Estate Tax Exemption 2022 Philippines Web May 26 2022 RR No 5 2022 Implements the Estate Tax Exemption under RA No 11597 An Act Providing for the Revised Charter of the Philippine Veterans Bank Repealing

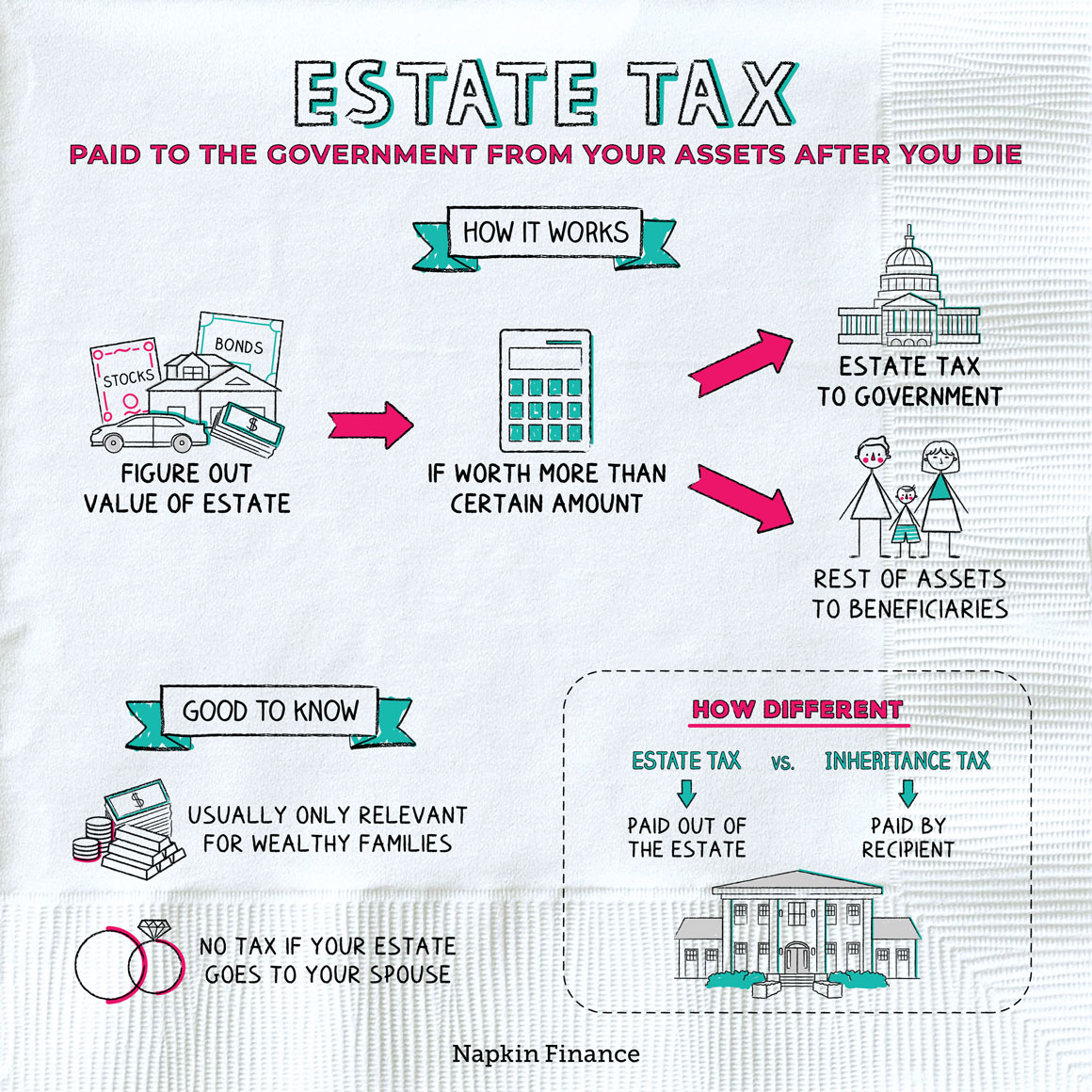

Web 7 Juni 2023 nbsp 0183 32 Learn how to compute estate tax in the Philippines who pays for it and what are the requirements and steps to file for it Find out the difference between estate tax Web 31 Aug 2023 nbsp 0183 32 In the Philippines there are certain assets and properties that are exempt from estate taxes Family Home If a family home is included in the estate an amount of

