Estate Tax Return Charitable Contributions Income tax charitable deductions for trusts and estates are governed by Sec 642 c these rules are substantially different from the rules for charitable contribution

But charitable donations work a little differently for estate tax purposes There are three key differences The first difference is that the estate tax charitable deduction is allowed Here are several things that you can do to keep your estate tax bill as small as possible Charitable gifts Any assets that you gift to charity will be excluded from your taxable estate

Estate Tax Return Charitable Contributions

Estate Tax Return Charitable Contributions

https://www.moneycrashers.com/wp-content/uploads/2019/02/charitable-contributions-tax-deductions.jpg

Non Cash Charitable Contribution

https://assets.website-files.com/5f58fc223340f841e9a35146/618986dd33166964bf1e22a6_box-of-donations.jpg

What Businesses Should Know About Charitable Contributions Provident

https://providentcpas.com/wp-content/uploads/2019/11/4-1.jpg

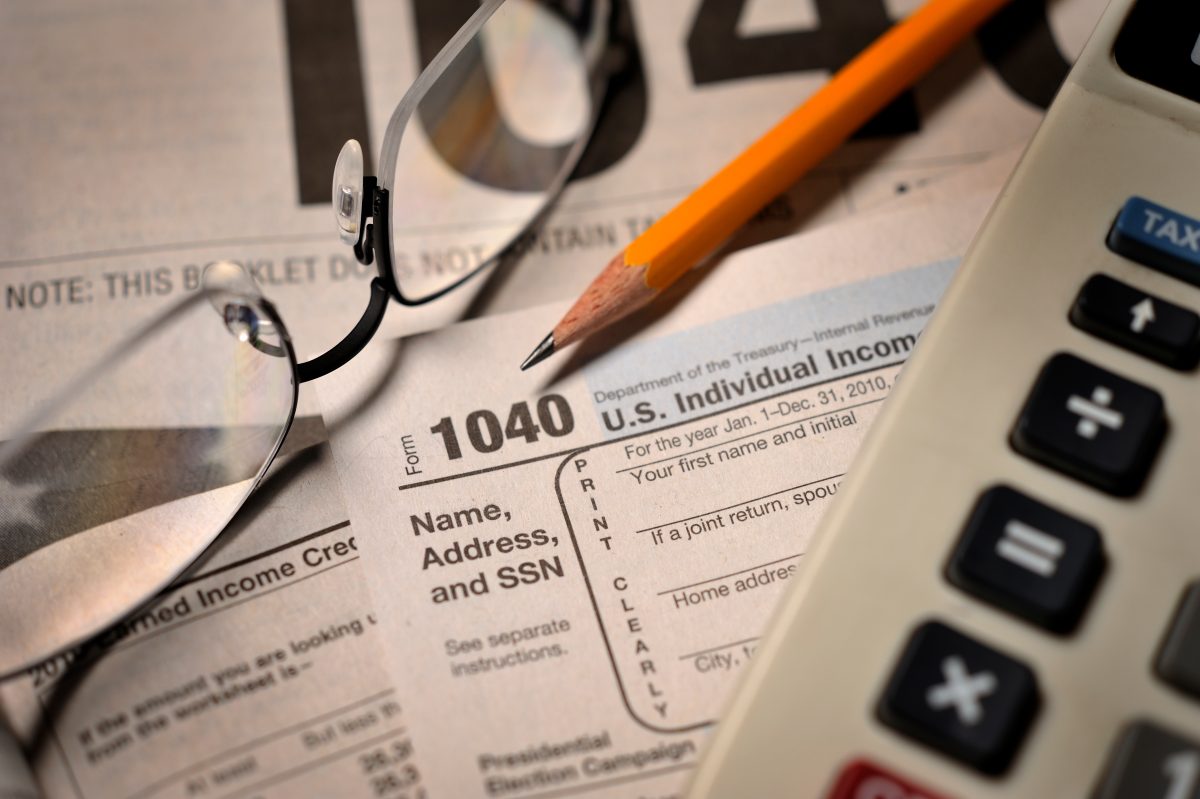

An estate tax return Form 706 must be filed if the gross estate of the decedent who is a U S citizen or resident increased by the decedent s adjusted taxable gifts and specific gift tax This publication explains how individuals claim a deduction for charitable contributions It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can

A donation tax credit can be claimed for charitable donations that the deceased or their spouse or common law partner made before the date of death in the Final Return Donations made by Overview of tax benefits Individuals who make charitable gifts during their lifetime may qualify for an income tax deduction and potentially reduce the size of their taxable estate Gifts made at

Download Estate Tax Return Charitable Contributions

More picture related to Estate Tax Return Charitable Contributions

12 Tax Smart Charitable Giving Tips For 2023 Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/IE_0523_Tax-Smart Charitable Giving Tips_chart_deductions_bunching.jpg

