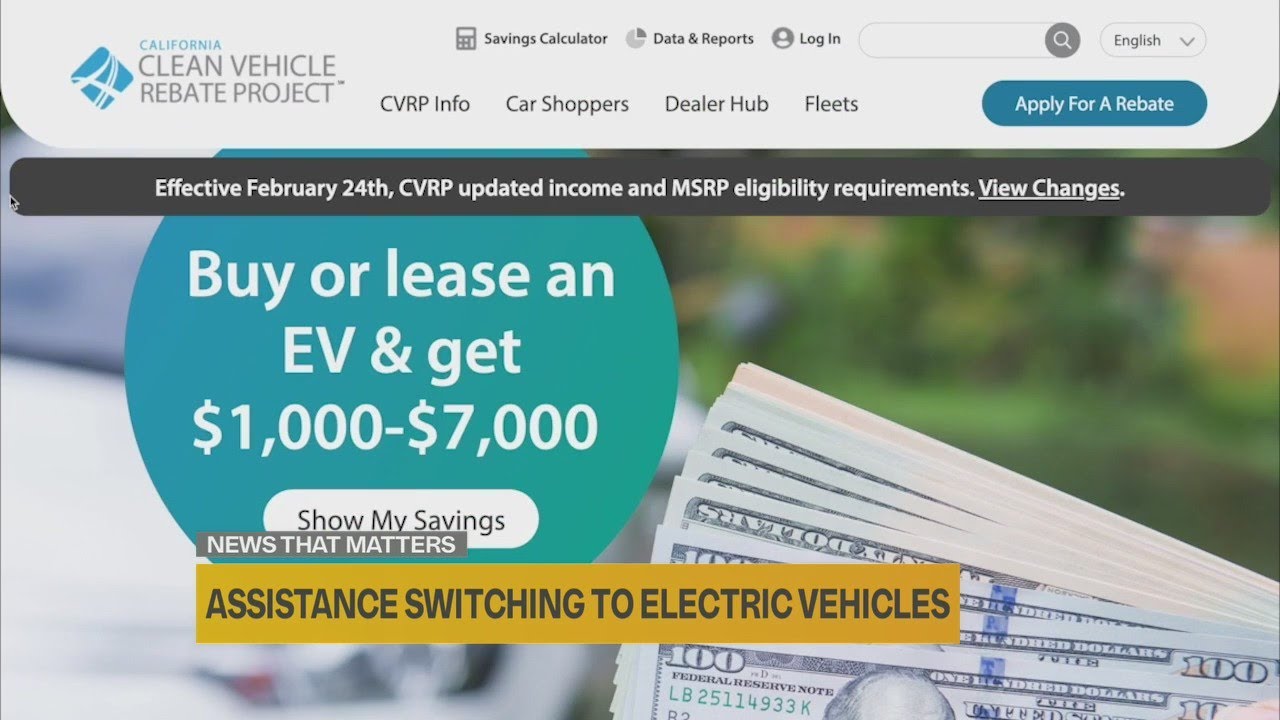

Ev Rebate Irs Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under

Ev Rebate Irs

Ev Rebate Irs

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

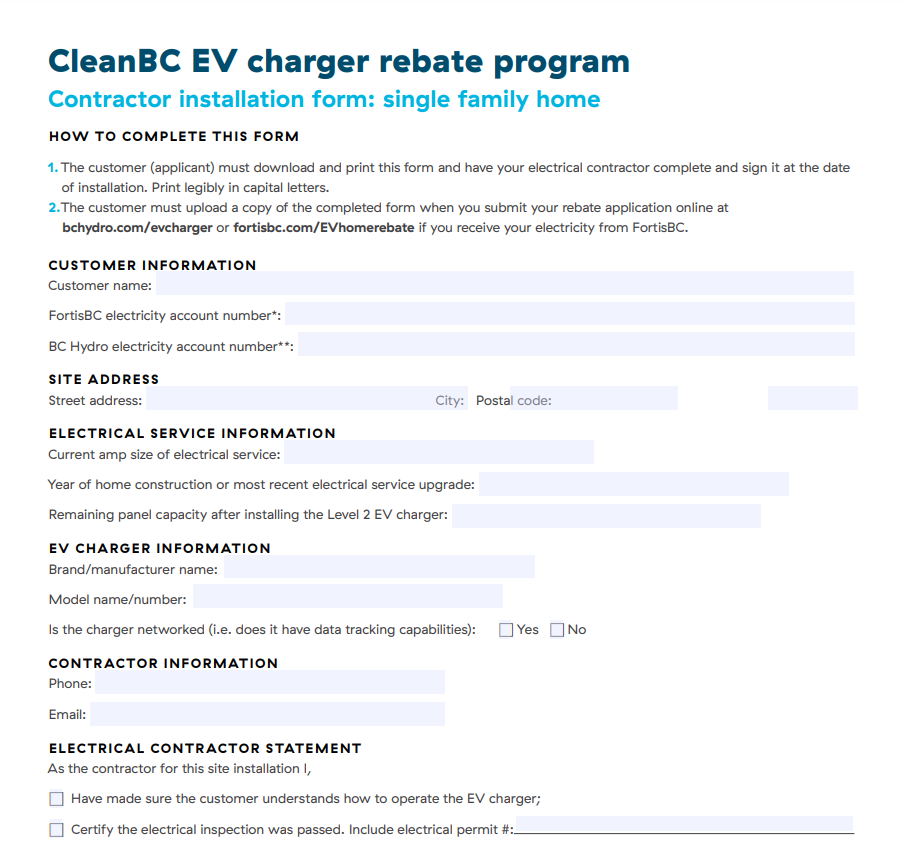

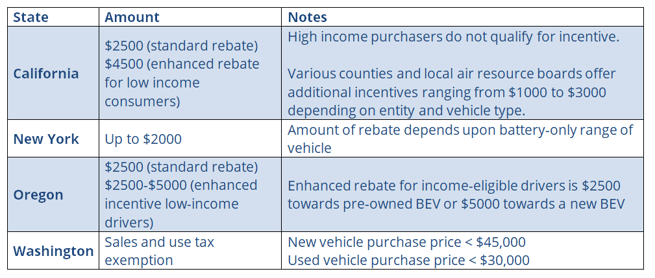

Ontario Ev Charger Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-Ev-Charger-Rebate-Form.png