Estate Tax Exemption 2022 Philippines

Estate Tax Exemption 2022 Philippines

https://www.haimolaw.com/wp-content/uploads/2022/03/image1-980x653.jpg

Will Estate Tax Exemption Change In 2022 Coleman Law Firm

https://colemanlaw.com/wp-content/uploads/Will-Estate-Tax-Exemption-Change-In-2022-scaled.jpg

Increased Federal Transfer Tax Exemptions For 2022 Grassi

https://www.grassicpas.com/wp-content/uploads/2022/01/AdobeStock_406627671-scaled.jpeg

Web 6 Feb 2018 nbsp 0183 32 An Estate Tax return must be filed if the estate consists of registered property vehicles stock shares or anything that requires a clearance from the Web 7 Juli 2021 nbsp 0183 32 Tax Notes Estate Tax Amnesty extended until June 14 2023 07 Jul 2021 1 min read On June 30 2021 Republic Act RA 11569 was signed into law which

Web 13 Sept 2023 nbsp 0183 32 Aside from the extension RA No 11956 expanded the coverage of the amnesty program to include estates of decedents who died on or before May 31 2022 Web 1 Apr 2022 nbsp 0183 32 The law was amended by RA 11569 last year and the amnesty period was extended for another two years or until June 14 2023 Those who will avail of the estate

Download Estate Tax Exemption 2022 Philippines

More picture related to Estate Tax Exemption 2022 Philippines

Ny Estate Tax Exemption 2022 Thao Stitt

https://i.pinimg.com/originals/ce/ad/8a/cead8a95463848ce1b3f531f26fb6d2c.jpg

2022 Estate Tax Exemption PB Elder Law

https://www.pbelderlaw.com/wp-content/uploads/2022/01/GettyImages-1304677572.jpg

How To Plan For The 2025 Sunset Of The Federal Estate Tax Exemption

https://www.howeandrusling.com/wp-content/uploads/2024/01/EstateSunset_011224-2-scaled.jpg

Web 12 Juli 2022 nbsp 0183 32 According to Delatina M J 2022 In the Philippines we cannot transfer personal or real properties to heirs without filing an estate tax return and paying the Web Standard Deduction in the amount of Five Million Pesos P5 000 000 00 Claims against the estate which mean debts or demands of a pecuniary nature which could have been enforced against the deceased in his

Web One significant change is the extension of the estate tax return filing deadline for another two years until June 14 2025 The coverage for deaths eligible for the program has Web Tax Guide Understanding Tax Exemptions and Requirements in the Philippines Mazars Philippines 13 December 2023 This short guide created by Mazars

Federal Estate Tax Exemption 2022 Betsey Hull

https://www.greensfelder.com/assets/htmlimages/blogs/2022/AdobeStock_461196006-resized.jpeg

Important Changes To Estate Tax Exemption For 2022 AmeriEstate

https://ameriestate.com/wp-content/uploads/2022/10/pexels-photo-8962476-1024x683.jpeg

https://www.bir.gov.ph/.../2022-revenue-regulations.html

Web May 26 2022 RR No 5 2022 Implements the Estate Tax Exemption under RA No 11597 An Act Providing for the Revised Charter of the Philippine Veterans Bank Repealing

https://www.moneymax.ph/personal-finance/articles/estate-tax-phili…

Web 7 Juni 2023 nbsp 0183 32 Learn how to compute estate tax in the Philippines who pays for it and what are the requirements and steps to file for it Find out the difference between estate tax

