Ev Car Rebate 2024 You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

Ev Car Rebate 2024

Ev Car Rebate 2024

https://electricvehicles.bchydro.com/sites/default/files/content-row/Incentives%402x_0.png

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t Be Easy NCPR News

https://media.npr.org/assets/img/2023/01/06/gettyimages-1243236963-1--742bba825bbd259580ed72411dbf7eae6b5409ca.jpg

Electric Car Credit Income Limit How The Electric Car Tax Credit Works For Businesses

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate The IRS first started handing out tax credits to EV buyers in 2022 after the passing of the Inflation Reduction Act up to 7 500 for new cars The policy was a key part of President Biden s

The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car must be plug in

Download Ev Car Rebate 2024

More picture related to Ev Car Rebate 2024

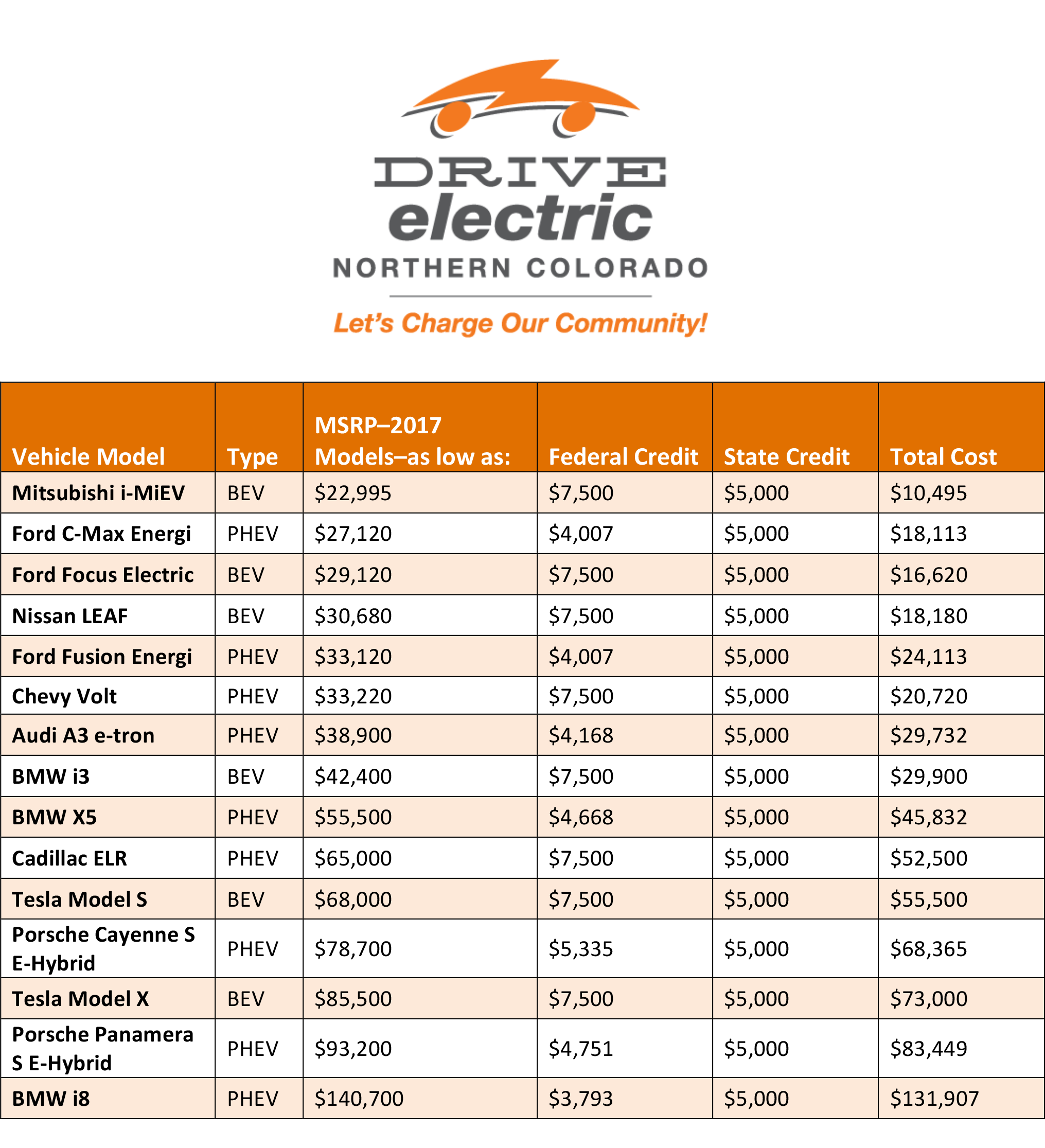

Tax Credits For Electric Cars 2021 ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/compare-electric-cars-ev-range-specs-pricing-more.png

Best Car 2023 Suv 2023 Ford Expedition Hybrid Redesign And Rumors Luud Kiiw

https://s1.cdn.autoevolution.com/images/news/gallery/2024-honda-cr-v-going-electric-accord-and-nsx-evs-also-rumored_2.jpg

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

The U S Department of the Treasury proposed a rule on Friday that would make it easier for consumers to get a 7 500 tax credit for new electric vehicles and a 4 000 credit for used EVs The Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