Charitable Contributions Tax Tips

https://www.affcf.org/wp-content/uploads/2021/03/By-zimmytws-1.jpg

Charitable Contributions Tax Strategies Fidelity Charitable

https://www.fidelitycharitable.org/content/dam/fc-public/shared/images/glasses-pencil-tax-form.jpg.transform/viewport-share-image/image.20211105.jpeg

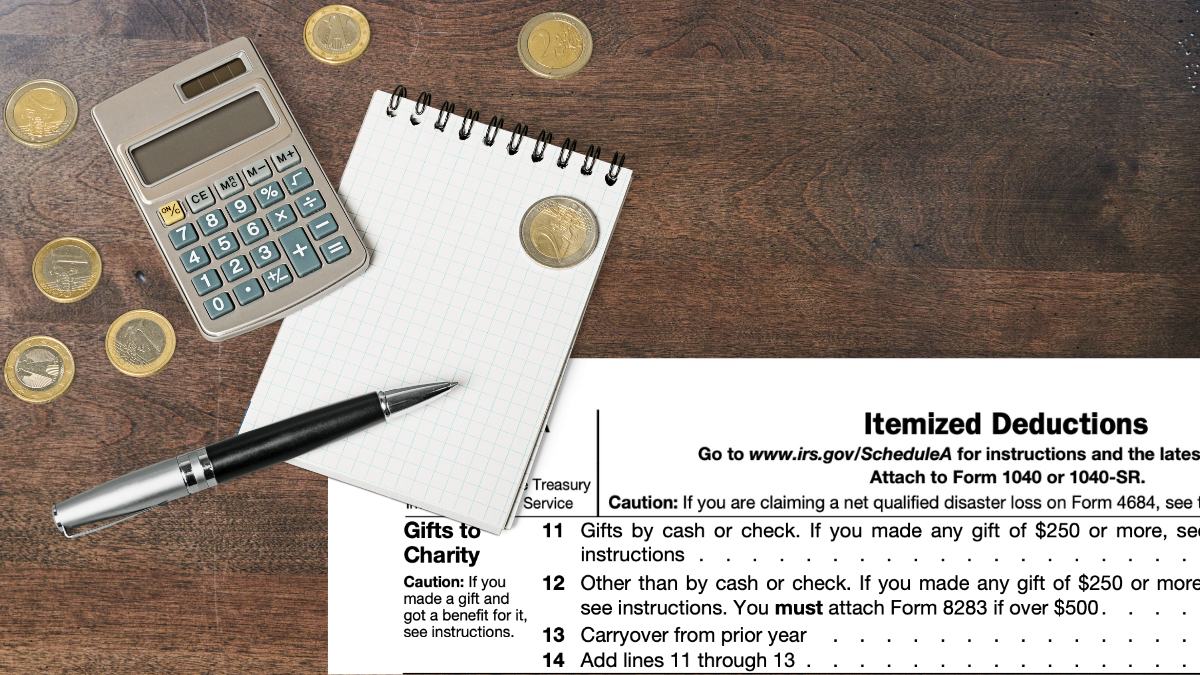

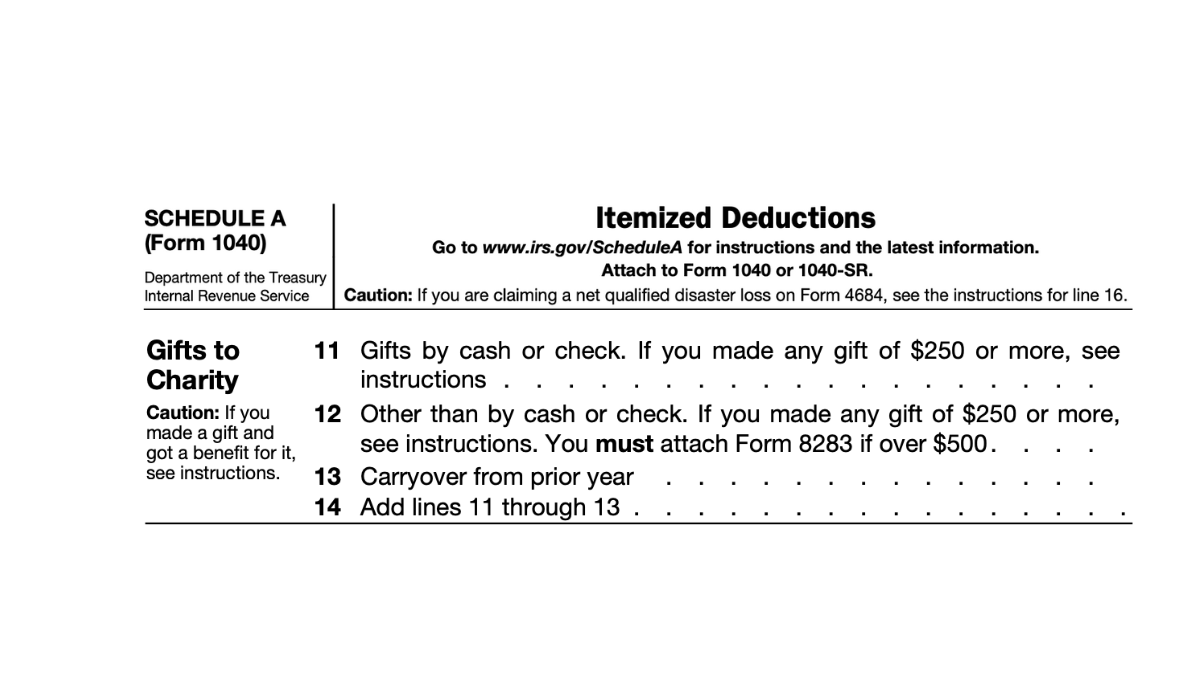

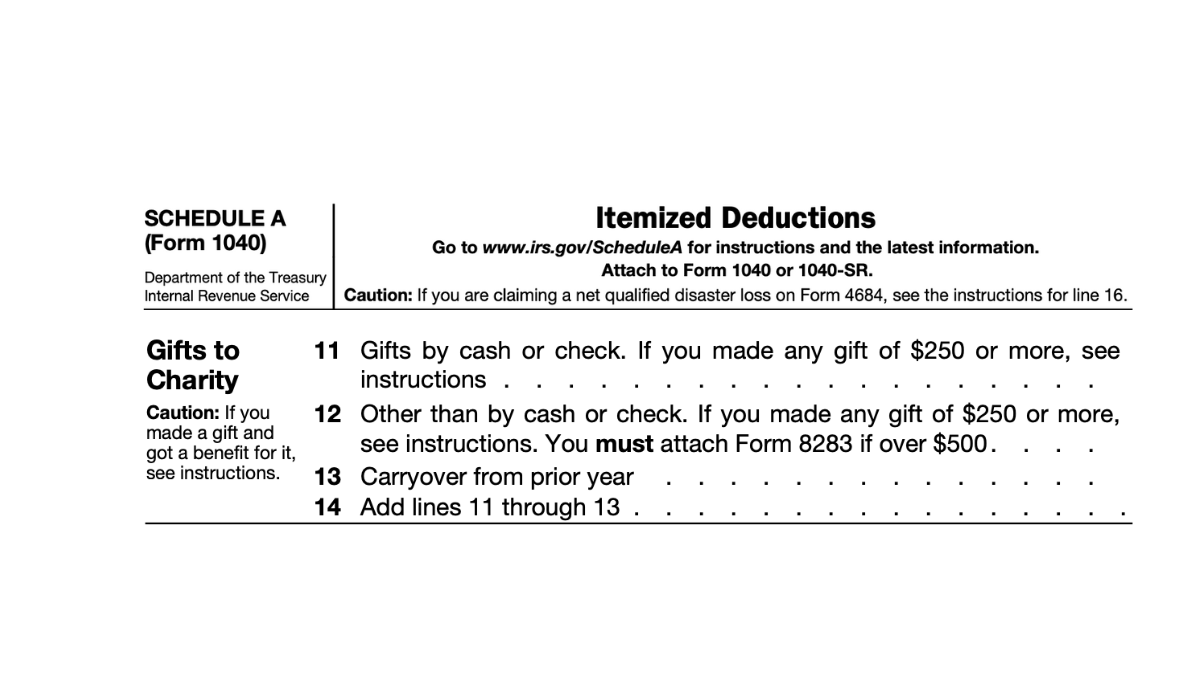

Because this rule is absolute charitable deductions on an estate or trust income tax return are rare Use Schedule A on Form 1041 to calculate deductions for charitable Gifts made to charity upon the death of the donor can be deducted on an estate tax return Of course estate taxes are only paid on estates with a value of 12 06 million in 2022

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions Generally you may deduct up to 50 percent of How you can defer or reduce taxes through charitable giving By using the proper tax planning strategies charitable contributions can reduce three kinds of federal taxes income capital

Pin By Pinner On Bexlee s First Birthday Tax Return Charitable

https://i.pinimg.com/originals/73/1c/94/731c94d863fa375ae0fa3f5d2f6660c2.png

Tax 101 2021 Charitable Contributions Becker

https://www.becker.com/sites/default/files/styles/atge_no_style_sm/public/2021-12/Charitable-Contributions-Article-12.9.jpg?itok=sD-eXsun

https://www.thetaxadviser.com/issues/2021/mar/...