BIR Certificate Of Tax Exemption PAGA

Federal Estate Tax Exemption 2022 Betsey Hull

Massachusetts Estate Tax Table Brokeasshome

Federal Estate Tax Exemption Sunset The Sun Is Still Up But It s

Estate Tax Exemption 2022 Inflation Adjustment Therefore Diary

Estate Tax Exemption Changes Coming In 2026 Estate Planning

Estate Tax Exemption Changes Coming In 2026 Estate Planning

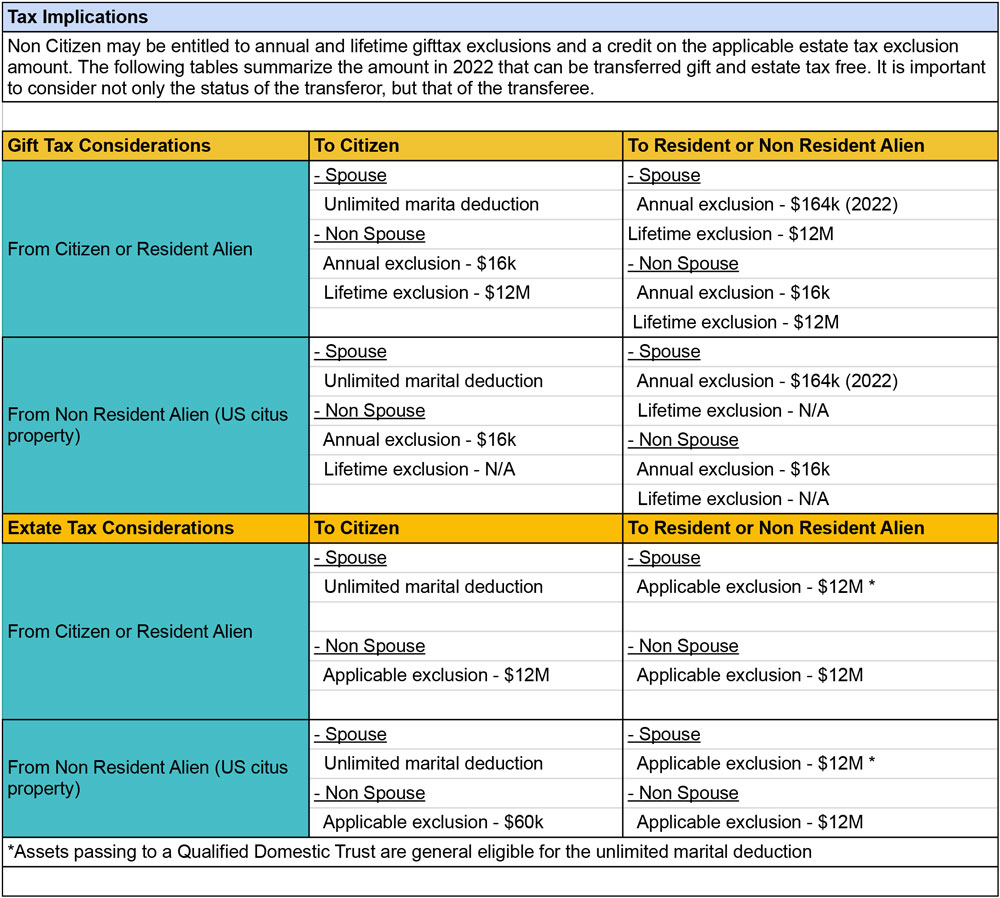

US Gift Estate Taxes 2022 Gifts Transfer Taxes HTJ Tax

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

E Filing Due Date 2022 Malaysia Tax Compliance And Statutory Due

Estate Tax Exemption 2022 Philippines - Web 8 Aug 2023 nbsp 0183 32 Metro Manila CNN Philippines August 8 Estate tax amnesty may be availed of for another two years or until June 2025 after the measure seeking such an