Ev Car Federal Tax Rebate Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of 2023 The EV tax credit Web Income cap for EV tax credit For the most part these changes took effect on Jan 1 2023 and will remain in effect until Jan 1 2032 Always check the IRS website for updates Find the

Ev Car Federal Tax Rebate

Ev Car Federal Tax Rebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

Ev Car Tax Rebate Calculator 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-23.png?fit=570%2C278&ssl=1

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000 Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Web 25 juil 2023 nbsp 0183 32 Some cars and trucks also qualify for a state rebate or tax credit Together those incentives could cut as much as 15 000 off the price of a new EV And falling prices and a surge in new Web Tax Incentives New Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less

Download Ev Car Federal Tax Rebate

More picture related to Ev Car Federal Tax Rebate

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

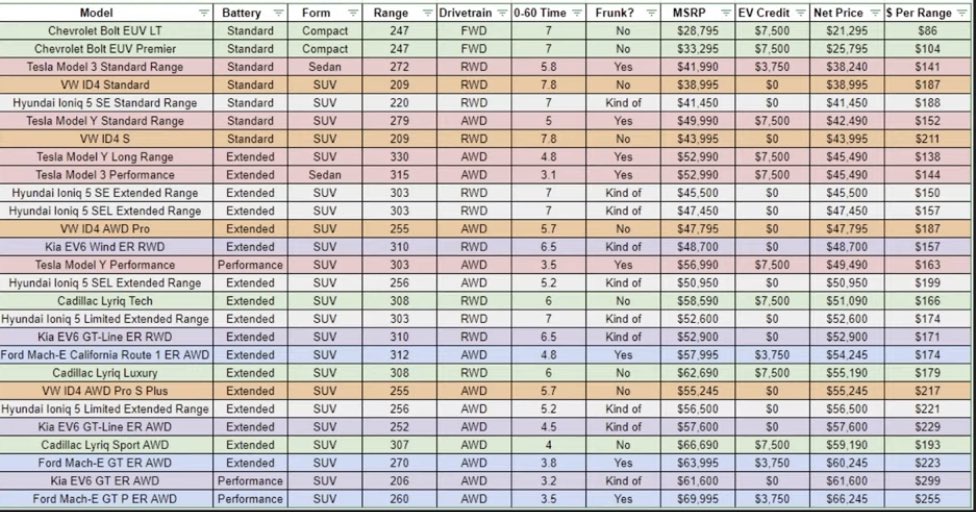

Dennis C On Twitter tesla Now Has The THIRD LEAST EXPENSIVE EV In

https://pbs.twimg.com/media/Ft8l7XHaYAE8WVO.jpg

Federal Tax Rebate Electric Car 2022 Process 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/2022-chevrolet-bolt-euv-and-ev-announced-with-almost-everything-you.jpg

Web 17 avr 2023 nbsp 0183 32 The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in previous years but some of Web 24 avr 2023 nbsp 0183 32 Here Is the EPA s List of EVs Eligible for the Full 7500 EV Tax Credit As of April 18 2023 each of these EVs has been named eligible for the full 7500 2023 federal EV tax credit

Web 24 avr 2023 nbsp 0183 32 The new EV incentives provide a tax credit of up to 7 500 for a qualifying new car and 4 000 if you purchase a qualifying used EV The old program excluded used car buyers Web 7 sept 2023 nbsp 0183 32 Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 in 2023 and 2024 By Keith

More Vehicles Now Qualify For The Federal EV Rebate In Canada

https://cms.creditcardgenius.ca/wp-content/uploads/2022/04/federal-ev-rebate-canada.jpg

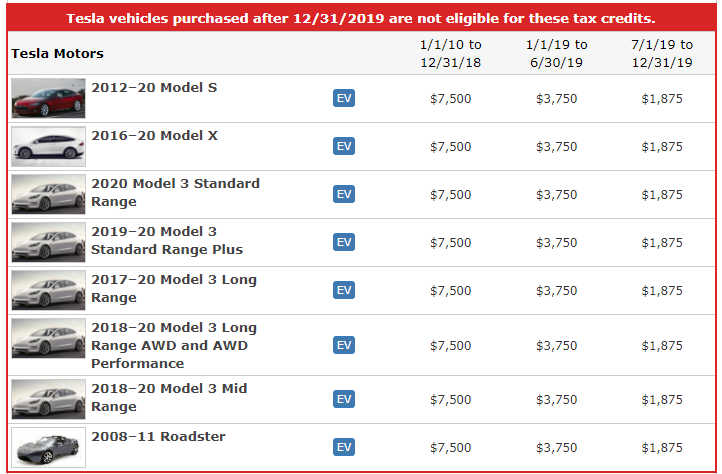

Electric Sticker Shock The Electric Vehicle Federal Tax Rebate Winds

https://www.torquenews.com/sites/default/files/images/electric_cars_charging_1200x900_size.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric...