While Sask Taxes EV Owners Some Canadian Provinces Are Offering Cash

https://www.cheatsheet.com/wp-content/uploads/2015/07/california-rebate-e1436457336945.jpg

Web 16 ao 251 t 2022 nbsp 0183 32 WASHINGTON Following President Biden s signing the Inflation Reduction Act into law today the U S Department of the Treasury and Internal Revenue Service Web WASHINGTON March 31 Reuters The U S Treasury Department unveiled stricter electric vehicle tax rules on Friday that will reduce or remove tax credits on some zero

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit Bestselling Chevy Bolts and Tesla Model 3s and Model Ys are Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Download Ev Rebate Irs

More picture related to Ev Rebate Irs

California Drops EV Rebates For Cars Over 60k Plug ins Below 35 Miles

https://electrek.co/wp-content/uploads/sites/3/2019/11/california-rebates.png

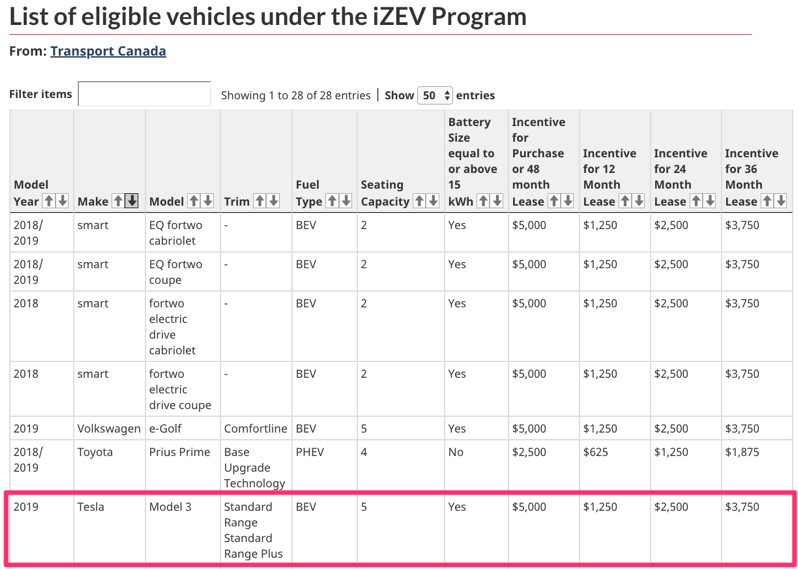

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

https://cdn.iphoneincanada.ca/wp-content/uploads/2019/05/Screenshot_2019-05-01_07_33_14.png

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Web What are the requirements for the EV tax credit The Inflation Reduction Act made several major changes to the tax credit There is a price cap on qualifying EVs For passenger Web 19 d 233 c 2022 nbsp 0183 32 WASHINGTON Dec 19 Reuters With a revamped 7 500 electric vehicle tax credit taking effect Jan 1 the U S Treasury Department said on Monday it will delay

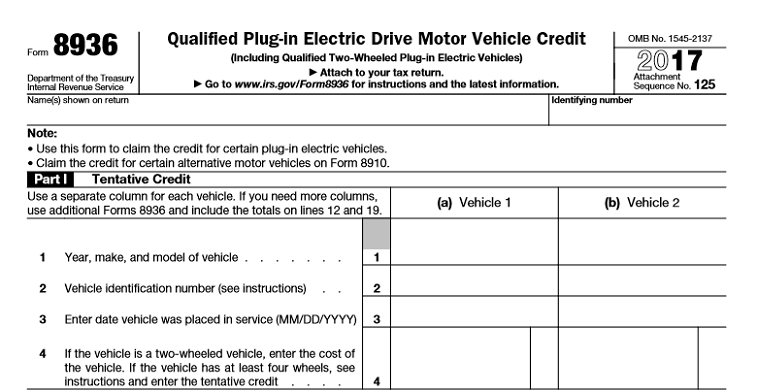

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your Web The year after buying a new EV fill out and submit IRS form 8936 along with your tax return What s the catch The credit isn t exactly free money for those who go electric It s

EV Rebates Valley Clean Energy

https://valleycleanenergy.org/wp-content/uploads/EV-rebate-infographic-english-scaled.jpeg

Funding For Electric Vehicles Stalled At The Massachusetts State House

https://blog.greenenergyconsumers.org/hs-fs/hubfs/EV Rebate Table.png?width=655&name=EV Rebate Table.png

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

California s EV Rebate Changes A Good Model For The Federal EV Tax

EV Rebates Valley Clean Energy

How To Claim The Electric Car Tax Credit OsVehicle

How The IRS Ignored The Inflation Reduction Act And Rejected The Most

Rising Demand Delays California EV Rebate Programs YouTube

Types Of Rebate Programs By Charger Type Graphs

Types Of Rebate Programs By Charger Type Graphs

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

EV Chargers And Rebates Infographic

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Ev Rebate Irs - Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act includes a provision that limits the 7 500 EV tax credit to vehicles that are assembled in North America