Income tax charitable deductions for trusts and estates are governed by Sec 642 c these rules are substantially different from the rules for charitable contribution

https://estatecpa.com/estate-tax-charitable-deduction-donation

But charitable donations work a little differently for estate tax purposes There are three key differences The first difference is that the estate tax charitable deduction is allowed

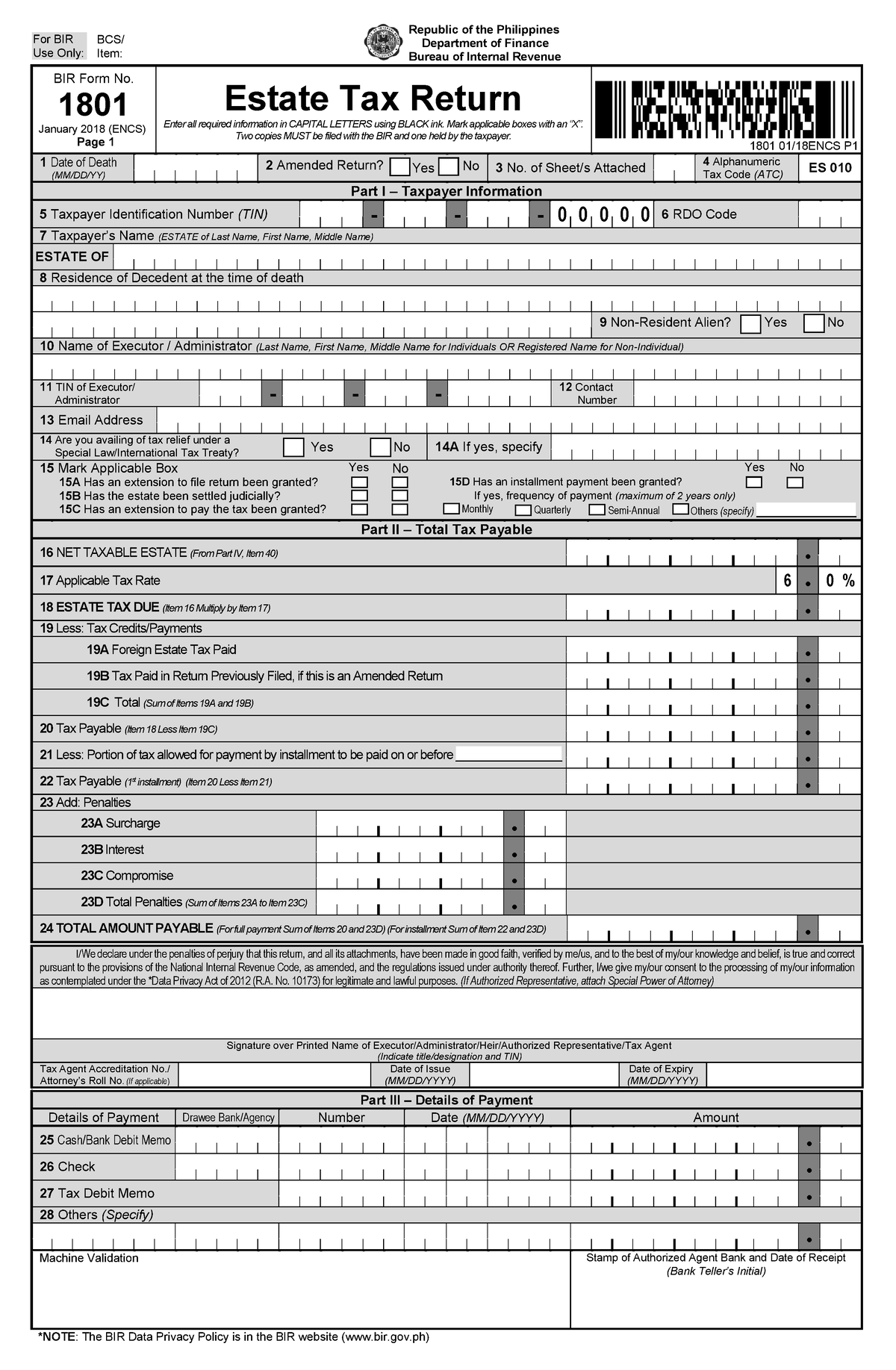

Estate Tax Return Form Sample For BIR Use Only BCS Item BIR Form

Pin By Pinner On Bexlee s First Birthday Tax Return Charitable

Pin By Carole Jones On Taxes Tax Return Charitable Contributions Tax

Claiming Charitable Contributions On Your Tax Return

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Claiming Charitable Contributions On Your Tax Return

Claiming Charitable Contributions On Your Tax Return

Did You Make A Qualified Charitable Distribution This Year Horizon

Your State Pension Hates You

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Estate Tax Return Charitable Contributions - Charitable contributions to public charities are generally deductible up to 50 60 through December 31 2025 of adjusted gross income AGI for cash and 30 of AGI