Ev Car Tax Credit If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit For more information on how to

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit

Ev Car Tax Credit

Ev Car Tax Credit

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified

https://verified.imgix.net/articles/en-us/guides/electric-vehicle-tax-credits/electric-vehicle-tax-credit.jpg

Those EV tax credit rules address requirements for critical mineral and battery component requirements for electric vehicles They are effective for EVs placed The tax credit for EVs provides up to 7 500 toward a purchase of a qualifying Tesla Rivian or other plug in car

Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you The IRS has made it a bit easier for EVs to qualify for tax credits in 2025 In the meantime here s what you need to know about which cars are eligible right now

Download Ev Car Tax Credit

More picture related to Ev Car Tax Credit

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

If you re thinking about buying an electric car or a plug in hybrid you should be aware that some vehicles are eligible for a federal EV tax credit of up to 7 500 The credit depends on where Under the new rule consumers can get up to 7 500 back in tax credits on eligible cars More than a dozen new models and some of their variations are eligible for

The IRS has made the EV tax credit easier to obtain and in 2024 it s redeemable for cash or as a credit toward the down payment on your vehicle Here s All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

https://www.irs.gov/credits-deductions/credits-for...

If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit For more information on how to

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Ev Tax Credit 2022 Cap Clement Wesley

2021 Electric Car Tax Credit Irs Galore Blogging Picture Show

Tax Credits For Electric Vehicles Are About To Get Confusing The New

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

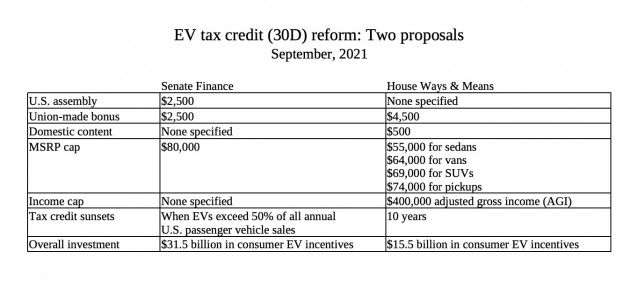

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

Electric Vehicle Tax Credit News Ev Electrek Money Qualify

Don t Worry About Losing The EV Tax Credit

Ev Car Tax Credit - The IRS has made it a bit easier for EVs to qualify for tax credits in 2025 In the meantime here s what you need to know about which cars are eligible right now