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of 2023 The EV tax credit

What Is The Tax Rebate For Electric Cars 2023 Carrebate

More Vehicles Now Qualify For The Federal EV Rebate In Canada

Electric Vehicle EV Incentives Rebates

Every EV Eligible For The 7 500 Federal Tax Credit

Tax Rebates On New Cars 2023 Carrebate

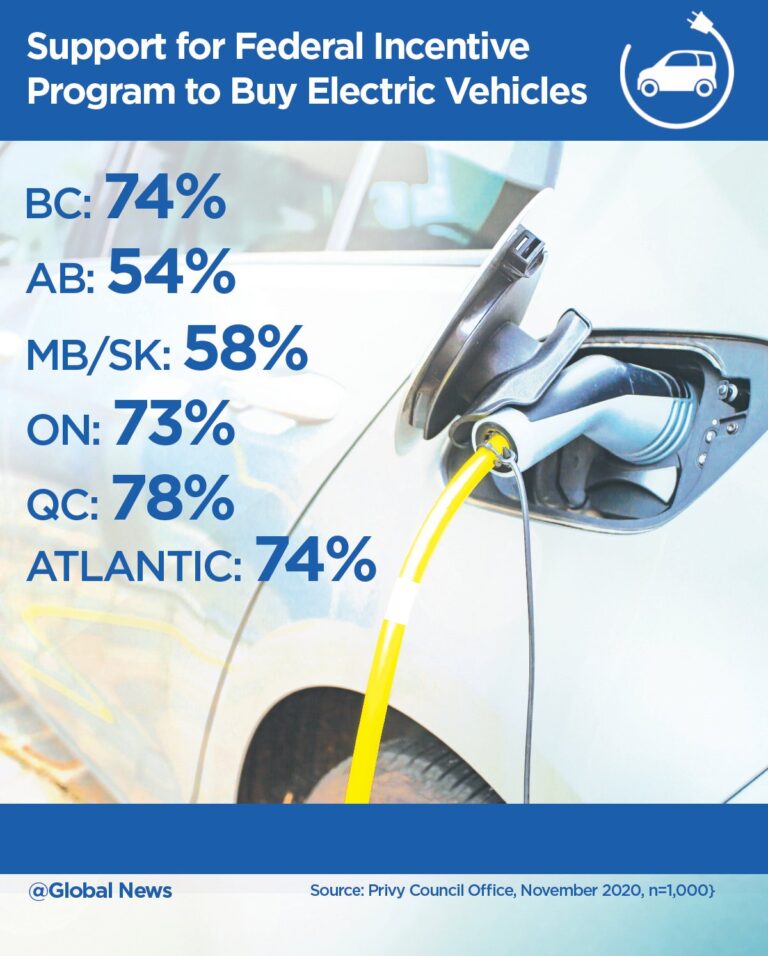

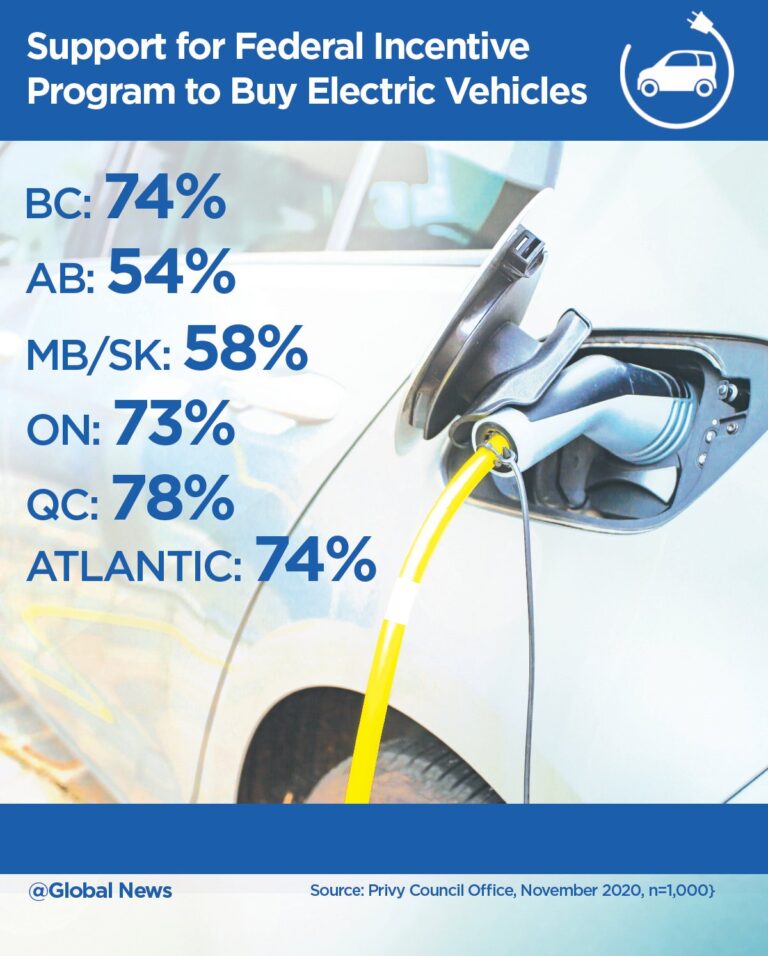

Canadians Support Federal EV Rebates Shows Internal Govt Poll

Canadians Support Federal EV Rebates Shows Internal Govt Poll

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Ev Car Federal Tax Rebate - Web 7 sept 2023 nbsp 0183 32 Car buyers also may qualify for a federal tax credit of up to 7 500 for some vehicles with income restrictions of 150 000 for individuals and 300 000 for married couples filing jointly