To claim the credit for vehicles placed in service before January 1 2024 file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with your tax return Starting January 1 2024 credit eligibility and amount will be determined at the time of sale using the IRS Energy Credits Online website EV prices in the US remain high compared to traditional combustion vehicles despite some recent decreases Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to

The California Electric Car Rebate A State Incentive Program OsVehicle Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/the-california-electric-car-rebate-a-state-incentive-program-osvehicle-3.jpg?w=1030&ssl=1

California Electric Car Rebate I Cartelligent

https://cartelligent.com/wp-content/uploads/2023/06/2023-Kia-EV6.jpg

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

https://www.usatoday.com/story/money/cars/2024/01/03/cars-qualify-ev-tax-credit-2024/72088375007/

What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler

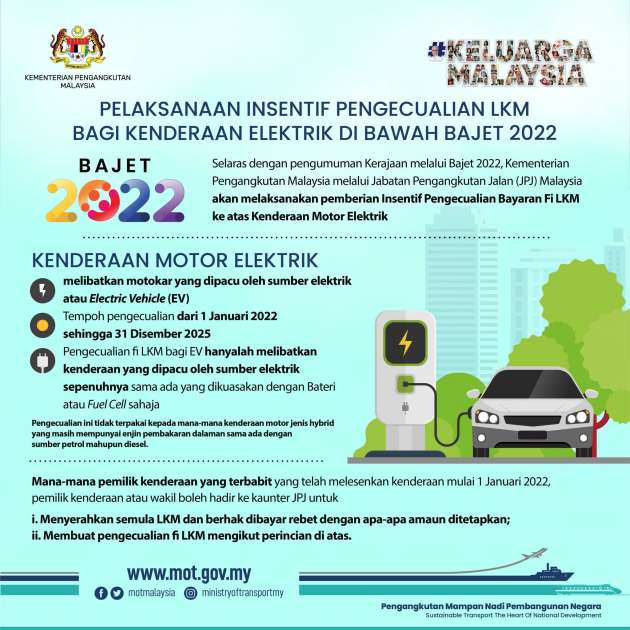

2022 EV LKM Road Tax Rebate Paul Tan s Automotive News

The California Electric Car Rebate A State Incentive Program OsVehicle Californiarebates

Electric Car Tax Rebate California ElectricCarTalk

Canada Electric Car Rebate 2022 2023 Carrebate

Government Rebate For Hybrid Cars Ontario 2023 Carrebate

Electric Vehicle Rebate Redwood Coast Energy Authority

Electric Vehicle Rebate Redwood Coast Energy Authority

New Jersey Pauses Electric Vehicle Rebate After Running Out Of Money Carscoops

Victoria EV Rebate Opens To Applications And All electric MG Leads The Charge Servopro

California EV Rebate Program Clean Vehicle Rebate Program

Ev Car Rebate 2024 - The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential