health plan expenses on wages

ERTC Tax Credit For Manufacturers Velocity Scheduling System

My Old Copy Backup ERTC Rebate Portal

Calam o Top ERTC Expert Scott Duncan Guarantees Maximum CARES Act Tax

Who Qualifies For ERTC Rebates 2022 Free CARES Act Tax Credit

ERTC Step by Step Instructions Employee Retention Tax Credit

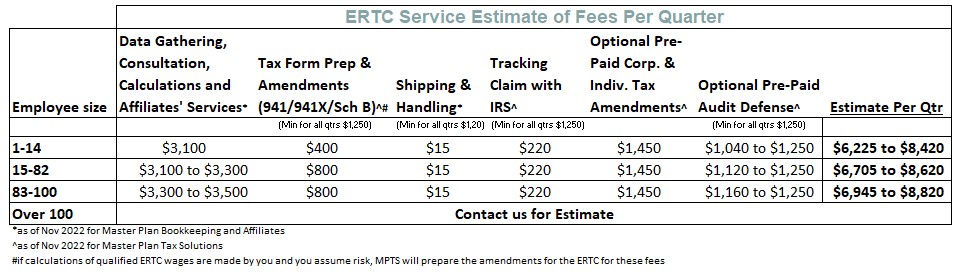

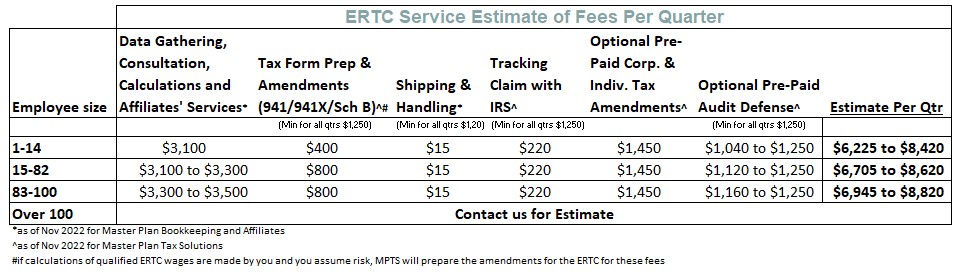

Employee Retention Tax Credit Master Plan Tax Solutions

Employee Retention Tax Credit Master Plan Tax Solutions

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

Fast ERTC Returns For Bookkeepers 2022 Pandemic Tax Credit Rebate

ERTC ELIGIBILITY Jeff Brown Investor

Ertc Tax Rebates - Web The ERTC was established by the Coronavirus Aid Relief and Economic Security CARES Act and provides a credit equal to 50 percent of qualified wages and health plan